Invoicing is like creating a receipt for buying something. Getting it right is super important to avoid mistakes in details like who’s selling, who’s buying, and where things are going. It’s also important for calculating costs, taxes, discounts, and more. Businesses should be extremely cautious about proper invoicing in conditions of GST with a whole number of tax rates and types.

Get this: one tiny mistake in your invoice, like misspelling a buyer’s name or goofing up on the tax calculation, can snowball into a nightmare. It can result in the taxman coming, and you’re left scrambling to fix things.

But here’s the kicker: proper invoicing isn’t just about avoiding trouble; it’s about saving money too. You can claim back the GST you’ve already paid on your business expenses.

In this article, we’ll explain the basics of invoicing under GST and offer you a free ready‑to‑use template of the GST invoice.

🧩 Still switching between Excel sheets, email threads, and printed bills?

A modern ERP could save you hours. Download our top 20 ERP software comparison table, sorted by feature set, pricing, and integrations — and grab a free 30‑day trial of Kladana to try one yourself.

What GST Regime Means

In simple terms, the GST regime refers to the system of taxation that India adopted in 2017, known as the Goods and Services Tax. Under this regime, various indirect taxes like VAT, luxury tax, service tax, purchase tax, and others were replaced by a unified tax called GST.

This change was aimed to simplify the tax structure, reduce tax evasion, and make the tax system more efficient. The GST regime classifies goods and services into different tax slabs, ranging from 0% to 28%, based on their nature and other factors. This system has brought about significant changes in how taxes are applied and has impacted businesses and consumers across the country.

GST is a tax collected on goods and services at each stage of the supply chain, from the manufacturer to the consumer. The rules determine how GST is calculated, collected, and paid. They also outline the registration process for businesses, the filing of returns, and the invoicing requirements.

Understanding these rules is important for businesses to comply with the law and ensure smooth operations.

Taxes under Goods and Services Tax

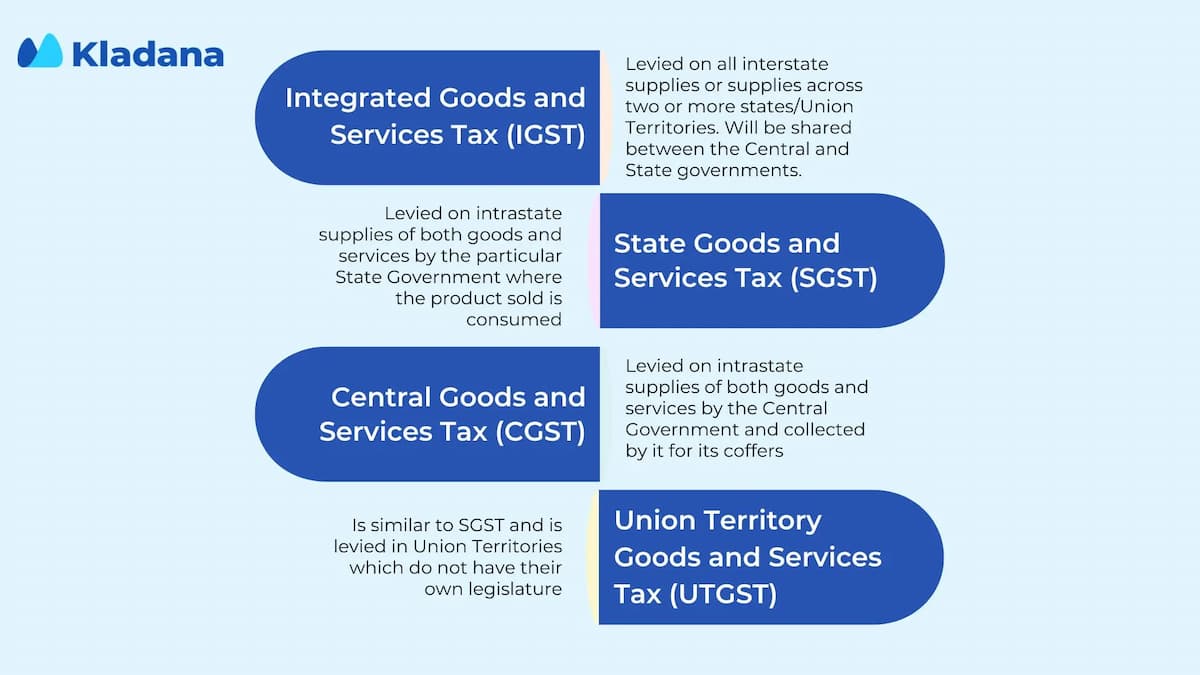

There are several types of GST under the Indian taxation system. These include:

- Integrated Goods and Services Tax (IGST)

- State Goods and Services Tax (SGST)

- Central Goods and Services Tax (CGST)

- Union Territory Goods and Services Tax (UTGST)

CGST and SGST are levied on intra‑state supplies, where the revenue is shared between the central government and the state government. IGST is applicable to inter‑state supplies and is collected by the central government.

