Tired of messy spreadsheets or half-baked invoice formats that don’t comply with GST rules?

If you’re a freelancer, small business owner, or accountant in India, creating an accurate GST invoice template isn’t just a box to tick. It’s how you avoid tax notices and ensure smooth Input Tax credit (ITC) claims. Inaccurate invoices can lead to penalties and delays.

This guide fixes that.

- You’ll get free editable GST Invoice templates in Excel, Word, and Google Sheets

- All formats are mobile-friendly and ready to send

- See a real GST invoice sample to understand the structure

- A quick breakdown on of invoice vs GST invoice

- Learn how to issue a GST invoice the right way

- Direct links on GST invoice download in multiple formats

- Understand the essential GST invoice rules so you never miss a field

We’ll also show you how to automate GST billing with Kladana ERP, saving time, reducing errors, and staying compliant.

- What Is a GST Invoice?

- When Do You Need a GST Invoice?

- Difference between Invoice and GST Invoice

- Mandatory Fields in a GST Invoice

- How to Fill a GST Invoice Template Step-by-Step

- Free GST Invoice Template Downloads

- Why Kladana Is Better Than a Static GST Format

- How to Create Your GST Invoice Template

- Summary

- Frequently Asked Questions on GST Invoice Templates in Excel and Word

- List of Resources

🧩 Still switching between Excel sheets, email threads, and printed bills?

🧊 4 Free Inventory Ckecklists

Learn how to manage stock, set up your warehouse, track barcodes, and build product cards for e‑commerce — even if you’ve never done it before

✅ Inventory management

✅ Warehouse setup

✅ Barcode tracking

✅ E-commerce product cards

What Is a GST Invoice?

India introduced the Goods and Services Tax (GST) on July 1, 2017, to simplify the country’s indirect tax system. Before the introduction of GST, businesses had to deal with multiple taxes, including VAT, excise duty, and service tax. Each has its own set of rules and paperwork. But GST replaces all of that with a single, nationwide tax structure.

If you’re a registered seller, issuing a GST invoice isn’t just best practice, but it’s a legal requirement under Rule 46 of the CGST Rules.

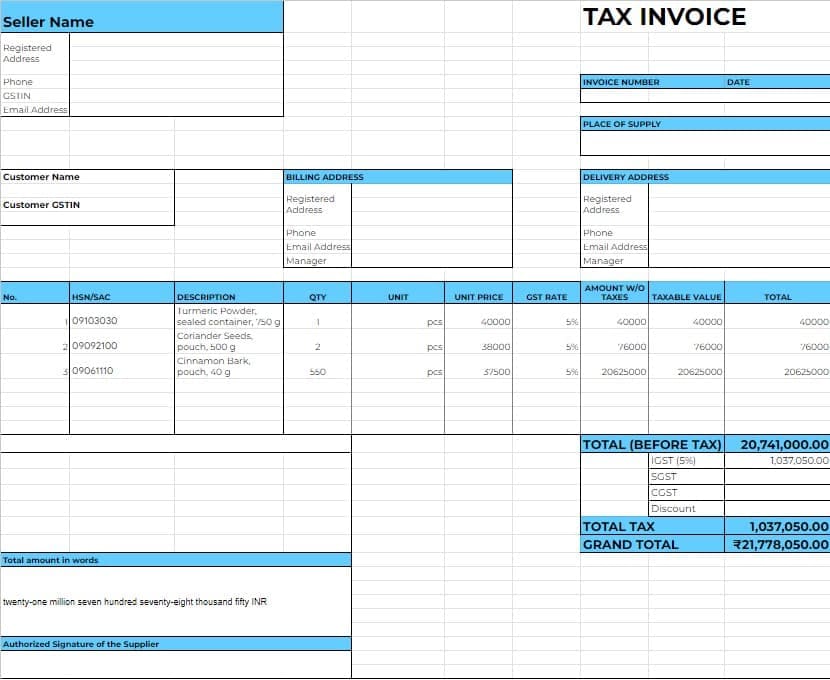

This invoice includes:

- Seller and buyer details with GSTIN

- Description of goods and services

- HSN/SAC codes

- GST rates (CGST, SGST, or IGST)

- Taxable value and total invoice amount

☑️ A proper GST invoice ensures your buyer can claim ITC and keeps you compliant for return filings, audits, and assessments.

