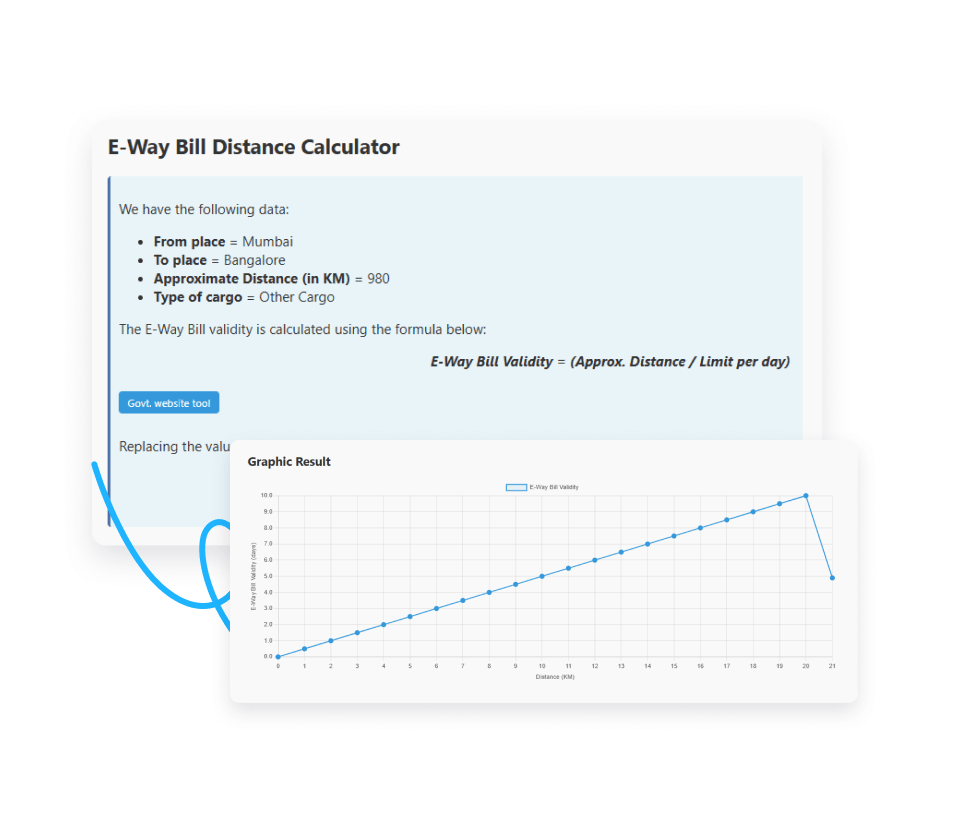

E-Way Bill Distance Calculator

We have the following data:

- From place =

- To place =

- Approximate Distance (in KM) =

- Type of cargo =

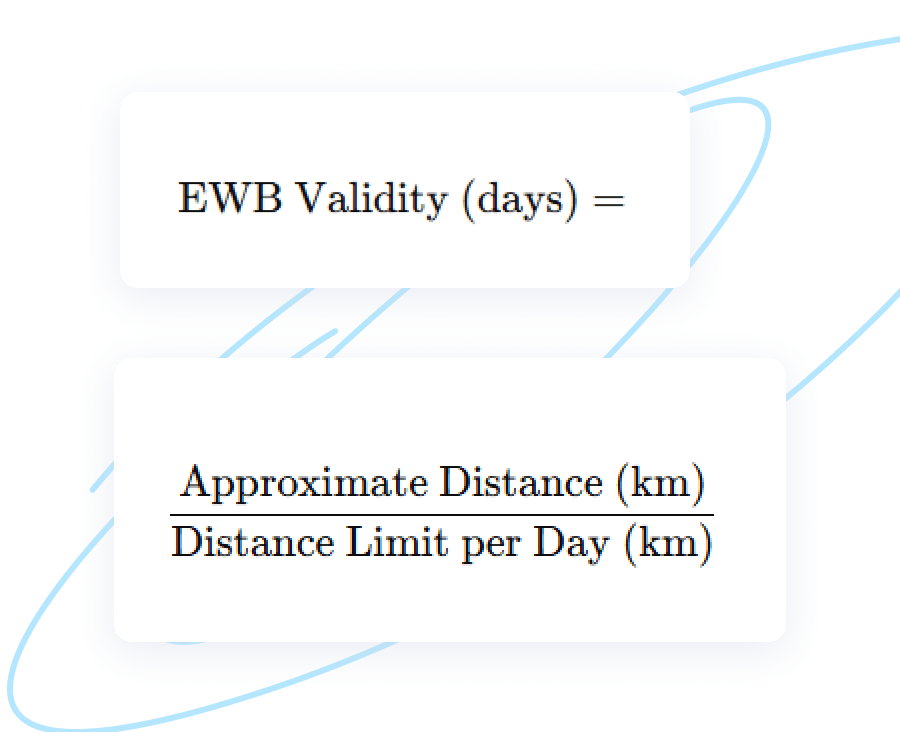

The E-Way Bill validity is calculated using the formula below:

Replacing the values we have:

EWB valid = days

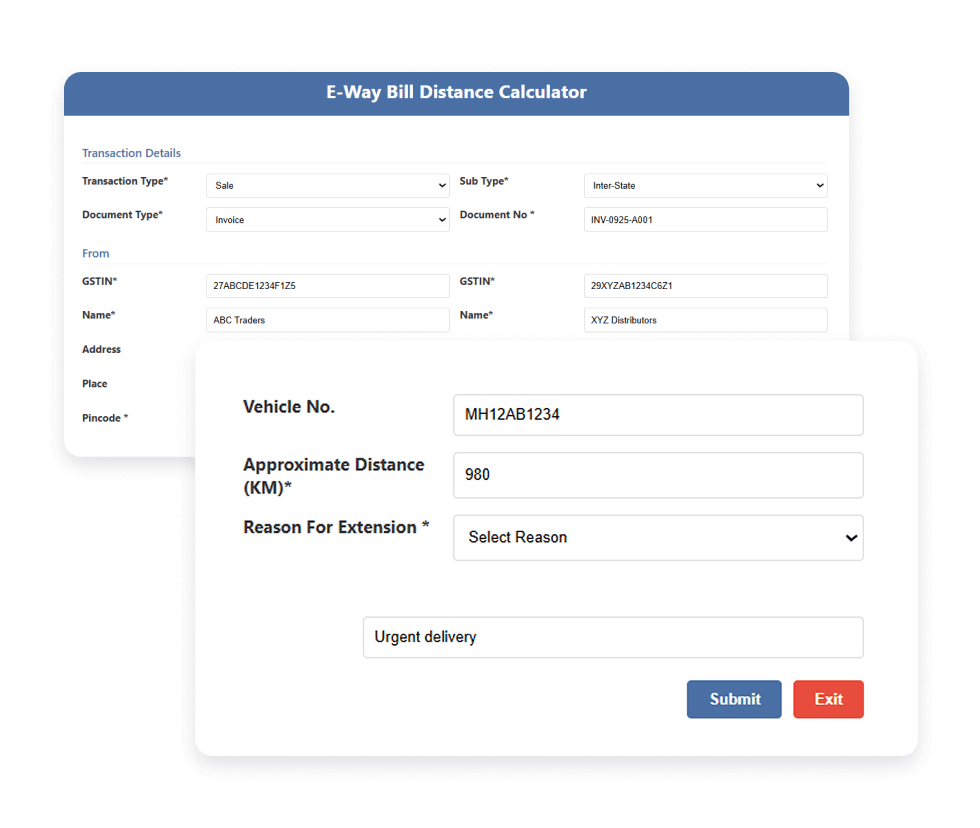

How to Use the Calculator

Step 1: Enter Transaction & Transport Details

1. Select transaction type, subtype, and document type

2. Enter document number, GSTINs of consignor and consignee

3. Fill in addresses, places, states, and pincode

4. Provide transportation details:

- Cargo type

- Vehicle number

- Transport mode (road/rail/air/ship)

5. Enter the approximate distance (in KM)

Step 2: Click «Submit» and View E‑Way Bill Validity

The tool automatically applies the official formula:

Validity = Distance ÷ Limit per Day

For other cargo: 200 km/day

In this case:

980 ÷ 200 = 4.9 days of E‑Way Bill validity.