UTGST is similar to SGST but is applicable in union territories. Each type of GST has its own set of rules and regulations, ensuring a smooth taxation process across the country.

What Is GST Invoice

A GST invoice or a GST bill is a document that is used to record the sale of goods or services under the Goods and Services Tax (GST) system in India. The GST invoice plays a crucial role in the GST regime as it serves as proof of the sale for both the seller and the buyer, and is essential for claiming input tax credit.

GST Invoice Format

All GST Invoices must include the following information:

| Mandatory Field | Description |

Invoice number and date |

Unique number and date of the invoice |

Seller details |

Name, address, phone number, and other details of the seller |

Customer name |

Name of the customer purchasing the goods and services |

Billing address |

The billing address of the customer |

GSTINs |

GST Identification Number of both seller and customer |

Place of supply |

In the overwhelming majority of cases this is the buyer’s registered business address or the location where the goods or services are delivered. |

Item details |

Description of the goods and services, unit prices, quantities, amounts |

HSN/SAC codes |

Harmonized System of Nomenclature codes for all goods and services mentioned in the invoice. The SAC code (Service Accounting Code) is a classification system used to categorize various services for taxation under India’s Goods and Services Tax (GST) regime. Similar to how the HSN code categorizes goods, the SAC code assists businesses in classifying the services they provide. |

Taxable value and discounts |

The value of the goods and services on which the taxes are calculated after deducting any discounts |

Rate and amount of taxes |

Rate and amount of Central GST (CGST), State GST (SGST)/Union Territory GST (UTGST) for intra‑state transactions, or Integrated GST (IGST) for inter‑state transactions |

Signature |

Signature of the representative of the supplier |

Still using spreadsheets for invoicing?

Switch to a tool that auto-generates invoices — synced with your sales and stock.

GST invoice rules

You’ll learn who is required to issue GST invoices, situations where invoices are not necessary, time limits for issuing GST invoices, and other vital details.

Who Must Issue GST Invoices

In India, the issuance of Goods and Services Tax (GST) invoices is a crucial part of the compliance framework under the GST regime. The following entities must issue GST invoices:

-

Registered Taxable Persons: Any business or individual who is registered under GST and supplies goods or services is required to issue a GST invoice. This includes:

- Regular Taxpayers: Businesses registered under the regular scheme must issue GST invoices for every sale of goods or services.

- Composition Dealers: While composition dealers are not required to issue a tax invoice, they must issue a bill of supply. Composition dealers cannot charge GST on their sales; instead, they pay GST at a fixed rate on their turnover.

- Exporters: Businesses that export goods or services must issue a GST invoice, clearly mentioning that the supply is an export and hence zero‑rated.

- Input Service Distributors (ISD): An ISD must issue an invoice or a credit note for distributing the input tax credit to its units or branches.

- Reverse Charge Mechanism (RCM): When a business or individual is liable to pay GST under the reverse charge mechanism, they must issue a self‑invoice if the supplier is unregistered.

- E‑commerce Operators: E‑commerce operators facilitating supplies on behalf of other suppliers must issue an invoice when they are liable to collect tax at source (TCS).

Situations Where Invoices Are not Required

In some cases, issuing a tax invoice is not mandatory:

- Unregistered Individuals: Individuals or entities not registered under GST.

- Small Businesses: Small businesses with turnover below the threshold limit for GST registration (currently ₹40 lakhs for goods and ₹20 lakhs for services, subject to specific conditions and exceptions).

- Exempt Supplies: Supplies that are wholly exempt from GST or non‑GST supplies.

Overall, the requirement to issue GST invoices ensures transparency and proper accounting within the GST system, aiding both compliance and tax administration.

Time Limits for GST Invoice Issue

The GST law sets a specific time frame for issuing a GST invoice, which varies depending on the type of supply. For goods, it’s typically required before or at the time of delivery for a single supply, or before or at the date of payment or issuing an account statement. For services, the invoice must be issued within 30 days from the date of supply.

Obligatory Number of Copies of the GST Invoice

When issuing a GST invoice, businesses are required to provide multiple copies, depending on the nature of the transaction. These copies ensure transparency and accountability in transactions, facilitating smoother operations and compliance. The following table shows what party of the transaction should get the copy.

