Filing GST returns is a mandatory part of running a registered business in India. Whether you’re a freelancer, a retail shop owner, or a growing startup, you need to report your sales, purchases, and tax payments to stay compliant.

A GST return summarizes all your outward and inward supplies, helping the government track tax liability and input tax credit. These returns are filed monthly, quarterly, or annually, depending on your business type and turnover.

This guide breaks down the essentials: what a GST return means, how to file GST return online, the types you may need to file, how the process works, and the key due dates to remember. We’ll also cover the benefits of timely filing, common mistakes to avoid, and how accounting tools can make the process faster and easier for small businesses. Since every business case is different, it’s always wise to check with your tax advisor or the official GST portal before filing. Let’s explore further.

- Understanding GST Returns

- Types of GST Returns

- GST Return Filing Process (Step by Step)

- Common Mistakes to Avoid in GST Returns

- Benefits of Accurate GST Return Filing

- How Technology Simplifies GST Return Filing

- How Kladana Integrates With Accounting Software and GST Portal

- Conclusion

- FAQ on GST Returns Filing in India

- List of Resources

Understanding GST Returns

Filing GST returns is a core compliance requirement for every GST-registered business in India. Before we get into the types, formats, and due dates, let’s start with the basics.

What is a GST Return?

A GST return is a summary report that every registered taxpayer must file with the Indian tax authorities. It contains details of:

- Sales (outward supplies)

- Purchases (inward supplies)

- Tax collected on sales (output GST)

- Tax paid on purchases (input GST or ITC)

The purpose is to calculate your net tax liability, which is the difference between output tax and eligible input tax credit. These returns are filed online through the GST portal using your GSTIN.

For example, if your business made sales worth ₹10,00,000 with ₹1,80,000 GST collected, and purchased inputs worth ₹5,00,000 with ₹90,000 GST paid, your payable GST would be ₹90,000 after adjusting ITC.

Purpose of Filing GST Returns

Filing GST returns serves both regulatory and operational purposes:

- Keeps your business compliant with Indian tax laws

- Ensures accurate tax payments to the government

- Enables you to claim input tax credit (ITC)

- Builds a transparent record of transactions for audits and funding

- Helps suppliers and vendors match invoices via auto-populated forms (like GSTR-2B)

In short, it’s not just a tax requirement; it’s an essential part of running a GST-compliant business.

Who Needs to File GST Returns?

GST return filing is mandatory for:

Regular taxpayers (turnover above ₹5 crore or not in QRMP scheme):

Must file GSTR-1 and GSTR-3B monthly, plus GSTR-9 annually. That’s 25 returns a year.

Small taxpayers (turnover up to ₹5 crore under QRMP scheme):

File GSTR-1 and GSTR-3B quarterly, pay tax monthly, and file GSTR-9 annually.

Composition scheme dealers:

File CMP-08 quarterly and GSTR-4 annually (total 5 returns per year).

Other special categories:

Such as Input Service Distributors (ISD), non-resident taxable persons, e-commerce operators, and TDS deductors, each with their own return types.

Each return type is tied to the nature of your business and your registration status under GST.

📘 Recommended Read: Filing GST returns starts with getting your invoicing right. If your invoices don’t meet GST rules, ITC claims can get blocked and returns become harder to reconcile. To save time and avoid compliance slips, explore these GST invoice templates with free editable formats and practical automation tips.

Types of GST Returns

Every GST return serves a different purpose and applies to different categories of taxpayers. Here are the five most important GST returns every small business should know about:

GSTR-1: Outward Supplies Return

GSTR-1 is used to report all sales (outward supplies) made during a tax period. It includes invoice-level details of goods and services sold, along with credit and debit notes issued.

Who files it: All regular and casual taxpayers registered under GST

Filing frequency:

- Monthly (by 11th): If annual turnover is over ₹5 crore or not opted into QRMP

- Quarterly (by the 13th of the month following the quarter): If under QRMP scheme

Why it matters: Details in GSTR-1 are used to auto-populate GSTR-2B for buyers. Accurate filing is critical for your customers to claim Input Tax Credit.

GSTR-2B: Input Tax Credit Statement (Auto-Generated)

GSTR-2B is a static, read-only report generated monthly to help taxpayers reconcile eligible Input Tax Credit (ITC).

Who uses it: All registered buyers

Released on: 14th of every month

Why it matters: Before filing GSTR-3B, use GSTR-2B to reconcile purchases and claim accurate ITC. It includes flagged invoices marked for reversal, ineligibility, or reverse charge.

Note: GSTR-2 (editable version) and GSTR-2A (dynamic version) are currently suspended or view-only.

GSTR-3B: Monthly Tax Summary & Payment Return

GSTR-3B is a summary return for declaring total taxable value, claiming ITC, and paying the net GST liability.

Who files it: All regular taxpayers

Filing frequency:

Monthly (by 20th): If turnover exceeds ₹5 crore

Quarterly (by 22nd or 24th): If under QRMP

- 22nd for ‘X’ states (e.g., Maharashtra, Karnataka, Gujarat)

- 24th for ‘Y’ states (e.g., Delhi, West Bengal, Bihar)

Why it matters: GSTR-3B is where the final tax is paid. Mismatches with GSTR-1 or GSTR-2B can lead to notices or ITC denial. You can’t edit or revise GSTR-3B once it is filed. Adjustment, if any, may be done while filing Form GSTR-3B for the subsequent period.

GSTR-4: Composition Scheme Return

GSTR-4 is filed annually by taxpayers who have opted into the Composition Scheme under Section 10 of the CGST Act.

Who files it: Composition dealers with turnover up to

- ₹1.5 crore (goods)

- ₹50 lakh (services)

Filing frequency:

- CMP-08 (quarterly payment): by 18th of the month following each quarter

- GSTR-4 (annual return): by 30th April of the next financial year

Why it matters: Composition dealers pay GST at a flat rate (e.g., 1% for traders) but cannot claim ITC.

GSTR-5: Return for Non-Resident Taxable Persons

GSTR-5 is filed by non-resident taxable persons (NRTPs) who conduct business in India but do not have a permanent business establishment here.

Who files it: Foreign businesses temporarily registered in India. For example, an overseas company selling goods at an Indian trade fair must file GSTR-5 for the duration of its operations.

What it covers:

- Details of outward and inward supplies

- Credit/debit notes

- Tax liability and payment

Filing frequency: Monthly

Due date: 20th of the following month

GSTR-5A: Return for OIDAR Service Providers

This return is for providers of Online Information and Database Access or Retrieval (OIDAR) services from outside India to unregistered individuals or consumers in India.

