Inventory costs add up fast when stock decisions rely on guesswork. For teams scaling D2C, they have to manage suppliers across borders or juggle multiple SKUs. In here, the question is no more about the software or more dashboards. It’s about timing orders right.

It’s here you can think of leveraging EOQ (Economic Order Quantity), which helps you define the optimal order size based on real data. There’s no second-guessing. No surplus. No emergency runs.

At its core, EOQ connects demand, ordering costs, and holding costs into a simple formula that cuts the noise and gives you an exact reorder quantity. And when this is automated inside your inventory system, your teams stop firefighting and start planning.

If you’ve ever faced stockouts in the middle of a production cycle or held deadstock for months, EOQ deserves your attention.

Let’s unpack what it is, how it works, and why it matters most in 2026.

EOQ Meaning and Concept

Economic Order Quantity, or EOQ, shows the optimal number of units a business should purchase to minimize both ordering and holding costs. This is a balance that ensures that stock replenishment happens at the right time and in the right quantity.

The concept is rooted in the Wilson Formula, developed in the early 20th century by Ford W. Harris. It was designed for manufacturing setups that needed a logical way to reduce the cost per unit without flooding warehouses.

EOQ prevents guesswork in procurement by creating a mathematical link between demand, purchase frequency, and storage cost. The result? A sweet spot that avoids last-minute reordering and also keeps excess stock from piling up.

Businesses turn to EOQ when they need predictability, especially for high-volume SKUs with steady demand patterns. Usually, businesses in wholesale, FMCG, retail, automotive parts distribution, and B2B manufacturing that manage thousands of product lines use EOQ.

Next, we’ll look at the EOQ formula, how to calculate it, and how it plays into actual ordering decisions.

EOQ Formula Explained

At the core of EOQ is a formula built to solve for one goal: cost efficiency.

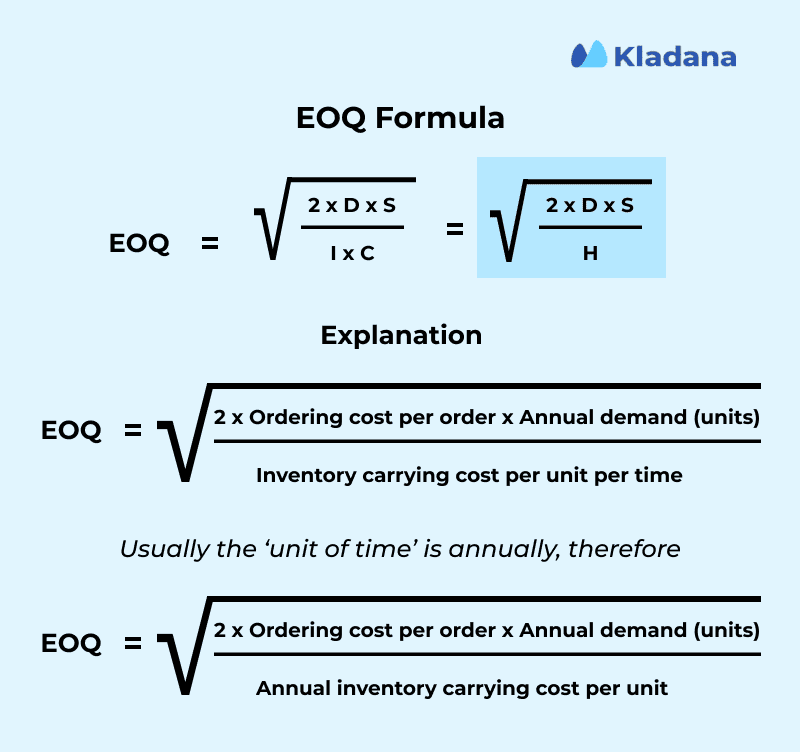

EOQ = √(2DS / H)

Where:

- D = Annual demand (units)

- S = Ordering cost per order

- H = Holding cost per unit per year

It’s a formula that returns the optimal order size in the form of a quantity that minimizes combined ordering and holding costs.

