Preparing bills for labour contracts can be time-consuming, especially when projects involve multiple workers, variable rates, or materials supplied by clients. A ready format simplifies this process. This labour contractor bill format in Excel lets contractors record completed work, calculate total costs, and issue professional-looking bills within minutes.

In this guide, you’ll find free downloadable labour contractor bill templates and a clear, step-by-step explanation of how to create and customize them in Excel. The examples include hourly, daily, and project-based billing formats that fit various sectors, including construction, maintenance, and facility services.

Download the free Excel templates below and start building accurate, easy-to-track contractor bills today.

- What is a Labour Contractor Bill?

- Why Use Excel for Contractor Bills?

- Key Components of a Contractor Bill

- Types of Labour Contractor Bill Formats

- Excel Templates for Labour Contractor Bills

- How to Create a Contractor Bill in Excel

- Best Practices for Contractor Billing

- Download Free Templates

- FAQs on Labour Contractor Bill Format in Excel

- List of Resources

What is a Labour Contractor Bill?

A labour contractor bill is a simple document that shows how much a contractor needs to be paid for the work their team has done. It lists the type of job, how long it took, the agreed rates, and the total amount due.

Contractors use these bills to keep payment records clear and avoid confusion with clients. It’s also a professional way to confirm that the work was completed as agreed and to make sure payments happen on time.

You’ll usually see such bills in construction, repair, or maintenance projects — any job where a contractor provides labour instead of selling goods. A well-made bill includes both parties’ details, the project site, service dates, and clear calculations for hours or days worked. It also helps with bookkeeping and project cost tracking, making it useful for both contractors and clients.

Why Use Excel for Contractor Bills?

Excel is one of the easiest tools for creating and managing contractor bills. You can build a format that fits your type of work, whether it’s hourly, daily, or project-based. It gives you full control over the layout, formulas, and calculations.

With simple formulas, Excel can automatically total up hours, rates, and taxes. That means fewer mistakes and faster billing. You can also save different versions of the same file — one for each client or project — without starting from scratch every time.

Another advantage is how easy it is to share or print. You can send the file by email, export it as a PDF, print the document, or keep it on record for future reference. It’s flexible, reliable, and free — which makes Excel the go-to choice for small contractors and businesses that don’t need expensive accounting software.

NB According to a survey by Levelset involving more than 500 construction companies working as contractors or subcontractors, fewer than 10% said they always receive payment for completed work on time.

In another study conducted by the same company, 12% of respondents named a poorly organized invoicing process as the main reason for payment delays.

So, filling out invoices correctly, sending them promptly, and keeping the process consistent can significantly improve your chances of getting paid on time.

Key Components of a Contractor Bill

A good contractor bill should include all the details that help both sides understand what work was done and how the final amount was calculated. Missing even one field can cause confusion or payment delays, so it’s best to keep the format complete and consistent.

Here’s what every contractor bill should have:

- Contractor details: Your name or company name, contact information, and business registration number.

- Client details: The client’s company name, address, and contact person.

- Project or work description: A short summary of the job — type of labour, number of workers, dates, and location.

- Rates and quantities: Hours or days worked, rate per unit, and subtotal for each task.

- Materials and services: If you also supply materials or equipment, list them separately with quantities and prices.

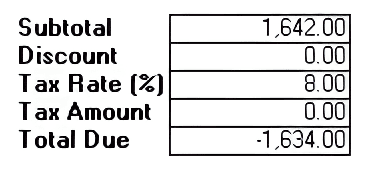

- Taxes and deductions: Include sales tax or VAT, discounts, and any advance payments or deductions.

- Total amount due: The net amount the client needs to pay.

- Signatures: Both parties can sign the bill to confirm that the work and payment details are correct.

A clear structure makes your bills easy to read and helps avoid misunderstandings.

Types of Labour Contractor Bill Formats

Not every project follows the same payment schedule. Some clients pay by the hour, others by the day or after the whole project is done. That’s why it helps to have different bill formats ready. Each one captures the same core details but adjusts the layout for how work is measured and paid.

