As your business in the UAE grows, keeping every department aligned becomes harder. Finance, sales, inventory, and HR often run on different tools, making it difficult to track performance, manage cash flow, or maintain accurate VAT compliance.

A unified UAE ERP software helps you bring order to that complexity. It connects accounting, operations, and reporting into a single system where every team uses the same real data. Instead of reconciling spreadsheets or chasing updates, you see what’s happening across your business.

For decision makers, ERP isn’t just about automation. It’s about control, streamlining processes, ensuring regulatory accuracy, and creating the visibility needed to grow without chaos.

In this guide, you’ll learn how to evaluate ERP in the UAE, compare the leading vendors, and apply best practices to choose a system that fits your company’s goals.

- What Is ERP? Why It Matters For UAE Businesses

- ERP Landscape & Growth In The UAE

- Key Evaluation Criteria For ERP In The UAE

- Leading ERP Vendors & Solutions In The UAE

- ERP Implementation Best Practices & Pitfalls

- UAE Example Case Studies

- ROI & Business Justification For ERP In UAE

- Future Trends In ERP — Especially for UAE/MENA

- Getting started — Roadmap & Next Steps.

- Frequently Asked Questions On ERP Software In The UAE

- List of Resources

What Is ERP? Why It Matters For UAE Businesses

When you manage multiple departments, vendors, or branches, it’s easy for data to get scattered across spreadsheets and disconnected tools. Enterprise Resource Planning brings everything together into one integrated system.

A modern UAE ERP software platform lets you automate accounting, control inventory, plan production, and monitor performance in real time.

Instead of relying on manual updates, your teams can access the same data instantly, whether they’re in Dubai, Abu Dhabi, or operating from a UAE free zone.

📖 Recommended Read: Curious about the real impact of ERP systems? Explore ERP Benefits and How It Enhances Business Efficiency

Core Modules and Functions

Most ERP solutions in the UAE include modules for:

- Finance & Accounting: Manage payables, receivables, and UAE VAT compliance

- Human Resources: Handle payroll, leave, and multi-language staff management

- Supply Chain & Inventory: Track stock levels, reorders, and warehouse movements across multiple emirates

- CRM & Sales: Integrate your leads, quotes, and customer orders within the same platform

- Analytics & Reporting: Gain real-time Insights for smarter, faster decisions

ERP Vs Best-of-Breed Systems

You might already use standalone tools like accounting software or CRM apps. While these work in isolation, they rarely share data automatically.

An integrated ERP in the UAE lets you manage every process in a single workflow. From purchase orders to delivery, without switching systems or duplicating entries.

A unified UAE ERP software simplifies that complexity by centralizing data, improving visibility, and maintaining VAT compliance.

As your operations expand, you’ll need your ERP to connect seamlessly with other tools, such as CRM and logistics platforms, as well as IoT-based production systems.

Modern platforms such as Kladana make this possible by offering deep integrations and automation through APIs and workflow rules.

- CRM & Sales Sync: Auto-link leads, quotations, and invoices between departments

- Inventory & Logistic Link: Connect warehouses, dispatches, and delivery updates in real time

- Automation: Trigger purchase or delivery documents automatically using workflow rules

- Unified Dashboard: View finance, sales, and operations metrics from one analytics layer

These integrations transform your ERP into a connected digital hub. It gives you faster insights, fewer manual steps, and stronger operational control across your UAE business.

Cloud vs On-premise vs Hybrid

Choosing between cloud ERP in the UAE and on-premises models depends on your budget, data policies, and scalability goals.

- Cloud ERP: Quick to deploy, subscription-based, and ideal for growing SMEs.

- On-premises: Offers more control but comes with a higher upfront cost and ongoing maintenance.

- Hybrid: Combines both popular among UAE companies, balancing compliance with flexibility.

Whichever model you choose, the right ERP software in the UAE should simplify operations, ensure compliance, and prepare your business for future growth.

ERP Landscape & Growth In The UAE

When you look at how quickly companies in the Emirates are digitizing, it’s clear that ERP in the UAE has moved from optional to essential. Businesses across logistics, trading, construction, and manufacturing now rely on UAE ERP software to consolidate their finance, HR, and supply chain operations into a single system.

According to Grand View Research, the UAE enterprise resource planning market is projected to reach $752.2 million by 2030, reflecting a compound annual growth rate CAGR of 15.5% over the current decade.

