For many small business owners, one of the earliest compliance concerns is understanding whether GST is required for a small business. The rules can be confusing because registration is not determined solely by revenue. The way you sell, whether locally, across states, or through an e-commerce platform, and the type of goods or services you provide can all determine if GST is compulsory or if you qualify for exemption.

This uncertainty often leaves entrepreneurs in a difficult position. You’ll know whether you fall under the GST exemption limit when GST registration for small businesses becomes mandatory, and in which case, choosing voluntary GST registration could work in your favour.

In this guide, you’ll learn:

- When is GST legally required for small businesses

- Who is exempt from registration under the GST turnover limit for small business

- The benefits and drawbacks of registering voluntarily

- How GST compliance affects pricing, competitiveness, and day-to-day operations.

- Understanding GST and Small Business Compliance

- GST Turnover Limit for Small Businesses

- When Is GST Mandatory for Small Businesses?

- Who Is Exempt from GST Registration?

- Voluntary GST Registration for Small Businesses

- Drawbacks of GST for Small Businesses

- GST Registration Process for Small Businesses in India

- To Sum Up

- Frequently Asked Questions on GST for Small Businesses

- List of Resources

Understanding GST and Small Business Compliance

Before deciding whether GST applies to you, it’s essential to take a step back and understand how the system works. The goods and services tax was introduced to replace multiple indirect taxes like VAT, excise, and service tax; instead of different state and central levies, you now deal with a single framework.

For a small business, this has two sides. On the one hand, GST promises simplicity, one tax, one system. On the other hand, it creates a compliance layer that many entrepreneurs find overwhelming. Filling returns, managing invoices, and staying on top of rules can feel like a burden, especially if you’re still figuring out your growth path.

This is where the real confusion begins. GST does not apply uniformly to all businesses. Some owners remain exempt under the GST exemption limit, others are required to register from day one because of the way they operate, and many opt for voluntary GST registration to gain advantages like input tax credit or access to larger clients.

⚡ Small business? Kladana helps simplify parts of GST filings

Auto‑calculate GST for supported invoice types, generate tax‑invoices and sales invoices quickly, and free up time for growth instead of paperwork

GST Turnover Limit for Small Businesses

The GST turnover limit for small businesses is the main criterion for deciding whether you need to register or not. But this limit is not the same everywhere in India. It depends on:

- Whether you supply goods or services.

- Whether you operate in a normal state or a special category state like Northeast and hill states.

🏔️ Why lower limits in Northeast & Hill States?

The government recognises that most businesses in the Northeast and hill regions operate on a smaller scale, often unorganised or seasonal. To bring more of them under the GST framework, lower exemption limits were fixed. This ensures tax coverage without requiring high turnovers, while still exempting micro and subsistence-level businesses.

Compliance Notes

☑️ If you’re one of these states, your GST threshold is half of that in normal states.

❌ However, agriculture and certain exempt supplies like unbranded food, education, and healthcare still stay outside GST, just like the rest of India.

⚠️ Many small traders and service providers in the Northeast assume they are exempt by default, but that is not true. Once your turnover crosses ₹20 lakh in goods or ₹10 lakh in services, GST applies.

➡️ With Kladana, you get real-time alerts as your turnover nears the GST threshold, helping you register on time and avoid penalties.

When Is GST Mandatory for Small Businesses?

GST registration becomes mandatory when your business activity crosses into categories covered explicitly by law. It isn’t limited to revenue; the nature of your operation often decides whether you must register.

1. Turnover Crosses the Exemption Limit

If your annual sales exceed the GST turnover limit for small businesses, you are legally required to register. This limit differs for goods and services and is lower in certain states. Once you cross it, registration is no longer optional.

2. Interstate Supply of Goods or Services

Even if your sales are small, supplying outside your state makes GST registration for small businesses mandatory. The government treats interstate trade as taxable from the first rupee to maintain uniformity across states. So, by registering, you ensure your invoices are valid for your out-of-state buyers, who may otherwise refuse to transact with you if you cannot provide a GSTIN.