Let’s run through a basic example.

Scenario:

A company uses 12,000 units of raw material per year.

Each order costs $75 to process.

Holding cost per unit per year is $2.50.

EOQ = √(2 × 12000 × 75 / 2.5)

EOQ = √(1,800,000 / 2.5)

EOQ = √720,000 = ~848 units

So the most cost-effective way to restock is by ordering 848 units per cycle. Fewer orders mean reduced admin costs. A balanced stock level means better cash flow.

Once you apply this consistently or automate it using an online inventory management software, inventory planning stops being reactive.

You’d know exactly when to buy and how much to bring in, based on real demand and actual cost.

Smarter Purchasing Starts with EOQ + Flexible Planning

Kladana’s smart inventory tools help you calculate EOQ, track stock in real time, and avoid overstocking or stockouts.

Importance of Economic Order Quantity

Inventory planning works best when decisions are backed by numbers. EOQ has a clear role in bringing that discipline into ordering decisions. It supports cost control, timing, and supplier management in ways that manual planning often misses.

Here’s where EOQ helps:

Reducing Inventory Carrying Costs

Holding inventory carries hidden costs such as storage, insurance, depreciation, and more. EOQ calculates an optimal order size that avoids overstocking while keeping those carrying costs in check.

Less capital locked in inventory

- Reduced need for storage expansion

- Lower risk of obsolete stock

Avoiding Frequent Reordering

Ordering in small batches creates high ordering costs and wastes team time. EOQ identifies the right reorder size to strike a balance between ordering frequency and operational efficiency.

- Fewer purchase cycles

- Lower administrative workload

- Better supplier terms through larger, consistent orders

Optimizing Order Size and Timing

EOQ gives planners a concrete number to work with in the form of an order size that reflects actual demand and cost data. This turns stocktaking and ordering into a proactive, structured process.

- Smoother inventory turnover

- Predictable ordering schedules

- Aligned purchase volumes with production needs

Supporting Supplier Negotiation and Planning

Knowing your ideal order size strengthens your position when negotiating with suppliers. It also allows your team to plan shipments more effectively.

