You can run a warehouse in Dubai, sell online across the UAE, and still lose money on “invisible” problems: items that show in stock but can’t be found, urgent purchases because reorder points were missed, and hours spent matching Excel sheets with POS and accounting reports.

UAE inventory management software solves this by keeping one live stock record across warehouses, stores, and sales channels. It also helps you reorder on time, reduce picking mistakes with barcodes, and get reports your finance team can trust. This guide breaks down the UAE market, the features that matter most, and a simple roadmap to shortlist vendors and roll out the system without chaos.

- What Is Inventory Management Software?

- UAE Market Landscape & Growth

- Key Selection Criteria for UAE Inventory Software

- Leading Inventory Software & Vendors in UAE

- Implementation Best Practices & Pitfalls

- UAE Use Cases

- ROI & Business Justification in UAE

- Future Trends in Inventory Software (for UAE)

- Next Steps & Buyer Roadmap

- Frequently Asked Questions on the UAE Inventory Management Software

What Is Inventory Management Software?

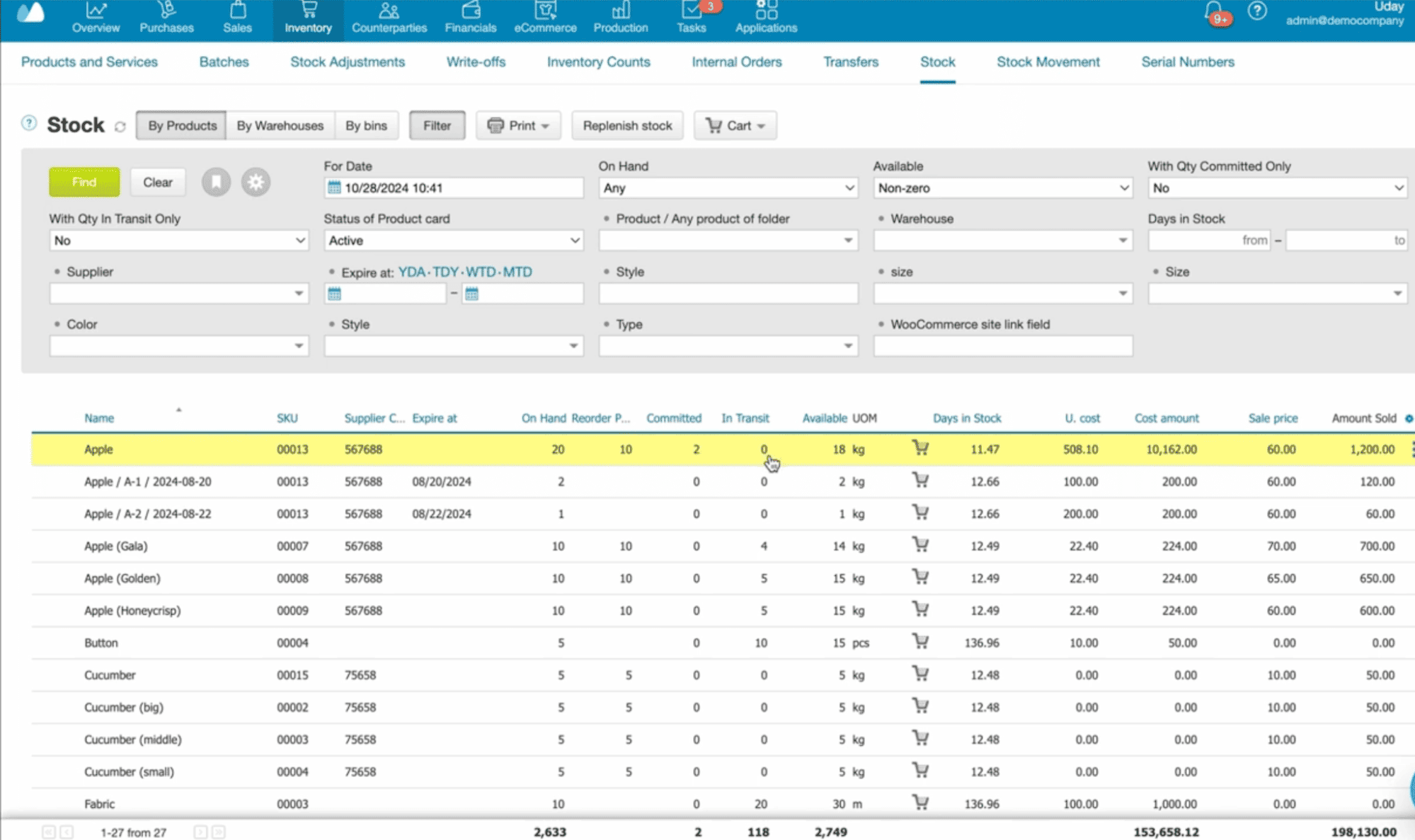

Inventory management software is a system that records every stock movement and keeps your on-hand quantities accurate. It replaces numerous scattered spreadsheets and manual updates with one source of truth.

For most UAE SMEs, the goal is simple:

- See exact stock by item, batch, serial number, and location

- Know what to reorder and when

- Prevent stockouts and overstock

- Keep inventory data aligned with sales and accounting tools

Core functions & modules

A reliable inventory management software UAE buyers look for usually includes these modules:

1) Real-time stock tracking (perpetual inventory)

The system updates quantities as soon as you sell, receive, or adjust stock. QuickBooks describes this as auto-updating inventory as items move in and out, so you can see what’s selling and what to reorder.

2) Purchase and reorder control

- Reorder points and low-stock alerts

- Suggested purchase quantities (based on min/max rules or past demand)

- Supplier lead times (basic level)

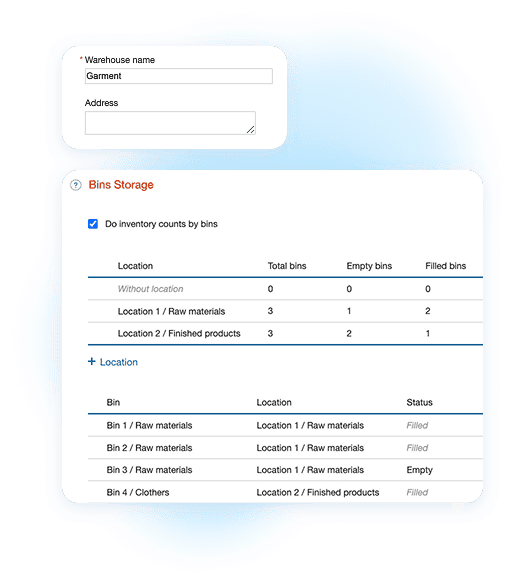

3) Multi-location and multi-warehouse stock

If you store goods in more than one place (store + warehouse, or Dubai + Abu Dhabi), you need stock by location, transfers, and location-based picking.

4) Barcode scanning (and optional RFID)

Barcode workflows reduce picking and receiving errors. Scanning also speeds up stock counts.

5) Batch/lot and serial number tracking (when needed)

Useful for expiry dates, warranties, regulated goods, and returns. This matters for many import-heavy categories.