Who files it: Foreign service providers like streaming platforms or software companies

Filing frequency: Monthly

Due date: 20th of the following month

Why it matters: Even if the recipient is unregistered, GST must be collected and reported by the supplier.

GSTR-6: Return for Input Service Distributors (ISDs)

ISDs are entities that distribute input tax credit to their branches or units. GSTR-6 helps them record how much credit they received and how they distributed it.

Who files it: Head offices or centralized billing units

What it includes:

- Details of ITC received

- Credit distributed to respective GSTINs

- Supporting invoice references

Filing frequency: Monthly

Due date: 13th of the following month

Example: A corporate head office paying for pan-India advertising services can distribute ITC to regional branches via GSTR-6.

GSTR-7: Return for TDS Deductors

Some government departments and notified entities are required to deduct TDS under GST. GSTR-7 is used to report these deductions.

Who files it: TDS deductors under Section 51 of the CGST Act

Filing frequency: Monthly

Due date: 10th of the following month

What it includes:

- TDS deducted and paid

- TDS certificates issued (auto-populated for deductees)

Timely filing ensures deductees can claim TDS credits without delay.

GSTR-8: Return for E-Commerce Operators

E-commerce platforms that collect tax at source (TCS) on behalf of sellers use GSTR-8 to report collections and transactions.

Who files it: E-commerce operators like Amazon or Flipkart

Filing frequency: Monthly

Due date: 10th of the following month

What it includes:

- Supplies made through the platform

- TCS collected

- Supplier GSTINs

Why it matters: Helps match TCS claims by sellers on the platform.

GSTR-9: Annual Return

GSTR-9 consolidates all monthly or quarterly returns (GSTR-1 and GSTR-3B) filed during the year.

Who files it: Regular taxpayers with annual turnover over ₹2 crore

Due date: 31st December following the financial year

Exemptions: Not required for composition dealers, ISDs, NRTPs, and TDS/TCS deductors

Why it matters: Mandatory for audit and financial reconciliation. Taxpayers with turnover over ₹5 crore also need to file GSTR-9C, a self-certified reconciliation statement.

GSTR-10: Final Return

GSTR-10 is filed when a GST registration is cancelled or surrendered. It captures all liabilities up to the cancellation date.

Who files it: Any taxpayer whose registration is cancelled

Filing frequency: One-time

Due date: Within 3 months of cancellation or order date (whichever is earlier)

Purpose: Ensures that all tax dues are cleared before closing the GST account.

GSTR-11: Return for UIN Holders

This return is filed by entities with a Unique Identification Number (UIN), such as foreign embassies and UN bodies, to claim refunds on inward supplies.

Who files it: UIN holders who are not liable to pay GST but want a refund on GST paid

What it includes:

- Inward supplies received

- Details of purchases with tax paid

- Refund claim request

Filing frequency: Monthly

Due date: 28th of the month following the tax period (or as notified)

| Return Type | Purpose | Who Files | Frequency | Due Date |

| GSTR‑1 | Report outward supplies | Regular taxpayers | Monthly/Quarterly | 11th or 13th |

| GSTR‑2B | Auto ITC statement | All taxpayers | Monthly | 14th |

| GSTR‑3B | Tax summary and payment | Regular taxpayers | Monthly/Quarterly | 20th, 22nd, or 24th |

| GSTR‑4 | Annual return for composition dealers | Composition taxpayers | Annually | 30th April |

| CMP‑08 | Tax payment for composition dealers | Composition taxpayers | Quarterly | 18th of next month |

| GSTR‑5 | Return for non-resident taxpayers | Non-resident businesses | Monthly | 20th |

| GSTR‑5A | Return for OIDAR services | OIDAR providers | Monthly | 20th |

| GSTR‑6 | Return for ISDs | Input Service Distributors | Monthly | 13th |

| GSTR‑7 | TDS return | Entities deducting TDS | Monthly | 10th |

| GSTR‑8 | TCS return | E-commerce operators | Monthly | 10th |

| GSTR‑9 | Annual consolidated return | Regular taxpayers | Annually | 31st December |

| GSTR‑9C | Reconciliation statement | Taxpayers over ₹5 crore turnover | Annually | 31st December |

| GSTR‑10 | Final return after cancellation | Cancelled registrants | Once | Within 3 months of cancellation |

| GSTR‑11 | UIN return for refund claims | UIN holders (e.g., embassies) | Monthly | 28th (or notified date) |

GST Return Filing Process (Step by Step)

You can file GST returns via the GST portal. It is designed to guide you through the entire process — from uploading invoices to submitting returns and making tax payments. We’ll walk you through how to file GSTR-1 and GSTR-3B along with the tax payment.

Step 1: Collect Invoices and Records of Sales or Purchases

Before logging in to the portal, gather all relevant documents:

- Sales invoices with GST breakup

- Purchase bills from registered vendors

- Debit and credit notes issued or received

- Delivery challans or e-way bills (if applicable)

Each invoice should include:

- GSTIN of supplier and recipient

- Invoice number and date

- HSN/SAC code

- Taxable value and GST rate

Tip: Use accounting software that auto-generates GST-compliant invoices and tracks them by tax period.