This growth highlights how organisations like yours are adopting integrated, cloud-based ERP systems to improve visibility, ensure VAT compliance, and streamline operations across departments and business units.

Key Trends: Cloud Adoption, AI, and Modular ERP

The UAE’s ERP market is evolving rapidly, driven by cloud technology and government-led digital transformation programs.

1. Cloud ERP UAE adoption is now the fastest-growing segment. Many SMEs prefer it because it offers lower upfront investment, faster deployment, and remote access for multi-site teams

2. AI-driven ERP tools are gaining ground as businesses use predictive analytics and automation to manage cash flow, plan demand, and make better operational decisions

3. Modular ERP architecture allows you to start small with finance or inventory and add modules for CRM, HR, or logistics as your business expands

4. Real-time analytics, ERP, and mobile ERP access are also transforming how decision-makers monitor operations, giving you complete visibility into cost, productivity, and stock movement from any location

This combination of flexibility, intelligence, and cloud infrastructure explains why the ERP market in the UAE continues to outpace regional averages, especially among SMEs upgrading from legacy or on-premise systems.

According to Statista, key figures for the Enterprise Resource Planning Software market in the UAE include:

💰 Market Revenue: Expected to generate $151.23 million in 2025, projected to reach $ 179.77 million by 2030

📈 Growth rate: Anticipated CAGR of 3.52% (2025-2030)

👨💼 Average spend Per Employee: Estimated at $22.34 in 2025

🌍 Global Context: The UAE leads globally, with $27.82 billion and projected ERP revenue for 2025

☁️ Adoption Insight: The UAE is witnessing rising demand for cloud-based ERP software to streamline operations, automate finance, and improve productivity across departments

Challenges In The UAE: Skills, Integration & Customization

Even as an adoption grows, implementing an ERP solution in the UAE isn’t always straightforward.

1. Technical skills and partner availability: Many SMEs face a shortage of experienced consultants or local ERP vendors in the UAE who understand sector-specific needs

2. Integration complexity: Connecting ERP with logistics, CRM, or port systems can be challenging, especially for companies operating across the UAE free zones and the mainland

3. Customization for regulatory frameworks: You often need to tailor your ERP to handle VAT and regulatory compliance in the UAE, Arabic-English localization, and free-zone reporting formats

4. On-premise vs cloud ERP decisions: Some sectors still choose hybrid setups for data sovereignty, balancing security with scalability

Key Evaluation Criteria For ERP In The UAE

Choosing the right UAE ERP software is not just about comparing features. It’s about finding a system that fits your business environment, regulatory needs, and long-term growth. Whether you’re evaluating global names or local vendors, here’s what you should look for before you invest.

1. Local Compliance & VAT Support

A reliable ERP solution in the UAE must adapt to regional specifics such as:

- Arabic and English interface options

- UAE date and numbering formats

- Multi-entity, multi-emirate operations

- Customizable charts of accounts for free zones vs mainland entities

👉 The more localized your ERP, the easier it becomes for teams to adapt. It is essential in multilingual or multicultural workplaces typical across Dubai, Abu Dhabi, and Sharjah.

2. Integration Capabilities

The best ERP in the UAE connects seamlessly with the tools you already use. Look for systems that allow:

- Two-way sync with CRM for leads, quotes, and customer history

- Integration with Inventory and warehouse management for real-time stock tracking

- Supply Chain Management (SCM) for procurement, warehousing, and logistics

- E-commerce platforms and payment gateways for real-time order updates

👉 Modern cloud ERP UAE platforms are built with these integrations in mind. They eliminate double-entry, reduce manual reconciliation, and give you single, unified data — from sales orders to delivery tracking.

3. Vendor Support & Implementation Network

Strong local presence matters as much as product quality. You’ll benefit from choosing local ERP vendors in the UAE or global ones with certified implementation partners in the region.

Local expertise ensures faster deployment, better training, and quicker troubleshooting. For growing SMEs, having an Arabic-speaking or regionally familiar support team can significantly reduce downtime and training overheads.

4. Deployment Model & Cost Transparency

Before finalizing, decide whether you need an on-premise, cloud, or hybrid ERP model.

- Subscription (Cloud ERP UAE): Lower entry cost, monthly/annual billing, minimal IT overhead

- License (On-Premise ERP): Higher upfront investment, more control, but extra costs for maintenance and servers

- Hybrid: Combines both for companies, balancing security and scalability

📍Tip: Whatever model you pick, ensure your vendor provides transparent pricing, including license fees, training, implementation, and support costs. All ideally quoted in AED for financial clarity

Leading ERP Vendors & Solutions In The UAE

When you compare UAE ERP software, the market divides into two distinct segments: established global vendors and specialized local ERP vendors. Your ideal choice depends on your company size, industry, budget, and localization needs.