3. Selling through E-commerce Platforms

If you sell on platforms like Amazon, Flipkart, or Shopify, GST applies regardless of your turnover. This rule ensures that online transactions are traceable and compliant. If you attempt to operate without registration, your sales can be blocked, and payments may be withheld.

4. Sector-Specific Rules

Some industries require GST registration from the start, even without crossing the GST exemption limit. These include:

- Ride-hailing and transport aggregators like cab operators are required to charge GST on fares

- Input service distributors, who transfer Input Tax Credit between different branches of the same company

- Online marketplaces or operators who earn commission or fees by providing a platform for others

If you fail to register in any of these categories, you will incur penalties. Interest charge and restrictions on working with larger clients who require a valid GSTIN.

💰 Track Every Rupee and See Your Business Clearly

Kladana’s financial tools help you control cash flow, payments, and profitability — all in one place

- Record income and expenses for each sale, purchase, or return

- Track advance payments, partial settlements, and outstanding balances

- Compare plan vs actual with financial reports and dashboards

- Analyze profits by product, project, or partner

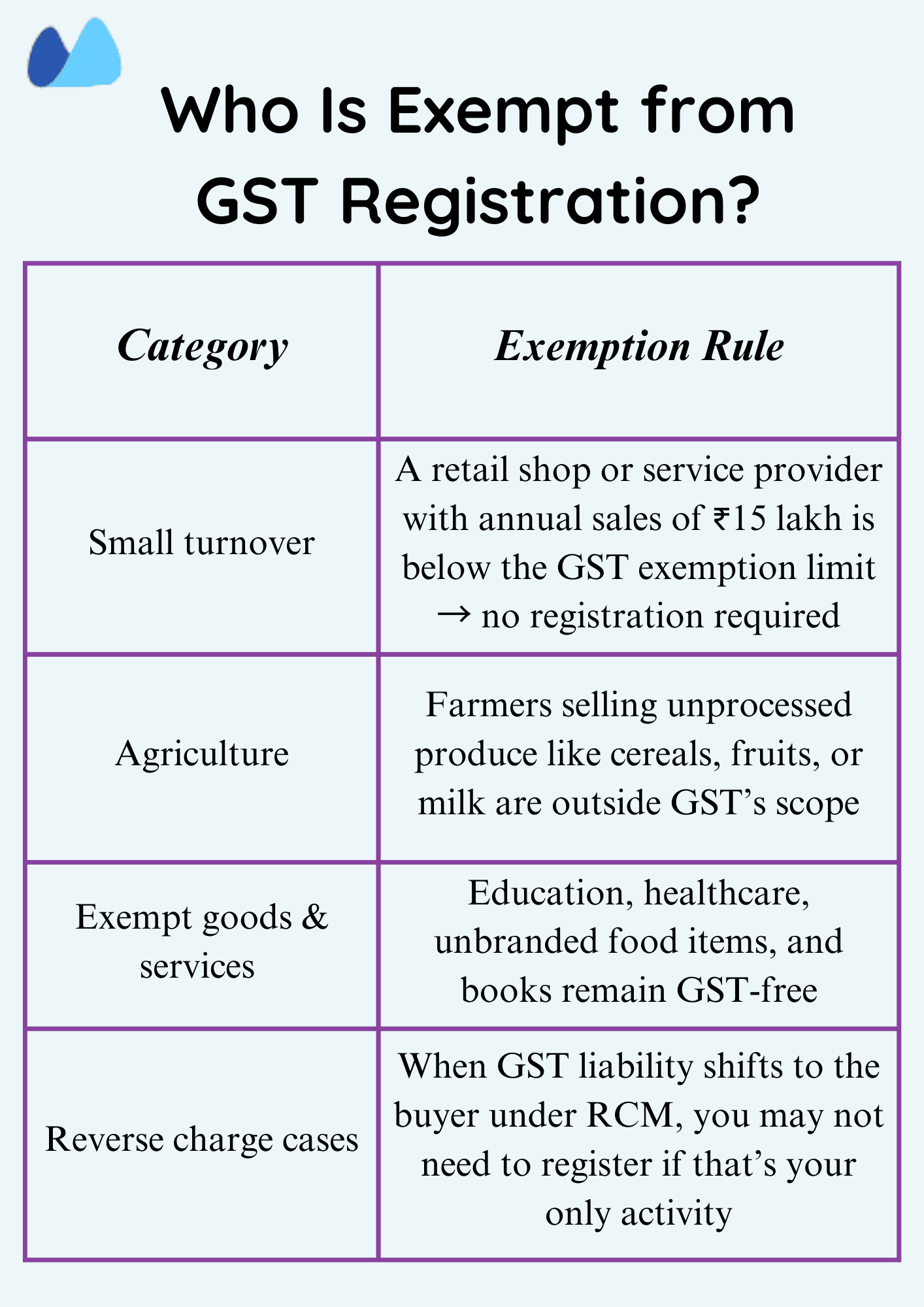

Who Is Exempt from GST Registration?

GST registration is not required for every small business. Very small traders, farmers, and providers of essential services are given relief so they don’t carry the burden of compliance. These exemptions mean that registration isn’t always mandatory.

Here are the key categories where GST registration is not required:

1. Business below the Turnover Threshold

If your annual sales remain within the GST exemption limit, you don’t need to register. The threshold is:

- ₹40 lakhs for goods (₹20 lakh in special category states)

- ₹20 lakh for services (₹ 10 lakh in special category states)

👉 What this means for you: If you’re running a small shop, consultancy, or freelancing service below this limit, you’re legally exempt. You can still opt for voluntary GST registration if you want to benefit from features like Input Tax Credit or need GST invoices for B2B clients.

2. Agricultural Activities

Farmers engaged in the direct supply of agricultural produce are exempt from GST registration. This exemption covers unprocessed products like cereals, fresh fruits, vegetables, and milk.