Step 2: Filing GSTR-1

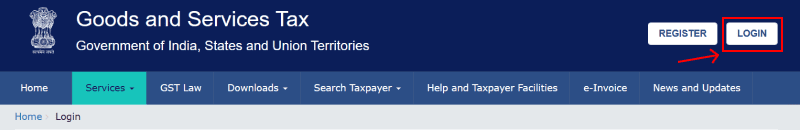

1. Go to www.gst.gov.in

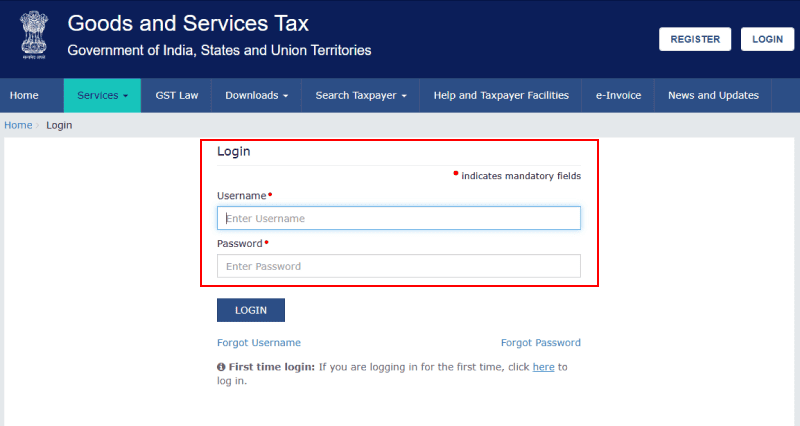

2. Select the option: ‘Login’

3. Enter your username, and password

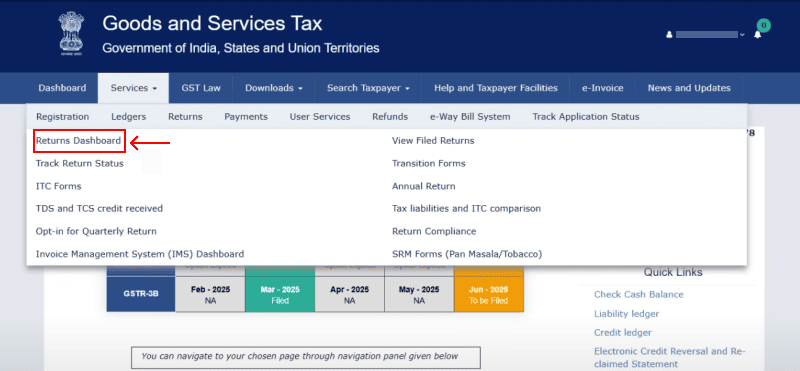

4. Navigate to Services → Returns → Returns Dashboard

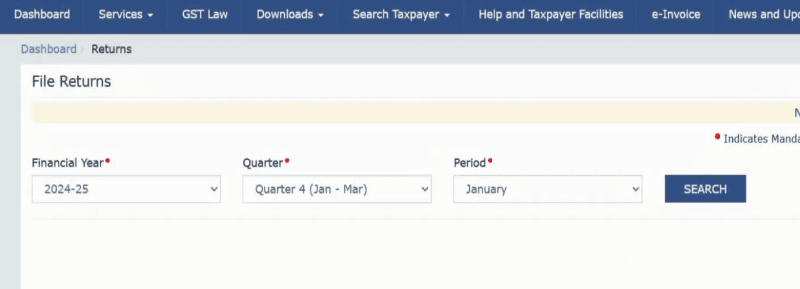

5. Select the relevant Financial Year, Quarter and Return Filing Period. Then click ‘Search’.

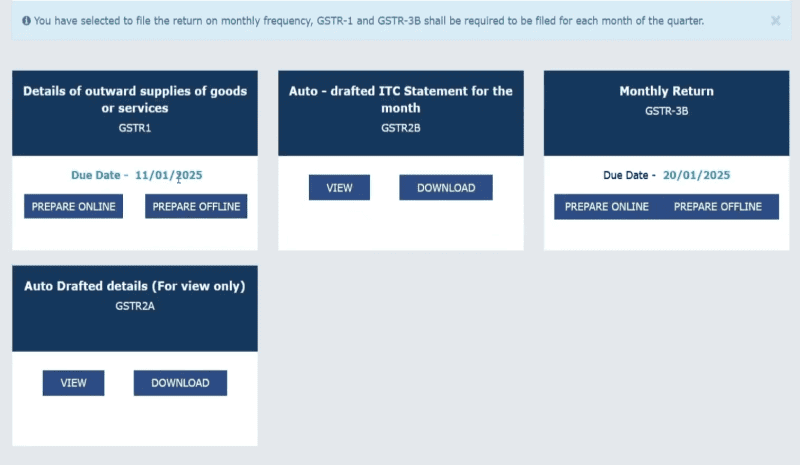

6. You’ll now see the forms applicable to your GST category (GSTR-1, GSTR-3B, etc.)

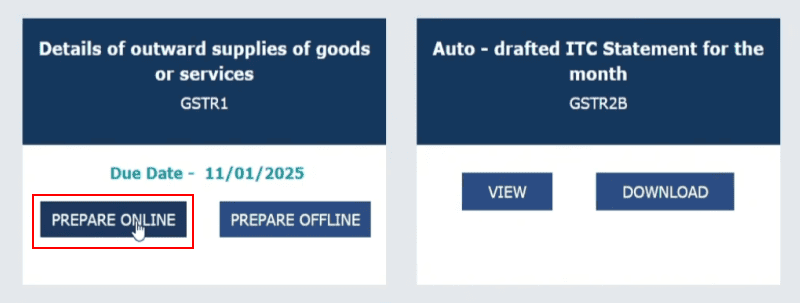

7. Now since we are exploring the process of filing GSTR-1, we will navigate to GSTR-1 and click on ‘Prepare Online’

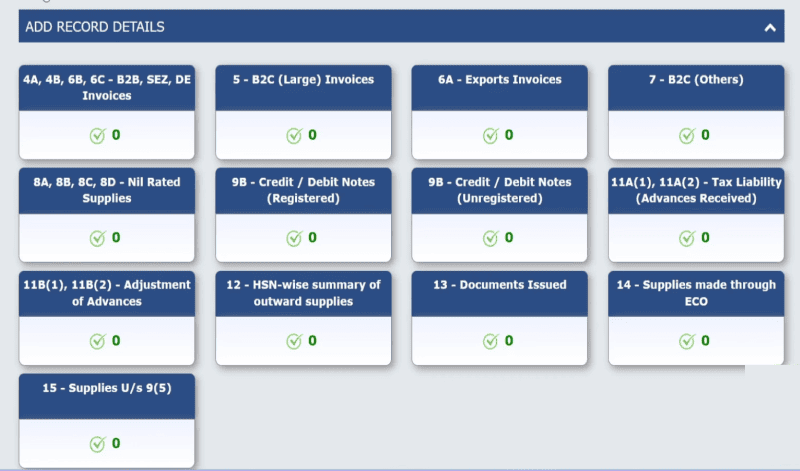

8. It will open up a page where there are multiple categories of invoices that you can register.

You can choose a relevant category as per the type of sale or record you want to add.

The details of your sales can be either entered manually if you have couple of invoices for the month, or you can use an accounting software or even upload an excel file to direct add details of sales invoices in bulk.

In case you have any questions or doubts about GST rules, process or compliances, you can browse to the FAQs page of the GST council website.

9. If you want to add other details like credit/debit notes, or make any adujstments/amendments, you can add those records.