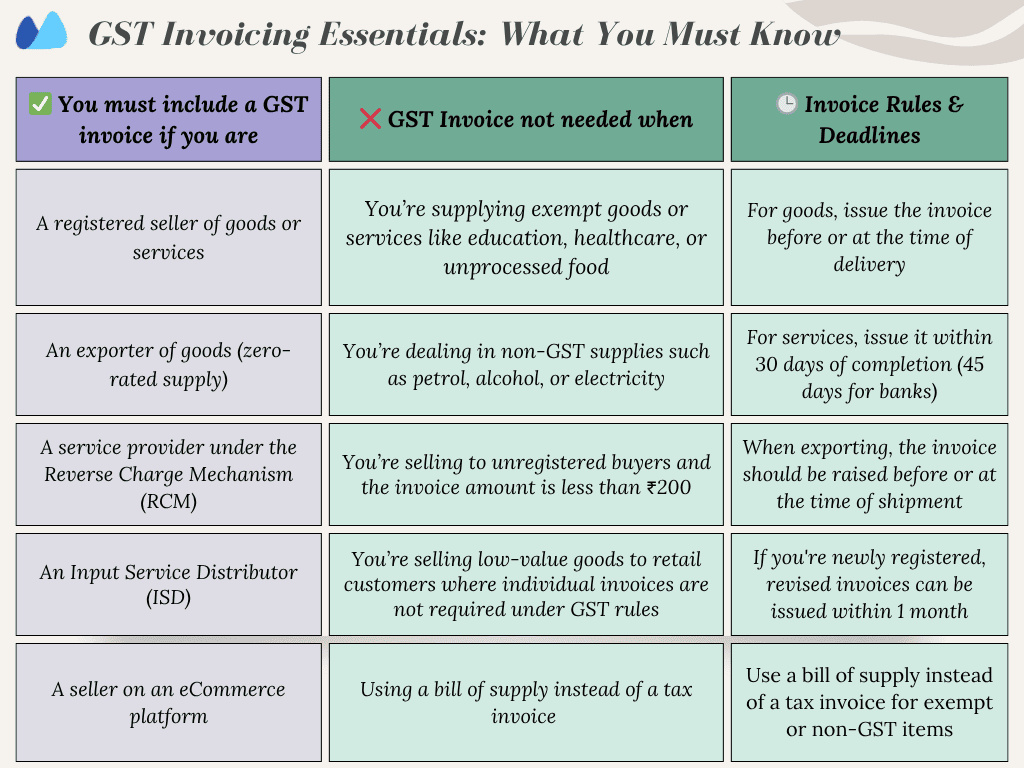

When Do You Need a GST Invoice?

Under Indian tax law, a GST invoice must be issued whenever a registered business supplies goods or services to another registered business. That includes everything from product sales and consulting work to ecommerce shipments and export orders.

💡 Tip: Always check the latest CBIC updates to stay compliant with changes in GST invoicing deadlines.

Difference between Invoice and GST Invoice

A regular invoice and a GST invoice may look similar at first glance, but only one is legally valid under India’s GST law

Here’s how they differ:

| Feature | Regular Invoice | GST Invoice |

Seller and buyer info |

Basic details |

Includes GSTIN of both parties |

Tax breakdown |

❌ Not required |

✅ Shows CGST, SGST, IGST |

❌ Not included |

✅ Mandatory for goods and services |

|

Invoice number format |

Free format |

Must follow a unique serial pattern |

Legal recognition for GST |

❌ Not valid for ITC claims |

✅ Required to claim ITC |

Place of supply |

Optional |

Mandatory under GST invoice rules |

Bill name |

Often just called “Invoice” |

Titled as «GST Invoice» |

📍Tip: When you’re downloading or designing a template, make sure to always use a GST-compliant bill format instead of a general invoice layout.

Mandatory Fields in a GST Invoice

To be legally valid, every GST invoice must follow the structure defined under Rule 46 of the CGST. Whether you’re using a printed format or a GST invoice format in Excel, these fields are non-negotiable.