Supply of Goods

| Invoice Copy | Recipient | Transporter | Supplier |

Original |

✔️ |

❌ |

❌ |

Duplicate |

❌ |

✔️ |

❌ |

Triplicate |

❌ |

❌ |

✔️ |

Supply of Services

| Invoice Copy | Recipient | Supplier |

Original |

✔️ |

❌ |

Duplicate |

❌ |

✔️ |

Minimum Transaction Amount to Issue a GST Invoice

While GST mandates the issuance of invoices for most transactions, there is a minimum transaction threshold below which businesses are not required to issue invoices. A tax invoice is not required for transactions below INR 200 in two cases:

- If the recipient is unregistered

- If the recipient does not specifically request an invoice. If the recipient asks for it, an invoice must be provided.

However, at the end of each day, a consolidated or aggregate invoice should be prepared for all transactions below the threshold where a tax invoice was not issued. Businesses may also choose to issue invoices voluntarily for record-keeping and transparency purposes.

📥 Download a Scroll‑Friendly ERP Overview Table

This ERP table is scroll‑friendly and designed for side‑by‑side comparison. Fill in the form to receive the file + your 30‑day trial code.

Difference between Invoice and GST Invoice

An invoice and a GST invoice serve similar purposes but differ in their scope and legal implications. While both documents detail the goods or services provided, a GST invoice includes additional information required for compliance with the Goods and Services Tax regulations. This includes the seller’s GSTIN (Goods and Services Tax Identification Number), the buyer’s GSTIN (if registered), the place of supply, the HSN (Harmonized System of Nomenclature) code for goods, and the SAC (Services Accounting Code) for services.

Additionally, a GST invoice clearly indicates the amount of GST charged on the transaction, which is essential for tax filing and claiming input tax credit. In contrast, a standard invoice may lack these specific details required by the GST regime, making it insufficient for businesses operating within the GST framework.