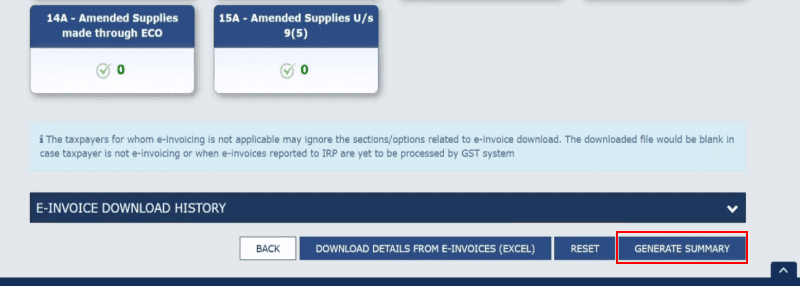

10. Once you have entered everything, navigate to the bottom of the page and click on ‘Generate Summary’

11. After clicking on ‘Generate Summary’ the option will change to ‘Proceed to File/Summary’. Click on it.

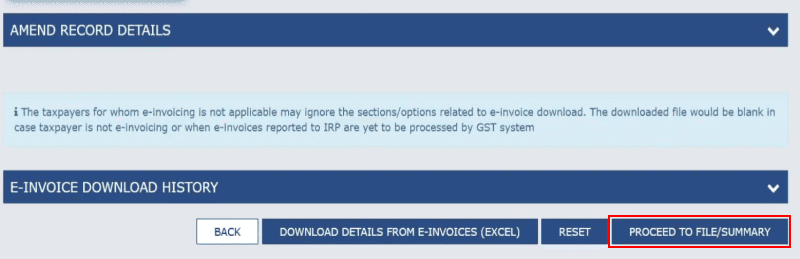

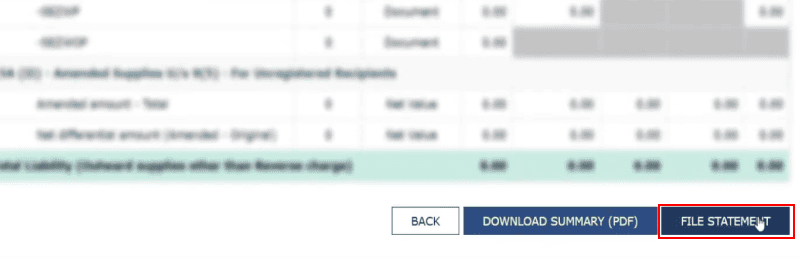

12. It will display the summary of all the records that you have entered previously. You can now proceed to ‘File Statement’

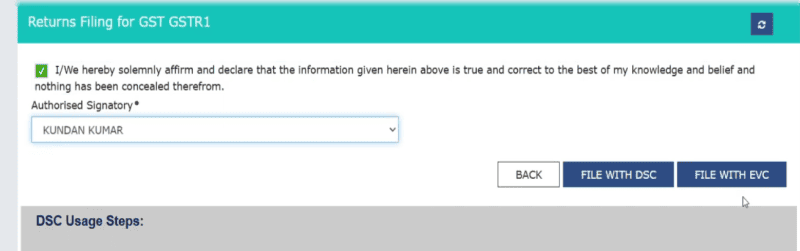

13. It will ask to sign the declaration cum acknowledgement, and there you can choose the authorized signatory from the drop-down. Once you do that, there are two options to verify:

- File with DSC (Digital Signature Certificate)

- File with EVC (Electronic Verification Code)

You can choose either of these, but usually, EVC is much better and faster option. We will go with that. So, click on ‘File with EVC’

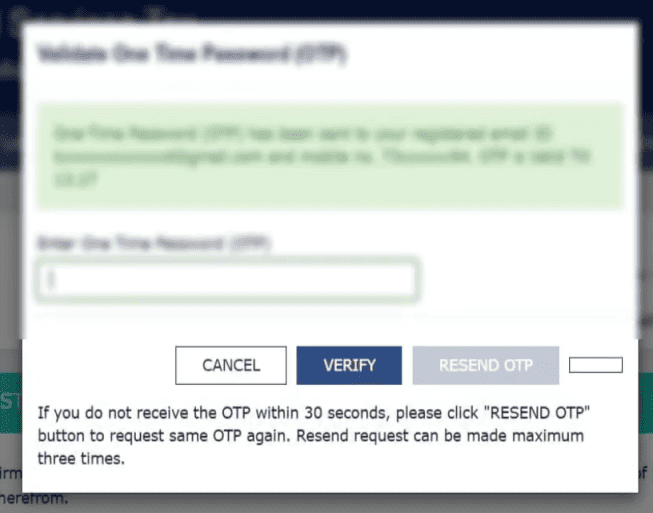

14. It will ask you to enter the OTP received on your registered mobile number.

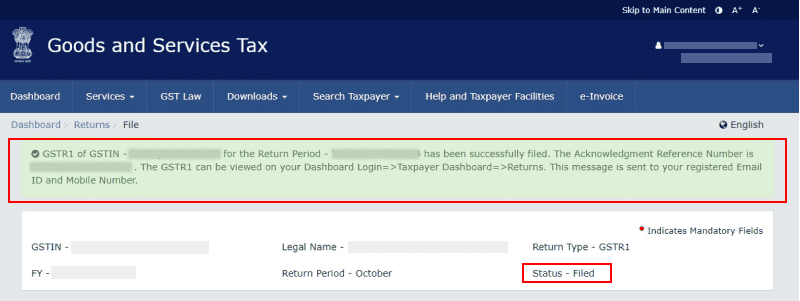

15. Once the OTP is verified, a success message will be displayed above that your GSTR-1 has been filed.

Step 2: Filing GSTR-3B

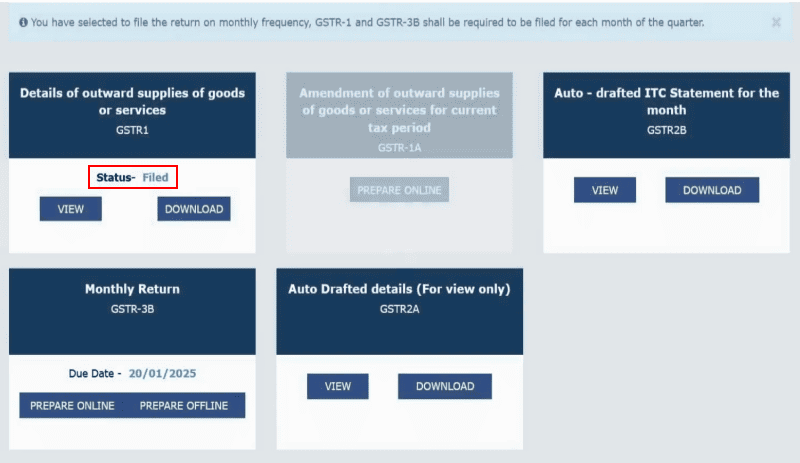

To file GSTR-3B, you have to again navigate to the returns dashboard, where you will see the available GSTR options as per the registered category of your business.

Since we have now filed GSTR-1, the status will show as ‘Filed’ under GSTR-1 option.