6) Reporting, analytics, and dashboards

At minimum:

- Stock on hand and stock value

- Fast/slow movers

- Stock aging

- Stockout history and reorder performance

7) Integrations (ERP/accounting, POS, e-commerce)

For UAE businesses selling across channels, you’ll want inventory to sync with POS and online stores so you keep stock visibility across channels and avoid overselling.

Cloud vs on-premise vs hybrid

Cloud inventory system UAE (most common for SMEs)

- You access it in a browser or mobile app

- Faster setup

- Easier remote access across emirates

- Updates handled by the vendor

On-premise

- Installed on your own servers

- More control over hosting and data location

- Higher IT responsibility (maintenance, backups, upgrades)

Hybrid

- Part cloud, part local setup

- Useful when you have legacy systems or special constraints

For most UAE SMEs, the deciding factors are:

- Internet reliability at the warehouse

- Integration needs (POS, e-commerce, accounting)

- Internal IT capacity

- Data access rules and customer requirements

💡 Tip: If your warehouse has weak connectivity, prioritize offline-friendly mobile scanning or a stable local picking flow that syncs once the connection returns.

UAE Market Landscape & Growth

The UAE is a high-volume trading and logistics hub. Many SMEs run multi-location operations across emirates. They also sell through stores, marketplaces, and their own sites. This mix creates one clear need: accurate, shared stock data.

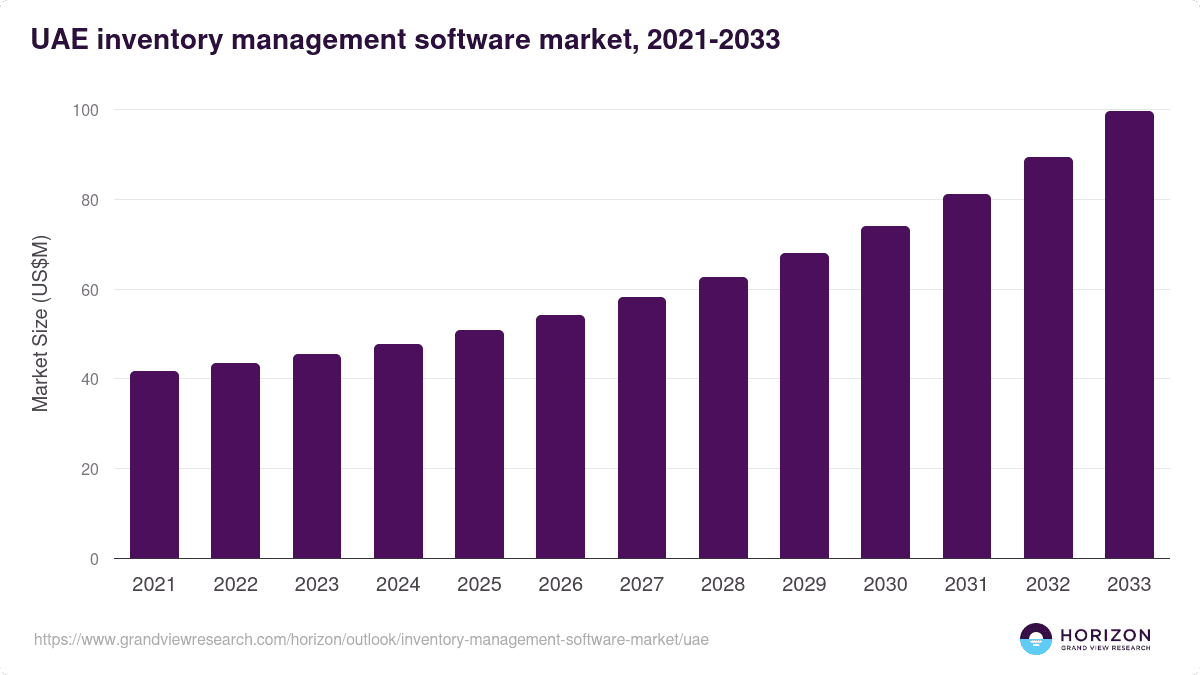

Market size & forecast for UAE inventory management software

Grand View Research estimates the UAE inventory management software market generated $47.8M in 2024 and may reach $99.7M by 2033, with 8.8% CAGR from 2025 to 2033.

What this usually means for buyers:

- More vendor options and more local partners

- Faster feature rollout (mobile apps, dashboards, integrations)

- More pressure to pick tools that scale, since switching later costs time and money

Regional MEA outlook

The same source group estimates the Middle East & Africa inventory management software market at $201.0M in 2024, with 6.2% CAGR (2025–2033). It also notes the UAE is expected to post the highest CAGR in the region. This UAE inventory software market growth is pushing more vendors to add integrations and mobile features.

This matters if you plan to expand to nearby markets or work with GCC suppliers. A system that supports multi-currency, multi-warehouse, and clean integrations can save you from a second rollout.

Drivers in UAE

1) E-commerce growth

The UAE’s e-commerce market reached AED 32.3B in 2024 and is projected to pass AED 50.6B by 2029, based on an EZDubai report.

More online orders create more stock movements per day. That raises the cost of “manual stock updates.”

2) Strong demand and fast replenishment cycles

In January 2026, the S& P Global UAE Purchasing Managers’ Index rose to 54.9, with a sharp rise in new orders (sub-index 60.0). Reuters notes firms increased purchases as demand rose.

When orders rise, stock accuracy matters more. Teams also need reorder alerts and clear supplier lead times.

3) Multi-emirate operations

Many UAE SMEs store goods in one emirate and sell in another. Inventory software that supports location transfers and location-based picking reduces “phantom stock” and late dispatches.

Challenges

Integration work

Many UAE businesses run a mix of tools: accounting, POS, e-commerce, and courier platforms. The pain point is not the tool itself. It is getting systems to share the same item list, units, taxes, and stock logic.

Data quality

Bad item masters create daily issues: duplicate SKUs, mismatched units, missing barcodes, wrong reorder points. Software will not fix messy data by itself. You need cleanup before migration.

Local support and rollout speed

SMEs often want fast go-live. They also want help with training and troubleshooting. That is why local support and partner networks become a buying factor in the UAE.

📖 Recommended Next Reads (for UAE businesses)

- Warehouse Management System in the UAE: When inventory software is not enough, and what to look for in a WMS

- UAE ERP Software: How to compare ERP options in the UAE, including evaluation criteria and rollout tips

Key Selection Criteria for UAE Inventory Software

You’ll see many tools described as “best inventory management UAE” or “warehouse inventory software UAE.” The real difference shows up after go-live: accuracy, speed, integrations, and how much manual work stays.

Use these criteria to shortlist inventory management software UAE buyers can trust.

VAT & tax compliance support

Inventory systems don’t file VAT returns by themselves. Still, they should help you keep clean records and support the workflows your accountant needs.

Look for:

- Tax-ready invoices and credit notes (when the tool includes sales)

- Consistent tax codes across items and transactions

- Audit trail: who changed stock, when, and why

- Stock valuation reports that match your accounting logic

If your inventory tool connects to accounting software, check if it syncs:

- Item master and tax settings

- Sales and purchase documents

- Stock value or COGS logic (depends on the stack)

✔️ Checklist question: Can you export reports that your accountant can use without manual rework?