👉 Why this matters: If your income is purely from agricultural sales, you don’t need to worry about GST compliance. However, if you transition into value-added activities, such as processing, packaging, or branded sales, GST rules may become applicable.

3. Certain Exempt Goods and Services

Some goods and services are fully exempt under GST, which means that even if you deal in them, you don’t need to register. Common examples include:

- Education services in recognised institutions

- Healthcare services provided by hospitals and clinics

- Unbranded food items such as flour, rice etc

- Books and newspapers

👉 Practical takeaway: If your entire business activity falls under exempt categories, registration is not required, no matter your turnover. But if you provide both exempt and taxable supplies, you may still need to register for the taxable portion.

4. Business Covered under Reverse Charge by the Buyer

In some cases, the buyer is liable to pay GST under the Reverse Charge Mechanism (RCM). For example, when unregistered goods transport agencies provide services, the recipient pays GST instead of the supplier.

👉 What this means: If your only supplies are under RCM and you don’t cross turnover limits, you are not required to register.

Recommended read: What is GST Return? Definition, Types, and Filing Process for Businesses

Voluntary GST Registration for Small Businesses

Even if you’re not legally required to register, you can still opt for voluntary GST registration. Many entrepreneurs choose this path to gain credibility, expand into new markets, or take advantage of tax credits.

| Pros | Cons |

| You can claim ITC on purchases such as raw materials, rent, or software, lowering your overall cost | Once you register, you must file GST returns regularly, issue GST invoices, and maintain digital records like bigger companies |

| You can expand interstate or on e-commerce platforms without disruptions, making growth smoother | You may need software or CA to manage filings, which adds costs for small businesses with tight margins |

| Larger B2B clients and government buyers prefer GST-registered vendors, so you build more credibility | Errors or late filings can bring penalties and notices, even if your turnover is low |

| By registering early, you build a compliance history and avoid scrambling when your turnover crosses the threshold later | Charging GST can affect your pricing, making you less competitive for very price-sensitive customers |

Benefits of GST registration for small businesses:

Even if registration feels like an extra burden, being GST-compliant offers several advantages that can directly impact your profitability and growth. For many SMEs, these benefits outweigh the compliance effort.