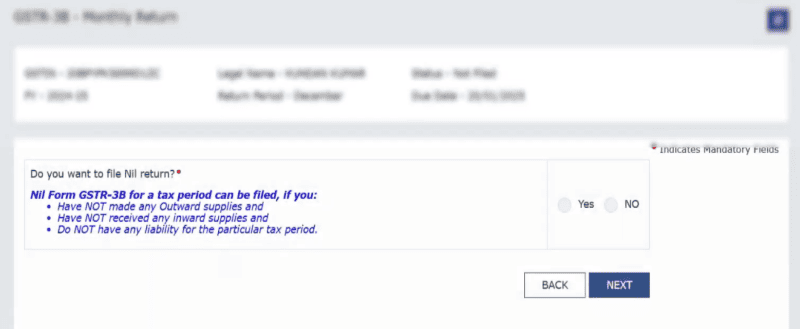

1. We will now proceed to file GSTR-3B, so select ‘Prepare Online’ option under Monthly Return GSTR-3B.

It will ask you whether you want to file NIL return or not.

NIL return can only be filed if you haven’t made any sales or purchase in particular month, or if you don’t have any tax liability for the particular period.

2. For this process, we will choose ‘No’ since we added data of sales in GSTR-1, and click on ‘Next’.

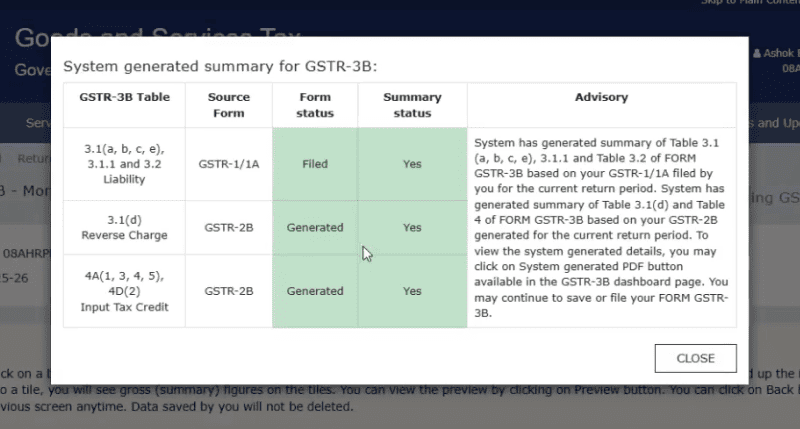

3. A pop-up will appear displaying a system generated summary for GSTR-3B. Click on ‘Close’

An important thing to note is that you can only file GSTR-3B if GSTR-2B is generated.

