Tracking what a business owns isn’t just good practice. It’s a financial necessity.

A fixed assets register is a central record of your company’s physical assets, which includes anything from laptops and machinery to office furniture and vehicles. It helps you monitor asset value, calculate depreciation, and prepare for audits without digging through old invoices or spreadsheets.

If you manage finances, run a small business, or prepare reports for auditors, a well-maintained asset register will save time and reduce errors. It also helps ensure compliance with accounting standards like IFRS and US GAAP.

This guide walks you through everything you need to know, from building a register in Excel to setting up depreciation formulas and disposal tracking. You’ll also find a free, downloadable fixed asset register format that you can customize for your business.

What Is a Fixed Assets Register?

A fixed assets register is a structured record of all long-term tangible assets owned by a business. It tracks key details for each item, such as description, acquisition date, cost, location, depreciation, and current value.

This register is not just for bookkeeping. It ensures every high-value asset is accounted for, whether it’s a $2,500 laptop or a $250,000 delivery vehicle. Any asset with a useful life beyond one year and above your capitalization threshold (commonly $1,000 or more) should be recorded here.

Why Is It Important?

Maintaining a fixed assets register is essential for:

- Financial Reporting: Ensures your balance sheet reflects the correct asset values, net of depreciation.

- Compliance: Helps meet regulatory requirements under IFRS and US GAAP, especially for depreciation and asset impairment.

- Audit Trail: Provides a clear record of each asset’s lifecycle, supporting external audits or internal reviews.

- Tax Deductions: Accurate depreciation records help businesses claim the right amount of capital allowances or tax deductions.

For example, say you purchase 10 desktop computers for $1,200 each. Without a proper register, it becomes difficult to track when they were bought, where they are installed, or how much depreciation has accumulated.

