Revenue and profit don’t always reflect how much cash a business actually has. That’s why finance teams rely on the cash flow statement.

It tracks where money comes from and where it goes across three areas: operations, investing, and financing. The section that matters most for day-to-day financial health is cash flow from operating activities.

It shows how much cash a company brings in from its core operations, like sales and services, not from loans or asset sales.

In this article, you’ll get to know what operating cash flow is, how to calculate it using the direct and indirect methods, and how to avoid common reporting mistakes. We’ll also look at Excel workflows, ERP software, and industry-specific examples to help you improve accuracy and decision-making. Let’s get into it.

- What is Cash Flow from Operating Activities?

- Why Operating Cash Flow Matters for Business Financial Health

- Direct vs Indirect Method of Calculating Operating Cash Flow

- Key Components of Cash Flow From Operating Activities

- How to Calculate Operating Cash Flow in Excel

- Using ERP Systems (Tally, Zoho, SAP) for Cash Flow Reporting

- Industry-Specific Examples of Operating Cash Flow

- Common Mistakes in Reporting Cash Flow From Operations

- FAQs on Cashflow Reporting

- List of Resources

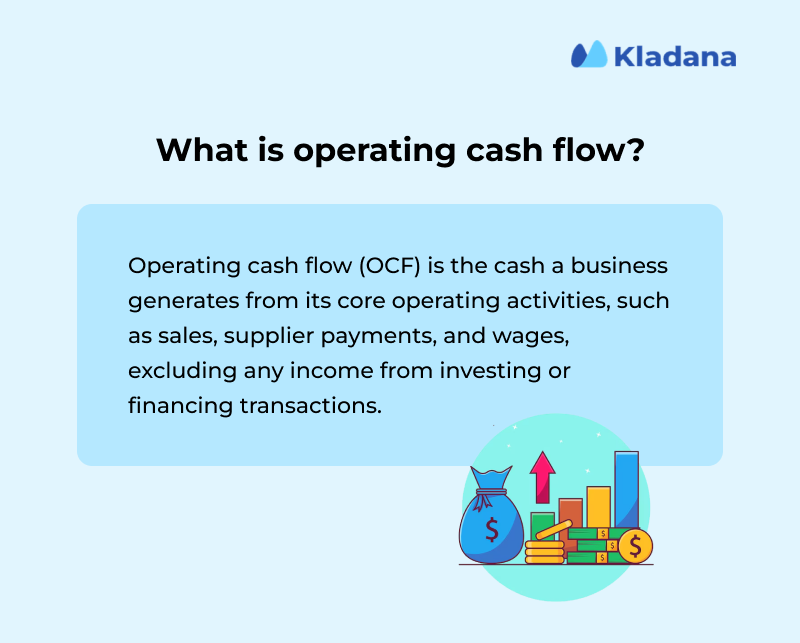

What is Cash Flow from Operating Activities?

Operating cash flow (OCF) measures how much cash a business generates from its core operations during a specific period. It excludes cash from investing and financing, focusing only on day-to-day income and expenses like sales, supplier payments, payroll, and taxes.

This is the first section of a cash flow statement and is closely watched by analysts. It shows whether a business can sustain itself, reinvest, or repay obligations using cash from its normal activities.

Positive OCF signals strong demand and efficient operations. Negative OCF, especially over multiple quarters, may point to collection delays, poor cost control, or excess inventory.

💰 See Your Cash Flow in Real Time

Track operating cash flow automatically with Kladana’s integrated ERP.

- Auto-generate daily cash flow reports from real payment and inventory activity

- Break down inflows and outflows by bank, cashbox, or expense type

- Click into any transaction to trace the source—no spreadsheets, no toggling

- Export reports in Excel, PDF, or Open Office for quick reviews and audits

➡️ Explore our Financial Integrations

Cash Flow From Operations vs Net Income

Net income reflects accounting profit but not actual cash movement. A company may report $2 million in net income but only $1.2 million in OCF due to unpaid invoices or increased inventory.

OCF adjusts for timing differences by adding back non-cash items like depreciation and reflecting changes in working capital. This makes it a more reliable metric for understanding a company’s cash position and short-term financial health.