1. Vendor Overview & Profiles

Here’s a quick overview of the most trusted ERP solutions in the UAE that businesses like yours rely on in 2026:

➽ Kladana ERP — A modern cloud ERP UAE solution built for SMEs and manufacturers. Integrates ERP+CRM+Inventory+Logistics for real-time visibility. It is lightweight, affordable, and mobile-friendly.

➽ SAP ERP — Ideal for large, multi-entity enterprises with complex supply chains. Offers advanced finance, HR, and production planning modules, deep customization, and robust analytics. Perfect if you operate across multiple emirates or GCC countries.

➽ Oracle ERP Cloud — Designed for digital-first organisations seeking AI-driven ERP and predictive insights. Strong in automation, accounting, and regulatory compliance in the UAE ERP. Cloud-native but enterprise-priced

➽ Microsoft Dynamics 365 — Combines ERP and CRM in one ecosystem. Great for mid- to large-sized companies already using Microsoft tools. Cloud and hybrid options fit multi-emirate, multi-currency operations.

➽ Odoo ERP — Open-source, modular, and affordable. It allows you start small with accounting or inventory, then scale to HR or eCommerce. Best for SMEs exploring cloud ERP UAE setups with flexible customization

➽ Focus Softnet (UAE-based) — A leading local ERP vendor in the UAE with bilingual Arabic/English UI, VAT compliance, and modules for trading, distribution, and finance. Affordable, fast to deploy, and widely used across SMEs.

➽ Facts ERP — Tailored for UAE free zones and local tax frameworks. Offers FTA-compliant VAT, project management, and multi-branch accounting. Ideal for trading, construction, and contracting firms.

📕 Recommended Read: Want to see how the top ERP systems compare? Read ERP Software Comparison Guide 2025 with features, Pricing & Top Solutions

Unify Finance, Inventory & Operations — All In One ERP Platform

Kladana brings together every process, from accounting to logistics

✅ Automate finance, VAT compliance reporting across branches

✅ Integrate CRM, Inventory, and logistics for faster decision-making

✅ Monitor production and deliveries from a single dashboard

Feature & Pricing Comparison Table

| Vendor | Target Business Size | Deployment Model | UAE Localization (VAT/Arabic UI) | Integration Capabilities | Approx Pricing (AED) |

| Kladana | SME/ Manufacturing | Cloud | High | CRM, Inventory, logistics | 220.35–2747.03+ AED/yearly |

| SAP ERP | Large enterprise | Cloud/On-Premise | High | CRM, HR, SCM, BI | Custom quote |

| Oracle ERP Cloud | Enterprise | Cloud | High | AI, Finance, HR, Analytics | Custom quote |

| Microsoft Dynamics 365 | Mid/ Enterprise | Cloud/Hybrid | Medium | CRM, HR, Power BI, E-commerce | Subscription |

| Odoo ERP | SME/Mid-size | Cloud/On-Premise | High | CRM, Inventory, POS, E-Commerce | 200 AED/month |

| Focus Softnet | SME/ Mid-size | Cloud/ On-premise | High | CRM, HR, SCM, Accounting | Custom quote |

| Facts ERP | SME/ Mid-size | Cloud/ On-premise | High | Finance, projects, Logistics | Custom quote |

📍Note: Prices are approximate and vary by modules, customization, and number of users.

Strengths & Weaknesses In The UAE Context

| Vendor | Strengths | Weakness |

| Kladana ERP | Cloud-native, SME focused, real-time automation | It is mainly for small to mid-sized enterprises |

| SAP ERP | Deep enterprise modules, regional partner network, scalable | High cost, long implementation cycle |

| Oracle ERP Cloud | Powerful AI automation, analytics, and substantial compliance | Expensive, enterprise-focused |

| Microsoft Dynamics 365 | Unified CRM + ERP, flexible deployment, strong integration | Expensive, enterprise-focused |

| Odoo ERP | Modular, cost-effective, open-source flexibility | Limited advanced analytics |

| Focus Softnet | Excellent localization, VAT-ready, Arabic UI, quick support | Interface feels dated |

| FACTS ERP | Built for the UAE market, strong project & trading modules | Fewer third-party integrations |

