Every business, large or small, needs cash flowing smoothly. Profits look good on paper, but they won’t keep your lights on if you can’t pay suppliers or meet payroll. That’s where we need to investigate working capital management (WCM). It’s about balancing what you own (current assets) with what you owe (current liabilities), so your operations run without cash surprises.

In this guide, you’ll learn:

- A simple definition of working capital and how to calculate it.

- An explanation, why it’s not just for big companies, and how small and medium businesses depend on it.

- Key strategies to improve cash flow and efficiency in everyday operations.

- Metrics, examples, and tools you can use right away to diagnose and fix working capital issues in your business.

By the end, you’ll be able to assess your own working capital health and apply practical steps to get more cash working for your business.

- What Is Working Capital Management?

- Why Is Working Capital Management Important?

- Objectives of Working Capital Management

- Key Components of Working Capital

- Working Capital Cycle Explained

- Challenges in Managing Working Capital

- Working Capital Management Strategies

- Working Capital Efficiency Metrics

- Examples of Working Capital Management in SMEs

- Working Capital Management Best Practices

- Conclusion: Strong Working Capital = Strong Business

- FAQ on Working Capital Management

What Is Working Capital Management?

Working capital management is the process of monitoring and controlling a company’s current assets and current liabilities to keep daily operations running smoothly. In simple words, it shows whether a business has enough short-term resources to cover its short-term obligations.

The basic formula is:

Working Capital = Current Assets − Current Liabilities

- Current assets include cash, accounts receivable, and inventory.

- Current liabilities include accounts payable, short-term loans, and accrued expenses.

A positive figure means the business can meet its obligations and still have funds to invest in growth. A negative figure signals potential cash flow problems.

📝 Example:

A small bakery has:

- Cash and receivables: $20,000

- Inventory of ingredients: $10,000

- Total current assets = $30,000

It owes suppliers and short-term loans totaling $18,000.

Working capital = $30,000 − $18,000 = $12,000

This positive balance means the bakery can pay suppliers on time, buy fresh ingredients, and still have a cushion to cover unexpected costs.

Why Is Working Capital Management Important?

Managing working capital well keeps a business financially stable and ready for growth. It directly affects cash flow, solvency, and relationships with both suppliers and investors.

- Liquidity and solvency

A company must have enough cash or liquid assets to pay bills, wages, and taxes on time. Weak working capital management can lead to late payments or even insolvency. - Smooth day-to-day operations

Businesses need consistent access to cash to order supplies, pay staff, and ship products. Proper management avoids interruptions that could stop production or sales. - Creditworthiness and investor confidence

Banks, investors, and partners look at working capital as a sign of financial health. Strong numbers build trust and open doors to financing and new opportunities. - Avoiding cash crunches

Even profitable companies can run into trouble if money is tied up in unpaid invoices or excess stock. Working capital management helps spot these risks early and keep cash moving.

💡 Stronger working capital, stronger business

Small companies use Kladana to manage finance, sales, and inventory together. Stay liquid and ready for growth.

Objectives of Working Capital Management

The main goal of working capital management is to balance liquidity and profitability without exposing the business to unnecessary risk. For small and medium businesses, these objectives translate into practical day-to-day decisions.

- Ensure sufficient liquidity

A company must always have enough funds to pay short-term debts and handle unexpected costs. This avoids delays in payroll, supplier payments, or utility bills. - Maintain profitability

Cash that sits idle in the bank does not generate returns. By managing receivables, payables, and inventory carefully, businesses can use money more effectively to grow sales and improve margins. - Minimize risk of insolvency

Too much short-term debt or poor cash flow can lead to financial distress. Working capital management reduces this risk by aligning payments and collections. - Improve operational efficiency

Monitoring cash, receivables, and inventory together helps spot bottlenecks. For example, too much stock may signal weak demand forecasting, while slow customer payments point to gaps in credit policy.

Good working capital management means not just survival but stronger competitiveness, as funds are freed up for investment and growth.