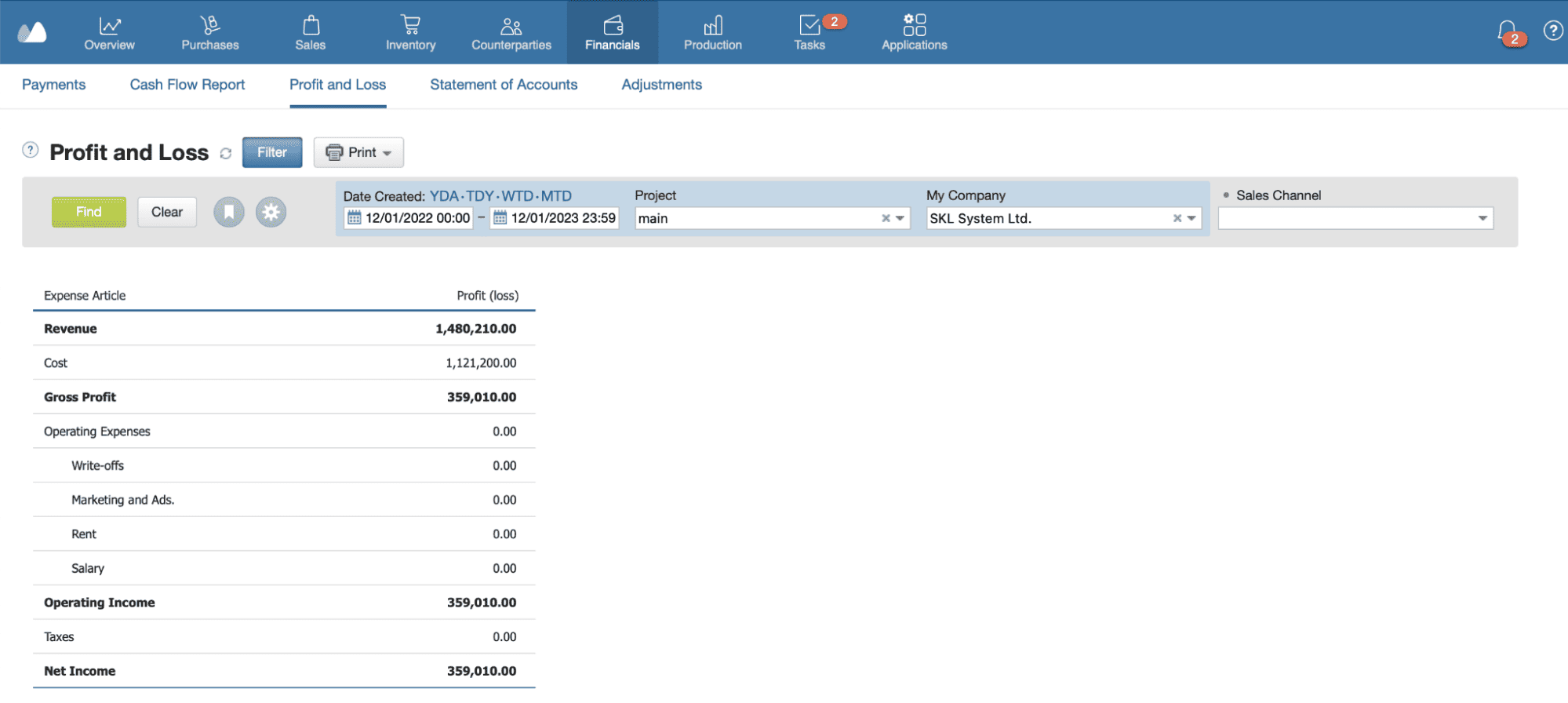

Automate Financial Reporting for Every Asset

Stop updating spreadsheets manually — Kladana’s Financials keep your fixed asset data, depreciation, and journal entries all in sync

- Track purchases, disposals, and write-offs automatically

- See updated balances in your Profit & Loss and Balance Sheet reports

- Get real-time insights into asset performance

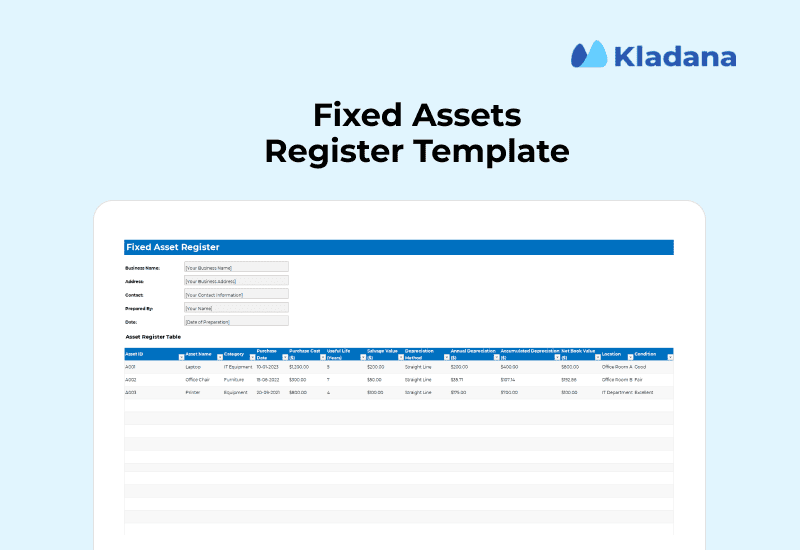

Download Free Fixed Assets Registers Excel Templates

We have done all the heavy lifting for you and prepared two versions of fixed asset register templates to get you started instantly. Check them out below:

1. Simple Fixed Asset Register Template

This basic fixed assets register Excel template includes essential elements like Quantity, Item, Cost, Date Purchased, Dept. and Asset ID.

Or

2. Detailed Fixed Asset Register Template

A more comprehensive version of fixed asset register that also includes Useful Life, Depreciation method, Depreciation Expense and Net Book Value along with the basics like Asset ID, Asset Name, Category, Purchase Date and Cost, Location and Condition.

Or

Why Maintain a Fixed Assets Register?

Keeping an accurate fixed assets register is important whether you’re managing 10 assets or 10,000. Here are the three key reasons:

1. Legal and Audit Requirements

Regulatory standards like IFRS and US GAAP require businesses to track assets and apply depreciation consistently. A fixed assets register:

- Creates a clear audit trail of purchases, disposals, and valuations

- Simplifies statutory reporting and supports tax filings

- Minimizes the risk of audit penalties or misstatements

For example, if you’re audited and can’t validate a $25,000 machinery purchase from 3 years ago, it could trigger deeper financial scrutiny.