- Better leverage for volume-based discounts

- Improved inbound logistics

- Clear expectations are set with suppliers on reorder cycles

EOQ in Inventory Control and Operations Management

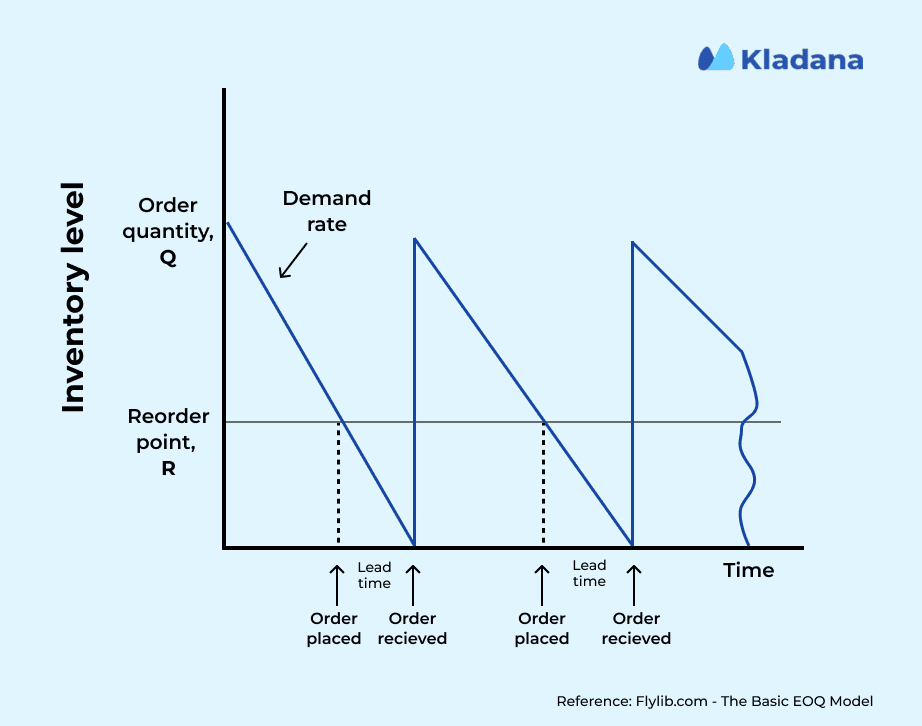

EOQ fits naturally into inventory control and operations. It takes guesswork out of ordering and lets planners build a system where the stock moves in sync with actual demand and lead times.

Case in point: businesses like Neytthomes have used automated inventory tools to achieve shorter cycle times and improve stock accuracy. Their work with Kladana shows how applying EOQ logic within a modern system drives measurable results.

How Kladana Helped Neytthomes Streamline Inventory & Operations:

✅ Real-Time Multi-Location Inventory Tracking — Enabled seamless visibility across 10+ locations with accurate stock control and barcoding.

✅ Error-Free Sales Quotes with Images & Pricing — Automated quotes with product visuals, MRP, discounts, and logistics costs, eliminating manual mistakes.

✅ System-Generated Purchase Orders — Replaced email-based confirmations with structured POs, improving vendor transparency and financial forecasting.

✅ Barcode Management for Fast Stock Audits — Made it possible to scan and verify 270+ products within an hour, boosting operational efficiency.

✅ Profit Margin Analysis Per Order — Delivered insights into gross/net profit, logistics cost, and order-level profitability.

✅ Custom ERP Fit for the Rug Industry — Handled dual units (pieces & sq. ft.), tailored invoices, and square-foot pricing with ease.

✅ KPI-Driven Sales Tracking — Enabled sales forecasting, lead prioritisation, and clear visibility into team and product performance.