ERP Implementation Best Practices & Pitfalls

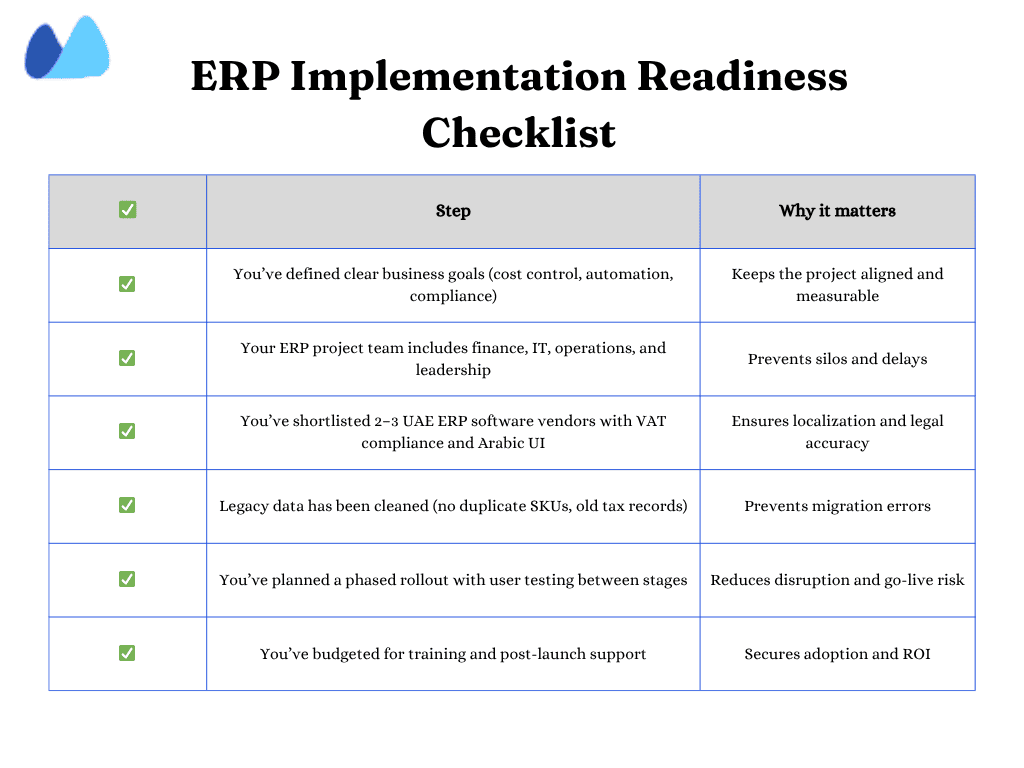

Choosing the right UAE ERP software is only half the job; how you implement it determines whether you will usually see results. A well-executed rollout can transform your operations, while poor planning can lead to cost overruns and user frustration. Here’s how to ensure your ERP implementation in the UAE goes smoothly.

1. Project Governance & Stakeholder Involvement

Before deployment, assemble a project team that includes leadership, finance, operations, IT, and end-users. You need everyone aligned on goals and timelines.

- Define clear KPIs — such as reduced manual entries, faster reporting, or improved stock accuracy.

- Assign ownership for modules with finance, HR, or logistics

- Set realistic milestones with vendor and partner teams

Before you start your ERP Implementation in the UAE, make sure you’ve ticked off every item below.

2. Data Migration & Cleansing

Migrating legacy data into a new ERP in the UAE can’t be tricky, especially if your company operates across free zones, warehouses, or multiple currencies.

