Keeping your business accounts updated makes you feel like you’re in control — until the bank statement arrives and throws off your numbers. Sometimes the gap is small. Other times, it’s not even clear where it came from. Either way, it slows you down.

Many small business owners encounter this issue. In fact, nearly 30% have faced financial losses simply because their bank balance didn’t match what was in their books, not due to carelessness, but because they assumed both were already in sync.

That’s where the Bank Reconciliation Statement (BRS) steps in. This guide will walk through what BRS means, why it matters, how to prepare one, and what a typical statement looks like, with examples and formats included.

What is a Bank Reconciliation Statement (BRS)?

A Bank Reconciliation Statement is a document that compares the cash balance in a company’s books with the balance reported by the bank. It identifies any gaps between the two and explains the reasons behind them.

In simple terms: the books say one thing, the bank says another, and BRS helps find out what changed, what’s pending, or what might be incorrect.

Why BRS Is Important

Money can go unaccounted for in the event of a balance mismatch. It doesn’t always mean that there’s some fraud or error. Sometimes, it could be just a delay, a fee, or an overlooked entry.

However, the longer those mismatches remain unresolved, the more difficult it becomes to identify the source.

Primary reasons why you should prepare BRS regularly:

- Catch missed entries: Includes identifying bank charges, interest credits, and direct debits. These won’t always appear in your books until they are reconciled.

- Prevent cash flow issues: Overestimating available funds can result in bounced payments or supplier delays.

- Improve audit readiness: Auditors often request past BRS reports to verify financial accuracy.

- Spot potential fraud: A recurring mismatch may suggest unauthorized withdrawals or duplicate payments.

How Kladana Supports Reconciliation-Led Financial Accuracy

✅ Bank & Cash Balance Adjustments — Manually align your system balances with actual bank or cash amounts by entering the final balance or adjustment sum directly in Kladana.

✅ Counterparty & Employee Account Corrections — Adjust balances for suppliers, customers, or employees to reflect advances, write-offs, or reconciliation-related changes.

✅ Financial Adjustment Reports — View a full log of balance changes and access cash flow reports to match internal records with bank statements.

✅ Accounting Integrations — Sync transactions between Kladana and Zoho Books or another solution, so payments, invoices, and inventory updates are reflected across systems.

✅ Linked Sales, Purchase & Payment Records — Every order or payment made in Kladana is auto-recorded in the finance module, helping you trace transactions during monthly or quarterly reconciliations.

How Bank Reconciliation Works

Reconciling bank and book balances requires identifying what has cleared, what hasn’t, and what needs attention.

The intent is to achieve a single adjusted closing balance that accurately reflects the available funds.

Matching Books vs Bank

Here’s a simple breakdown of what each source shows:

| Item | Company’s Books | Bank Statement |

Cheques issued but not cleared |

Already deducted |

Not shown |

Direct bank charges |

Missing (unless manually added) |

Already deducted |

Deposits in transit |

Already added |

Not yet reflected |

Interest earned |

Often missing |

Shown in the bank statement |

Duplicate entries or errors |

Possible |

Rare (banks post automated entries) |

Timing Differences & Common Causes

Discrepancies usually fall under three categories. Recognizing these makes reconciliation easier:

- Outstanding cheques: Payments issued by the business haven’t yet been cashed or deposited by the recipient.

- Deposits in transit: Payments received and recorded in the books but not yet cleared by the bank.

- Bank-only transactions: Charges, interest, or automatic payments that the bank has processed but the business hasn’t recorded yet.

These discrepancies are not present simultaneously in both systems, which is why reconciliation remains essential.