Multi-location, multi-currency, multi-warehouse support

Many UAE SMEs need stock across:

- One warehouse + one retail store

- Several branches across emirates

- A 3PL or external storage location

Core features to require:

- Stock by location (not just a global number)

- Transfers between locations with a clear trail

- Location-based reorder points

- Cycle counts by location

If you buy and sell in different currencies, ensure your system supports:

- Multi-currency purchase and sales documents

- Accurate stock valuation rules (and clear settings)

❗ Avoid this trap: Some tools show multiple sites stock but don’t support clean transfers. Teams then fix numbers with manual adjustments.

Integration with ERP, POS, and e-commerce platforms

In the UAE, a common setup is:

- POS in store

- Online store and marketplace accounts

- Accounting system

- Courier or shipping tool

- Inventory layer (or ERP)

Integration matters because it protects you from double data entry. It also keeps stock visibility across channels.

Ask vendors these direct questions:

- Do you have native integrations, or do we need custom API work?

- Is sync real time, scheduled, or manual?

- What happens in conflicts (two systems update the same item)?

- Can you map SKUs, units, and taxes reliably?

Where Kladana fits

If your stack has several tools and you want less custom connector work, an ERP like Kladana can act as a central inventory layer and connect sales, purchasing, warehouse, and accounting workflows.

This reduces “patchwork” integrations and keeps one item master.

Local support and UAE presence

- Faster onboarding and training

- Help with local workflows and document formats

- Partner network for integrations and rollout support

When vendors claim “UAE support,” verify:

- Support hours and response time

- Implementation services: in-house or partner-based

- Training format: live sessions, help center, videos

Scalability & future-proofing

Your inventory needs may change within 12–18 months. Common growth steps in the UAE:

- New branch or warehouse

- More SKUs and variants

- More channels (marketplaces, B2B orders, wholesale)

- Batch/serial tracking for returns and warranties

- Stronger warehouse processes (bins, picking routes, barcode rules)

Check:

- User and location limits

- Performance with large catalogs

- Advanced tracking (lots/serials, expiry)

- Permissions and audit logs

- API access if you plan deeper integrations

Pricing models & total cost of ownership

Most tools price by one (or a mix) of these:

- Users

- Locations/warehouses

- Transactions or order volume

- Modules (inventory only vs inventory + accounting + CRM)

- mplementation and training services

When comparing inventory control software UAE, don’t stop at the monthly fee. Include:

- Setup and data migration cost

- Integration cost (native vs custom)

- Barcode hardware and labels (if needed)

- Training time (internal cost)

- Ongoing support plan

➕ Quick math for SMEs: A cheaper plan that needs daily manual exports and re-imports often costs more than a higher plan with stable integrations.

Leading Inventory Software & Vendors in UAE

You’ll usually see two groups while searching for UAE inventory management software,:

- Accounting-first tools with inventory (good for basic stock + invoicing)

- ERP / inventory suites (better for more that one warehouse workflows, traceability, and deeper control)

Below is a practical shortlist of vendors you’ll often find on the UAE “best inventory management” pages. This is not a ranking.

Vendor profiles

Kladana (cloud ERP with inventory + warehouse workflows)

Best fit: UAE SMEs that need one system for stock control across warehouses, purchasing, and sales, with integrations across the stack.

What it’s strong at: Kladana positions itself as a cloud ERP and highlights ready-made integrations with e-commerce and accounting platforms such as Shopify, Tally, and Zoho Books.

Why it’s useful in the UAE context: If you use several tools (online store + accounting + delivery apps), the hard part is keeping one item list and one stock truth. A central inventory layer with prebuilt connectors can reduce custom integration work.

Watch-outs: confirm your needed tax/invoice workflow, and test your required integrations and conflict handling.

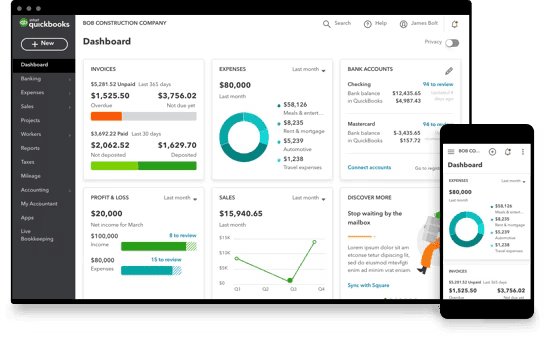

QuickBooks Intuit (accounting-first)

Best fit: small teams that want accounting plus basic inventory in one product.

What it highlights: QuickBooks promotes real-time stock value tracking and low-stock alerts for reordering, plus purchase order flow into payables.

Watch-outs: inventory depth depends on the plan and add-ons. Validate the needs of several warehouses and the exact integrations you depend on.