- Clean your financial, Inventory, and customer data before migration

- Eliminate duplicate records, outdated SKUs, and inactive clients

- Validate VAT entries and audit trails to stay compliant with FTA requirements

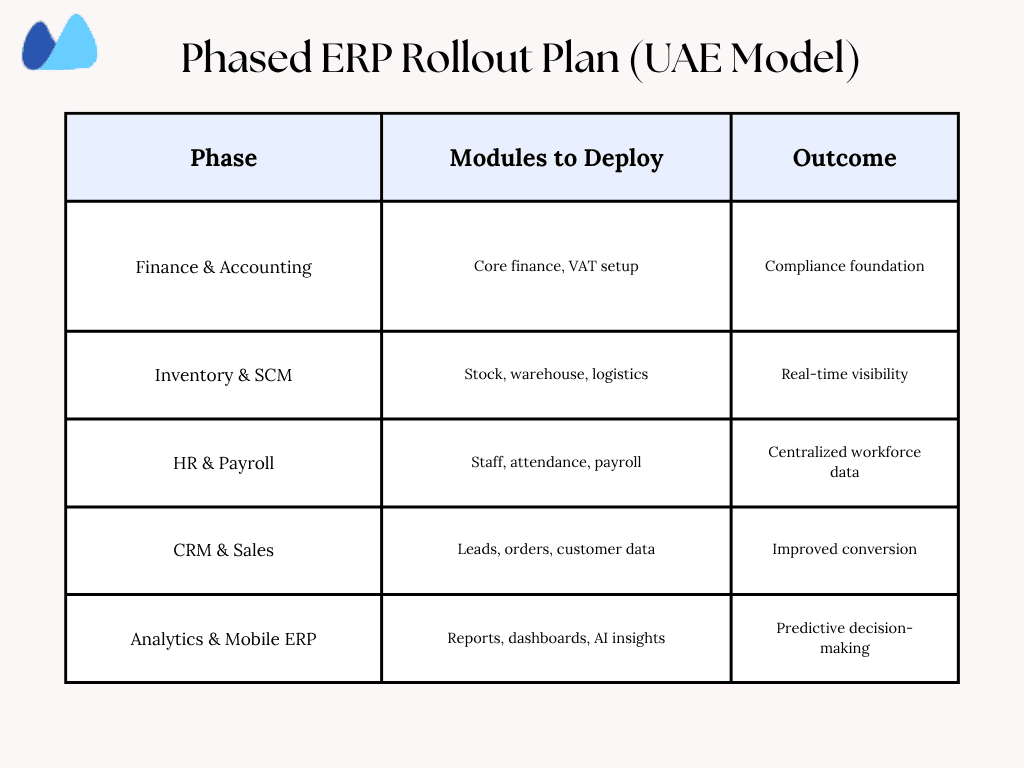

3. Phased Rollout & MVP Approach

Instead of going live with every module at once, deploy your cloud ERP UAE in phases.

- Start with core modules like accounting and Inventory

- Add HR, CRM, and production planning once users are comfortable

- Test every stage in a controlled environment before scaling

➡️ A phased rollout minimizes disruption and lets your team adapt gradually

4. Customization vs Configuration

You’ll likely want to tailor your ERP for UAE-specific workflows, but resist the urge to over-customize.

- Configuration is fast and upgrade-safe

- Customization can slow down upgrades and increase dependency on the vendor

4. Training, Change Management & Support

Even the best ERP solution in the UAE fails if your team doesn’t know how to use it.

- Conduct hands-on training sessions before and after go-live

- Offer bilingual training materials to fit your workforce

- Encourage managers to act as ERP champions in their departments

- Set up continuous vendor support, especially if you’re using a local ERP vendor in the UAE for implementation

5. Common Pitfalls To Avoid

- Rushing the go-live date without proper user testing

- Ignoring data migration or underestimating cleanup time

- Choosing a vendor with limited post-launch support in the UAE

- Over-customizing and breaking upgrade compatibility

- Failing to communicate benefits to staff, leading to poor adoption

UAE Example Case Studies

When you look at how UAE businesses use ERP systems, you’ll notice a clear pattern: connecting data across finance, operations, and logistics always pays back through smoother workflows and strong financial control. These examples show how that efficiency translates into real business returns.

1. Manufacturing In A UAE Free Zone

Problem: You run separate tools for production, purchasing, and accounting, which slows approvals and complicates VAT reporting

Solution: You adopt a cloud ERP UAE platform that unites production schedules, material purchases, and finance under one system that is localized for VAT and free-zone compliance

Outcome ROI: Routing reports are generated automatically, purchase cycles shorten, and production planning becomes proactive rather than reactive. Those efficiency gains reduce overheads and free capital for growth.

2. Multi-Branch Trading Across the UAE

Problem: Each branch tracks sales and stock independently, so reconciling data across Dubai, Abu Dhabi, and Sharjah takes days

Solution: You roll out a UAE ER system that consolidates inventory, invoicing, and accounts into a single database, supporting multi-currency operations.

Outcome ROI: you close books faster, maintain accurate VAT submissions, and keep stock balanced across locations. The time saved on manual work directly improves cash flow and profitability.