📘 Recommended Read: Planning business growth but unsure how to measure profitability? Discover how to use Break Even Analysis to calculate when your business will start generating profit.

Key Components of Working Capital

Working capital depends on how a company manages its short-term assets and liabilities. Four elements play the biggest role. Monitoring them closely helps maintain liquidity, reduce risks, and improve efficiency. When these components are managed together, a business can sustain operations, support growth, and build financial resilience.

Accounts Receivable

Accounts receivable are payments owed by customers for goods or services already provided. Delayed collections can trap cash, making it unavailable for paying suppliers or meeting daily expenses. To keep receivables healthy, businesses need clear credit policies, prompt invoicing, and active follow-up on overdue accounts. Offering small discounts for early payment can also speed up collections.

Accounts Payable

Accounts payable represent what the business owes to suppliers, contractors, or lenders. Managing payables well means paying on time to build trust and, at the same time, avoid overly early payments that reduce available cash. Negotiating better credit terms or bulk purchase discounts with suppliers improves flexibility. For SMEs, it’s essential to balance supplier goodwill with cash preservation.

Inventory

Inventory includes raw materials, work in progress, and finished goods. Holding too much ties up capital, increases storage costs, and risks obsolescence. Holding too little can cause missed sales or production delays. Effective demand forecasting, safety stock policies, and just-in-time techniques help optimize stock levels. Modern ERP tools also allow real-time monitoring to prevent overstocking or shortages.

Cash Management

Cash is the most liquid asset and the essence of daily operations. Businesses need enough on hand to cover wages, rent, utilities, and supplier payments. However, excess idle cash reduces profitability since it could be invested back into operations or short-term instruments. Strong cash management balances security with efficiency, uses forecasting to predict needs and makes smart use of surplus funds.