2. Better Asset Management and Tracking

Without a register, businesses often lose sight of what they own. That leads to wasted purchases, idle assets, or worse, ghost assets. A proper register helps you:

- Track the current status, condition, and location of each asset

- Avoid duplicate purchases or forgotten maintenance

- Assign custodians or departments for accountability

Let’s say your business has 50 laptops. If 8 of them are idle in storage, knowing this helps reassign instead of buying more.

3. Simplified Depreciation and Disposal Records

Calculating depreciation without structured data leads to errors in tax filings and misrepresented financials. A fixed assets register helps you:

- Apply depreciation formulas (e.g. straight-line or declining balance) accurately

- Track accumulated depreciation and net book value

- Record disposals with date, reason, and gain or loss calculations

For example, if a $10,000 vehicle is sold after 4 years with $6,000 depreciation, your register helps you calculate and report the $2,000 loss correctly.

📘 Recommended Read: Once your fixed assets are organized and depreciation is under control, it’s worth reviewing your broader financial processes too. Explore our end-of-year checklist to learn how to reconcile accounts, close books efficiently, and prepare your business for a smooth start to the next financial year.

Key Components of a Fixed Assets Register

To manage fixed assets effectively, your register should include clear, structured fields that track each asset from purchase to disposal. The more complete your data, the easier it is to calculate depreciation, identify issues, and stay compliant.

Below are the core components every fixed assets register should contain.

Asset Details (ID, Name, Category, Location)

Each asset needs a unique ID for identification and tracking. Use a consistent format based on asset type, such as:

- IT-0001 for laptops

- VEH-0203 for vehicles

- EQP-1105 for heavy equipment

Include the asset name (e.g., “Dell Latitude 7420”), category (e.g., IT Equipment), and physical location (e.g., Warehouse B, San Diego).

This ensures you know what the asset is, where it is, and who is responsible for it.

Acquisition Details (Date, Supplier, Invoice No., Cost)

Track how and when each asset entered the books:

These details establish your asset’s historical value and are essential during audits or vendor disputes.

Depreciation Details (Method, Rate, Accumulated Depreciation)

Capture the depreciation method applied, such as:

- Straight-Line (SLM)

- Declining Balance (WDV)

- Sum-of-Years-Digits (SYD)

Also include:

- Depreciation rate (e.g., 33.33% for a 3-year life)

- Accumulated depreciation (total till date)

This helps calculate the depreciation expense per period and track how much value has already been expensed.

Current Value and Net Book Value

Show the current carrying value of each asset on your books:

Net Book Value = Purchase Cost − Accumulated Depreciation

For example, if a printer was purchased for $800 and has depreciated $480 to date, the net book value is $320. This is the value shown on your balance sheet.

Keep this updated to ensure accurate reporting and avoid overstated asset values.

Disposal Details (Date, Value, Reason)

When an asset is sold, scrapped, donated, or lost, record:

- Disposal date

- Disposal method (e.g., auction, recycle, theft)

- Sale proceeds or final value

- Any gain or loss from the transaction

For instance, a truck bought for $20,000 with $15,000 accumulated depreciation, sold for $6,000, results in a $1,000 gain.

Proper disposal tracking ensures your asset list reflects reality and keeps your financials clean.

Simplify GST and Tax Calculations

From depreciation entries to GST-ready invoices — handle your asset-related taxes with ease inside Kladana

How to Create a Fixed Assets Register in Excel

Creating a fixed asset register in Excel is fairly simple. We’ll walk you through step by step on how to do it.

Step 1: Plan and Gather Information

Before diving into Excel, identify all fixed assets your business owns. Things to do here:

- Compile a list including tangible items like computers, furniture, or vehicles.

- Gather supporting documents such as purchase invoices, receipts, and any existing records.

- Classify assets by type (e.g., office equipment, vehicles) or department for better organization.

- Decide on a depreciation method. Common options include straight-line (even allocation over time), declining balance (faster early depreciation), or units of production (based on usage).

This planning ensures accurate data entry later.