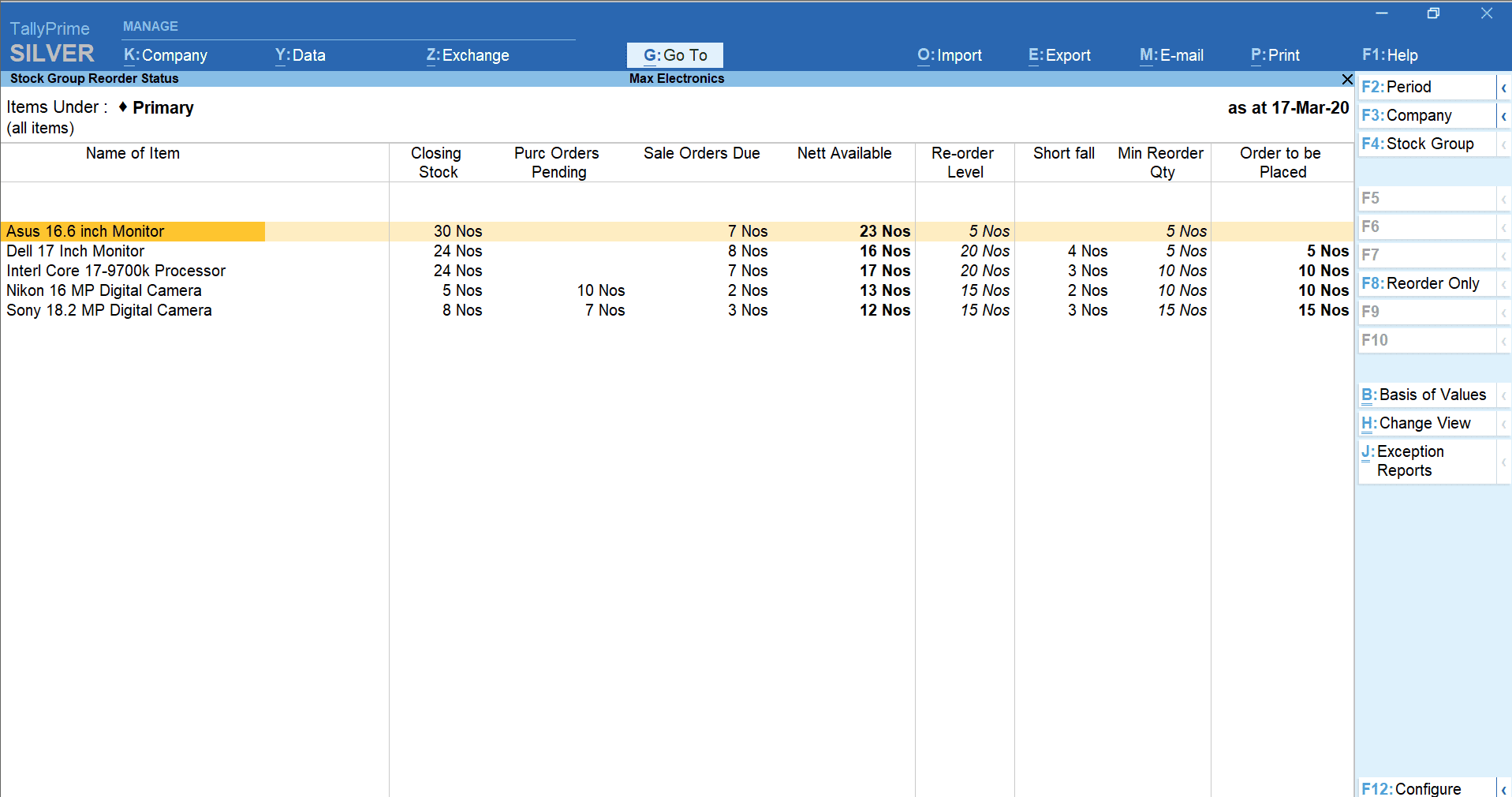

TallyPrime (UAE / MENA, accounting-first)

Best fit: trading and distribution companies that already use Tally for accounts and want inventory in the same platform.

What it highlights: Tally positions TallyPrime for SMEs as a business platform for UAE businesses that includes inventory, and supports stock control across different warehouses (godowns/locations) as part of its inventory capabilities.

Watch-outs: confirm how your team will access it (local desktop vs hosted/cloud access), and validate multi-location workflows and integration options during the proposal stage.

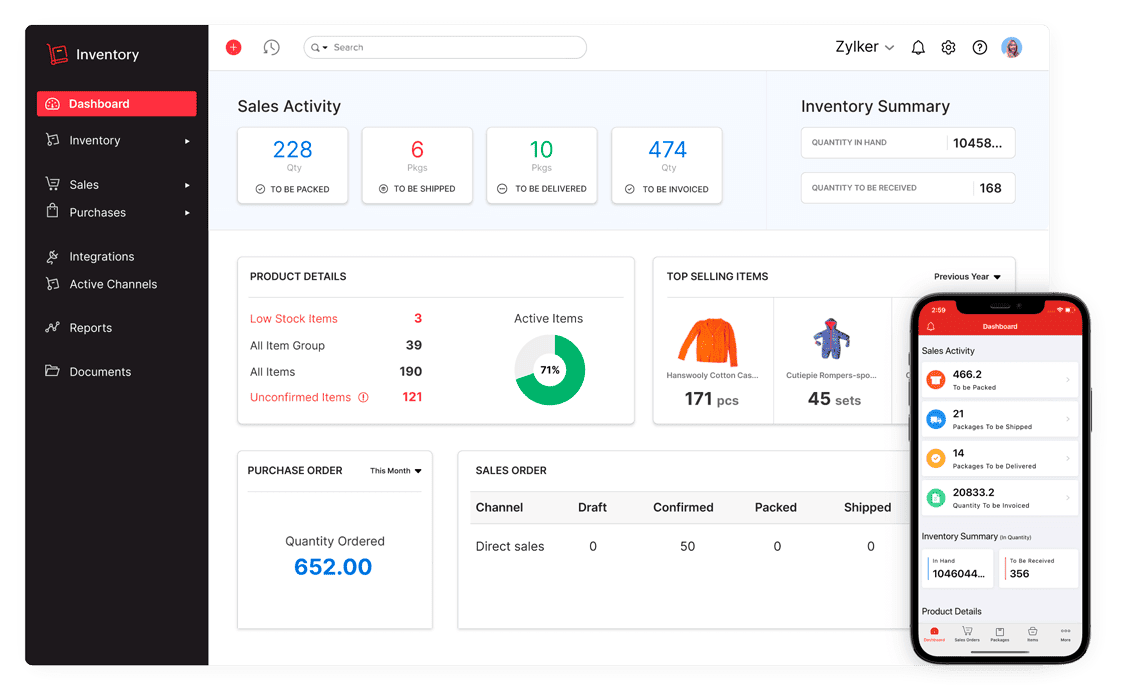

Zoho Inventory (UAE edition)

Best fit: e-commerce and trading teams that want inventory plus order flow, especially if they already use Zoho apps.

UAE angle: Zoho explains how to enable VAT in settings and add VAT registration details (e.g., TRN).

Watch-outs: confirm how stock sync behaves across channels and how returns/refunds affect inventory and accounting.