Why Operating Cash Flow Matters for Business Financial Health

Operating cash flow reflects how well a business can fund its operations without outside help. Let’s look at its key advantages:

Use in Liquidity and Solvency Analysis

Positive OCF means a business can cover short-term expenses like payroll, rent, and vendor payments. Low OCF, even with strong revenue, can cause cash shortfalls during slow periods.

Role in Debt Servicing, Reinvestment, and Dividend Payments

Lenders look at OCF to assess if a business can repay loans. A company with $100,000 in annual loan payments and only $80,000 in OCF may face risk, while one with $300,000 in OCF has room to invest and distribute dividends.

Reinvestments like hiring, R& D, or asset upgrades are often funded from operating cash. CFOs track this closely to make sure growth doesn’t come at the cost of financial strain.

Trusted KPI for Investors and Credit Agencies

Strong OCF shows that a business earns real cash, not just profits that are on paper. That’s why investors and rating agencies treat it as a more reliable signal than earnings alone. It also feeds into valuation models like Discounted Cash Flow (DCF) and metrics such as cash flow yield or free cash flow per share.

In short, healthy operating cash flow increases trust, improves valuation, and gives businesses the flexibility to act when opportunities or risks arise.

🧮 Estimate Your Break-Even Point for Stronger Cash Flow Insights

Struggling to understand when your business really becomes profitable from operations?

Kladana’s Free Break-Even Point Calculator helps you link your cash inflows and outflows with pricing strategy & cost structure — to see exactly:

- How many units or sales revenue you need to break even

- How changes in costs or price affect your profitability

- Scenarios under different cost or revenue assumptions

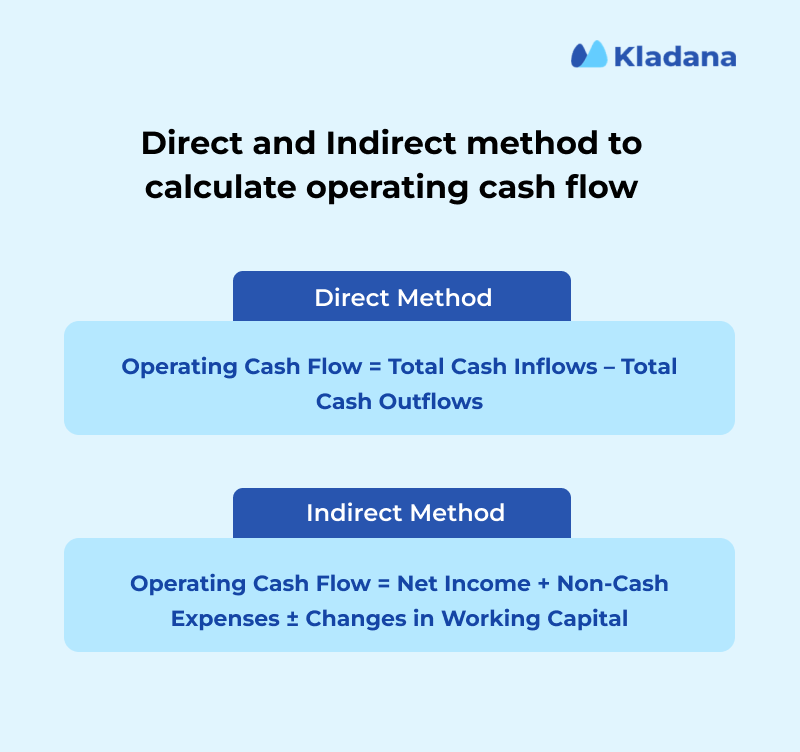

Direct vs Indirect Method of Calculating Operating Cash Flow

Cash flow from operations can be calculated using the direct or indirect method. Both yield the same result but differ in inputs and format. The choice depends on accounting practices and reporting needs.

Here’s how each method works and when to use it.

Direct Method

The direct method calculates operating cash flow by adding up all actual cash transactions related to core operations. It lists cash collected from customers, cash paid to suppliers, salaries, rent, and other operating expenses.