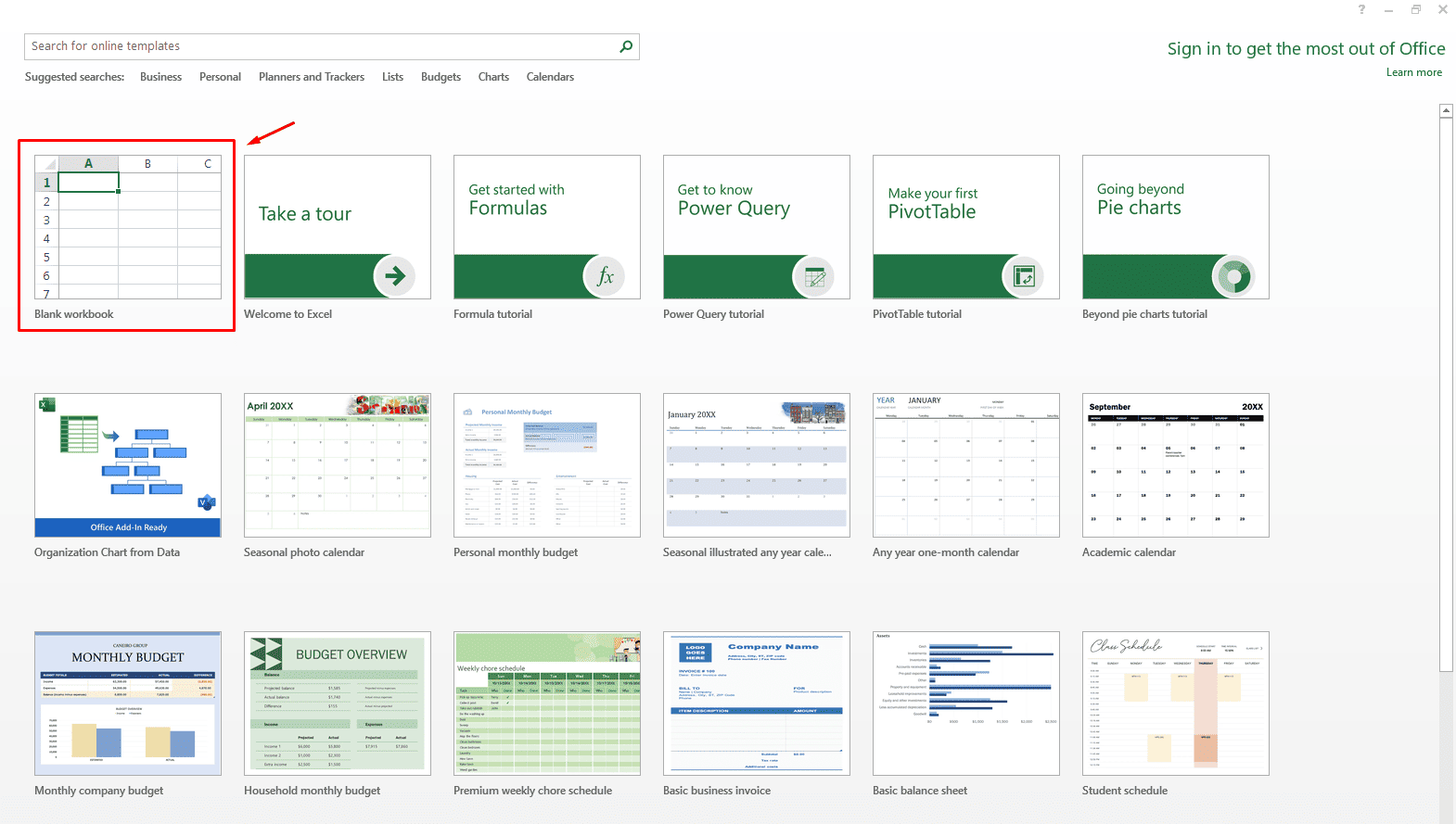

Step 2: Set Up Your Excel Workbook

Open Microsoft Excel and create a new blank workbook.

For a basic register, use a single sheet named “Fixed Assets Register.” If you need more complexity (e.g., separate transaction logs), add additional sheets like “Transactions” or “Summaries.”