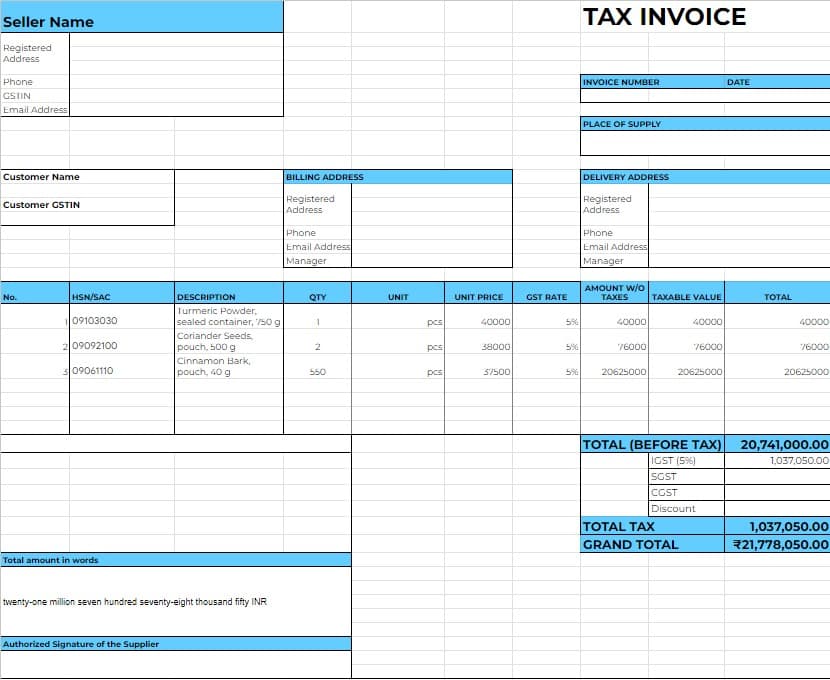

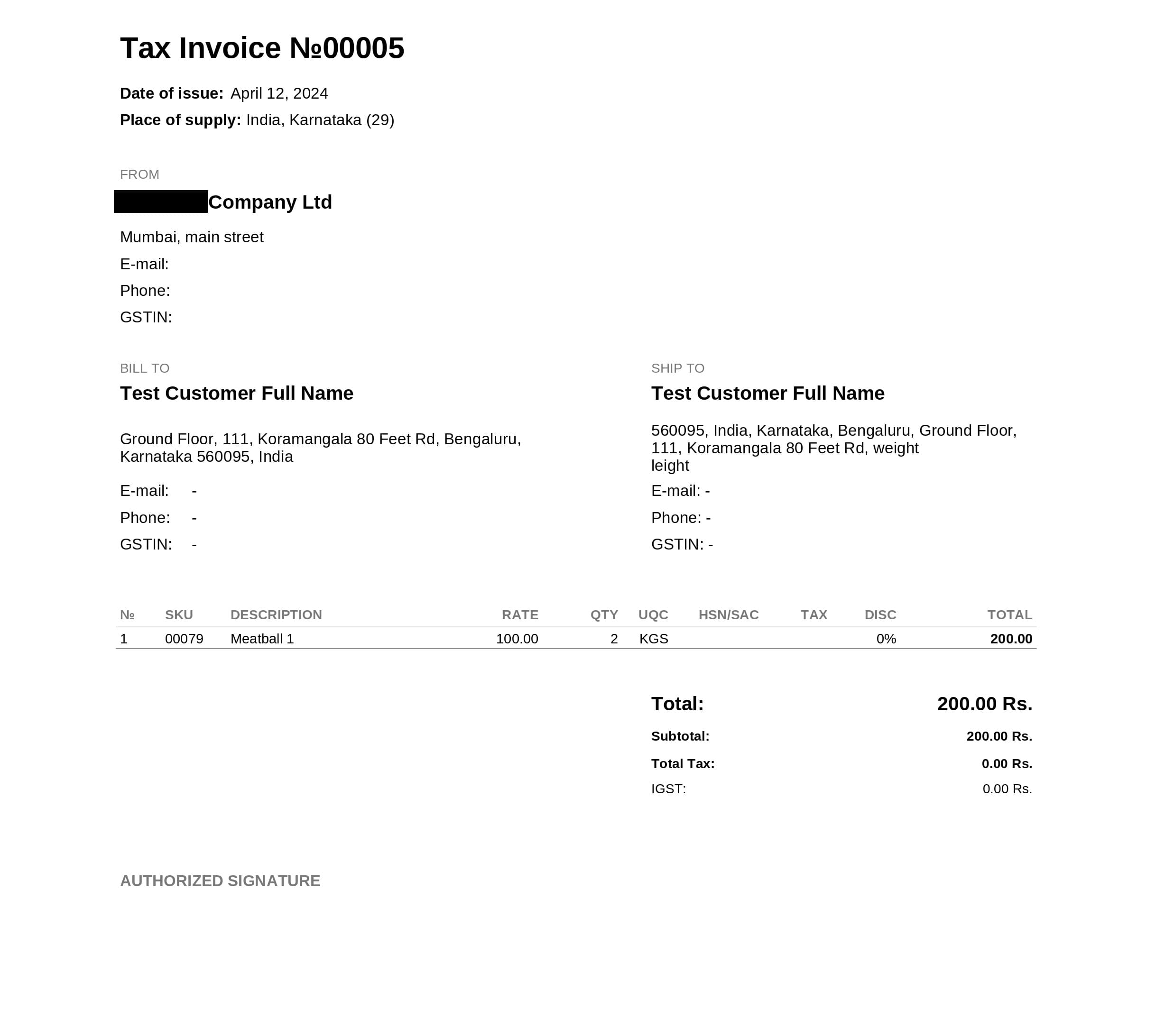

Kladana’s Free GST Invoice Template

Attention! This invoice template was created according to GTS standards for 2024. Use the document with caution. It does not guarantee compliance with the current tax laws of your country.

We recognize the importance of accurate and professional invoicing, which is why we offer a complimentary GST invoice template tailored to meet your invoicing needs. Our ready‑to‑use template simplifies the invoicing process, ensuring adherence to GST regulations.

Customizable fields and a simple interface enable you to generate invoices swiftly and accurately. Try using Kladana’s free GST invoice template, and take the first step towards optimizing and automating your invoicing procedures.

Try our free ready‑to‑use GST invoice template

How to Use Free Template in 8 Steps

Using our step-by-step guide, you can manage GST invoices yourself.