Role of EOQ in Minimizing Total Cost

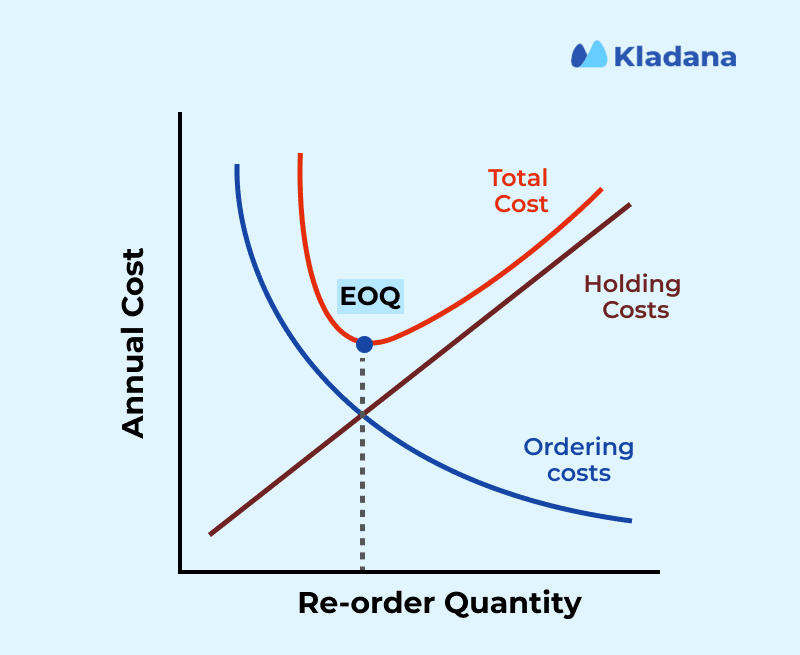

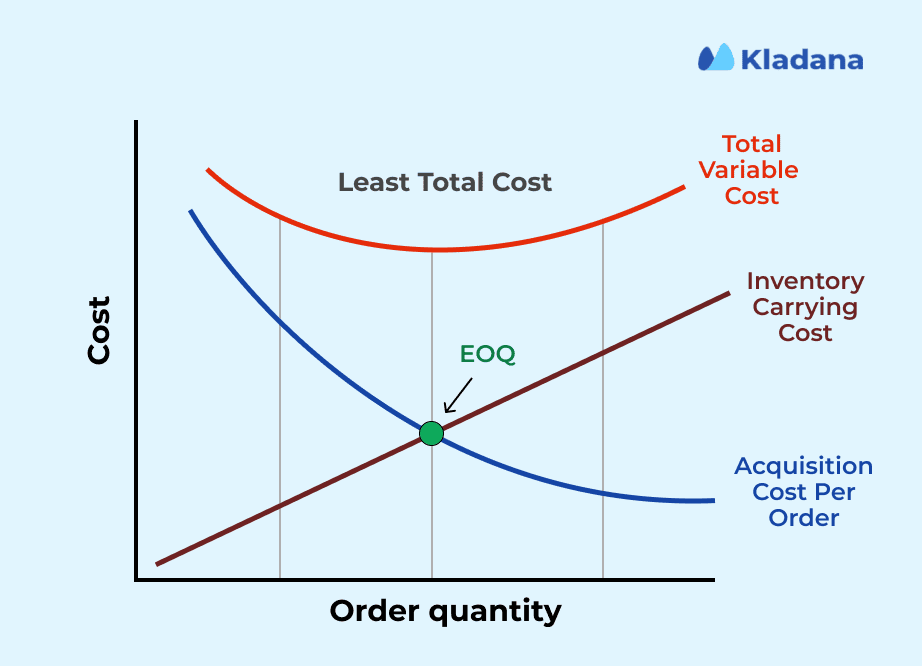

The core value of EOQ lies in balancing two competing costs:

- Ordering cost: Every time a purchase order is raised, there’s a processing cost

- Holding cost: Every extra unit kept in storage adds cost per day

EOQ calculates the order size that minimizes the sum of these costs. This gives businesses a clear path to improve margins through better inventory practices.

Use in MRP and Inventory Policies

In modern manufacturing and distribution, EOQ feeds directly into Material Requirements Planning (MRP). It helps set reorder quantities within MRP systems, aligning purchasing with production demand.

- Aligns purchase orders with production runs

- Creates more accurate inventory forecasts

- Supports consistent lot sizing across SKUs

Integration with ERP and Inventory Software

Automating EOQ calculation is where the model delivers its best results. ERP platforms compute EOQ in real time, using updated demand and cost data.

- Continuous recalculation as demand shifts

- Automated reorder suggestions

- Reduced manual intervention in purchase planning

EOQ Analysis in Inventory Management

Once EOQ is calculated, it becomes a working number that feeds directly into purchasing decisions. But EOQ is not a static figure, instead, it needs you to adapt as market conditions, costs, and demand patterns shift.

Here’s how teams apply and adjust EOQ in real-world inventory management:

Interpreting EOQ Results

An EOQ number by itself does not drive change. It must be viewed alongside other operational data:

- Compare EOQ to existing order sizes. Large gaps may indicate the need to review ordering practices.

- Track how EOQ impacts stock turnover. Higher turnover often signals improved cash flow.

- Monitor inventory carrying costs pre- and post-EOQ implementation to validate improvements.

Adjusting EOQ with Quantity Discounts

Suppliers often offer discounts for higher volume purchases. In such cases:

- Run cost comparisons between ordering at EOQ and ordering at discount thresholds.

- If the discount savings outweigh the additional holding cost, adjust the order size accordingly.

- Use this approach selectively for items with stable demand and long shelf life.