Here’s a breakdown of all required fields:

1. Invoice Number and Date

- Add a consecutive serial number, unique for each invoice

- It is possible to include alphabets, numerals, hyphens, or slashes, but do not repeat within a financial year

- Do not miss filling in the date because it will reflect the actual date of issue

2. Seller and Buyer Details with GSTIN

- Add the official name, address, and GSTIN of both parties

- For exports, mention “Export” and include the recipient’s country and shipping address

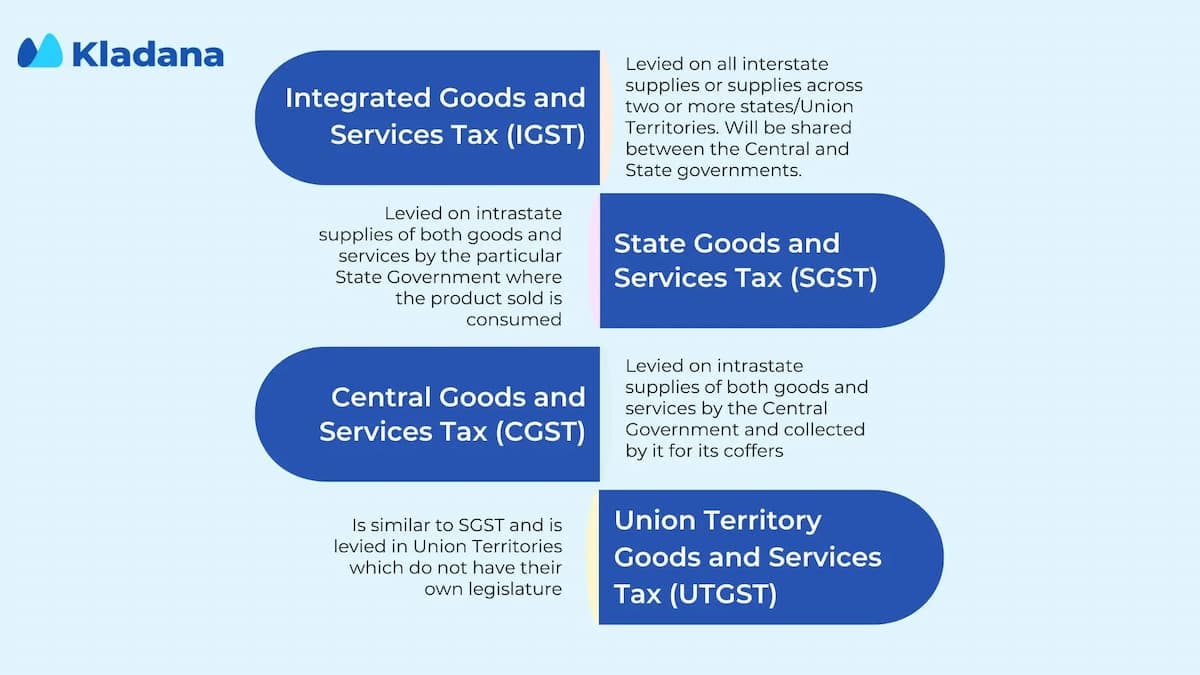

3. Place of Supply

- Mention the state where goods and services are delivered

- Determine whether to apply CGST+SGST or IGST

- Use the format: Place of supply: State Name, State Code

- Example: Place of supply: Bangalore, 560034

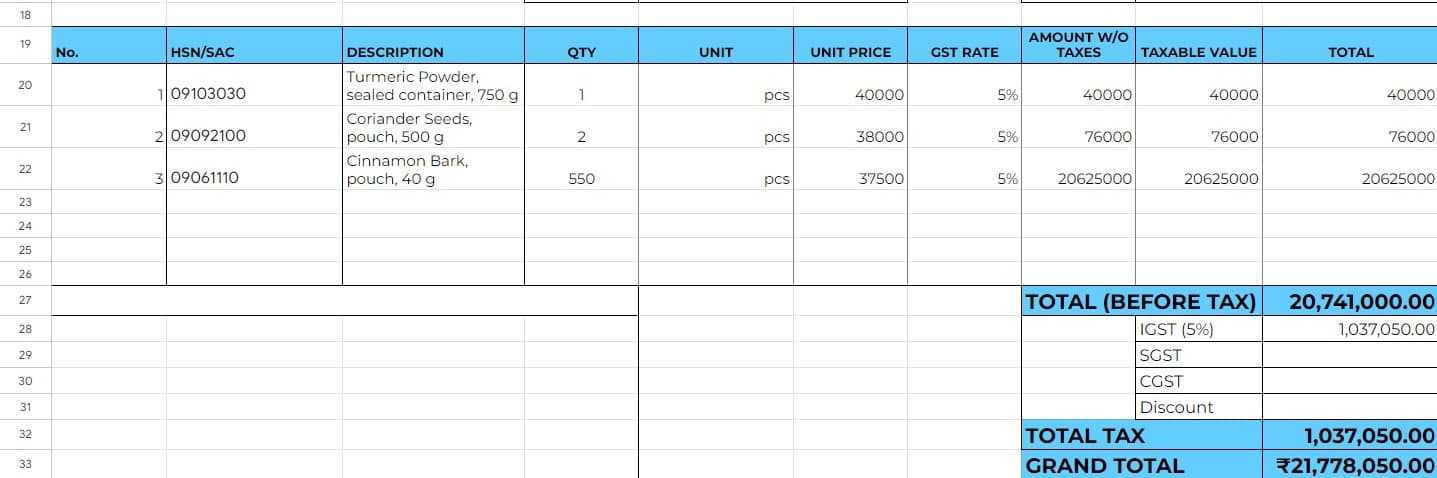

4. HSN/SAC Codes

- Add the HSN code for goods and the SAC code for services

- Use four-digit codes if turnover is up to ₹ 5 crore (B2B only)

- Use six 6-digit code if turnover exceeds ₹ 5 crore

- Refer to the official HSN/SAC code list for correction classification

5. Tax Rates and Amounts

- Split CGST, SGST, and IGST clearly

- Each line item should show taxable value, applicable rate, and calculated tax

6. Discounts and Taxable Value

- Mention any discounts offered before or after tax clearly on the invoice

- Show discounts clearly on the invoice, either per item or on the total

- Ensure GST is calculated on the net taxable value after discount

📌 Tip: You can use this formula for calculation (Price − Discount) × Quantity

7. Signature or Digital Signature

- Add the signature of the supplier or authorized signatory at the bottom of the invoice.

- If the invoice is sent digitally, such as a PDF or email, a digital signature is valid.

- Physical invoices must carry a handwritten or stamped signature.

Try Our Ready To Use GST Template

How to Fill a GST Invoice Template Step-by-Step

Attention! This invoice template was created according to GTS standards for 2025. Use the document with caution. It does not guarantee compliance with the current tax laws of your country.

Here’s a step-by-step guide using a typical GST invoice format in Excel (works the same in Google Sheets):