Formula:

Operating Cash Flow = Total Cash Inflows − Total Cash Outflows

For example, if a business received $500,000 from customers, paid $120,000 in salaries, $180,000 to suppliers, and $20,000 in rent and utilities, its operating cash flow would be:

$500,000 − ($120,000 + $180,000 + $20,000) = $180,000

The direct method offers high clarity since it shows the exact sources and uses of cash. However, it requires detailed cash tracking and is rarely used in practice due to the time involved.

Indirect Method

The indirect method starts with net income and adjusts for non-cash items and changes in working capital. It’s based on accrual accounting and is easier to prepare since the data comes from the income statement and balance sheet.

Formula:

Operating Cash Flow = Net Income + Non-Cash Expenses ± Changes in Working Capital

If a company reports $100,000 net income, adds back $15,000 in depreciation, and shows a $10,000 increase in accounts receivable, the OCF would be:

$100,000 + $15,000 − $10,000 = $105,000

This method is more commonly used and accepted by most regulatory bodies, though it’s less transparent than the direct approach.

| Criteria | Direct Method | Indirect Method |

| Input | Cash transactions | Net income and adjustments |

| Common Use | Rare | Most widely used |

| Clarity | High | Less transparent |

| Preparation | Time-intensive | Easier with existing reports |

| Regulatory Preference | Recommended by FASB | Widely accepted under GAAP and IFRS |

When to Use Which Method

Use the direct method if your company tracks cash receipts and payments in detail and wants to present a clear picture of actual inflows and outflows. Retail or service businesses with high transaction volumes and simple structures may benefit from this approach.

The indirect method is more suitable if your accounting system runs on an accrual basis and you need a faster way to reconcile net income with actual cash. It is also preferred for internal comparisons, forecasting, and investor reporting.

Regulatory Considerations (IFRS, GAAP)

Under International Financial Reporting Standards (IFRS), both methods are permitted, though the direct method is encouraged. However, companies using the direct method must also provide a reconciliation using the indirect method.

Generally Accepted Accounting Principles (GAAP) also allows both, but the indirect method is far more common in the U.S. Most publicly listed companies use it to keep reporting simple and consistent with income statements and balance sheets.

The FASB recommends the direct method for better transparency, but adoption remains low due to the additional work required.

📘 Recommended Read: Curious how book and bank balances stay aligned in practice? Explore how a Bank Reconciliation Statement helps catch missed entries, prevent cash flow mismatches, and improve audit readiness.

Key Components of Cash Flow From Operating Activities

Accurate operating cash flow requires adjusting accrual-based net income to reflect actual cash movement. Both methods need changes for non-cash items and working capital.

Here are the key components that impact operating cash flow.

Adjustments to Net Income

When using the indirect method, you start with net income and adjust it for items that impact cash differently than they do accounting profit.

Depreciation and Amortization

These are non-cash expenses. While they reduce accounting profits, they don’t involve any cash movement. So, they are added back to net income.

For example, if a company has $50,000 in depreciation on equipment, that amount increases the operating cash flow.

Changes in Working Capital

Working capital refers to current assets and liabilities. Changes in these items directly affect how much cash is tied up in daily operations.

Inventory: An increase means more cash spent, so it’s subtracted. A decrease adds to cash flow.

Accounts Receivable (A/R): If A/R rises, cash is still outstanding, so it’s subtracted. A decrease is added back.

Accounts Payable (A/P): An increase means you held on to cash longer, so it’s added. A decrease is subtracted.

Example:

If A/R increased by $20,000 and A/P increased by $10,000 during the period, the net cash impact would be

−$20,000 + $10,000 = −$10,000 adjustment to net income.

Deferred Tax, Provisions, and Non-Cash Expenses

These entries affect reported earnings but may not involve actual cash flow during the period.

Examples include:

- Deferred tax liabilities or assets

- Accrued expenses and provisions

- Stock-based compensation

- Impairments or write-downs

These items are added back or subtracted based on whether they increased or decreased net income without affecting cash.