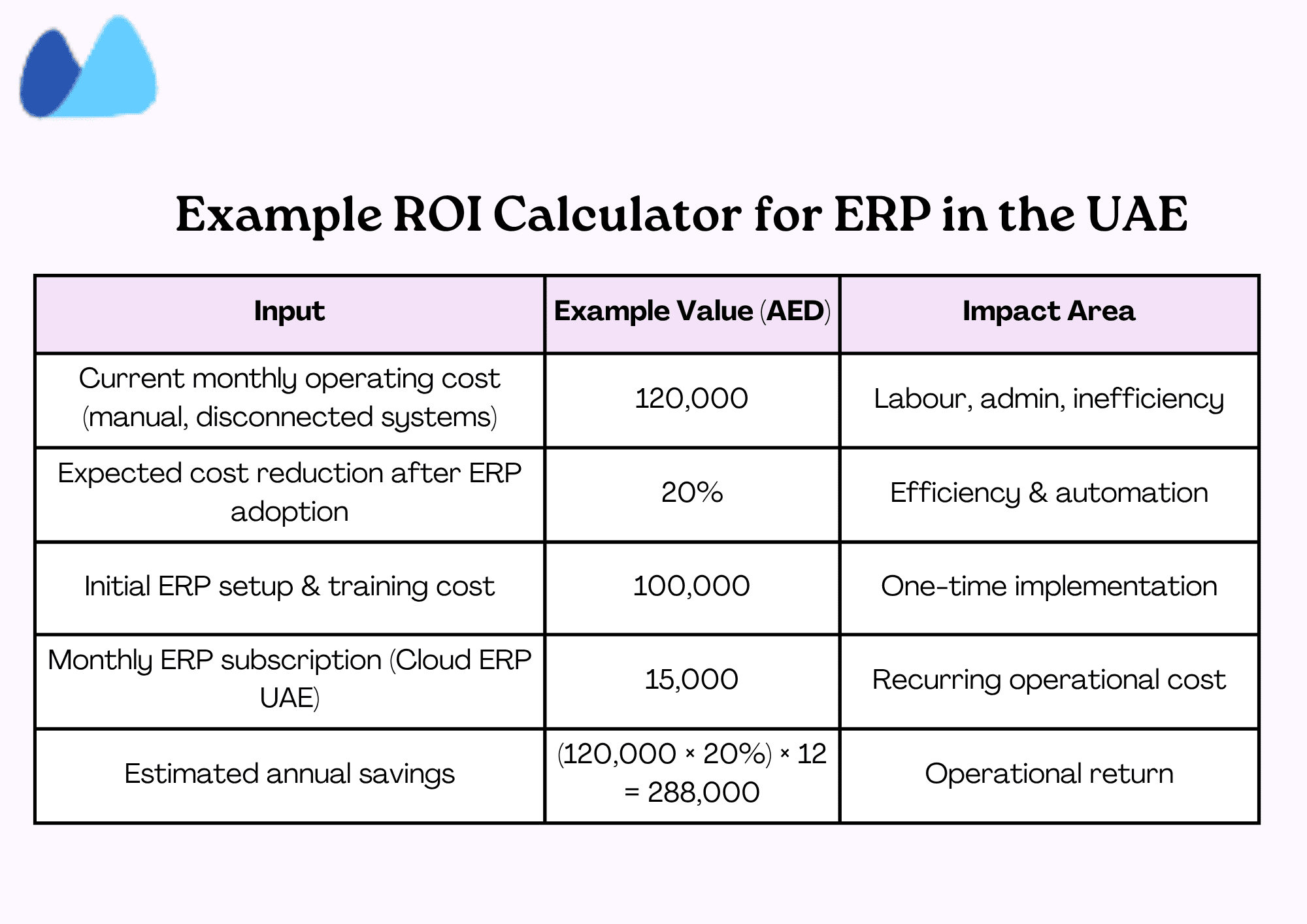

ROI & Business Justification For ERP In UAE

When you invest in ERP software in the UAE, you’re not just buying technology. You’re changing how your business works. The return comes from efficiency, fewer manual tasks, fewer mistakes, and faster decisions. But to justify the investment, you need to consider both the costs and benefits in your own operating context.

1. Understanding The Cost Drivers

Before you calculate ROI, map out your total cost of ownership.