Here are the most common types:

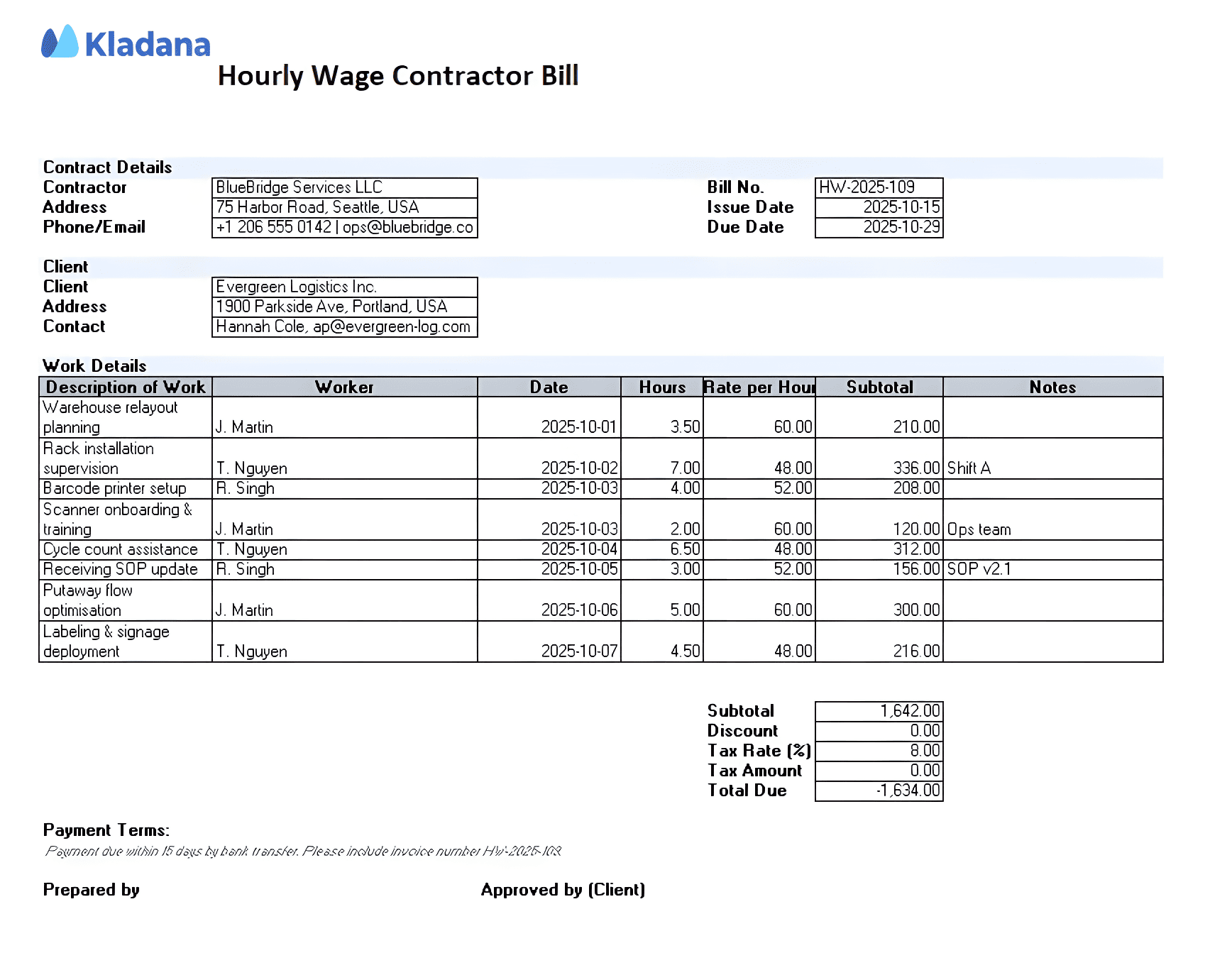

- Hourly wage bill format: Best for short-term or service-based jobs. You list each worker, the number of hours worked, and the hourly rate. Excel can automatically multiply hours by rate to show the total.

- Daily wage bill format: Works well for projects where workers are paid per day. You can include total days worked, rate per day, and overall cost.

- Monthly contract bill format: Suitable for ongoing contracts or retainers. It records total labour provided in a month, along with deductions, allowances, and bonuses if any.

- Project-based bill format: Used for large contracts that are billed after completion or at specific milestones. You can include progress details, materials used, and partial payments.

Having all these options makes it easier to choose the format that fits your client’s payment terms and your project’s workflow.

Manage Contractors and Subcontractors in Kladana

Working on the client side? If you hire contractors or subcontractors, Kladana helps you assign jobs, track progress, create specific statuses — all in one place.

Learn how subcontracting works in Kladana and keep costs, deadlines, and documents under control.