📘 Recommended Read: Want to reduce the cash stuck in receivables? Learn how a well-structured Accounts Receivable Process helps you get paid faster, lower DSO, and keep working capital under control.

Non-Operating Items to Exclude

Cash flow from operations should reflect only core business activities. Non-operating items, even if they appear in the income statement, must be excluded from this section.

Examples are:

- Interest income or dividends received (unless you’re a financial institution)

- Gains or losses from the sale of fixed assets

- Loan repayments or interest paid (often classified under financing)

- Income tax refunds or payments (some companies classify these separately)

If a company sells machinery and earns a $15,000 gain, that gain appears in net income. But since it’s a non-operating activity, it needs to be subtracted when calculating operating cash flow.

How to Calculate Operating Cash Flow in Excel

Excel is a practical tool for calculating operating cash flow. With a clear structure and formulas, finance teams can build reliable models and validate numbers before syncing with ERP systems.

Let’s break down how you can do it in Excel:

Setting Up an Operating Cash Flow Sheet

The indirect method is more common, so we’ll use that for the structure.

Here’s what you have to do:

- Open Excel and create a new spreadsheet.

Label your columns as:

- Column A: Line Item (e.g. Net Income, Depreciation, Change in A/R)

- Column B: Value (numeric amount, can be positive or negative)

- Column C: Adjustment Type (e.g. Add to OCF, Subtract from OCF)

- Column D: Final Impact (calculated based on logic)

Start filling in the data like this:

| A | B | C | D |

| Net Income | 120000 | Start Point | =B2 |

| Depreciation | 18000 | Add to OCF | =IF (C3=”Add to OCF”, B3, -B3) |

| Change in A/R | 5000 | Subtract from OCF | =IF (C4=”Add to OCF”, B4, -B4) |

| Change in A/P | 7000 | Add to OCF | =IF (C5=”Add to OCF”, B5, -B5) |

| Final Operating Cash Flow | =SUM (D2:D5) | ||

Formula breakdown:

Row 2 (D2): =B2 (starting point is net income)

Rows 3–5 (D3:D5): =IF (Cx=”Add to OCF”, Bx, -Bx)

Replace x with the row number.

Row 6 (D6): =SUM (D2:D5)

This gives your total operating cash flow.

How this looks with numbers:

| A | B | C | D (Amt in $) |

| Net Income | 120000 | Start Point | 120000 |

| Depreciation | 18000 | Add to OCF | 18000 |

| Change in A/R | 5000 | Subtract from OCF | -5000 |

| Change in A/P | 7000 | Add to OCF | 7000 |

| Final Operating Cash Flow | 140000 | ||

Your operating cash flow in this case is $140,000.

Excel Tips to Automate Faster

You can use these formulas to streamline calculations:

SUM for totals

=SUM (B2:B10)

Calculates total adjustments or values in a range.

IF for conditional adjustments

=IF (C3=”Add to OCF”, B3, -B3)

Automatically adjusts value based on type.

Data Validation for dropdowns

Use Excel’s Data → Data Validation to create dropdowns in Column C with options:

Add to OCF, Subtract from OCF, Start Point

Conditional Formatting

Highlight negative values in red or apply icons to show increases and decreases at a glance.

Use of Templates or Financial Models

Instead of building from scratch, you can use ready-made Excel templates that follow GAAP or IFRS standards. These models typically include:

- Structured sections for income statement inputs

- Auto-calculated working capital movements

- OCF summary linked to the cash flow statement

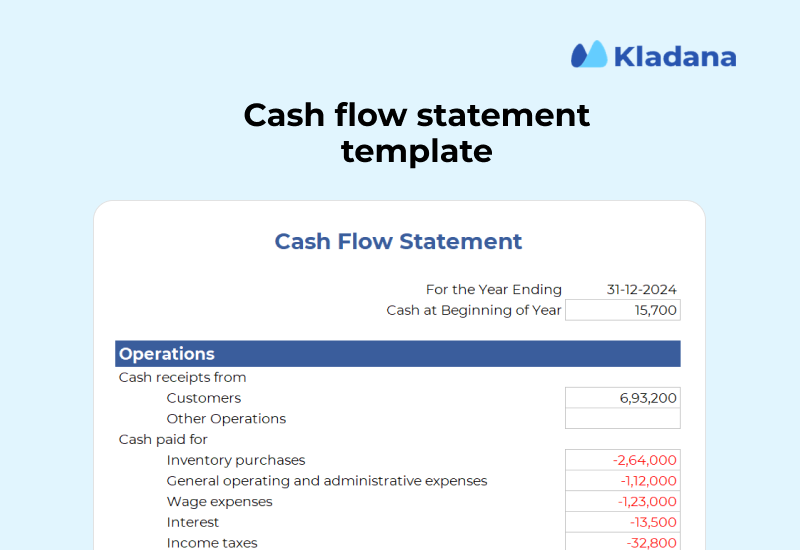

We’ve prepared a ready-to-use cash flow statement template to get you started right away.

OR

Excel vs ERP System Reconciliation

ERP systems like Tally, Zoho Books, or SAP often automate cash flow reporting based on real-time accounting entries. However, their default formats may not align with internal custom reporting or management dashboards.

Use Excel for:

- Forecasting or budgeting

- Adjusting historical entries manually

- Comparing scenarios (e.g., sales slowdown vs rapid growth)

Use ERP for:

- Real-time actuals

- Tax-compliant cash flow reports

- Audit trail and data integrity

For best results, export trial balances or general ledger data from your ERP, plug them into your Excel model, and validate the OCF output for consistency.

Using ERP Systems (Tally, Zoho, SAP) for Cash Flow Reporting

Manually tracking operating cash flow in spreadsheets can be slow and error-prone. ERP systems automate this process using real-time accounting data. Let’s explore more about them:

Features of Cash Flow Modules in Major ERP Software

The below accounting ERP platforms come with built-in cash flow reporting tools that track operating, investing, and financing activities:

TallyPrime offers a detailed Cash Flow Statement report that automatically separates transactions by activity type and allows drill-downs into source entries. It also includes forecast reports that estimate future cash positions based on outstanding receivables and payables.

Zoho Books provides visual dashboards and real-time cash flow graphs that update as new transactions are recorded. You can filter reports by cash flow type, compare historical periods, and export reports for board presentations or audits.

SAP Business One integrates cash flow planning with your full financial module. It lets you track expected inflows from open sales orders and payables, helping you manage working capital more effectively.

Real-Time Cash Insights for CFOs and Finance Teams

ERP systems reflect cash movement the moment a transaction is recorded. CFOs and finance teams can view live dashboards to monitor collections, payables, or liquidity gaps, and set alerts for key changes, improving control without waiting for manual reports.

Integrating Accounting Entries and Audit Trails

Each cash flow entry is linked to source records like invoices, receipts, or purchase orders.

TallyPrime: Trace cash flow lines to vendor bills.

SAP Business One: See the original transaction for each inflow or outflow.

Zoho Books: Attach notes or documents for audit-ready trails.

This linkage ensures accuracy, simplifies audits, and keeps manual and system reports in sync.

Industry-Specific Examples of Operating Cash Flow

Operating cash flow patterns vary by industry based on how revenue is earned, how fast payments come in, and how working capital is managed. Understanding these differences helps businesses benchmark cash efficiency within their sector.