Use Reset to start over

Formula for Validity of an E‑Way Bill

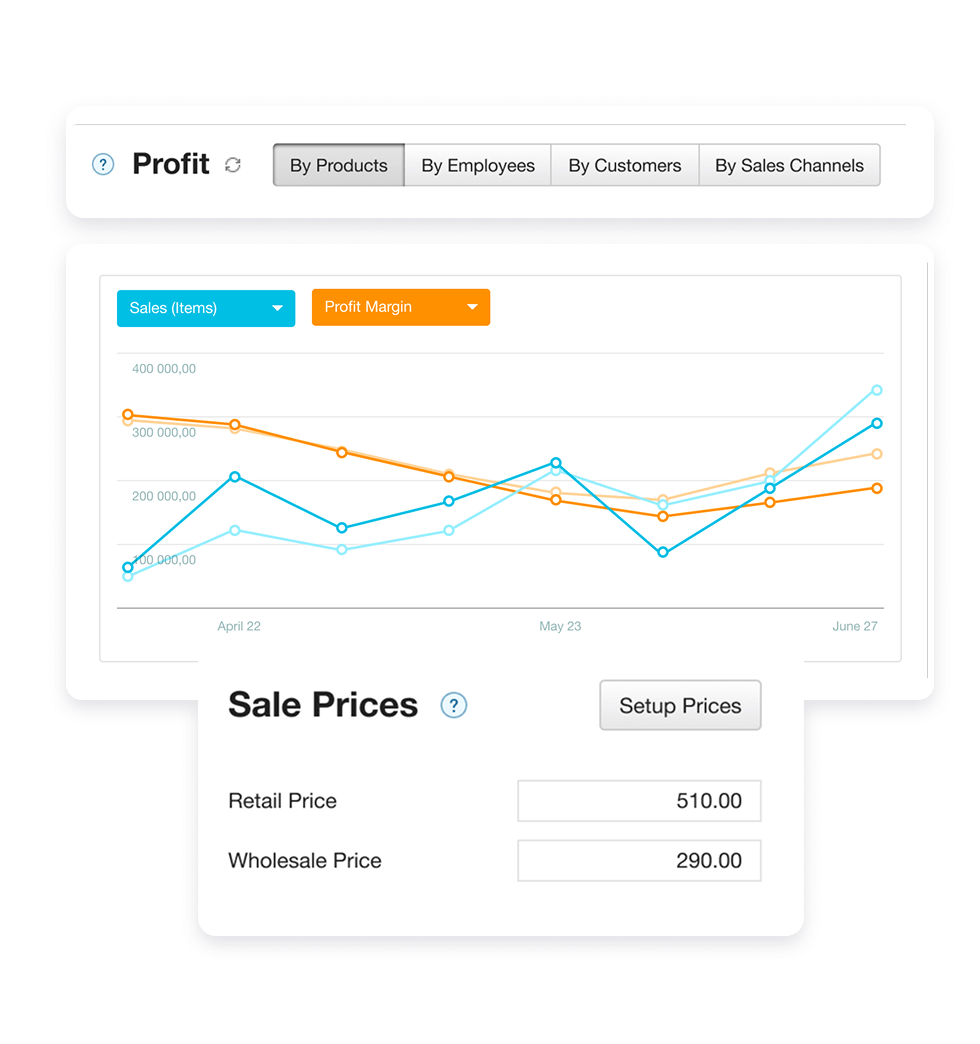

Get Clarity on Your Business Finances

Don’t just track distance — track every dollar. With Kladana, you get full financial visibility across sales, purchases, stock, and money movement.

- Monitor cash flow in real time — see what’s paid, pending, and expected

- Get instant profit and loss reports — skip manual spreadsheets

- Stay on top of receivables and payables to avoid cash crunches

- Make informed decisions with accurate, always-updated financials

Start with our forever free plan or explore all features with a 14‑day trial.

Frequently Asked Questions about E‑Way Bill Calculator

An E‑Way Bill is an electronically generated document required under GST for transporting goods worth over ₹50,000 across state or within a state.

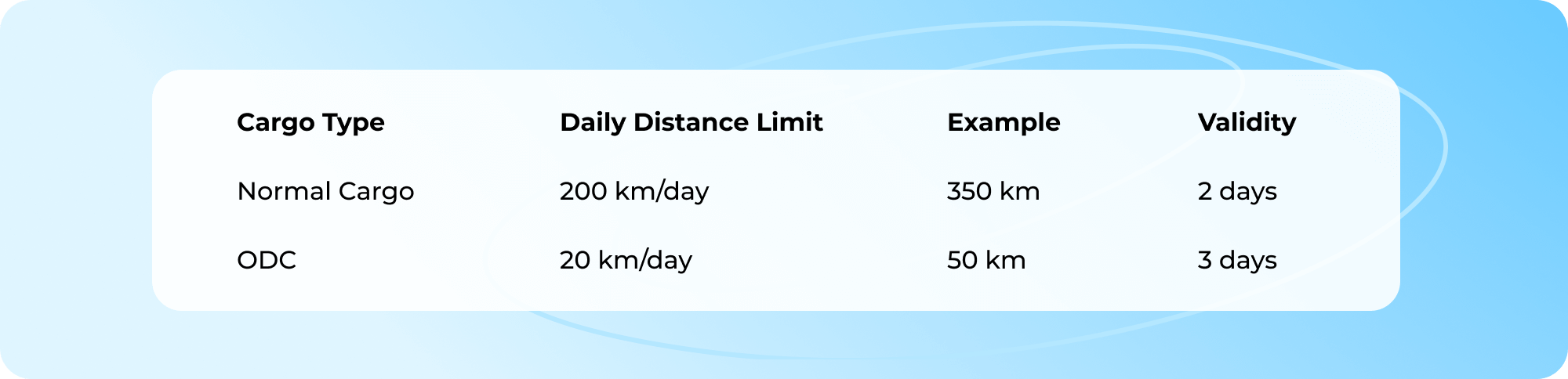

The validity depends on distance and cargo type:

- Normal cargo: 1 day per 200 km

- ODC (Over‑Dimensional Cargo): 1 day per 20 km

The calculator applies this rule automatically.

Yes. It applies to road, rail, air, and ship transport within India.

Yes. Before expiry, citing valid reasons like:

- Vehicle breakdown

- Natural calamity

- Traffic delay

- Accident or route diversion

ODC stands for Over‑Dimensional Cargo — if your goods exceed the legal dimensions of the vehicle (e.g. machinery, beams), they fall under ODC. You’ll need special permissions and the validity will be shorter (20 km/day).

Your consignment becomes non‑compliant under GST. It can be detained by tax authorities and may incur penalties. Always plan ahead or request an extension in time.

Yes. Each movement of goods — whether for return, job work, or stock transfer — requires its own valid E‑Way Bill.

Learn how to arrange business routines for manufacturing, wholesale, retail & e‑commerce