1. Input Tax Credit

With GST registration, you can claim ITC on the tax you pay for purchases such as raw materials, equipment, rent, or professional services. This reduces your overall cost of operations. Without registration, the tax you pay on inputs becomes a sunk cost.

➡️ With Kladna, you can track GST applied across your sales and purchase documents in one dashboard, instead of juggling spreadsheets.

2. Easier Interstate Sales

Once registered, you can sell freely across state borders without worrying about entry restrictions or buyer objections. Businesses outside your state often demand a GST invoice, and without a GSTIN, they may refuse to transact with you.

3. Access to Government Tenders and Contracts

Many government departments and large corporations work with GST-registered vendors. If you plan to participate in tenders, supply to Public Sector Undertaking, or partner with established companies, having a GSTIN is essential.

4. Improved Credibility and Trust

Registration adds legitimacy to your business. Clients, distributors, and partners see you as a compliant and reliable supplier. This credibility can open up opportunities for larger deals, long-term contracts, and partnerships.

5. Streamlined Tax Structure

Instead of navigating multiple indirect taxes, GST consolidates everything under a single system. This simplifies your tax planning, record-keeping, and audits, especially as your business scales

Drawbacks of GST for Small Businesses

While GST offers several benefits, it also brings compliance requirements that can feel heavy for small firms. Before registering, you should be clear about these drawbacks so you can plan for them.

1. Regular Filling Requirements

Once registered, you’re required to file returns monthly or quarterly, depending on your scheme. This includes maintaining GST-compliant invoices, uploading data on the GST portal, and reconciling purchases and sales. For a small business with limited staff, this ongoing compliance can eat into valuable time.

2. Penalties for Mistakes or Delays

If you miss a filing deadline or enter incorrect details, penalties and late fees apply. Interest is also charged on delayed payments. Even small errors in invoices or mismatches between your records and your supplier’s records can trigger notices.

3. Higher Compliance Costs

To manage GST properly, you may need accounting software or professional help from a CA. These costs can feel significant for micro or early-stage businesses where margins are thin.

4. Increased Administrative Burden

Beyond filing, GST requires you to track invoices, manage digital records, and stay updated on rule changes. If you don’t have a dedicated finance team, this may pull you away from focusing on growth and operations.

⚠️ 2025 GST Compliance Rule (Based on GSTN Advisory)

| What’s Changing | Details |

| Rule | GST returns can be filed only within 3 years of their due date |

| Applies to | GSTR-1, GSTR-3, GSTR-4, GSTR5/5A, GSTR-6, GSTR-7, GSTR-8, GSTR-9/9C |

| Start Date | From the July 2025 tax period |

| Example | From Oct 1, 2025, returns due for August 2022 or earlier will be permanently blocked |

| Action Needed | File any pending returns before the 3-year deadline to avoid a lockout |

GST Registration Process for Small Businesses in India

Registering for GST is now entirely online, but it requires preparation. Here’s a step-by-step view of how the process works:

| Step | What You Need To Do | Key Notes |

| Visit the GST Portal | Go to www.gst.gov.in | Registration is free. Avoid third-party agents charging unnecessary fees |

| Submit application | Fill form GST REG-01 with PAN, mobile number, and email ID | PAN of the business/owner is mandatory |

| Upload documents | Proof of business address, bank account details, Aadhaar, PAN, passport photo | Documents vary by business type (proprietorship, partnership, company) |

| Verification | OTP verification and Aadhar authentication | Speeds up approval if Aadhaar is linked |

| Application Reference Number generation | You need to issue an ARN to process | You can track application status online with ARN |

| GSTIN allotment | Get GSTIN (15-digit number) once approved | This GSTIN must be quoted on all invoices, returns, and official communication |