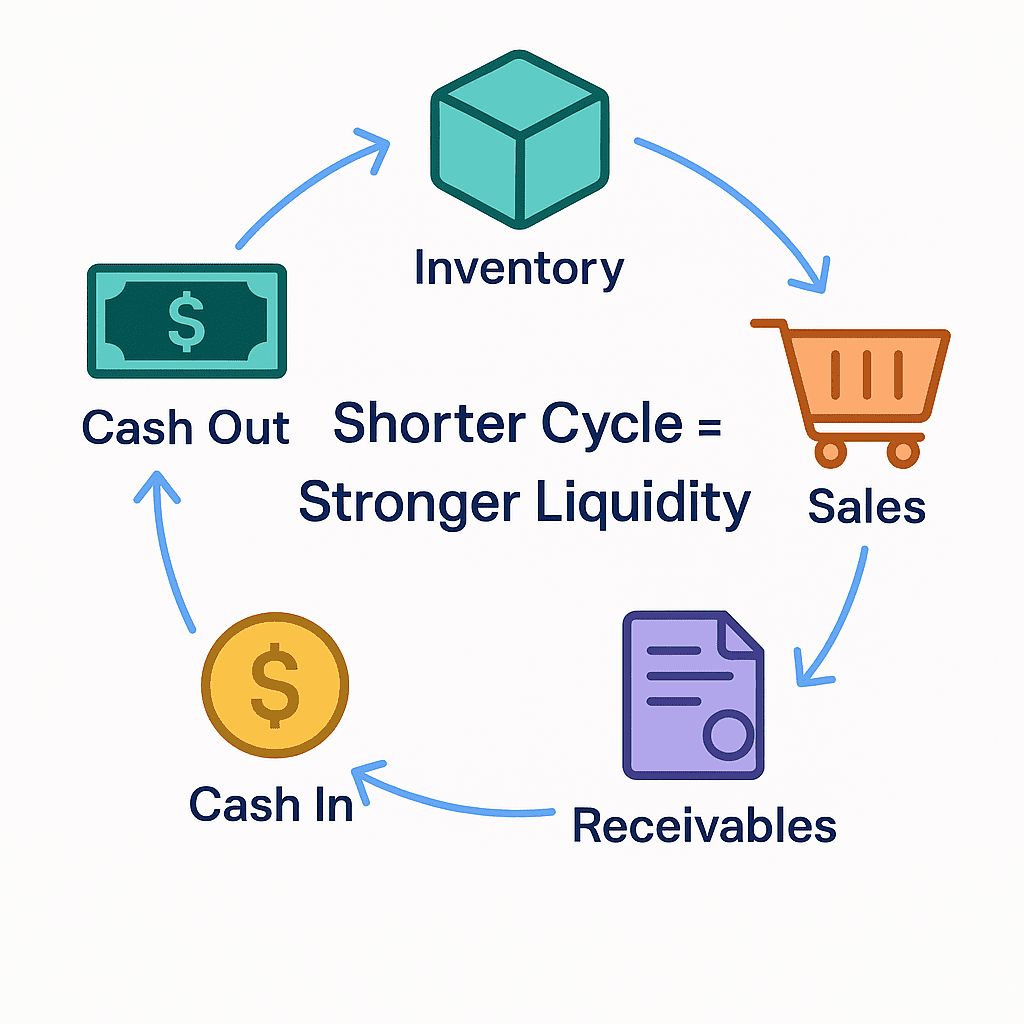

Working Capital Cycle Explained

The working capital cycle shows how cash moves through a business. It starts with cash spent on materials and ends when payments from customers come in. A shorter cycle means faster recovery of cash and stronger liquidity.

Cycle steps:

- Cash goes out to buy raw materials or stock.

- Materials are turned into products and kept as inventory.

- Goods are sold to customers.

- Sales turn into accounts receivable.

- Receivables are collected, and cash returns to the business.

➕ Positive cycle example:

A clothing store buys fabrics worth $5,000. It sells finished items within two weeks and collects payments in another two weeks. The store gets cash back in one month, which it can use for the next purchase.

➖ Negative cycle example:

A wholesale trader buys goods worth $20,000 and must pay the supplier in 30 days. Customers, however, take 60 days to pay. For one month, the trader faces a cash gap and may need outside financing to bridge it.

📘 Recommended Read: Struggling with excess stock or stockouts? Our guide to Inventory Management Techniques explains proven methods to optimize stock and free up cash.

Challenges in Managing Working Capital

Even profitable businesses can face cash flow problems if working capital is not managed well. Each of these issues affects liquidity and increases financial risk. Identifying them early allows a business to take corrective action.

The main challenges include:

- Late customer payments

Customers may delay paying invoices, which locks up cash. This makes it harder to pay suppliers and cover expenses. - Excessive inventory holding

Stock that sits too long ties up money and increases storage costs. It can also lead to waste or obsolescence. - Poor supplier terms

Short payment deadlines or lack of credit from suppliers can put pressure on cash flow. Small firms may struggle if they cannot negotiate flexible terms. - Seasonal fluctuations

Some businesses earn most of their revenue in peak seasons. During off-peak months, cash inflows slow down while expenses remain steady. This creates gaps that need planning.

Working Capital Management Strategies

Strong working capital management requires proactive steps. Businesses can improve cash flow and reduce risk with these strategies:

- Improve receivables collection

Set clear credit terms, send invoices promptly, and follow up without delay. Offer discounts for early payments and use reminders to reduce overdue accounts. - Negotiate better supplier terms

Seek extended payment periods or flexible schedules. Building trust with suppliers can also help secure discounts for larger or repeat orders. - Optimize inventory with forecasting tools

Use sales history to predict demand and adjust stock levels. This avoids excess storage costs and prevents stockouts during busy periods. - Use cash flow forecasting

A simple forecast highlights upcoming gaps between inflows and outflows. It helps prepare for seasonal lows or unexpected expenses. - Leverage automation and ERP

ERP systems are able to track receivables, payables, and inventory in real time. Automated alerts, payment tracking, and stock reports help avoid errors and save time.

Working Capital Efficiency Metrics

Efficiency metrics show how well a business uses its resources. Tracking them regularly helps spot weaknesses and measure progress.