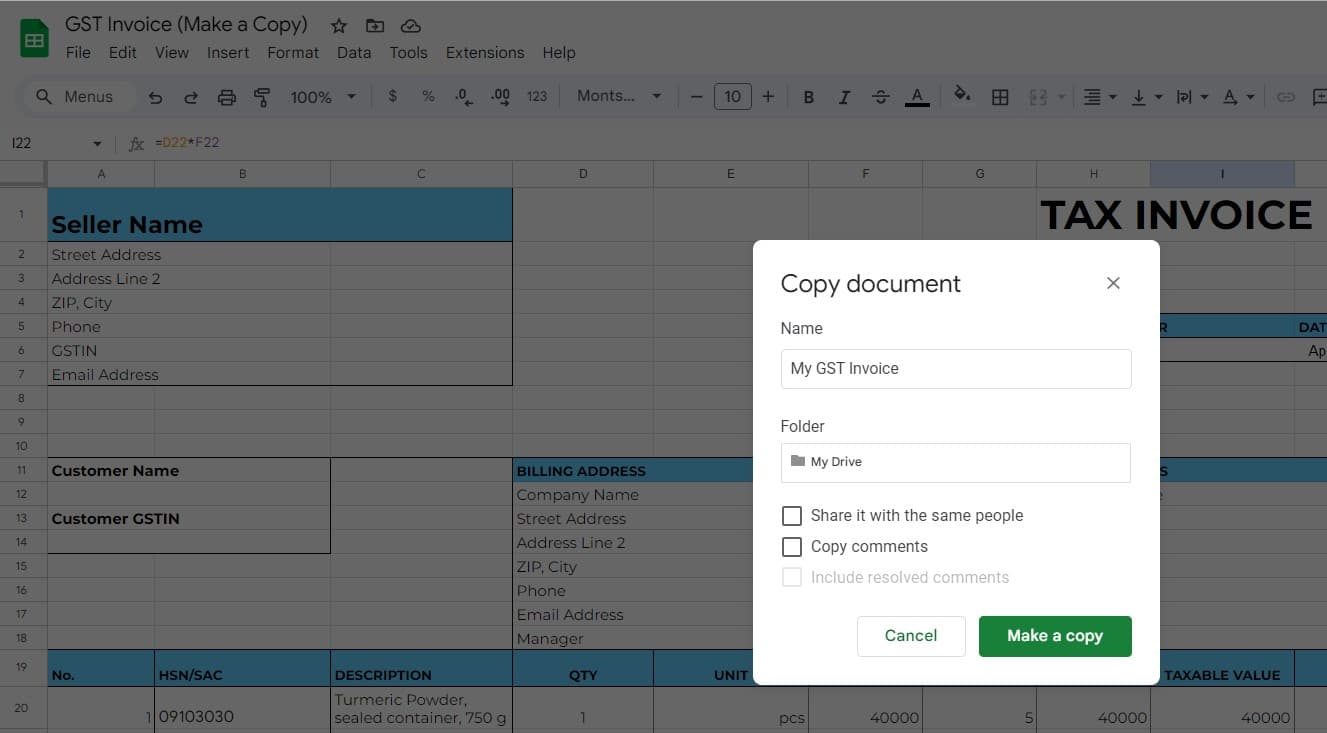

Step 1. Make a Copy of the Template

Open Google Sheets, head to the File menu → Make a copy → Rename the spreadsheet the way you need.

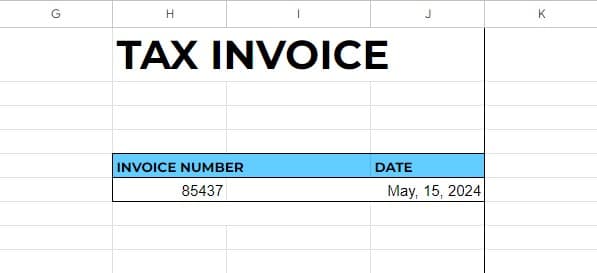

Step 2. Indicate an Invoice Number and Date

The tax invoice number must not exceed 16 characters and is generated sequentially, ensuring each tax invoice receives a unique number for the fiscal year.