Typical components include:

| Cost element | Description (AED Context) |

| Software subscription or license | Cloud ERP UAE systems often start from AED 150 -500 per user/month, and on-premise licenses may require an upfront purchase |

| Implementation & Customization | Configuration, training, and integration can range from AED 20K — 100K +, depending on business size and modules |

| Data Migration | Cleaning and importing legacy data and cost depend on data volume and complexity |

| Training & Support | Initial workshops, onboarding, and ongoing vendor assistance |

| Hardware or cloud infrastructure | If on-premise, add servers and maintenance. If cloud, factor in annual hosting fees |

🟢 Tip: Always request quotes in AED and clarify if support, localization, or upgrades are included in the subscription.

2. Where The ROI Comes From

The financial return on ERP in the UAE usually shows up in these areas:

➨ Operational Efficiency: Faster workflows, real-time inventory updates, and automated reporting save labour hours each week

➨ Cost control: Unified data helps you catch unnecessary purchases or stock overages early

➨ Compliance savings: Accurate VAT and regulatory compliance in the UAE ERP reduces penalties and audit risk

➨ Faster financial closings: Month-end consolidation that once took days can happen in hours, freeing finance teams for strategy

➨ Decision Speed: Live dashboards and analytics reduce dependence on guesswork, helping you act faster in a competitive market

3. Estimating Payback Period

A simple way to assess your payback is:

ROI = (Total Annual Benefits − Total Annual Costs) ÷ Total Annual Costs

But in practice, look at the payback period — the time it takes for your efficiency gains to offset the investment. SMEs in the UAE often see payback within 12-24 months when an ERP replaces multiple disconnected tools. Larger enterprises may take longer but achieve more profound, recurring benefits through scalability.

4. Presenting The Business Case

When presenting your ERP proposal to management or investors, emphasize these UAE-specific factors:

- VAT & FTA compliance: Built-in controls protect against fines and simplify audits

- Multi-emirate operations: Consolidated visibility avoids duplication of systems per branch

- Data-driven planning: Real-time analytics enable better procurement and sales forecasting

- Scalability: Cloud ERP UAE models grow with your workforce and new branches

Future Trends In ERP — Especially for UAE/MENA

ERP systems in the UAE are evolving fast. It is driven by the country’s push for Industry 4.0, cloud adoption, and AI integration. The next few years will redefine how you use ERP, making it more intelligent, automated, and connected across every part of your business.

1. AI, Machine Learning & Predictive Analytics

- ERP is no longer a passive reporting tool. It is becoming a forecasting engine.

- AI and machine learning help your system recognize demand patterns, detect irregularities, and recommend the following sections.

- You can predict supply gaps before they occur, automatically adjust purchase cycles, and plan cash flow with confidence.

2. Embedded Automation & Low-Code/ No-Code Extensions

- Future UAE ERP software will automate repetitive work and let you adapt faster.

- Tasks such as approvals, reconciliations, and purchase orders run on built-in rules, while low-code tools let you modify dashboards and workflows yourself.

- Your ERP keeps pace with your business even when regulations, teams, or processes change.

- For UAE SMEs, it’s a way to innovate quickly without heavy IT spend

3. Edge Computing & IoT-Enabled RP

- As businesses expand across free zones and the UAE, real-time data becomes critical.

- Edge computing ensures that data from your factories, warehouses, or stores is processed locally for speed and accuracy.

- When combined with IoT-enabled ERP, you can track assets, monitor equipment, and automate maintenance directly from within the system.

Getting started — Roadmap & Next Steps.

Implementing ERP in the UAE is a strategic move, and success depends on the proper evaluation process. Here’s how to approach it step by step — from initial readiness to vendor selection

1. Evaluation Checklist

Before you contact vendors, check if your organisation is ready for ERP:

Before you contact vendors, check if your organisation is ready for ERP:

| Question | Why It Matters |

| Do you have clear process goals (inventory visibility, faster accounting, compliance)? | Defines success benchmarks |

| Have you mapped VAT & FTA reporting requirements? | Ensures legal compliance |

| Are your operations multi-emigrate or multi-currency? | Determines system complexity |

| Do you need an Arabic interface and local partner support | Improves adoption in UAE teams |

| Have you estimated the total cost (setup, subscription, and training)? | Clarifies ROI timeline |

| Are your teams ready for training and change management | Ensures smooth rollout |

2. Shortlist Rubric

Once you identify your needs, use a rubric to objectively score vendors.

| Criteria | Weightage | Description |

| Localization & VAT readiness | 25% | Must support FTA-compliant VAT and Arabic UI |

| Industry | 20% | ERP must match your business type (manufacturing, trading, logistics) |

| Ease of use & customization | 15% | Low-code or configurable interface preferred |

| Integration capabilities | 15% | Should connect easily with CRM, HR, or eCommerce systems |

| Vendor presence & support in the UAE | 15% | Local partners and bilingual helpdesk |

| Cost transparency | 10% | Transparent AED pricing, no hidden costs |

📍How to use it: Score each ERP (1-5 per criterion), multiply by weightage, and rank by total score.