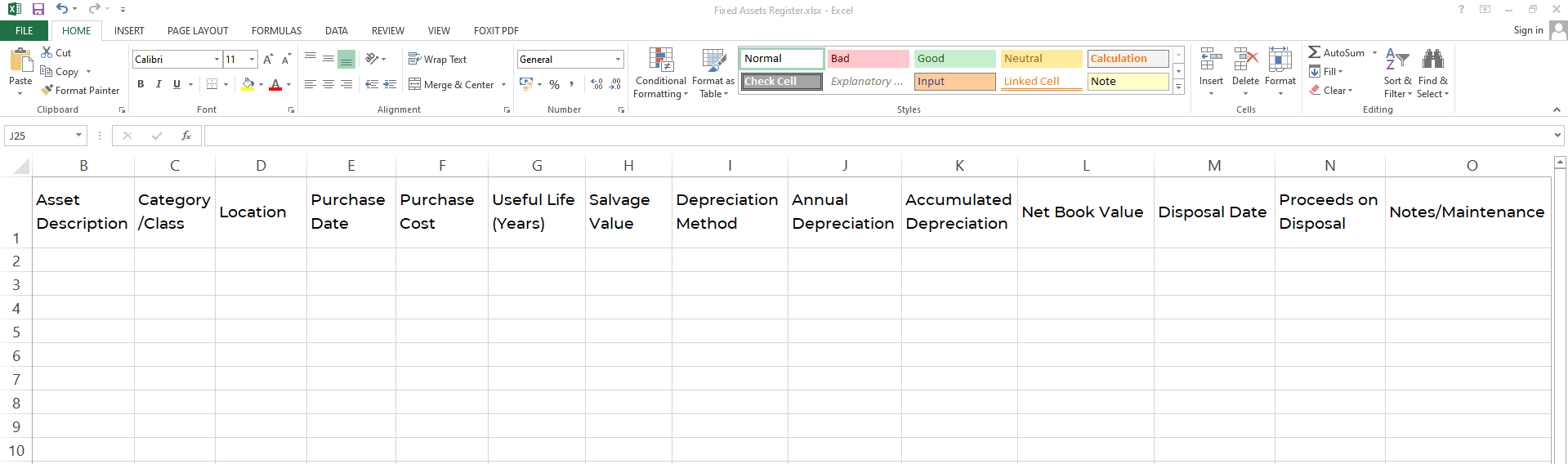

Step 3: Define and Label Columns

In the first row, create column headers to capture essential asset details. Use the following as a starting point — these can be expanded based on your needs (e.g., add columns for insurance or warranty info).

- Asset ID

- Asset Description

- Category/Class

- Location

- Purchase Date

- Purchase Cost

- Useful Life (Years)

- Salvage Value

- Depreciation Method

- Annual Depreciation

- Accumulated Depreciation

- Net Book Value

- Disposal Date

- Proceeds on Disposal

- Notes/Maintenance

Format the columns as below:

| Column Name | Formatting Tip |

| Asset ID | General; make it unique to avoid duplicates |

| Asset Description | Text |

| Category/Class | Text; use dropdown lists (Data Validation) for consistency |

| Location | Text |

| Purchase Date | Date format (MM/DD/YYYY) |

| Purchase Cost | Currency (USD, GBP, INR etc.) |

| Useful Life (Years) | Number |

| Salvage Value | Currency |

| Depreciation Method | Text; use dropdown for options. |

| Annual Depreciation | Currency; auto-calculate |

| Accumulated Depreciation | Currency |

| Net Book Value | Currency |

| Disposal Date | Date (leave blank if the asset is active) |

| Proceeds on Disposal | Currency (leave blank if the asset is active) |

| Notes/Maintenance | Text |

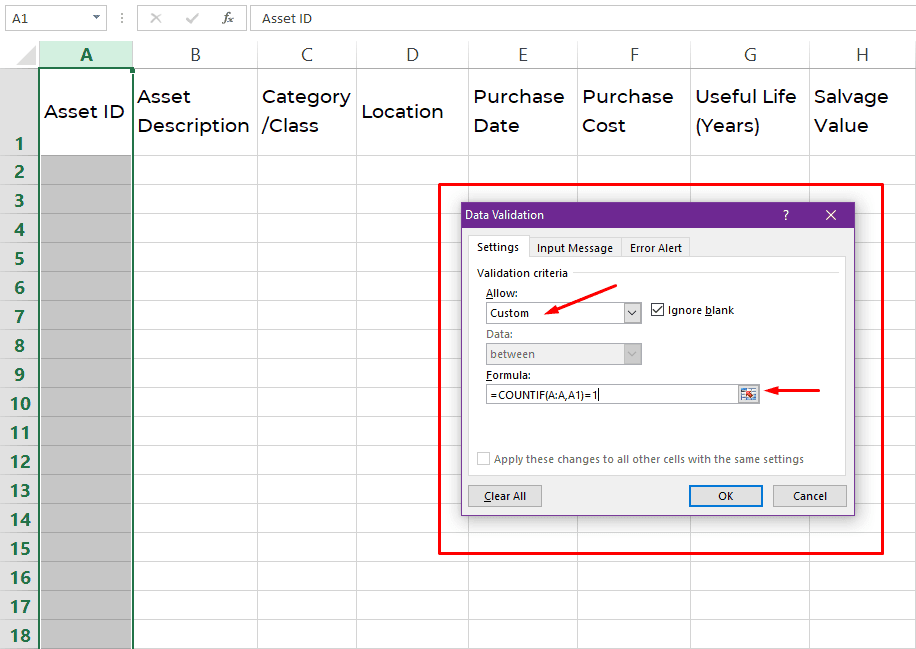

Step 4: Enter Asset Data

Start in row 2 and input data for each asset row by row.

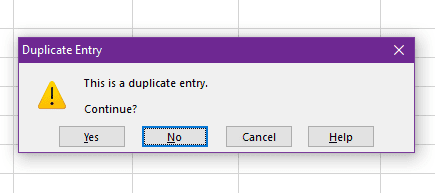

Assign a unique Asset ID to prevent duplicates. Use the Data Validation feature with a custom COUNTIF formula. Select the entire column, go to the Data tab → Data Validation, choose Custom from the “Allow” dropdown, and enter a formula =COUNTIF (A: A, A1)=1

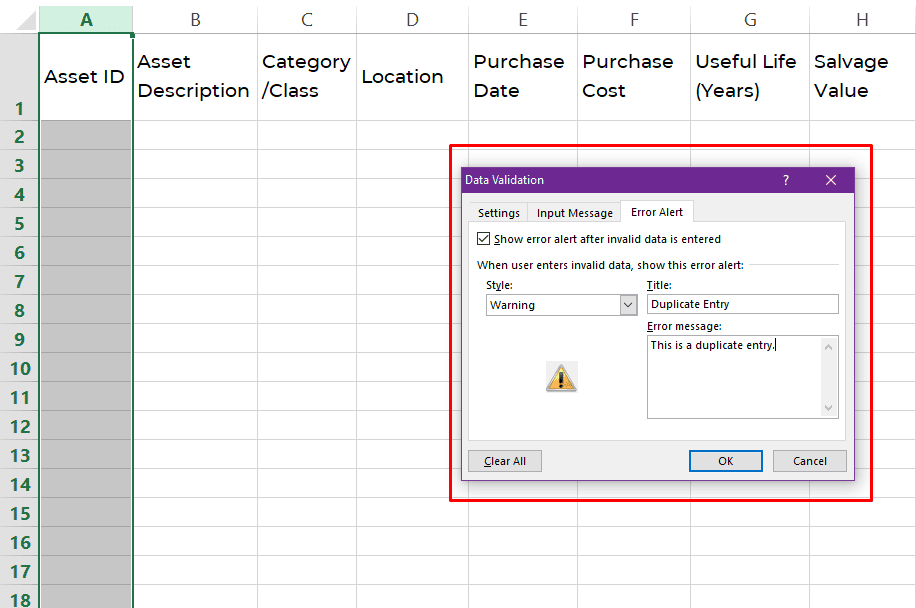

Next, configure the ‘Error Alert’ style and add a message.

So, if you enter a duplicate entry, it will display a warning message like this:

Enter static details like description, purchase date, and cost from your gathered documents.

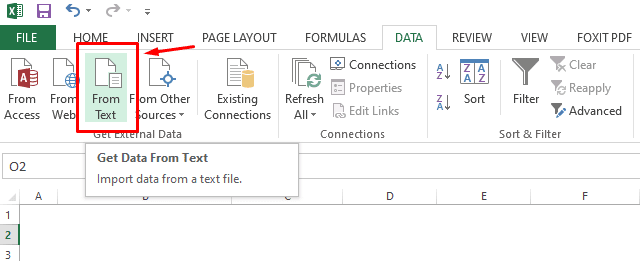

For consistency, use Excel’s Data Validation (Data → Data Validation) to create dropdowns for categories or depreciation methods.

If you have many assets, import data from another source via Copy-Paste or Data → From Text (it also allows importing of CSV).