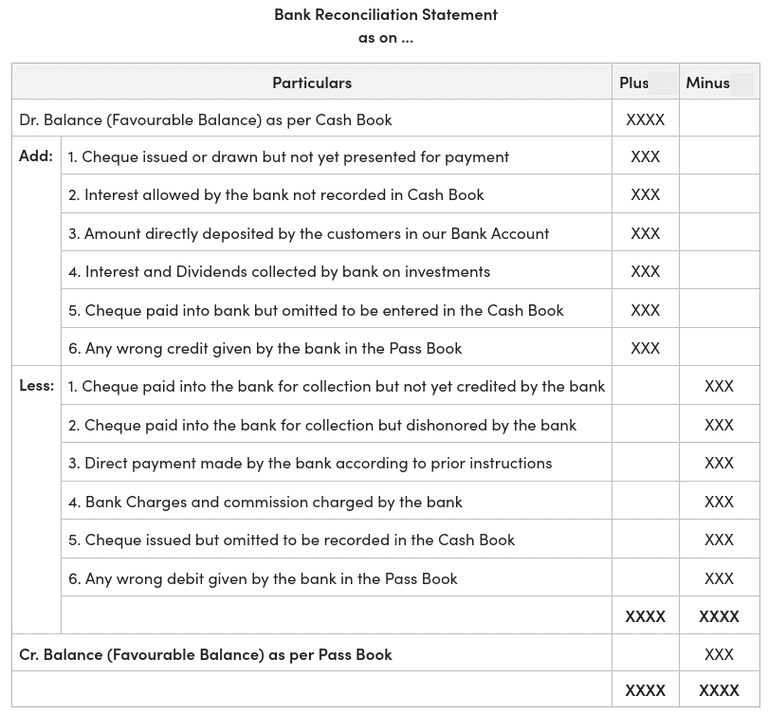

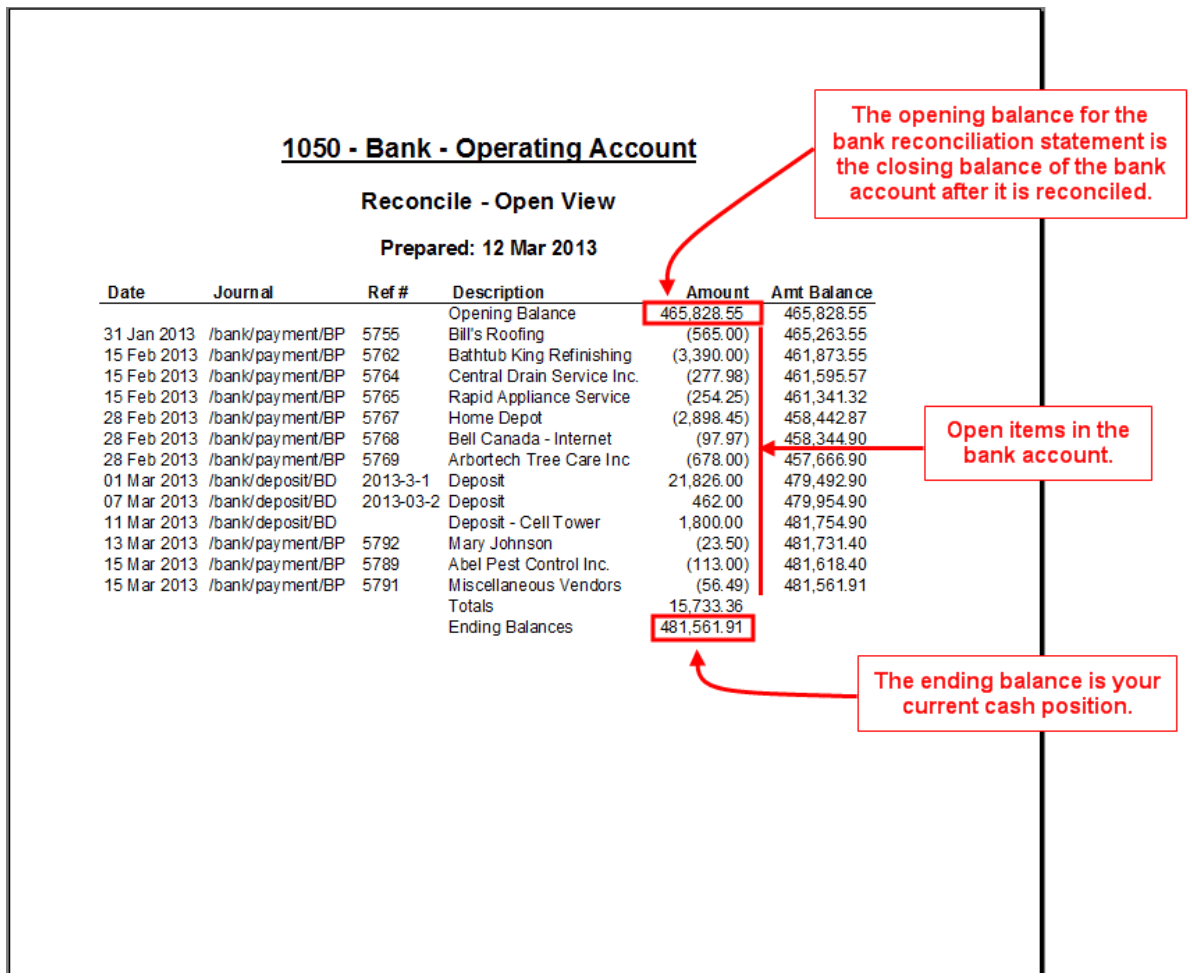

Format & Example of BRS

The layout of a Bank Reconciliation Statement follows a logical, checklist-based structure. Whether done manually or via software, the format captures both book-side and bank-side adjustments to explain the balance difference.