How Subcontracting Works in Kladana

Excel Templates for Labour Contractor Bills

To save time, you can start with a ready Excel template instead of building your bill from scratch. Templates give you a structure that already includes all the essential fields — you just need to fill in your project details.

Each format can be adjusted to fit your needs — add your company logo, change currency, or insert a digital signature field. Download our free Excel templates below and choose the one that fits your billing style.

📘 Recommended Read: Find ready-to-use quotation templates for Excel and learn how to customize them for services, products, or combined offers.

How to Create a Contractor Bill in Excel

If you prefer to build your own format instead of using a template, Excel makes it simple. You just need to set up a few columns, add formulas, and make the sheet easy to read.

Here’s how to do it step by step:

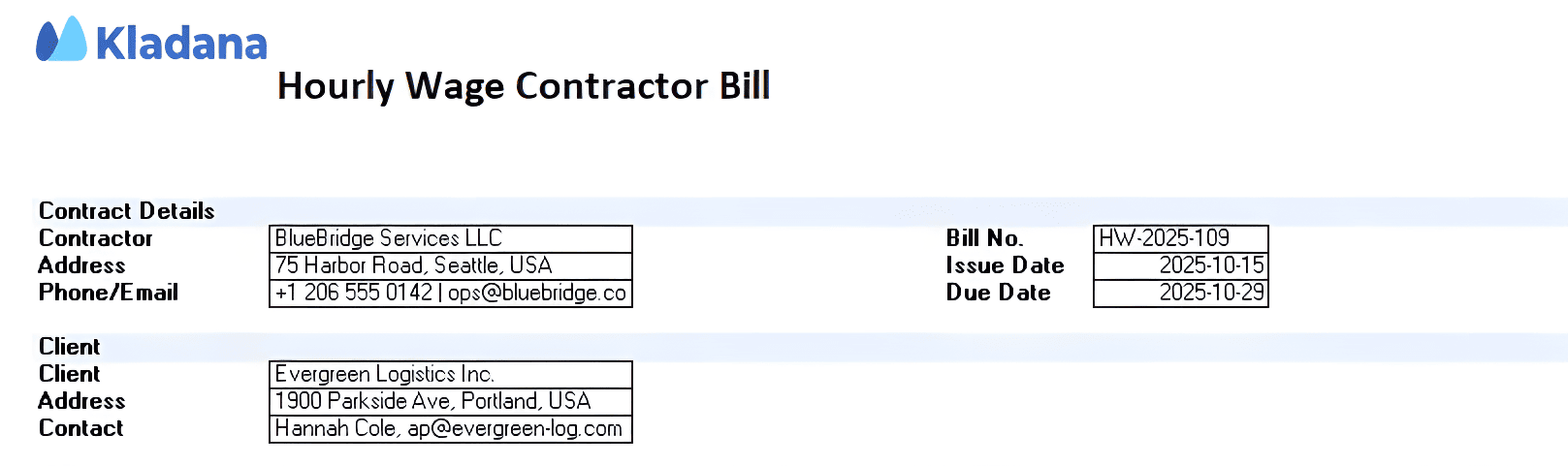

- Set up the headers.

In the first rows, enter your business name, address, and contact details. Then add the client’s information and a unique bill number with the date of issue.

- Add the main table.

Create columns forDescription of Work,Quantity (hours/days),Rate per Unit,Subtotal,Tax, andTotal.

- Use formulas for calculations.

Multiply hours or days by rate using the formula =C5*D5 (adjust the cell numbers as needed). Add totals with =SUM(E5:E20) or similar.

- Add data validation.

Use Excel’sData Validation feature to create dropdowns for client names, project types, or tax rates. This reduces manual errors and saves time. - Format for clarity.

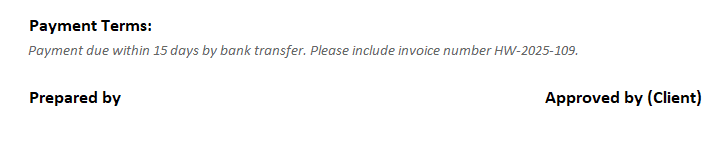

Apply bold headings, borders, and alternating row colors. You can also use conditional formatting to highlight unpaid bills or overdue dates. - Include signatures and payment terms.

Add a “Prepared by” and “Approved by” line at the bottom. Leave space for signatures or use a digital signature image.