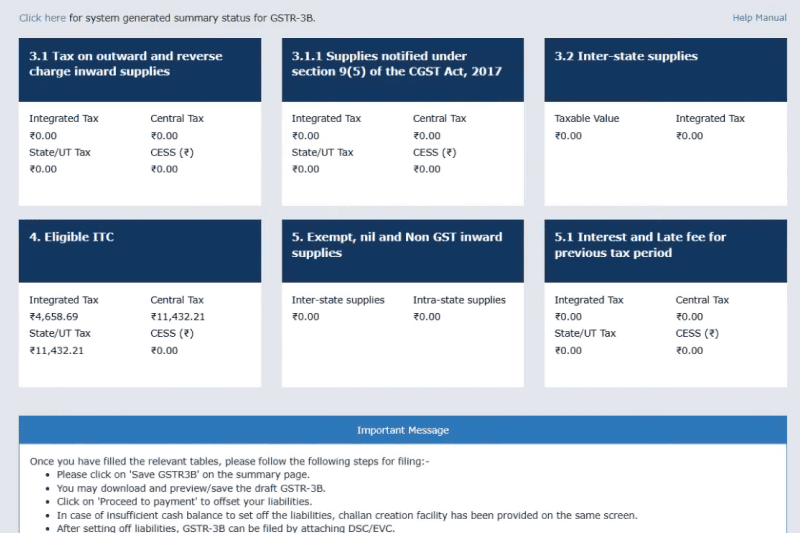

4. In GSTR-3B, the data gets auto-populated from the GSTR-1 and 2B.

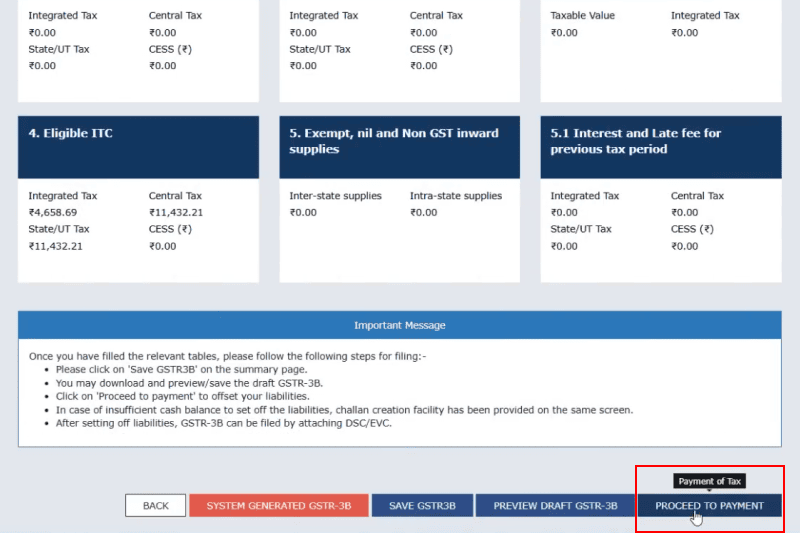

5. Double-check if all the amounts are correct in each of the respective fields i.e. 3.1, 3.1.1, 3.2, 4, 5 and 5.1

6. If everything is locked in, you can navigate to the bottom to make the payment. Click on ‘Proceed to Payment’ option.

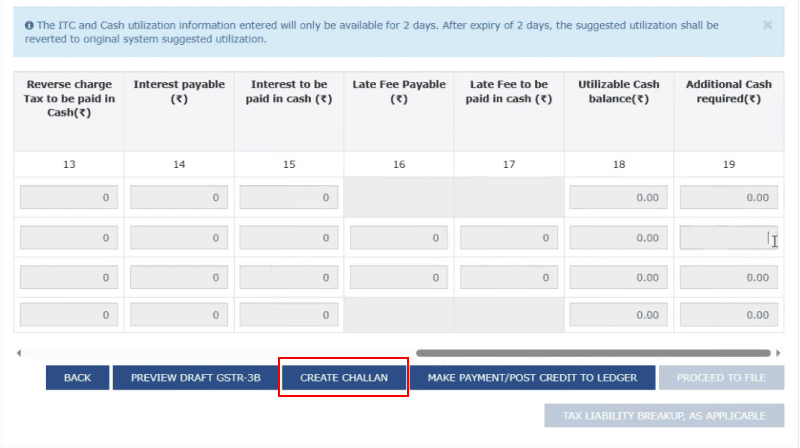

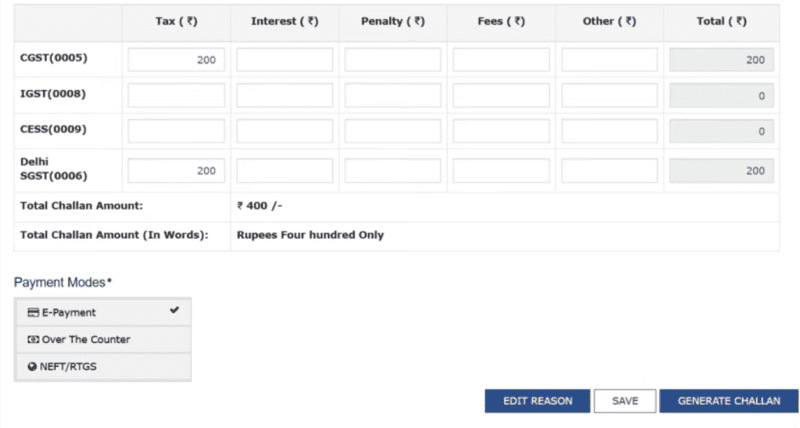

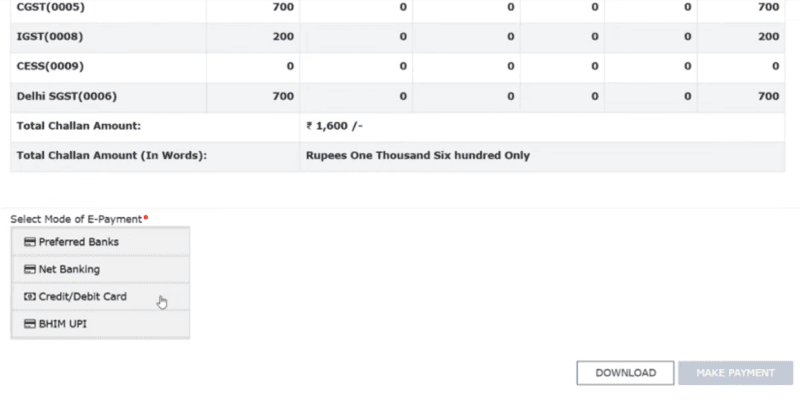

7. To make the payment, you have to click on ‘Create Challan’ option.

8. Choose the ‘Payment Mode.’ There are primarily three methods to pay GST:

- E-Payment

- Over the Counter

- Net Banking

E-Payment includes following options:

- Preferred Banks

- Net Banking

- Credit/Debit Card

- BHIM UPI

Net Banking: Most banks offer net banking services to facilitate GST payment. IMPS/ NEFT/ RTGS can be used through your bank to make the online payment.

Over the Counter (OTC): Payment can be made from authorized banks by visiting a branch and providing the generated challan along with cash, valid cheque, or demand draft.

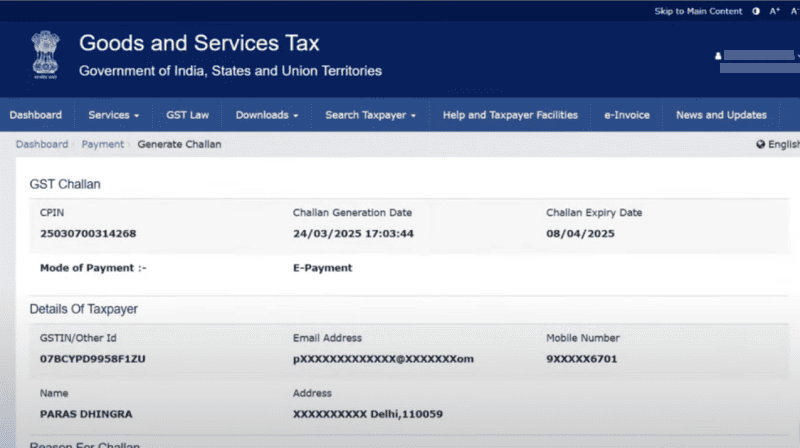

9. Finalize the transaction and save the Challan Reference Number (CRN) for your records.

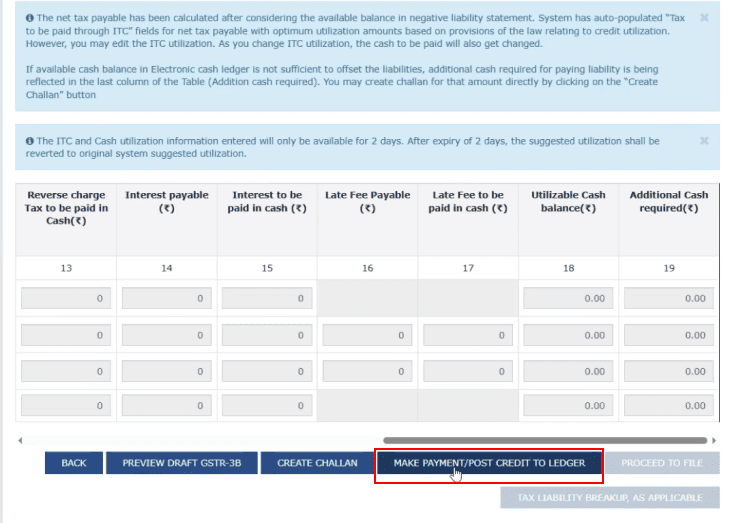

10. After making the payment, you have to select this option: ‘Make Payment/Post Credit to Ledger’

This ensures that the input tax credit has been set off against your tax liability and saved for future filings.