Typical BRS Format

Start with the balance as per the cash book or passbook. Then, add or subtract all relevant adjustments until the balance on one side matches the other.

Example Format (Balance as per Cash Book):

| Particulars | Amount ($) |

Add: Cheques issued but not presented |

8,000 |

Add: Direct deposit by the customer |

2,500 |

Less: Bank charges not entered in cash book |

(350) |

Less: Cheques deposited but not cleared |

(1,200) |

Balance as per Pass Book |

$8,950 |

The same structure works in reverse if you start from the passbook balance.

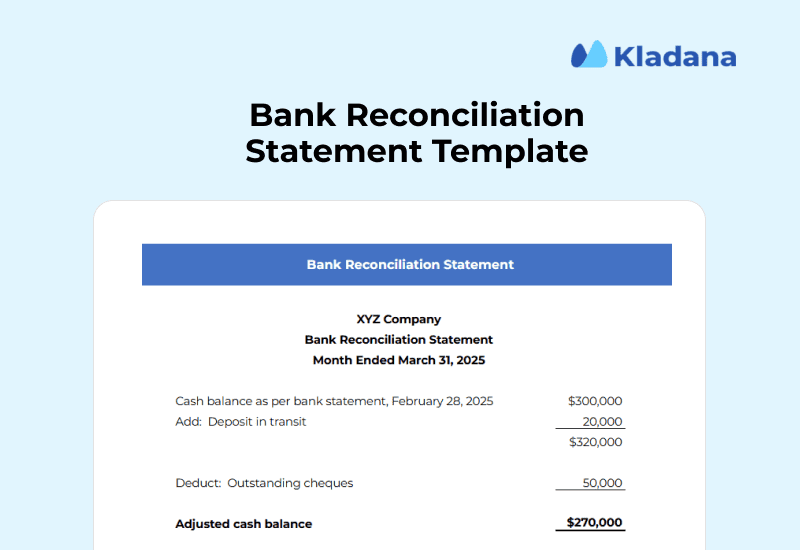

Sample Filled Statement

Let’s say your cash book shows $12,000. You issued a cheque of $4,000, which is yet to be presented. The bank also charged a fee of $500, which is absent in your books.

On top of that, one of your customers directly transferred $3,000, but you’ve yet to record it.

Here’s how the BRS would look:

| Particulars | Amount ($) |

Balance as per Cash Book |

12,000 |

Add: Cheque not yet presented |

4,000 |

Add: Direct deposit from the customer |

3,000 |

Less: Bank charges |

(500) |

Balance as per the Pass Book |

$18,500 |

It is one way to make sure that both balances meet and confirm that no entry has been missed or duplicated.

Take our free BRS template and customize it to fit your needs:

How to Prepare a Bank Reconciliation Statement

A Bank Reconciliation Statement (BRS) starts with two imperfect sources: your company’s books and your bank’s version of events.

Now, this is possible either by using accounting software or doing it manually in Excel; in either case, the process remains essentially the same. It’s about being methodical.

Every unmatched line item is either because there’s something pending, overlooked, or suggests an entry that never belonged.

Let’s take a look at the process of creating a bank reconciliation statement, which has five steps.

Step 1: Pull records for the same date range

Start by gathering:

- Your cash book or general ledger. A more optimized way to do so is by enabling integrations with accounting solutions and banks.

- The bank statement for the same period (usually monthly)

Both must cover the same date range. Otherwise, you’ll waste time chasing false mismatches.

Make sure the cash book includes all entries: payments made, cheques issued, deposits received, and fees logged.

Step 2: Mark off matched entries

Go line by line. For every entry in your books, check if the same transaction appears in the bank statement.

This includes:

- Customer payments received

- Vendor payments made

- Cash deposits

- Bank charges or interest

Place a tick (✔) next to entries that appear in both. These don’t need any changes. They’re already reconciled.

Step 3: Identify and list unmatched entries

Now, turn your attention to the unmatched items that appear in only one source.

Split them into two groups:

A. Present in cash book, missing in bank

These often include:

- Cheques you’ve issued but haven’t been presented

- Cash or cheque deposits made at month-end

- Mistaken double entries

B. Present in the bank statement, missing in cash book

Common examples:

- Bank fees, charges, or interest

- Direct credits from customers

- Standing instructions (e.g., EMI deductions)

- Returned or bounced cheques

Review each item and check for any legitimate delays. Other times, they point to entry errors.

Step 4: Prepare your reconciliation sheet

Now that you’ve separated the unmatched items, it’s time to create the statement.

Start with the balance as per your cash book (if reconciling from books to bank).