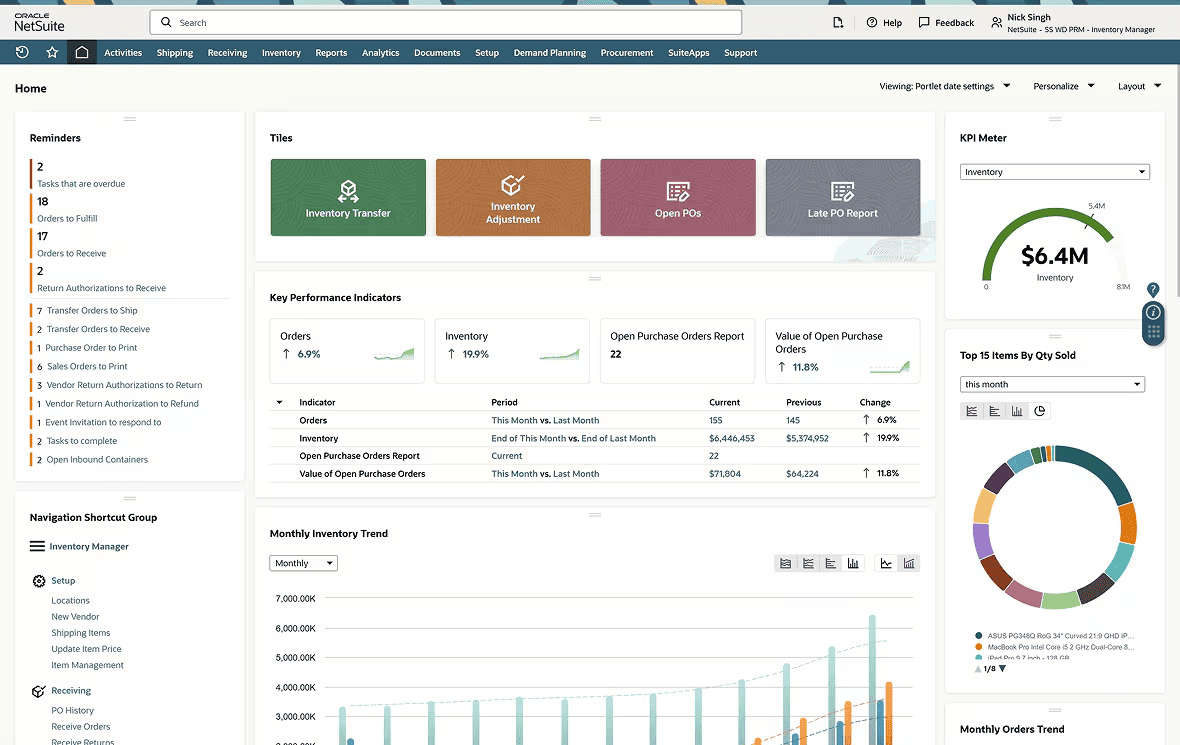

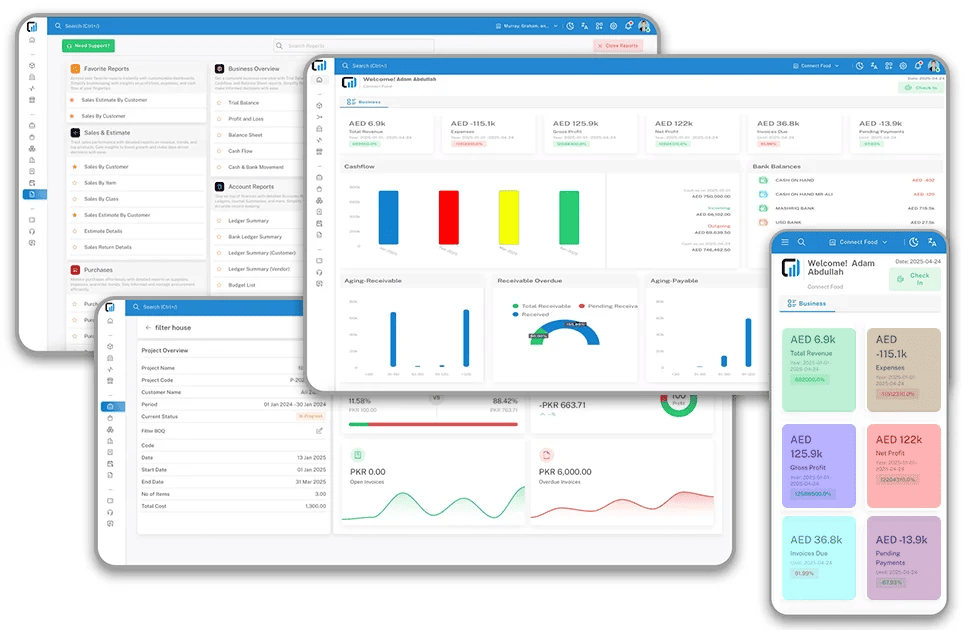

Oracle NetSuite (Inventory Management)

Best fit: scaling SMEs and mid-market companies that want a full ERP suite with advanced inventory control.

What it highlights: NetSuite lists features such as fulfillment, replenishment, cycle counting, lot/serial traceability, and item visibility for more than one location.

Watch-outs: higher cost and a longer rollout are common for ERP projects. Plan time for data cleanup, process setup, and training.

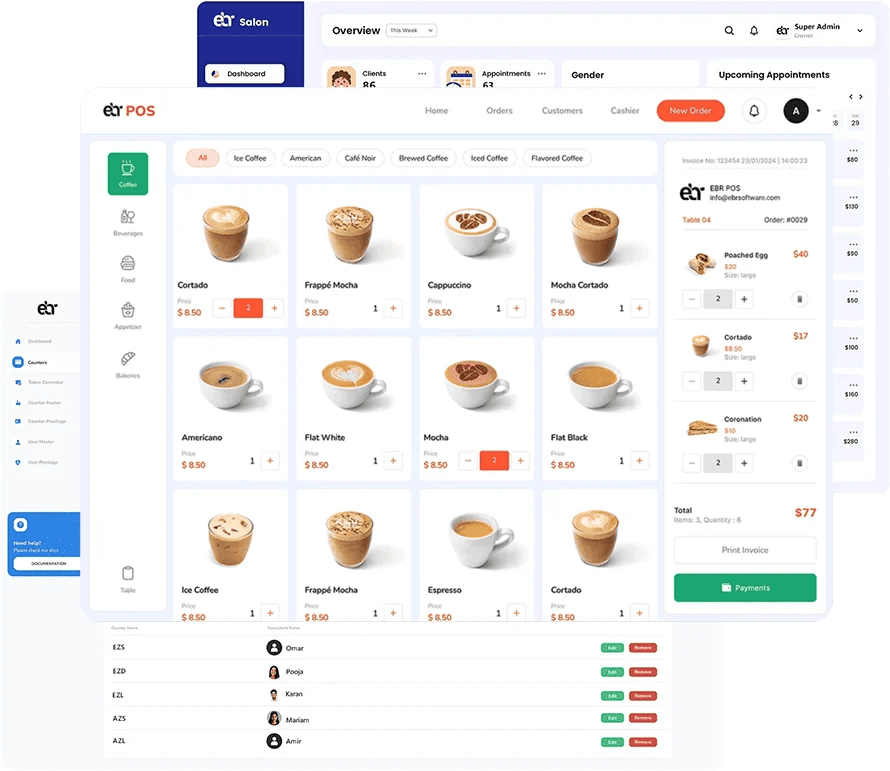

EBR (Dubai-based ERP / inventory module)

Best fit: UAE companies that prefer UAE-based implementation/support and an ERP-style suite.

What it highlights: inventory visibility, real-time stock control, automated tracking/reorder points, and operations for more than one storing facility.

Watch-outs: validate integrations (accounting, POS, e-commerce), reporting depth, and rollout capacity.

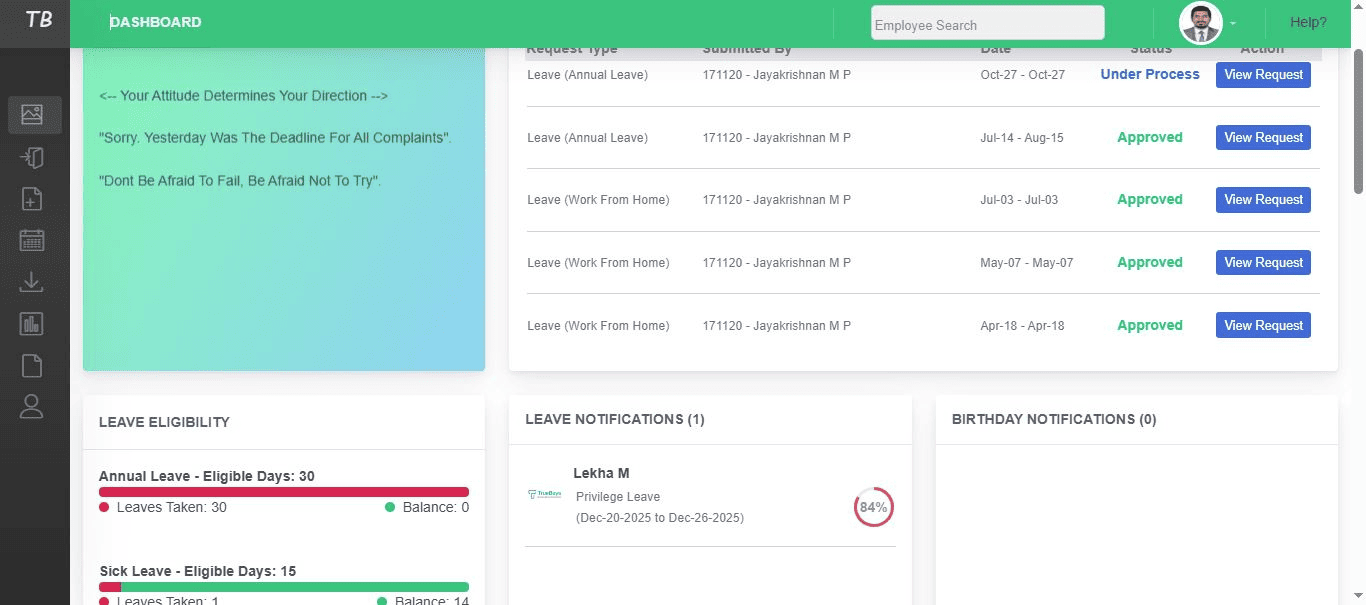

TrueBays (UAE-focused inventory software)

Best fit: SMEs that want a straightforward inventory system with standard operational features.