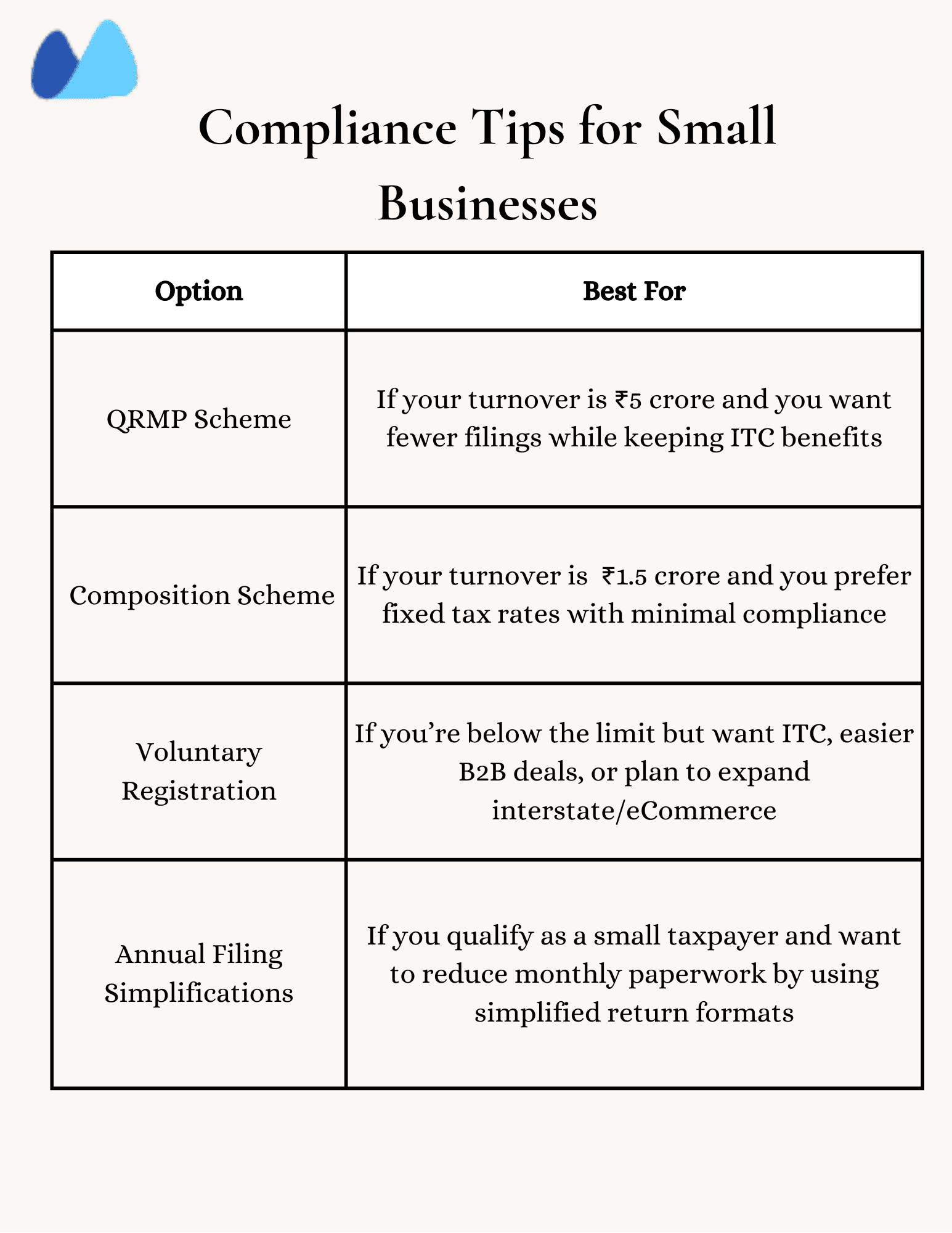

Compliance Schemes for Small Businesses

Once registered, small businesses can opt for simplified GST schemes to reduce compliance requirements.