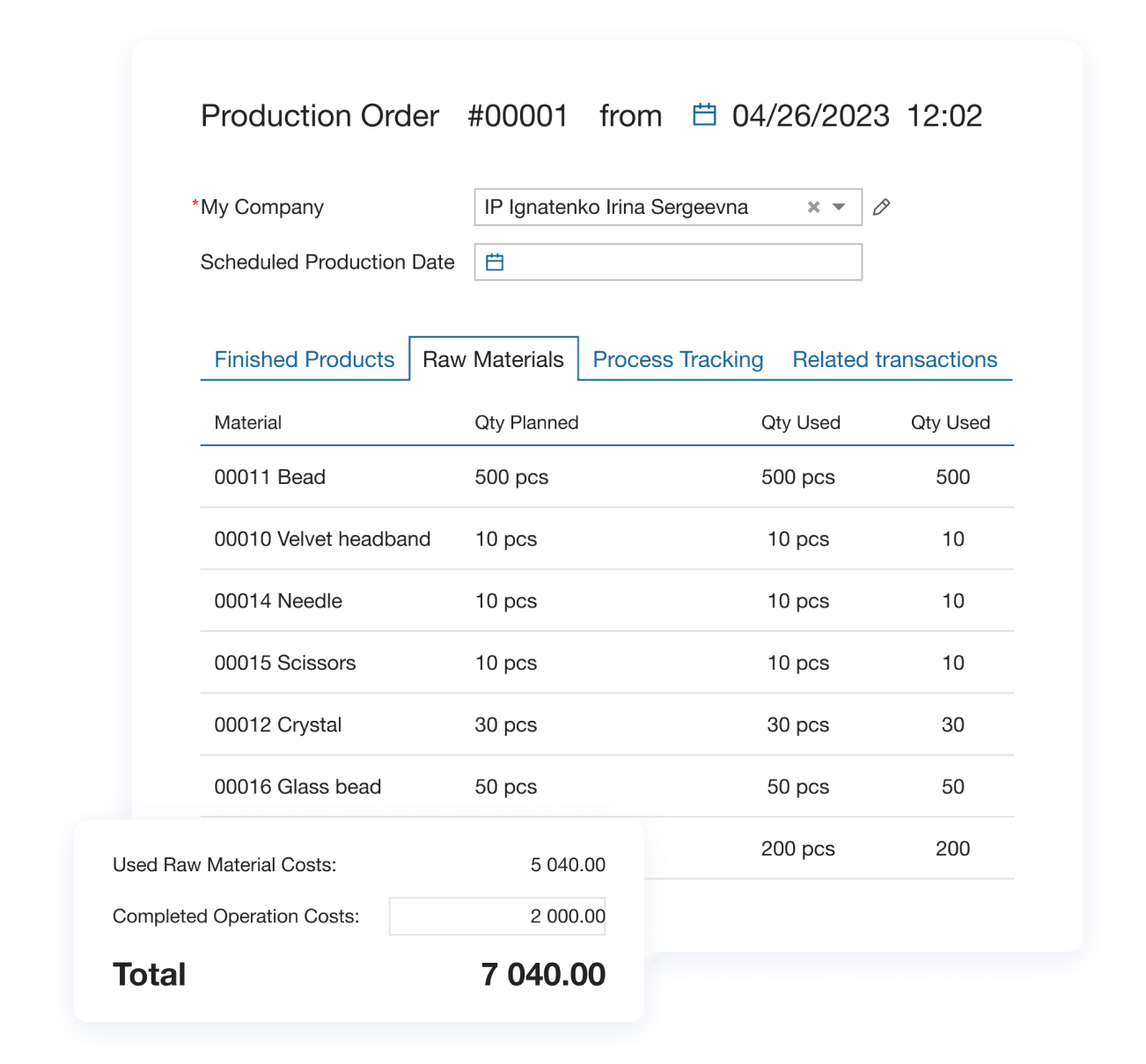

Manufacturing: Raw Material Purchases, WIP Inventory

Manufacturers often deal with large upfront costs for raw materials and slow-moving work-in-progress (WIP) inventory. These cash outflows happen long before final products are sold.

For example, a factory that spends $200,000 on steel and labor in January may not receive payment until March when goods are delivered. This delay increases working capital needs and puts pressure on OCF.

Retail: High Inventory Turnover, Payment Cycles

Retail businesses typically experience fast inventory turnover but face fluctuating payment terms. While daily cash inflows from card and cash sales improve OCF, overstocking or slow-moving SKUs can tie up cash.

If a retailer buys $50,000 in seasonal goods and sells them quickly at a markup, OCF improves. But unsold inventory or supplier prepayments can create cash gaps.

Service-Based: Limited Depreciation, Prepaid Revenue Models

Service businesses have fewer fixed assets and minimal depreciation but rely heavily on customer prepayments and recurring revenue.