- Current ratio

Formula: Current Assets ÷ Current Liabilities.

A ratio above 1 shows that assets are higher than liabilities, which is usually a good sign. Too high a ratio, however, may indicate idle assets. - Quick ratio

Formula: (Current Assets − Inventory) ÷ Current Liabilities.

This stricter test excludes inventory since stock may not convert into cash quickly. It shows whether a business can cover debts with the most liquid assets. - Days Sales Outstanding (DSO)

Average number of days it takes to collect payments from customers. A lower DSO means faster cash inflow and better liquidity. - Days Payables Outstanding (DPO)

Average number of days the business takes to pay suppliers. A higher DPO can improve cash flow, but stretching it too far may harm supplier relations. - Inventory Turnover

Formula: Cost of Goods Sold ÷ Average Inventory.

This shows how often inventory is sold and replaced within a period. A higher turnover indicates efficient stock use.

Examples of Working Capital Management in SMEs

It’s hard to overestimate the importance of working capital management. Practical examples show how working capital management works in real businesses.

Retail Store Managing Seasonal Demand

A small clothing retailer earns most of its revenue during festive seasons.

To avoid a cash gap in off-peak months, the store forecasts demand and reduces orders after the peak. It also negotiates with suppliers to extend payment terms until sales pick up. This way, the retailer avoids excess stock and keeps cash available for rent and salaries.

Manufacturing SME Balancing Supplier Credit

A furniture workshop buys timber and hardware on credit. Suppliers give 30 days for payment, while customers often take 45 days to settle invoices.

To bridge this gap, the workshop improves receivables collection by sending invoices on delivery and following up weekly. It also offers a 2% discount for payments within 10 days. These steps shorten the cash cycle and reduce reliance on short-term loans.

Both examples show how everyday decisions about credit, stock, and payments directly affect working capital.

Working Capital Management Best Practices

Strong working capital management comes from consistent discipline across finance and operations. These best practices help businesses stay prepared and avoid cash flow risks.

- Align finance and operations

Finance teams should work closely with sales, purchasing, and production. Shared planning prevents overstocking, late collections, or supplier disputes. - Use technology to automate AR/AP

Automated invoicing, reminders, and digital payment tracking reduce errors and speed up collections. ERP tools can provide real-time visibility of receivables and payables. - Monitor KPIs regularly

Ratios and metrics such as DSO, DPO, and inventory turnover should be reviewed monthly. Tracking trends helps spot risks before they turn into problems. - Maintain an emergency liquidity buffer

A reserve of cash or access to short-term credit protects the business from shocks such as delayed payments, supply chain issues, or seasonal dips.

💡 Keep your cash flow under control with Kladana ERP

Track receivables, payables, and inventory in one system. Get real-time insights to avoid cash gaps and grow with confidence.

Conclusion: Strong Working Capital = Strong Business

Working capital management is more than a financial calculation. It is the foundation of daily stability and long-term growth. A company with strong working capital can pay suppliers on time, invest in new opportunities, and handle unexpected costs without stress.

For small and medium businesses, effective management means:

- Liquidity is always available for daily needs.

- Profitability improves as cash is used more efficiently.

- Risks of insolvency and cash shortages are reduced.

Healthy working capital makes a business more reliable in the eyes of banks, suppliers, and investors. It also creates room for expansion and innovation.

The first step is to assess your current position. Review receivables, payables, inventory, and cash. Then apply strategies and best practices to improve flow. Small improvements add up quickly and create lasting stability.

💡 Tip: Start by checking your own working capital health today. As shown in the examples of working capital management from SMEs, even one adjustment in receivables collection or inventory control can free up cash and strengthen your business.