What it highlights: TrueBays lists features such as stock reports, purchase orders, supplier management, stock transfers, and basic stock planning (e.g., low-stock alerts / reorder levels).

Watch-outs: confirm barcode workflow depth, transfer logic between different warehouses, and integrations.

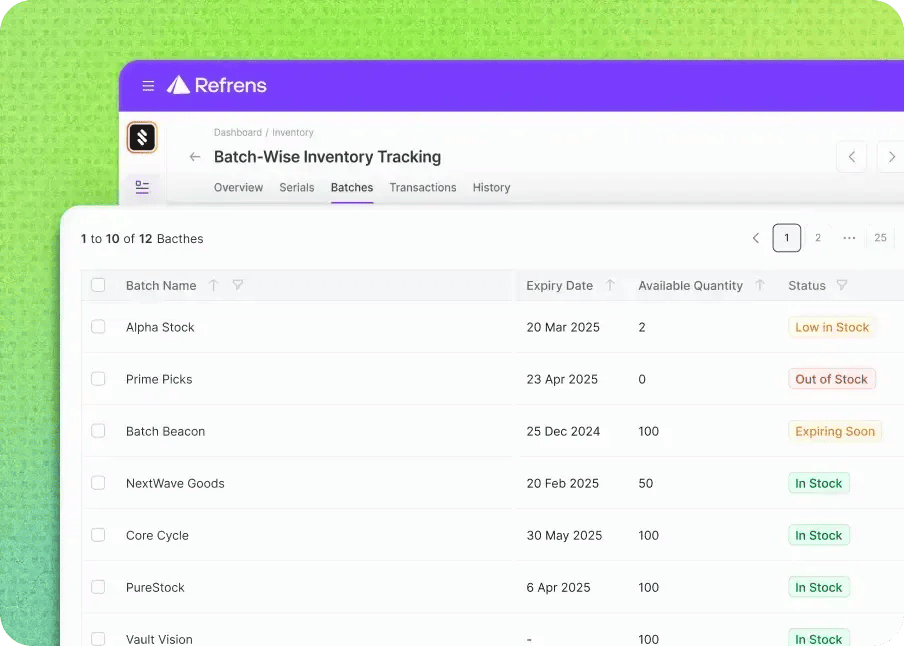

Refrens (often seen in UAE “top software” roundups)

Best fit: very small businesses that want billing plus simple inventory tracking.

Why it appears here: Refrens publishes UAE roundups and includes vendors like Zoho Inventory as options for UAE businesses.

Watch-outs: if you need bin locations, barcode pick lists, or complex warehouse execution, confirm capability early.

LightCloud ERP (cloud ERP option)

Best fit: trading and distribution firms that want an ERP approach with inventory controls and internal stock movement for several storages.

What it highlights: LightCloud ERP highlights multi-warehouse management, stock transfers, real-time stock updates, and low-stock alerts.

Watch-outs: verify which integrations are available for your stack and confirm the level of implementation and ongoing support coverage in the UAE.

Feature & pricing comparison table

Use this table to shortlist. Then confirm details in demos and proposals (especially integrations and multi-warehouse workflow depth).

| Vendor | Type | Deployment | Inventory depth (typical) | Multi-warehouse | Barcode/RFID |

| Kladana | Cloud ERP (inventory + warehouse + purchasing/sales) | Cloud | Mid–deep | Yes | Barcode (warehouse routines) |

| QuickBooks Intuit | Accounting + inventory | Cloud | Basic–mid | Plan-dependent | Often via apps |

| TallyPrime Mena | Accounting + inventory | Desktop / hosted | Mid | Setup-dependent | Partner-dependent |

| Zoho Inventory (UAE Edition) | Inventory + invoicing | Cloud | Mid | Yes | Barcode; serial/batch options |

| Oracle NetSuite | ERP suite | Cloud | Deep | Yes | Yes |

| EBR | ERP suite | Varies | Mid | Yes | Barcode reading module |

| TrueBays | Inventory system | Cloud | Basic–mid | Yes | Varies by plan |

| Refrens | Billing + basic inventory | Cloud | Basic | Basic | Barcode |

| LightCloud ERP | ERP suite | Cloud | Mid | Yes | Vendor-dependent |

Pricing note: treat the subscription as one line. Include implementation, migration, integrations, training, barcode hardware, and ongoing support in total cost.

Pros & cons in UAE context

Accounting-first tools (QuickBooks, TallyPrime)

- Pros: quick start, familiar workflows for invoicing and finance, basic reorder alerts.

- Cons: advanced warehouse execution often needs add-ons, partners, or workarounds. Validate transfers and barcode routines across your warehouses early.

Inventory-first / ecosystem tools (Zoho Inventory)

- Pros: good fit for online selling and order processing; VAT setup is documented in product help.

- Cons: once you need deeper process control across departments, you may need an ERP layer.

ERP suites (Kladana, NetSuite, EBR, LightCloud ERP)

- Pros: stronger controls for multi-location operations, replenishment planning, traceability, and consistent stock logic across teams.

- Cons: rollout is a project. Data cleanup, process setup, training, and integration mapping decide the outcome.

Implementation Best Practices & Pitfalls

Implementation decides whether your UAE stock management software becomes a daily tool or a daily headache. Most failures come from four areas: messy data, rushed rollout, weak training, and unstable integrations. ERP rollouts that go well usually start with clear goals, data cleanup before migration, testing, and steady training support.

Data migration & cleaning

If your current stock lives in spreadsheets, POS exports, and supplier files, treat data prep as a separate project. Migration guides consistently stress these steps: extract → clean → transform → import → validate.

What to clean before you import

- Item master: SKU, name, unit of measure, barcode, category, tax code, cost method

- Locations: warehouse/store names, bin logic (if used), transfer rules

- On-hand quantities: one “truth” count per location, same cut-off date

- Suppliers and customers: duplicates, spelling variants, missing IDs

- Old items: archive discontinued SKUs so they don’t pollute reports

A common pitfall is underestimating the time needed for this step. Poor data quality can cause immediate problems and call out location naming, product attributes, and inventory counts as key cleanup targets.

📝 Practical note: pick a cut-off date (for example, end of business day), freeze stock movements for a short window, do a physical or cycle count, then import opening balances by location.

Pilot + phased rollout

A phased rollout reduces risk. Start with one warehouse or one business line, run it for 2–4 weeks, then expand.