For example, a SaaS company may receive $120,000 in annual subscriptions upfront, boosting OCF early in the year. But they must manage delivery and support costs over time to avoid mid-year shortfalls.

Each model presents different challenges for managing short-term cash and long-term sustainability.

Common Mistakes in Reporting Cash Flow From Operations

Accurate cash flow reporting requires close attention to how transactions are classified and adjusted. Even small errors can distort how much cash the business truly generates. Below are some of the most frequent mistakes that affect operating cash flow.

Misclassifying Investing or Financing Cash Flows

One of the most common errors is placing cash flows in the wrong section of the statement. For example, loan proceeds should go under financing activities, not operations. Similarly, purchasing fixed assets should be classified under investing, even if it’s part of regular business expansion.

Example:

If a business reports a $100,000 loan under operating activities, it inflates OCF and gives a false impression of internal cash generation.

Ignoring Working Capital Changes

Some businesses overlook changes in accounts receivable, inventory, or payables when calculating OCF. Since these affect how much cash is actually available, ignoring them skews results.

Example:

A company with $50,000 in net income but a $30,000 increase in inventory must adjust for that outflow. If not, the reported OCF will be overstated.

Double-Counting Depreciation or Interest

Depreciation is already a non-cash add-back in the indirect method. Adding it twice by mistake is a common error. The same goes for interest, which is sometimes wrongly added to OCF after already being deducted from net income.

To avoid this, trace each adjustment back to its source entry.

Not Adjusting for Non-Cash Transactions

Non-cash items like stock-based compensation, barter deals, or asset revaluations must be carefully handled. Including them as if they involved cash leads to inaccurate reporting.

Example:

Acquiring equipment through a lease should not appear as a cash outflow in the operating section. If no cash was paid upfront, it should be disclosed separately.

Get Full Visibility Into Your Cash Position With Kladana ERP

Kladana connects your sales, purchases, and payments in one system. Track inflows, monitor expenses, and make faster financial decisions without switching between tools.

FAQs on Cashflow Reporting

Here are quick answers to the most common questions about calculating, interpreting, and improving operating cash flow.

What is cash flow from operating activities?

It is the cash a business generates from its core operations, such as sales, supplier payments, wages, and taxes. It excludes investing or financing activities.

How is OCF different from net profit?

Net profit includes non-cash items and accounting adjustments. OCF removes those and shows how much actual cash the business generated or used.

What is the direct vs indirect method of OCF?

The direct method lists actual cash inflows and outflows. The indirect method starts with net income and adjusts for non-cash items and changes in working capital.

Which OCF method is preferred under GAAP/IFRS?

Both GAAP and IFRS allow either method. However, the indirect method is more common, while IFRS encourages using the direct method for better clarity.

How does depreciation impact operating cash flow?

Depreciation is a non-cash expense. It is added back to net income when calculating OCF using the indirect method.

How does working capital affect OCF?

Increases in receivables or inventory reduce OCF. Increases in payables improve it, since they delay cash outflows.

What are common errors in cash flow reporting?

Typical errors include misclassifying investing or financing activities, ignoring working capital changes, or double-counting non-cash adjustments like depreciation.

Can ERP software generate OCF automatically?

Yes. ERP systems like Tally, Zoho, and SAP can calculate and display OCF using real-time accounting data and preset report templates.

Why is positive OCF critical for SMEs?

It shows the business can cover its expenses, reinvest, or repay debts using its own cash. This reduces dependency on loans or external funding.

How to prepare OCF in Excel?

List net income, add non-cash expenses, and adjust for working capital changes. Use structured columns and formulas to automate the final calculation.

List of Resources

Harvard Business School Online — Discounted Cash Flow (DCF) Formula: What It Is & How to Use It

Read‑alikes

Understanding the Cost of Goods Manufactured: Formula, Components, Examples & Importance

Break Even Analysis: Definition, Formulas, and How to Calculate Your BEP

Selling Price Formula: How to Calculate SP with Profit or Loss Easily

Costing Methods and Approaches: A complete guide for Manufacturing & Inventory