Double-check for accuracy to avoid errors in calculations.

Best Practices for Managing Fixed Assets

The following best practices will help you maintain control over your asset records and avoid costly gaps in data:

Regular Updates and Audits

Update your asset register every time an asset is acquired, relocated, or disposed of. Waiting until year-end creates backlogs and errors.

- Record new purchases on the day they’re deployed

- Log disposals with date, method, and value

- Update depreciation monthly or quarterly

Run a full asset verification audit at least once a year. Physically verify each asset’s presence, condition, and location. Investigate missing assets or discrepancies to avoid “ghost assets.”

Assigning Asset Codes and Barcodes

Every asset should have a unique ID and visible physical tag. Use:

- Barcode or QR code labels

- Consistent naming conventions (e.g., IT-1001, VEH-2302)

- Digital scan tools for fast audits

For example, a barcode on a $1,400 projector lets your team scan and pull up its entire history during an audit or repair.

Barcoding reduces manual errors and improves traceability across departments.

Linking with ERP or Accounting Software

If you’re using accounting platforms like QuickBooks, Xero, or ERP systems like Kladana, NetSuite or SAP, link your asset register to them.

- Sync purchase data directly from procurement modules

- Automate depreciation entries into your books

- Maintain audit trails without duplicate data entry

For small businesses, Excel may be enough. But once you cross 100+ assets, integration becomes critical for scalability and accuracy.

Maintaining Backup Copies for Compliance

Always store backup copies of your asset register:

- Keep one offline (external drive or secure folder)

- Maintain version history (daily or weekly backups)

- Use cloud storage with access logs for traceability

In case of audit, data loss, or accidental changes, these backups serve as your fallback.

📘 Recommended Read: Accurate asset data is only part of the equation. To get a complete view of business performance, learn how to track operations effectively with a structured business operations report. It helps you connect financial insights from your asset register with day-to-day activities, making performance reviews and decision-making much faster.

FAQs on Fixed Assets Register

Below is a quick reference to common questions about fixed assets registers and depreciation.

Which Columns Are Mandatory In A Fixed Asset Register?

At a minimum include: Asset ID, Asset Name/Category, Acquisition Date, Cost, Depreciation Method, Accumulated Depreciation, Net Book Value, Location, Disposal Date and Disposal Value (if applicable).

How Do I Switch Depreciation Methods Mid‑Life? (Accounting Estimate Change)

You treat it as a change in accounting estimate rather than restating past periods. You recalculate depreciation going forward from the book value at the change date under the new method.

Straight‑Line vs Declining Balance vs SYD — When To Use Which?

Use straight‑line if the asset provides uniform utility over its life. Use declining balance when an asset loses value faster early on (e.g. tech equipment). Use SYD when you want an accelerated but smoother schedule between those extremes.

How Do I Calculate Monthly Depreciation In Excel? (SLN / VDB Examples)

Use =SLN (cost, salvage, life) for straight‑line. For accelerated or partial periods use =VDB (cost, salvage, life, start_period, end_period) which handles switching methods.

How Should I Handle Disposals (Gain/Loss) And Accumulated Depreciation?

When disposing, remove cost and accumulated depreciation from the register, and record gain or loss = proceeds minus net book value. Update the register immediately with disposal details.

What Is Component Depreciation And When Is It Required?

Component depreciation splits an asset into significant parts that have different useful lives (e.g. building roof vs structure). It is required under IFRS when parts have materially different depreciation patterns.

How Do I Record Revaluations or Impairments in the Register?

Record impairment as a write‑down reducing the carrying amount, with a corresponding expense. For revaluations, adjust the asset’s carrying value and reframe depreciation going forward; always include proper disclosures under IFRS.

How Often Do I Review Useful Life and Residual Value?

Review useful life and residual value at least annually (commonly at year‑end). Change them if new information suggests the previous estimates are no longer valid.

Can I Track Asset Locations / Custodians And Audits In The Same File?

Yes, by including columns for location, custodian, status, and last audit date. Use filters, data validation, and conditional formatting to flag discrepancies or assets due for audit.

How Do I Produce A Fixed Asset Schedule (Summary By Class / Period)?

Use pivot tables to summarize by asset category, location, or year. You can also group by acquisition or disposal year to generate a clean fixed asset schedule.