A typical rollout pattern:

- Pilot scope: one location + a limited SKU set

- Core flows first: receiving, sales dispatch, returns, adjustments

- Go-live checklist: barcode rules, user roles, reports, approval steps

- Scale: add the next warehouse, then new channels and integrations

Implementation frameworks also highlight testing before go-live and keeping training support active across phases.

❗ Pitfall to avoid: switching on every feature on day one (lots/serials, RFID, forecasting, complex approvals). Start with what you must run daily.

Change management & training

People don’t resist software. They resist extra steps and unclear rules.

What works:

- Assignone process owner for inventory data (SKU rules, naming, units, barcode format)

- Create 1-page SOPs for warehouse actions: receiving, put-away, picking, transfers, stock counts

- Train by role (warehouse, purchasing, sales admin, finance)

- Track adoption with simple signals: number of manual edits, stock adjustments, and support tickets

Implementation guides often point to training and internal ownership as a core success factor, not a “nice-to-have.”

📝 UAE note: if you have multilingual teams, keep SOPs visual (screenshots + short steps) and use consistent item labels on shelves and bins.

Integration issues & API strategy

Integrations are where many rollouts slow down, because businesses often run a mix: POS, Shopify, marketplaces, accounting, and shipping tools.

Integration best practices

Define a singlesystem of record for each data type

- Items/SKUs (one master)

- Stock quantities (one truth)

- Prices (one owner)

Document sync rules:

- real-time vs scheduled

- conflict handling (two systems edit the same SKU)

- returns/refunds logic (stock + accounting impact)

Test with real scenarios: partial shipments, bundles, substitutions, backorders

If your vendor supports CSV imports/exports, use them for initial loading and as a safe fallback.

❗ Pitfall to avoid: “We’ll fix integrations after go-live.” If orders keep flowing, your team will double-enter data and trust will drop fast.

UAE Use Cases

Below are common scenarios where inventory management software for UAE SMEs delivers clear results.

Use case 1: Multi-store retail (Dubai + other emirates)

Typical setup

- 5–10 stores + one central warehouse

- Stock moves between stores daily

- High risk of “phantom stock” (system shows stock, shelf is empty)

What software fixes

- Stock by location (store vs warehouse)

- Transfers with approval trail

- Barcode receiving and cycle counts

- Reorder alerts per store

What to measure in your business

- Stock accuracy rate per location

- Replenishment lead time (request → shelf)

- Shrinkage and adjustment volume

Use case 2: Warehouse barcode rollout (receiving, picking, stock counts)

Typical setup

- Manual receiving and picking

- Errors in SKU selection, quantities, or location

- Stock counts take too long

What software fixes

- Barcode tracking for receiving, picking, and transfers

- Faster cycle counts

- Fewer manual edits

What to measure in your business

- Picking error rate and return rate

- Receiving discrepancies per supplier

- Time per cycle count and variance levels

ROI & Business Justification in UAE

Inventory software pays off when it reduces three leaks: stockouts, overstock, and manual work. You don’t need perfect forecasts to get ROI. You need accurate stock, clean reorders, and fewer errors.

Inventory carrying costs often average 20% of total assets depending on the industry and the primary operations of the business. This includes storage, insurance, shrink, obsolescence, and the cost of cash tied up in stock. The biggest cost savings through inventory management usually come from fewer stockouts and better inventory optimization.

Cost components

When you budget for inventory software in UAE, include these lines:

1) Subscription / license

- monthly or annual fee

- users, warehouses/locations, and modules

2) Implementation

- setup, workflows, permissions, reports

- training sessions and SOP creation

3) Data work

- item master cleanup, opening stock import, barcode mapping

4) Integrations

- POS, e-commerce, accounting, shipping tools

- API work if native connectors don’t cover your stack

5) Hardware (if you scan)

- scanners or mobile devices

- label printer + labels

- shelf/bin labels for warehouse layout

Benefit metrics to track

Use metrics that a finance or ops lead can check monthly:

Stockouts and lost sales

- Stockouts usually cost real revenue. A retail study reports retailers lose about 4% of annual sales due to out-of-stocks.

Track: stockout rate on top SKUs, backorders, “cancelled due to no stock,” and lost margin.

Lower holding costs (less overstock)

- If carrying/holding costs run around 20% of inventory value annually, then reducing average inventory has a direct cash and cost impact.

Track: average inventory value, aging stock, write-offs, dead stock.

Fewer warehouse errors

- Measure picking errors, returns caused by wrong item/qty, and receiving discrepancies. Barcode flows usually reduce these fast (if labels and SKU rules are clean).

Labor time

- Time spent on manual updates, cycle counts, reconciliation, and fixing mismatches across systems.

Simple payback estimate

You can estimate ROI with a basic model. Here’s a simple example for a UAE SME:

Assumptions

- Annual sales: AED 10,000,000

- Gross margin: 25%

- Average inventory value on hand: AED 2,000,000

- Holding cost rate: 25% per year

- Current stockout impact: 4% of sales (benchmark)

- Inventory software reduces:

- stockout impact by 25%

- average inventory by 10%

- warehouse/admin labor by AED 3,000/month

1) Stockout benefit (profit impact)

- Lost sales estimate: 4% × 10,000,000 = AED 400,000

- Recover 25% of that: 400,000 × 25% = AED 100,000 revenue recovered

- Profit from recovered sales (25% margin): 100,000 × 25% = AED 25,000/year

2) Holding cost benefit

- Current annual holding cost: 2,000,000 × 25% = AED 500,000/year

- Reduce average inventory by 10%: inventory down by AED 200,000

- Holding cost saved: 200,000 × 25% = AED 50,000/year

3) Labor savings

- AED 3,000/month × 12 = AED 36,000/year

✔️ Total annual benefit (rough):

25,000 + 50,000 + 36,000 = AED 111,000/year

If your total annual software + support + integration cost is AED 60,000, your payback is usually within the first year in this example.

📌 Tip: This model is conservative because it ignores secondary gains (fewer refunds, fewer urgent purchases, fewer write-offs, faster dispatch).

Future Trends in Inventory Software (for UAE)

UAE companies buy inventory tools for accuracy and speed today. The Cloud-based Inventory Software market for retailers is experiencing a boom: it reached $ 1.2 billion according to a Research and Markets report.

AI & predictive forecasting

AI-based replenishment is moving from “nice to have” to a normal expectation in mid-size retail and distribution. More and more e-commerce businesses start using AI to predict stockouts and place inventory better across locations, which reduces shortages and improves availability.

What this means for UAE SMEs:

- Start with clean item data and accurate on-hand stock

- Add demand signals from online and offline sales

- Use AI forecasting after your basic stock movements stay stable

Automation, IoT / RFID

UAE warehouses are adopting more automation — barcode and QR scanning, RF devices, conveyor systems, and in some cases robotics — pushing inventory software to support automated putaway, picking, and replenishment workflows.

Modern WMS platforms in the UAE increasingly integrate with IoT devices and cloud dashboards to manage receiving, putaway, picking, packing, and dispatch with minimal manual intervention.

Local compliance, free-zone, and regionalization focus

Because many UAE firms operate in mainland and free zones, software is evolving to handle multi-entity, multi-currency, and cross-border flows between UAE, KSA, and wider GCC within a single platform.