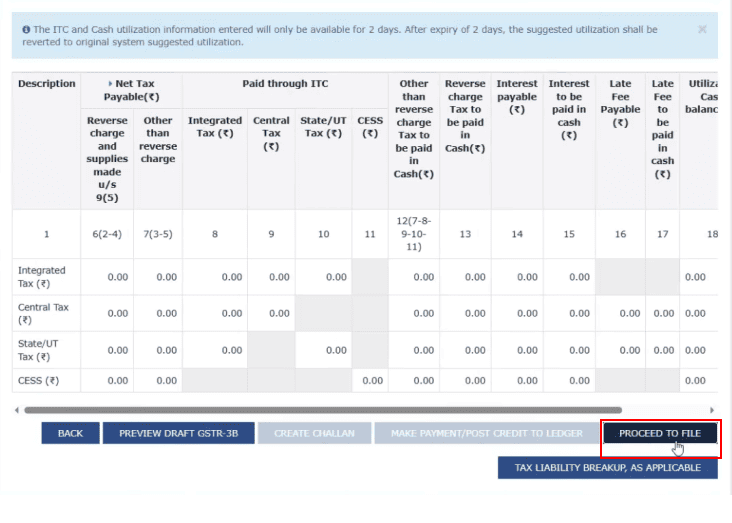

11. Once you do that, you can proceed to file GSTR-3B. Click on the said option.

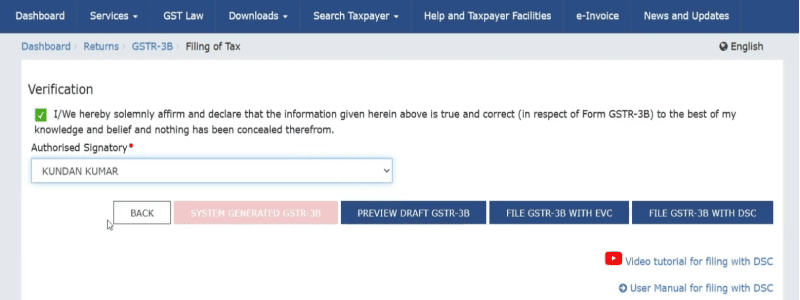

12. Now, it will ask for verification; you have to select the checkbox, authorized signatory and mode to authorize (DSC or EVC).

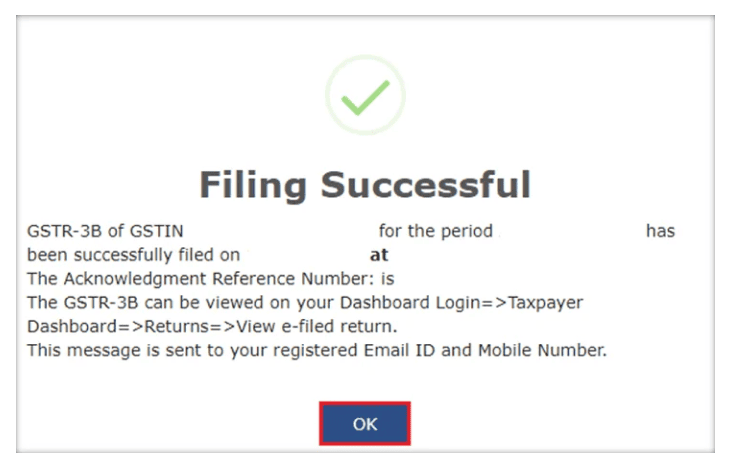

13. After verification is successful, your GSTR-3B will be filed.

Common Mistakes to Avoid in GST Returns

Filing GST returns is an act of compliance with the Indian law, and even a small mismatch or oversight can lead to penalties, interest, and compliance issues. Below are some of the most frequent GST return filing mistakes and how to prevent them.

Mismatch Between GSTR-1 and GSTR-3B

Your GSTR-1 contains invoice-level sales data, while GSTR-3B is a summary return used to declare outward supplies and pay taxes.

Common mistake: Taxpayers report a higher taxable value in GSTR-1 than in GSTR-3B, or vice versa. Since GSTR-3B is where tax is paid, any mismatch can trigger scrutiny.

Fix: Cross-verify total outward supply values between GSTR-1 and GSTR-3B every month. Many accounting tools now flag these mismatches before submission.

Not Reconciling ITC with GSTR-2B

Claiming excess Input Tax Credit (ITC) based on internal records without matching them with GSTR-2B can result in ITC rejection.

Best practice: Always reconcile books of accounts with GSTR-2B (released by the 14th of each month). Claim only the ITC that reflects as “eligible” in GSTR-2B.

Example: If your GSTR-2B shows eligible ITC of ₹90,000 but you claim ₹1,00,000 in GSTR-3B, the excess ₹10,000 becomes recoverable with 18% interest.

Late Filing Leading to Penalties and Interest

Missing due dates for GSTR-1 or GSTR-3B attracts:

Late fees: ₹50 per day (₹25 CGST + ₹25 SGST)

Nil returns: ₹20 per day (₹10 CGST + ₹10 SGST)

Interest: 18% annually on tax dues

Tip: File a NIL return even if you had no transactions. Skipping it can block future filings.

Uploading Incomplete or Incorrect Invoices

Mistakes in invoice details, such as incorrect GSTIN, missing HSN codes, or duplicate invoice numbers, can cause data mismatches, ITC denial, or delays in processing.

Checklist for every invoice:

- GSTIN of buyer and seller

- HSN/SAC code

- Taxable value and GST breakup

- Invoice number and date

- Place of supply (especially for interstate transactions)

Use a GST-compliant billing system to auto-populate these fields correctly.

Ignoring Reverse Charge Mechanism (RCM)

Reverse charge applies to specific services and notified goods, where the buyer pays the GST instead of the supplier.

Common errors:

- Failing to pay tax under RCM

- Claiming ITC on RCM without actual cash payment

- Reporting RCM invoices under normal tax category

Fix: Maintain a list of RCM-applicable transactions and report them under the correct section in GSTR-3B.

Not Reversing Ineligible or Blocked ITC

ITC must be reversed in situations like:

- Non-payment to vendors within 180 days

- Inputs used for personal consumption

- Free samples or destroyed goods

- ITC on ineligible expenses (e.g., club memberships, employee meals)

Solution: Keep a monthly record of potential reversals and block ineligible credits before GSTR-3B filing.

Missing Return Amendments or Delayed Corrections

GST returns cannot be revised once filed. However, amendments for previous periods can be made in future returns.

Mistake: Delaying the correction of invoice-level errors leads to cumulative mismatches and longer audit trails.

Fix: Track unreported or misreported invoices. Use credit/debit notes instead of modifying the original invoice unless legally required.

Other Critical Mistakes to Watch For

- Incorrect GSTIN entries (even one digit off causes rejections)

- Duplicated invoice numbers

- Wrong HSN codes leading to classification disputes

Use audit trails, auto-validation tools, and proper naming conventions in your invoicing system (e.g., INV001/2025-26).

📘 Recommended Read: Filing errors often stem from poor expense classification. Learn how classifying direct and indirect expenses affects costing, tax treatment, and financial reporting, with examples across industries.

Benefits of Accurate GST Return Filing

Timely and accurate GST return filing isn’t just about staying compliant. It creates long-term value for your business across operations, finance, and reputation.

Compliance With GST Laws

Regular filings keep your GSTIN active and your compliance rating healthy. This helps avoid audits, registration suspension, or unnecessary legal hassles.

Smooth Claim of Input Tax Credit (ITC)

Only businesses that file correctly and match purchases with GSTR-2B can claim eligible ITC. This improves working capital by offsetting taxes paid on inputs.