EOQ vs. JIT vs. Reorder Point

EOQ fits best where demand is stable and predictable. It complements other inventory methods rather than replacing them.

| Method | Primary Focus | Best For |

EOQ |

Balancing ordering and holding costs |

High-volume, steady-demand SKUs |

JIT |

Minimizing stock levels through frequent, small orders |

Short lead time environments with highly predictable supply |

Reorder Point (ROP) |

Triggering replenishment based on actual stock level |

Variable demand patterns or items with uncertain lead times |

A modern order management system for small businesses can handle EOQ, JIT, and ROP logic in parallel so that you can apply the right model per SKU.

Limitations and Assumptions of EOQ

EOQ provides value, but it operates on certain assumptions. Understanding these helps inventory planners know when to trust the model and when to apply caution.

Constant Demand Assumption

EOQ works best when product demand stays relatively steady since the calculation relies on an accurate forecast of annual demand. If demand fluctuates wildly, the output of the EOQ formula may quickly become inaccurate.

- For seasonal products or demand spikes, EOQ requires frequent recalculation.

- Modern inventory systems with demand forecasting can help adjust the EOQ automatically.

Uniform Lead Time and Pricing

The EOQ formula assumes that lead times and unit costs remain consistent. But then, fluctuating lead times (caused when dealing with dynamic supplier networks or commodity-based purchases) can disrupt planned reorder cycles. If orders arrive too early, holding costs rise.

If they arrive late, stockouts occur.

- Fluctuating supplier lead times can disrupt EOQ-based planning.

- Variable costs or spot pricing should trigger a review of ordering decisions outside of strict EOQ application.

Challenges in Dynamic Environments

Dynamic, highly competitive markets or heavily promotional categories can break EOQ assumptions. In such cases, relying purely on EOQ may create mismatches between stock and demand.

For example, a product might sell steadily for three quarters of the year, then spike tenfold during a holiday campaign. If procurement runs solely on EOQ, the business risks running out of stock or flooding storage during the wrong period.

To manage this —

- Combine EOQ with safety stock strategies to buffer against demand uncertainty.

- For product launches or markets with aggressive competitor activity, lean on shorter planning cycles with more frequent EOQ recalibration.

You can integrate EOQ with flexible planning and modern cloud-based Purchase Order Software for small businesses to apply EOQ where it works best.

FAQs on Economic Order Quantity

Let’s address some of the common questions around FAQs.

What is EOQ, and why is it important?

Economic Order Quantity (EOQ) is a calculation that identifies the optimal order size for inventory purchases.

What is the EOQ formula, and how is it calculated?

EOQ = √(2DS / H), where D is the annual demand, S is the ordering cost per order, and H is the annual holding cost per unit. This formula provides the ideal order quantity to minimize combined costs.

How does EOQ help reduce inventory costs?

EOQ reduces ordering frequency while avoiding excessive stock. It balances storage costs with order processing costs, which directly improves cash flow and operational efficiency.

When should a business avoid using EOQ?

Businesses with highly volatile demand, seasonal spikes, or unpredictable supplier lead times should use EOQ carefully or combine it with other planning methods.

Is EOQ suitable for seasonal products?

EOQ can support seasonal products if recalculated regularly. However, demand forecasting and safety stock should supplement EOQ in such cases.

How does EOQ compare to JIT and ROP?

EOQ focuses on cost-based order sizing. JIT prioritizes frequent ordering with low stock levels, while Reorder Point (ROP) triggers orders based on current inventory position.

Can EOQ be automated?

Yes. Many modern inventory management software platforms calculate EOQ automatically using historical demand and cost data.

How often should EOQ be recalculated?

It should be reviewed at least quarterly, or whenever major changes occur in demand patterns, ordering costs, or holding costs.

Does EOQ apply to perishable goods?

EOQ can be used for perishable items, but additional constraints such as shelf life and expiration risk must be factored into the order size decision.

How does EOQ support supplier negotiations?

Knowing your optimal order size provides a basis for negotiating better volume discounts or delivery terms. It also helps suppliers plan production and logistics more efficiently.

List of Resources

Calhoun: The NPS Institutional Archive — An assessment of relevant costs in the Wilson EOQ model.