Faster rollout and cloud infrastructure expansion in the UAE (backed by government digital initiatives such as Smart Dubai) are creating more opportunity for specialized local SaaS vendors focused on the retail and logistics ecosystem.

Next Steps & Buyer Roadmap

This roadmap helps you move from “we need inventory software” to a shortlist and a safe rollout.

Step 1: Define scope in one page

Write down:

- Locations: how many warehouses, stores, 3PL points

- Channels: POS, Shopify, marketplaces, B2B orders

- SKU volume: products, variants, kits/bundles

- Tracking needs: batch/expiry, serial numbers, barcodes, bin locations

- Users: warehouse, purchasing, sales admin, finance

- Reports you must have: stock on hand by location, stock value, aging, fast/slow movers, stock adjustments

➕ Output: a 1-page scope doc you can share with vendors.

Step 2: Send an RFP-style checklist to vendors

Use these questions in emails and demos:

Product & data

- Can we manage multi-warehouse inventory management with transfers and audit trail?

- Can we import items and opening stock by location (CSV/Excel)?

- Do you support barcodes and mobile workflows for receiving, picking, counts?

- Do you support batch/serial/expiry if we need it?

Operations

- Can we set reorder points per location and get reorder alerts?

- Can we handle returns, damaged stock, and adjustments with reasons?

- Can we run cycle counts by location without stopping operations?

Integrations

- Do you have native integrations for our tools (POS, e-commerce, accounting)?

- How does sync work (real-time vs scheduled)?

- What happens on conflicts (same SKU edited in two systems)?

- Do you have an API, and what data does it cover?

Security & control

- Role-based access and approvals?

- Audit log for stock changes?

- Data export for reporting and backups?

Support

- Implementation timeline and responsibilities (vendor vs partner vs your team)?

- Training format and support hours?

- SLA for response time?

➕ Output: a comparable set of answers across vendors.

Step 3: Build a vendor comparison scorecard

Score each vendor 1–5 on these categories:

- Inventory accuracy features (locations, transfers, counts)

- Barcode workflow fit (receiving, picking, counting)

- Integration fit (your stack, conflict handling, API depth)

- Reporting fit (stock value, aging, movement)

- Rollout risk (data migration support, training, local support)

- Total cost (subscription + setup + integrations + hardware + training)

💡 Tip: weight the top 3 categories higher. Most UAE teams put integrations and multi-location workflows at the top.

Step 4: Run a pilot (2–4 weeks)

Pilot goal: prove daily workflows, not fancy features.

Pilot plan:

- Pick one location and a limited SKU set

- Migrate cleaned item data + opening stock

Test these daily flows:

- receive stock

- transfer stock

- pick and dispatch

- handle returns

- run a small cycle count

- Track issues and fix the root causes (SKU rules, barcode labels, user permissions)

🛫 Go-live signal: your team can complete daily operations with few manual fixes.

Step 5: Integration readiness checklist

Before full rollout, confirm:

- One system owns the item master (SKUs, units, barcodes)

- One system owns stock truth

- Prices have one owner (POS or ERP or e-commerce)

- Return/refund logic is documented

- Bundle/kit logic is clear (what reduces stock, when)

- Sync schedule and error handling are set

- You have a fallback process for outages (manual packing list, later sync)

Step 6: Roll out in phases

A safe sequence:

- Add the next warehouse

- Add stores or sales channels

- Add advanced tracking (bins, batch/serial, expiry)

- Add forecasting and automation rules after data stays clean

Frequently Asked Questions on the UAE Inventory Management Software

If you search for “UAE inventory management software” you’ll see many similar claims. These FAQ answers help you focus on what matters in the UAE: cloud vs on-premise, VAT readiness, integrations, cost, and implementation time.

What is inventory management software and why use it in the UAE?

Inventory management software records every stock movement and keeps on-hand quantities accurate across warehouses, stores, and sales channels. The UAE businesses often handle imports, multi-emirate operations, and fast dispatch cycles, so accurate stock data helps prevent overselling, stockouts, and cash tied up in slow items.

How does cloud vs on-premise compare in the UAE?

A cloud inventory system UAE teams use runs in a browser or mobile app, with updates managed by the vendor. On-premise software runs on your servers and needs in-house IT for upgrades and backups. Most SMEs choose cloud for faster setup and remote access across locations. If your warehouse has weak internet, check offline-friendly mobile scanning or stable sync options.

Which inventory software vendors operate in the UAE?

The UAE buyers often compare accounting-first tools, inventory-first tools, and ERP suites. Your shortlist should depend on your workflows, integrations, and number of locations.

How much does inventory software cost in the UAE?

Pricing depends on users, locations, modules, and transaction volume. The subscription is only one cost line. Add implementation, data cleanup, integrations, training, and barcode hardware if you scan. Ask vendors for an “all-in year-one cost” estimate in AED to compare fairly.

How long does implementation take?

Basic setups can go live in a few weeks if you have clean item data and simple workflows. Multi-warehouse rollouts with integrations and barcode routines often take longer. A pilot in one location for 2–4 weeks helps you find gaps before full rollout.

Can the software support the UAE VAT and compliance needs?

Many vendors offer VAT settings and VAT-ready invoice workflows. Still, you should confirm how the system handles tax codes, audit trail, exports for your accountant, and stock valuation reports. If you use a separate accounting system, verify the sync rules.

Can it integrate with existing ERP, POS, and e-commerce?

Most vendors support integrations, but quality varies. Ask if integrations are native or need custom API work, how often sync runs, and how conflicts are handled. Test real scenarios: returns, partial shipments, cancelled orders, and bundles.

What pitfalls should we avoid during rollout?

Common issues include:

- importing messy SKUs and duplicate items

- skipping opening stock verification by location

- turning on every feature on day one

- weak warehouse training and unclear barcode rules

- “we’ll fix integrations later” thinking

What ROI can an UAE business expect?

ROI usually comes from fewer stockouts, less overstock, fewer picking/receiving errors, and less manual reconciliation. Track stock accuracy, stockout rate, inventory aging, and labor time. Many teams see payback within the first year if integrations reduce double entry and inventory levels become more controlled.

What future features should an UAE business look for?

Look for tools that support:

- clean APIs and stable integrations

- real-time dashboards and mobile workflows

- automation rules for reordering

- batch/serial tracking if your category needs it

- optional RFID support for high-volume operations

List of Resources

- Grand View Research — UAE Inventory Management Software Market Size & Outlook

- Grand View Research — Middle East & Africa Inventory Management Software Market Size & Outlook

- Day of Dubai — EZDubai Highlights Rapid Growth of UAE E-Commerce Market, Reaching AED 32.3 Billion in 2024

- Reuters — UAE non-oil private sector growth boosted by jump in demand in January, PMI shows

- UAE Federal Tax Authority —VAT Topics

- Researchgate — A Methodology for Calculating Inventory Carrying Costs

- Scribd — Stock-Outs Cause Walkouts

- Research and Markets — UAE Cloud-Based Retail Inventory Management Software Market Size, Share, Growth Drivers, Trends, Opportunities, Competitive Landscape & Forecast 2025-2030

- LinkedIn — Why AI Will Redefine Logistics in the GCC by 2030 by Scalable Solutions

- Nyx Wolves — Fastest Growing Cloud-Based WMS in UAE for Multi-Warehouse Operations