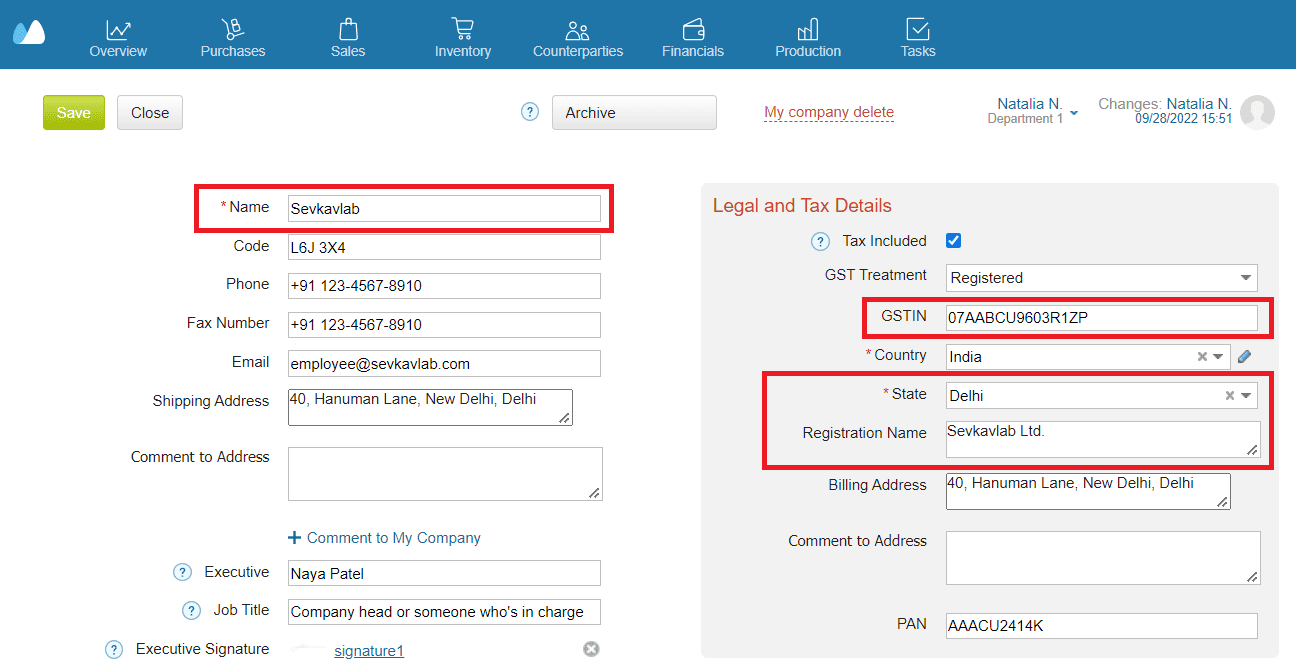

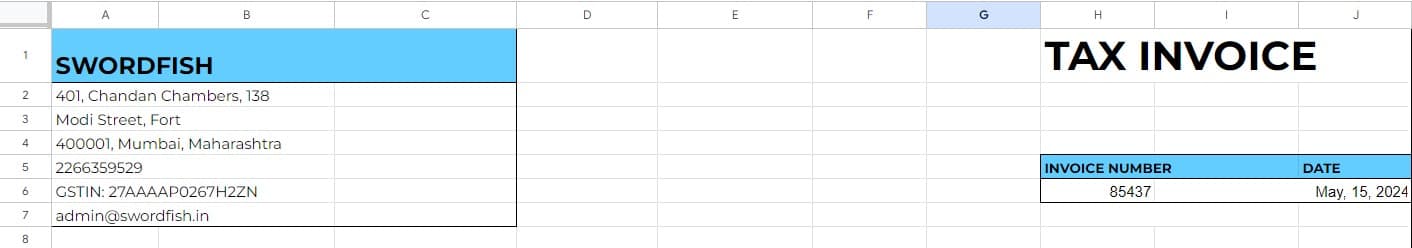

Step 3. Input Your Company Details

Provide your company’s complete address, email address, GSTIN, and phone number accurately.

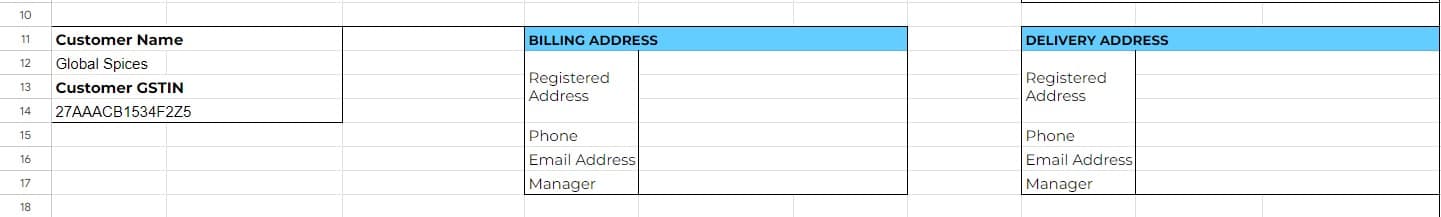

Step 4. Add Counterparty’s Name and GSTIN

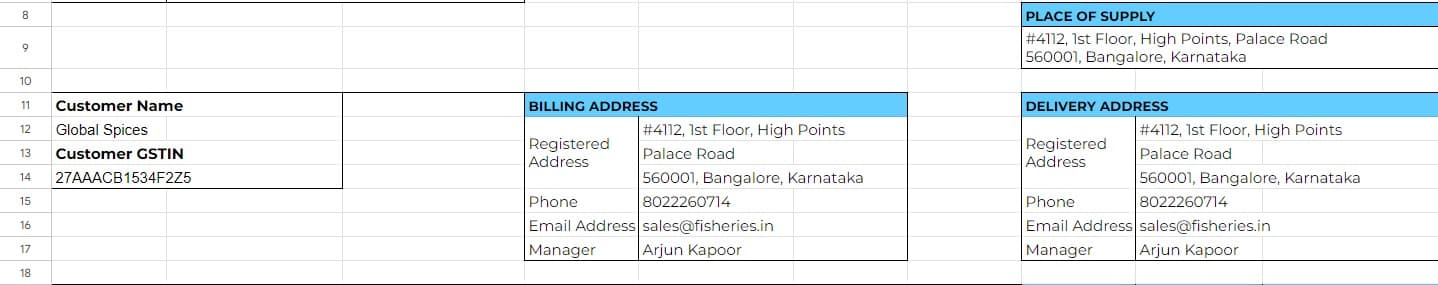

Please refer to the example in the picture below.