Once you’ve set up the layout, save the file as your standard template. You can duplicate work contract bill Excel template for each new project, keeping all your billing records organized in one place.

Best Practices for Contractor Billing

A well-prepared labour payment bill format isn’t just about filling in numbers. It also shows professionalism and helps you get paid faster. Here are a few simple rules to follow every time you prepare a contractor bill:

- Always include key details.

Make sure your business name, bill number, contact details, and the client’s information are complete and accurate. - Add clear payment terms.

Specify when payment is due and how it can be made — for example, within 15 days by bank transfer or cheque. - Include tax information if required.

Add your business registration number and the applicable tax rate. This helps clients process your bill faster. - Keep consistent numbering.

Use a logical format such as “LB-001,” “LB-002,” etc. It keeps your records easy to track and avoids duplicate entries. - Store digital copies.

Save all bills in a secure folder or cloud storage. This helps during audits and makes it easy to reissue copies if needed. - Get client confirmation.

Ask for a signature or written acknowledgment after sending the bill. It protects both sides in case of disputes.

Track precise time and resource expenditures across all production stages. Ensure accurate payroll and cost price calculations.

Download Free Templates

You don’t need to start from scratch. Below, you can download ready-to-use Excel templates for different types of labour contractor bills. Each file includes pre-set formulas and space for your business and client details.

Available templates:

- Hourly wage bill format: Best for service-based or short-term jobs. Records hours worked, hourly rates, and auto-calculates totals for each task.

Or

- Daily wage bill format: Suitable for site work or short-duration projects. Lists workers, days worked, daily rates, and calculates total payment per person.

Or

- Monthly contract bill format: Ideal for ongoing or retainer contracts. Summarizes monthly labour, allowances, and deductions to show the final payable amount.

Or

- Project-based contractor bill format: Used for milestone or progress-based payments. Tracks project phases, completion percentage, and total amount due for each stage.

Or

- GST or VAT-compliant template: Includes additional fields for tax rate, tax amount, and total after tax. Works well for contractors who need to issue tax invoices.

Or

- Construction labour bill format: Designed for projects that involve multiple workers, stages, or materials. You can track both labour and material costs on separate tabs.

Or

Each contractor bill template in Excel is editable — you can adjust currencies, tax rates, and layout to match your business needs. Download your free contractor invoice template Excel or make a copy in Google Sheets to get started. Just open the file, fill in your project details, and print or share it as a PDF.

FAQs on Labour Contractor Bill Format in Excel

Here are some common questions contractors ask when preparing and sending labour bills. Each answer will help you make your billing process faster, clearer, and more professional.

What details are mandatory in a contractor bill?

Include your business name, contact details, client information, bill number, date, project description, work duration, rate, and total amount. If applicable, add tax details and payment terms.

Can I include VAT or sales tax in a labour contractor bill?

Yes. If your business is registered for tax, include the rate and the total tax amount in the bill. Make sure it’s applied correctly to each line item or subtotal.

How do I make my contractor bills audit-friendly?

Use consistent numbering, keep copies of all bills, and save related contracts or project documents. Clear records make financial tracking and audits much easier.

What’s the difference between a bill and an invoice for labour contractors?

They serve a similar purpose. A “bill” is a request for payment, while an “invoice” is often used in formal accounting. Both list the same information — work done, amount owed, and payment terms.

How should I number my bills or invoices?

Use a simple system that grows with your business, such as “LB-001” for the first bill and “LB-002” for the next. Avoid restarting numbering every month to maintain clarity.

Can I bill by day, hour, or fixed rate — which is better?

Choose what fits your project. Hourly billing suits service jobs, daily billing works for short-term site work, and fixed-rate billing fits long projects with clear scope and milestones.

How do I include travel or additional expenses in the bill?

Add a separate section for extra costs, such as transportation, accommodation, or materials. List them clearly and keep receipts for reference.

What payment terms are standard?

Contractors often use 7, 15, or 30-day payment terms, depending on the agreement with the client. Always mention the due date in the bill.

Should the client sign the bill?

Yes, if possible. A client’s signature confirms that the work was accepted and the bill was approved for payment.

How can I track unpaid bills and send reminders?

Keep a record of all bills in Excel or a project tracker. Highlight unpaid bills using conditional formatting. You can then send polite email reminders before the due date.

List of Resources

- Levelset — National Construction Payment Report

- Levelset — 2022 Construction Cash Flow & Payment Report