Then:

- Add items that the bank has processed but you haven’t

- Subtract payments or adjustments you’ve entered that the bank hasn’t recorded yet

Alternatively, you can begin with the bank statement balance and adjust in reverse.

At this point, you’ll start building the BRS: a structured format with adjustments listed, leading to the reconciled balance

Step 5: Cross-verify and finalize

Once the adjusted balance from one side matches the balance from the other, you’ve successfully reconciled.

Important: Save the statement. For businesses, this becomes part of your audit trail. For students, this step reinforces accuracy. And, if there’s a mismatch in the closing figure, then it means something has been skipped.

Also check:

- Were any entries added twice?

- Were any debit/credit directions reversed?

- Do all items have supporting documentation?

Even if the BRS balances, unexplained entries should never be ignored.

5 Tips to Avoid Errors

Bank reconciliation often looks simple until you’re tracking down a $1,000 mismatch across 90 transactions. You can implement these tips that help most people trip up when preparing BRS.

Each point below solves a real-world issue and helps tighten your workflow.

1. Review the opening and closing balances carefully

Many reconciliation errors begin with incorrect opening balances. Always verify that the opening balance in your cash book matches the closing balance from your previous reconciliation.

If your previous month’s reconciliation wasn’t finalized or saved properly, the mismatch will carry forward and waste hours of unnecessary checks.

2. Use reconciliation-specific working sheets

Create a separate working sheet or tab within your reconciliation file that only includes unmatched entries, date-wise breakdowns, and notes. This separation ensures you’re not editing your master ledger while reconciling, which keeps your audit trail intact.

Avoid reconciling directly in your accounting ledger unless your software has a version history or a lock-in system for reconciled periods.

3. Always work from both ends

Start by matching transactions from the bank statement side. Then cross-check the unmatched entries from your books.

- Bank charges were missed in the books

- Duplicate entries are recorded on either side

- Bounced payments or chargebacks that only appear in the bank

This method is far more accurate than scanning just from one direction.

4. Check narration consistency, but reconcile on amount and date

Descriptions often differ. The same cheque could be labeled “Payment to Vendor X” in your ledger and “CHQ-8475” in the bank statement.

Focus on:

- Transaction amount

- Date (or +1 day if processed next working day)

- Known identifiers (cheque numbers, references)

Cross-referencing only narrations can lead to skipped matches or incorrect pairings.

5. Let your reports reflect clean reconciliation

Once your BRS is done, it shouldn’t live in isolation. Good accounting tools let your reconciliation feed directly into your closing reports. That way, adjusted balances, flagged entries, and cleared transactions are all visible at a glance.

In tools like Kladana, these records appear within the Kladana financial reports, enabling you to track actual cash flow, monitor corrections, and simplify audits without needing to review past entries.

Make sure of the following:

- Exact or near-exact values of dates and amounts

- Known identifiers (cheque numbers, references) to confirm the origin of the entry

Simplify Balance Adjustments and Stay Financially Aligned

Kladana helps you keep internal records clean with adjustable balances, synced payments, and integration with tools like Zoho Books.

FAQs on the Bank Reconciliation Statement

Let’s answer a few major questions around the bank reconciliation statement.

What is a bank reconciliation in simple terms?

It’s a process where you compare your business’s cash records with the bank statement to make sure both show the same closing balance.

Why is a BRS prepared?

A BRS helps identify pending transactions, missed entries, or errors. It confirms that your actual bank balance matches your books.

How often should you do a bank reconciliation?

Most businesses reconcile monthly. If you handle high transaction volume, weekly or biweekly reporting helps catch issues early.

What are the common reasons for differences?

Delays in cheque clearance, direct bank charges, customer deposits not yet recorded, and data entry mistakes are the most frequent causes.

What does the BRS format look like?

It’s a simple table that starts with your cash book or bank balance, then adjusts for pending items until both sides match.

Can you automate bank reconciliation?

Yes. Many accounting tools offer automated matching. However, you’ll still need to check for any exceptions or unclear entries manually.

Is BRS only needed for businesses?

No. Even individuals managing large payments, loans, or multiple accounts can benefit from preparing one.

How do outstanding checks affect BRS?

They lower your cash book balance, but the bank hasn’t cleared them yet, so they appear as pending in reconciliation.

Who prepares the bank reconciliation?

Usually, the accountant, finance team, or business owner handles it. In small setups, it’s often done directly by the person managing the cash.

What happens if errors aren’t found?

Unreconciled errors can lead to inaccurate financial reports, overestimated cash flow, missed payments, and difficulties during audits.

List of Resources

Conciliac — The importance and benefits of performing effective bank reconciliation