Step 5. Record the Place of Supply, Delivery and Billing Address

Please note that place of supply is a mandatory field that must be filled in every GST invoice.

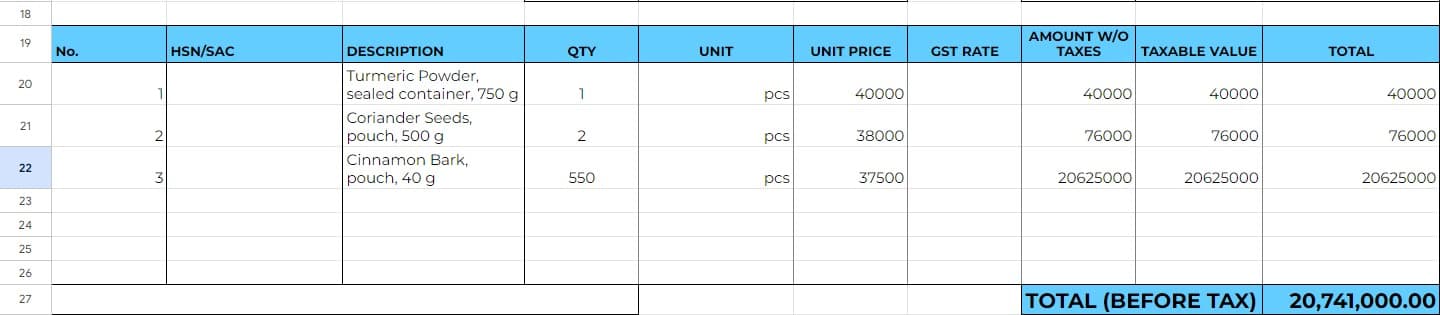

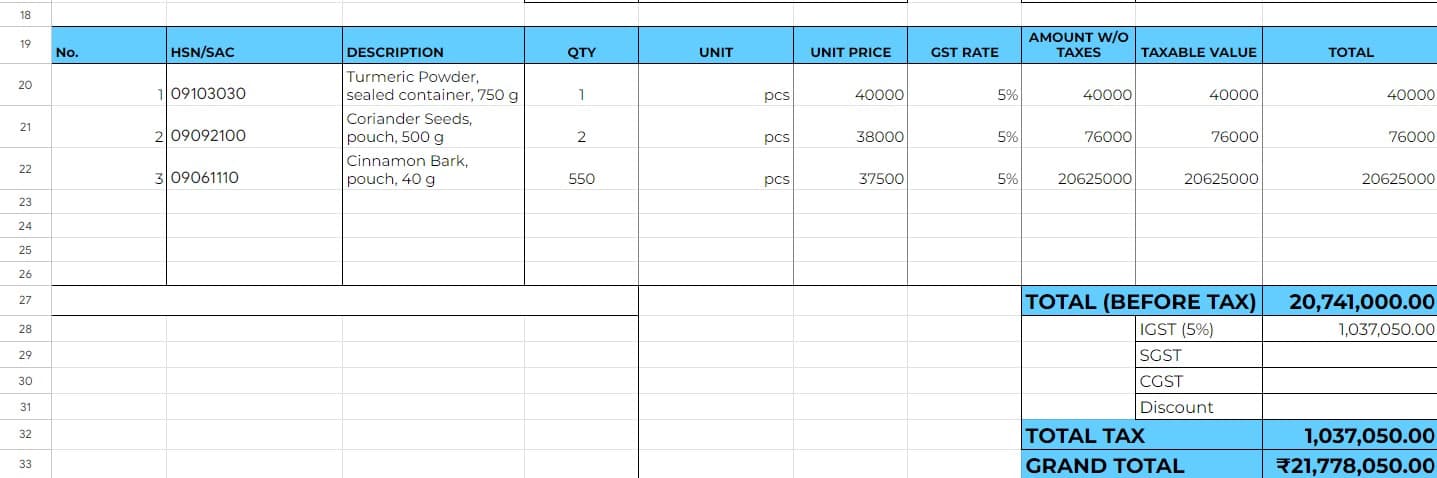

Step 6. List the Goods or Services and Specify Their Characteristics

Make sure you indicate the right quantities, units, and prices.

Step 7. Add Tax Details

Add and carefully check every HSN/SAC and tax rate in trustworthy sources.

Step 8. Check the Formulas

Before sending your GST invoice make sure that all the formulas for amounts and taxes calculations work correctly.

If you prefer more traditional formats, make your GST invoices easily with our free template in Word or Excel.