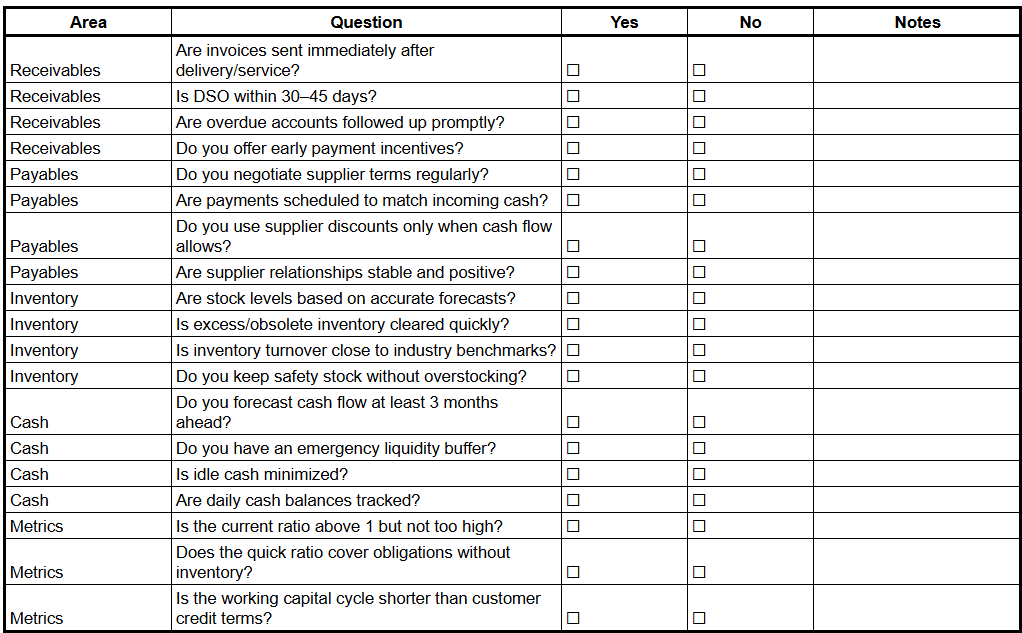

To make this simple, we’ve created a practical checklist with a short instructions. It helps business owners review receivables, payables, inventory, cash, and efficiency metrics in one place. By going through the list, you can quickly see whether your working capital supports growth or exposes you to risk.

FAQ on Working Capital Management

Business owners often have similar questions about working capital. Here are clear answers to the most common ones.

What is working capital management in simple terms?

It is the process of controlling current assets and current liabilities so a business always has enough cash to meet short-term needs.

Why is working capital management important?

It ensures liquidity, supports smooth daily operations, builds trust with investors and suppliers, and helps prevent cash shortages.

What are the main objectives of working capital management?

To keep enough liquidity, maintain profitability, minimize the risk of insolvency, and improve efficiency across operations.

What are examples of current assets and liabilities?

Current assets include cash, accounts receivable, and inventory. Current liabilities include accounts payable, short-term loans, and accrued expenses.

What is the working capital cycle?

It shows how cash moves through buying inventory, making sales, collecting receivables, and returning cash to the business. A shorter cycle means better liquidity.

How do you measure working capital efficiency?

By using ratios such as current ratio, quick ratio, DSO, DPO, and inventory turnover. These metrics highlight how effectively resources are managed.

What strategies improve working capital?

Faster receivables collection, negotiating better supplier terms, optimizing inventory, cash flow forecasting, and using automation tools like ERP systems.

How does working capital affect profitability?

Efficient management frees up cash that can be reinvested into operations, reducing financing costs and improving margins.

What is the difference between gross and net working capital?

Gross working capital is the total value of current assets. Net working capital is current assets minus current liabilities.

How can small businesses improve working capital quickly?

By collecting overdue invoices, reducing excess inventory, delaying non-essential purchases, and negotiating short-term credit with suppliers.

Read‑alikes

How to Estimate Manufacturing Costs: Methods, Tools, and Best Practices

End-of-Year Checklist for Small Business: Essential Tasks Before January

What is Cash Flow from Operating Activities? A Complete Financial Guide

Direct vs Indirect Expenses: How to Classify Them Correctly in Accounting