Avoid Penalties and Notices

Missing deadlines or filing incorrect returns can lead to late fees, 18% annual interest on dues, or notices from the tax department.

Build Credibility With Suppliers and Tax Authorities

Vendors prefer dealing with compliant businesses. A clean filing track record also improves your trustworthiness with banks, NBFCs, and regulatory bodies.

Filing on time helps you stay audit-ready and gives your business the financial edge it needs to grow confidently.

How Technology Simplifies GST Return Filing

Manual GST compliance can be time-consuming and error-prone. Technology bridges this gap by automating calculations, reconciling data, and ensuring timely submissions. For small businesses, this can mean fewer compliance headaches and more focus on growth.

Role of Accounting Software and ERP Systems

Modern accounting tools like TallyPrime, Zoho Books, QuickBooks, Xero, FreshBooks, and others make GST return filing easier by generating GST-compliant invoices, calculating tax automatically, and preparing data in the correct return format.

ERP systems like Kladana further streamline operations by handling GST within daily workflows such as sales invoices, quotations, and purchase orders. While Kladana doesn’t replace full-fledged accounting software, it ensures accurate GST calculation in supported transactions and printed forms, reducing manual effort.

Auto-Reconciliation of Invoices

Reconciliation is often the toughest part of GST filing. Tools integrated with the GST portal can auto-match purchase data with GSTR-2B, flagging mismatches in real time. This helps businesses claim only eligible ITC and prevents notices later.

Example: A trader using Zoho Books linked with the GST portal can instantly identify supplier invoices missing from GSTR-2B before filing GSTR-3B.

📘 Recommended Read: Accurate reconciliation doesn’t just impact GST returns; it also determines how quickly your business turns invoices into cash. Learn how the accounts receivable process works, why revenue often gets stuck in AR, and practical ways to fix cash flow delays.

Automated Reminders for Due Dates

Missing deadlines attracts late fees and 18% annual interest on dues. Most accounting platforms now send automated alerts for return filing dates and payment schedules.

Kladana can complement this by providing timely invoice-level accuracy, ensuring that returns are ready for submission when the reminder comes.

Integration With GST Portal

API-based integration allows data to flow directly from ERP or accounting software into the GST portal. This eliminates manual uploads, reduces human error, and accelerates filing.

How Kladana Integrates With Accounting Software and GST Portal

Kladana ERP plays a key role in preparing GST-ready data within day-to-day operations. Here’s how the integration flow works in practice:

Sales Invoice in Kladana

A sales invoice or quotation is generated in Kladana.

- GST is calculated automatically based on company and counterparty GSTIN, HSN/SAC codes, and applicable rates.

- The invoice can be printed in GST-compliant formats such as Tax Invoice or Sales Invoice.

Export to Accounting Software

- The invoice data is exported from Kladana into accounting software like TallyPrime, Zoho Books, QuickBooks, or Xero.

- These systems are built to handle the complete GST workflow, including credit notes, debit notes, challans, and reconciliations.

- This ensures that all invoices recorded in Kladana are captured in the books of accounts.

Sync With GST Portal

- The accounting software then connects with the GST portal through API integration.

- GSTR-1 is auto-populated with outward supply data, and GSTR-3B is prepared with summarized liability and ITC adjustments.

- Businesses can review, reconcile, and file directly without re-entering data manually.

Try Kladana accounting integrations to keep your money flows and books synchronized and control your finances in real-time mode.

Conclusion

GST return filing is not just a statutory requirement, it is central to keeping your business financially healthy and compliant. Filing the right returns on time ensures access to eligible Input Tax Credit, protects yourself from late fees and notices, and maintains credibility with suppliers, lenders, and tax authorities.

Small businesses, freelancers, and growing enterprises alike can benefit from building a disciplined GST filing routine, since accuracy directly affects cash flow and compliance ratings.

With tools like accounting software and ERP systems working alongside platforms such as Kladana, it is easier to automate calculations, reconcile data, and stay on top of deadlines. Adopting digital workflows means fewer errors, faster filing, and more time to focus on business growth instead of compliance stress.

FAQ on GST Returns Filing in India

Here are answers to some of the most common questions about GST return filing.

What is a GST return?

A GST return is a document that records your sales, purchases, and taxes collected and paid for a given period. It helps the government calculate your net GST liability after adjusting Input Tax Credit.

Who needs to file GSTR-1 vs GSTR-3B?

GSTR-1 is for reporting detailed sales invoices, while GSTR-3B is a monthly or quarterly summary return used to pay taxes. All regular taxpayers must file both.

What is the due date for GSTR-3B?

The due date is the 20th of the following month for taxpayers with turnover above ₹5 crore. For QRMP taxpayers, it is the 22nd or 24th of the month after the quarter, depending on the state.

Can I edit GSTR-3B after submission?

No, once submitted, GSTR-3B cannot be revised. Any errors must be adjusted in the next return period using credit or debit entries.

What happens if I miss filing a return?

You will incur late fees, interest at 18% on unpaid tax, and possible notices from the GST department. Filing must be completed before subsequent returns can be submitted.

How far back can I file missed GST returns?

You can file past-due returns as long as they are within three years of the original due date. After that, the GST portal does not allow filing. Interest and late fees apply for any delayed returns filed within this period.

What is GSTR-4 and who is eligible?

GSTR-4 is an annual return filed by composition scheme taxpayers. Businesses with turnover up to ₹1.5 crore in goods or ₹50 lakh in services can opt for this scheme.

How does QRMP scheme affect filing frequency?

Under QRMP, businesses with turnover up to ₹5 crore file GSTR-1 and GSTR-3B quarterly, but tax payments must still be made monthly through Form PMT-06.

How to correct mistakes in GSTR-1?

Errors can be corrected in the next filing period by amending invoice details. Always cross-check with GSTR-3B to ensure consistency.

What is the impact of GSTR-2B for ITC claims?

GSTR-2B provides a monthly snapshot of eligible Input Tax Credit. Claiming ITC exactly as reflected in 2B helps avoid rejection, interest, or future notices.

List of Resources

- Official GST website — GST portal

- Official GST Council website — All FAQs on GST

- Central Board of Indirect Taxes and Customs — GST Rates

- Tax Information Portal by CBIC — All latest GST notifcations

Read‑alikes

How to Fill The E-Way Bill Format? Guide + Editable Templates in Excel, PDF & Word

Proforma Invoice Format in Excel: Free Templates and How to Create One

How to Create a Delivery Challan Format in Excel with Free Templates and GST Guide

How to Grow Business in India: a Step-by-Step Guide

Small Business Management: Strategies, Tools, and Actionable Tips