Bonus

Feel free to utilize, adjust, and personalize this GST invoice template to suit your requirements. If you’re seeking to streamline your sales and shipments, accelerate business operations with greater precision, and access all the preferences of automation, try Kladana ERP solution.

Explore case studies and blog posts from Kladana customers, request a demo to explore the features, and take advantage of our 14‑day free trial (no credit card needed).

How to Create GST Invoice Template

It may seem hard but you can create and customize your own GST Invoice template without any significant complications. Let us guide you through the whole process of creation. We’ll start with the easiest steps.

Step 1: Create a New Spreadsheet

Go to Google Sheets and create a new spreadsheet. Name the spreadsheet so it’s easy to find when needed.

Step 2: Label Basic Fields

Label the first row with basic fields like Invoice Number and Invoice Date.

Step 3: Include Your Company Details

In the upper part of the spreadsheet, include your company’s name, address, GSTIN, and any other relevant information.

Step 4: Prepare Counterparty Details

Ensure there’s enough space in the document to fill in all the information for your counterparties.

Step 5: Add Details of Goods and Services

Include fields for details of goods and services, GST rates, amounts, discounts, and taxable value.

Step 6: Add Formulas for Calculations

Add formulas to calculate the total taxable value, tax rates, and total amount automatically. For example, you can use a formula like =Quantity*Unit Price for the taxable value.

How‑to:

- Click on the cell where you want the result to appear. This is usually the cell next to the values you want to multiply.

- Start the formula with an equals sign (=). This tells Google Sheets that you’re entering a formula.

- Click on the cell containing the quantity, type * (asterisk) to represent multiplication, and then click on the cell containing the unit price.

- Press Enter on your keyboard.

Google Sheets will calculate the total price by multiplying the quantity and unit price and display the result in the cell. You can use similar formulas to calculate taxes, discounts, and other values in your invoice.

Step 7: Format the Document

Draw borders to separate important sections and make information easier to digest.

Step 8: Make a Copy for Future Invoices

Make a copy of this sheet whenever you need to create a new invoice. This way, you won’t have to clear the data every time and avoid confusion.

A handy tip: Enter Sample Data and Apply More Formatting

Fill in a few rows with sample data to visualize how the invoice will look. Format the cells to make the invoice easy to read and professional. You can use bold text for headings and align text to the left or right as needed.

To ensure you created all mandatory fields check out the table at the beginning of this article or download it in Excel format.

Frequently Asked Questions on GST Invoices

We’ve compiled answers to the most frequently asked questions about issuing GST invoices.

What is a GST invoice and why is it important?

A GST invoice is a document that contains the details of goods or services sold or supplied, and it serves as proof of the supply. It is important because it helps in the claiming of input tax credits, determining the value of goods or services, and maintaining proper records for tax purposes.

Who is required to issue a GST invoice?

Any registered business supplying goods or services is required to issue a GST invoice. However, there are specific cases where a GST invoice is not required, such as in the case of exempt supplies.

What are the mandatory fields that must be included in a GST invoice?

The mandatory fields that must be included in a GST invoice are specified under the GST law and include details such as the name, address, and GSTIN of the supplier and recipient, place of supply, invoice number, date of invoice, description of goods or services, HSN/SAC codes, quantity, taxable value, total value, discounts, applicable taxes (rates and amounts), and signature of the supplier.

Can a GST invoice be modified or canceled once issued?

A GST invoice can be modified or canceled under certain conditions and within a specified time limit as per the GST law. Any modification or cancellation should be done following the prescribed procedure to avoid penalties.

What is the time limit for issuing a GST invoice?

The time limit for issuing a GST invoice is specified under the GST law, and it varies based on the type of supply. For example, for goods, it is generally before or at the time of delivery for a single supply and before or at the date of payment or issue of an account statement. For services, it is within 30 days from the date of supply.

Are there any specific rules for issuing a GST invoice for the export of goods or services?

Yes, there are. The invoice should contain additional details such as the name and address of the recipient, the name of the country of destination, the number and date of the export invoice, the conversion rate from INR to the currency of the recipient, export type, and shipping bill details.

How does GST invoicing differ for composition scheme dealers?

Composition scheme dealers have different rules for GST invoicing, including issuing a bill of supply instead of a tax invoice and not charging GST on their supply.

Is it mandatory to issue a GST invoice for every sale or supply?

Yes, it is mandatory to issue a GST invoice for every transaction, except in specific cases where a different document is required.

What are the consequences of not issuing a GST invoice or issuing an incorrect invoice?

The consequences of not issuing a GST invoice or issuing an incorrect invoice can include severe penalties from fines to imprisonment. Even if a business unintentionally utilizes an incorrect invoice, it can still be accountable for the violations.