QRMP Scheme (Quarterly Return, Monthly Payment)

- For businesses with a turnover of up to ₹5 crore

- Pay tax monthly but file quarterly returns (GSTR-3B)

- Cuts filings from 12 to 4 annually

The Composition Scheme for Small Taxpayers

If your turnover is below ₹ 1.5 crore (₹75 lakh in special category states), you can opt for the GST composition scheme.

- Tax rates are fixed and lower: 1% for traders, 2% for manufacturers, and 5% for restaurants

- Filling is quarterly, not monthly

- Simpler compliance: You don’t need to maintain detailed ITC records

However, under the scheme, you:

- Cannot claim ITC

- Cannot supply goods interstate

- Cannot sell through e-commerce platforms

✅ For very small businesses, this scheme reduces compliance headaches while still keeping them GST-compliant.

To Sum Up

So, is GST required for small businesses? The answer depends on how you operate. If you cross the turnover threshold, sell interstate, or list on e-commerce platforms where registration is compulsory, then GST is mandatory. If you remain below the GST exemption limit and deal only in exempt goods or services, you’re not required to register.

For small businesses, the key decision is about striking a balance between compliance efforts and growth opportunities. Staying exempt keeps things simple, but registering early can position you for expansion, new contracts, and long-term stability.

Frequently Asked Questions on GST for Small Businesses

What is the GST turnover limit for small businesses?

The GST turnover limit is ₹40 lakh for goods and ₹20 lakh for services in normal states. In special category states, it’s ₹20 lakh for goods and ₹10 lakh for services. Crossing these limits makes registration mandatory.

Is GST required if turnover is below ₹20 lakh?

No, if your annual turnover is below the exemption limit, GST registration is not mandatory. You can still register voluntarily if you want to work with ITC or B2B clients.

Do freelancers and consultants need GST registration?

Yes, if your annual income crosses ₹20 lakh (₹10 lakh in special states. If it’s lower, registration is optional, but corporate clients may insist on GST invoices.

What is the difference between mandatory and voluntary GST registration?

Mandatory registration applies when your turnover or business activity crosses the legal threshold. Voluntary registration is when you choose to register even if exempt, usually to claim ITC or gain credibility with larger clients.

What is the GST exemption limit for special category states?

In North-Eastern and hill states, the exemption limit is ₹20 lakh for goods and ₹10 lakh for services, half of the normal state limits.

Can a small business under the composition scheme avoid monthly filings?

Yes. Under the Composition scheme (₹1.5 crore turnover, ₹75 lakh in special states), you pay a fixed rate and file quarterly statements with a single annual return, instead of monthly returns.

Is GST required to sell on Amazon or Flipkart?

Yes. GST registration is mandatory for all e-commerce sellers, regardless of their turnover. Platforms require a valid GSTIN before you can list products.

What happens if I cross the threshold mid-year?

GST liability begins the day your turnover exceeds the limit, not a year-end. You must register immediately to avoid backdated tax and penalty.

Can I cancel GST registration if turnover falls below the limit?

Yes. You can apply for cancellation through the GST portal. Once approved, you’ll be deregistered and won’t need to file returns.

How does GST benefit a small business?

GST registration allows you to claim ITC, expand into interstate and e-commerce markets, and build credibility with B2B clients and government tenders.

List of Resources

- GST Schemes: MSME Schemes

- GSTR: Forms on GSTR — 3B

- Composition Levy Scheme: GST Composition Scheme

- GST Portal: GSTIN Web Portal