3. Demo & RFP Process

When you’re down to your top 2-3 options:

- Request a live demo using your own workflows

- Assess response time — how quickly can they configure VAT, reporting, or free-zone compliance for you?

- Ask for references from UA clients in similar industries

Then issue a Request for Proposal with these essentials:

- Modules and integrations required

- Expected users and deployment

- Local compliance needs

- Implementation timeline and post-launch support

- Transparent AED-based pricing

4. Vendor Comparison Snapshot

| Vendor | Strength | Best For | UAE Fit |

| SAP | Enterprise depth | Large multi-entity firms | Excellent, high cost |

| Oracle | AI-driven analytics | Enterprises | Excellent, cloud only |

| Microsoft Dynamics | ERP + CRM combo | Mid to large firms | Strong integration |

| Odoo | Modular & open source | SMEs | Good, customizable |

| Focus Softnet | Localized, bilingual | UAE SMEs | Excellent |

| Kladana | Cloud-native for SMEs | Manufacturing & trading | Excellent, easy setup |

5. Pilot, Feedback & Rollout

- Start small, like one branch, department, or process

- Monitor usage, data accuracy, and report generation

- Collect feedback before scaling

- A phased approach ensures that your ERP Implementation in the UAE delivers consistent results across teams and locations.

Frequently Asked Questions On ERP Software In The UAE

ERP is a system that connects all your core processes into one platform. For UAE businesses, it brings visibility, ensures VAT compliance, and simplifies multi-branch management. With ERP, you can reduce manual errors, control costs, and make faster data-driven decisions across your entire organisation.

How is cloud ERP different from on-premises in the UAE?

Cloud ERP is hosted online and accessed through the internet, making it easier to deploy and maintain. It’s ideal for SMEs and multi-location teams. Whereason-Premise’s ERP, in contrast, runs on your internal servers, offering more control but higher setup and maintenance costs. Many UAE companies now prefer cloud ERP for scalability, security, and remote access.

What are the top ERP solutions used in the UAE?

UAE companies use a mix of global and local ERP systems, including:

- SAP

- Oracle ERP

- Cloud

- Microsoft Dynamics 365

- Focus Softnet

- FACTS ERP

How much does ERP cost in the UAE?

Pricing depends on the size of your business, number of users, and deployment model, such as:

- Cloud ERP: AED 150-500 per user/month (subscription model)

- On-premises ERP: Higher upfront cost with additional expenses for servers, setup, and support. It can range from AED 20,000 to AED 100,000+ based on your complexity and selected modules.

How long does ERP Implementation take in the UAE?

Implementation timelines vary by company size and readiness. For SMEs, ERP deployment usually takes 2-3 months, while large organisations may need 6-9 months for full rollout. A phased approach, starting with the accounting and inventory module, helps reduce disruption and accelerate user adoption.

Can an ERP handle UAE VAT and compliance requirements?

Yes, leading ERP solutions are fully FTA-compliant and support automatic VAT calculation, e-invoicing, and audit reporting.

What are the common pitfalls when implementing ERP in the UAE?

The most frequent challenges include:

- Inadequate training or poor change management

- Over-customization that complicates future updates

- Weak data migration or incomplete VAT setup

- Choosing a vendor without local implementation experience

Should I choose a local UAE ERP vendor or a global provider?

If you want an Arabic interface and quick support, it is better to choose local vendors. Still, if you wish for automatic advancement and scalability, it is better to go with global providers.

What ROI can I expect from ERP in the UAE?

Most UA companies see ROI within 12-14 months of implementation. Savings come from reduced manual work, fewer compliance errors, faster reporting, and better inventory control. In this way, your ERP also improves decision-making by providing real-time visibility into cash flow, sales, and stock movements.

What future trends in ERP should UAE businesses prepare for?

ERP systems in the UAE are moving toward AI-driven automation, predictive analytics, and IoT integration. You’ll also see more low-code ERP tools that let you customize workflows without complex programming.