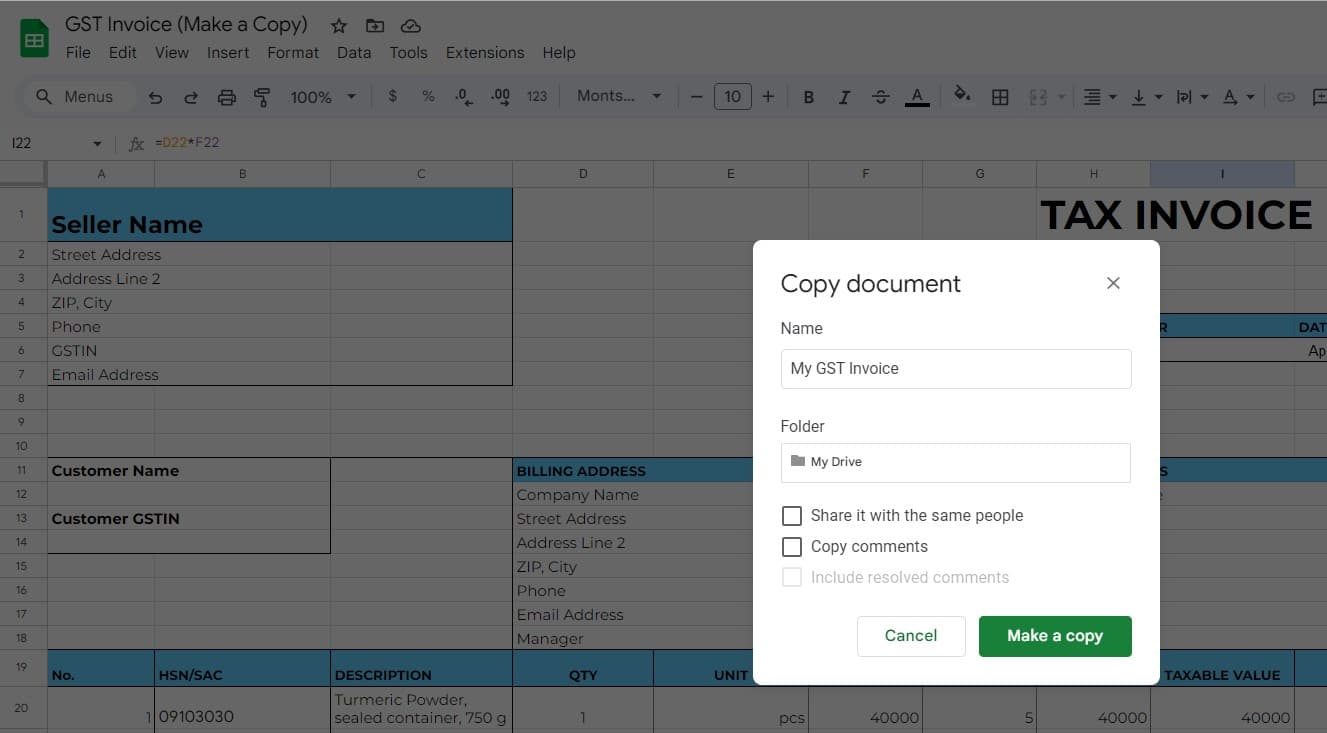

Step 1: Make a Copy of the Template

- Open the template file (Excel or Google Sheets)

- Save a new version with the customer’s name or invoice number for tracking

📍Tip: If you’re using Google Sheets, click File ➞ Make a copy to work online

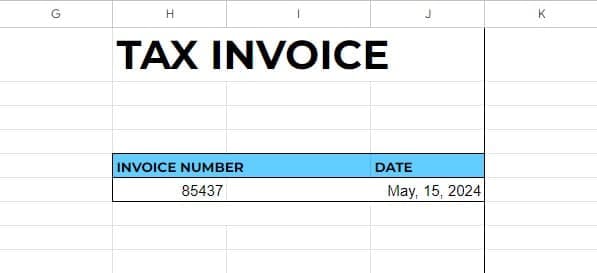

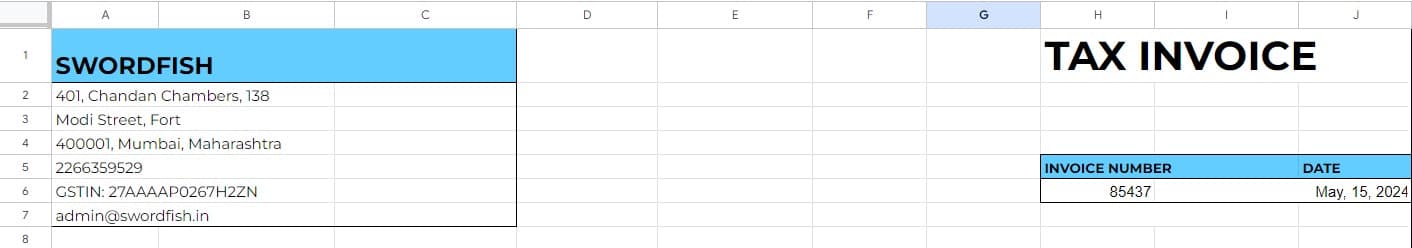

Step 2: Enter Invoice Number, Date, and Seller Details

- Start with a unique invoice number

- Add the invoice date

- Fill in your business name, address, GSTIN, and contact info

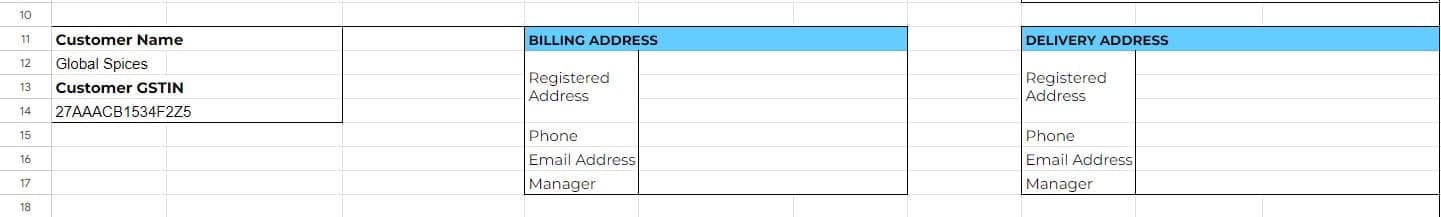

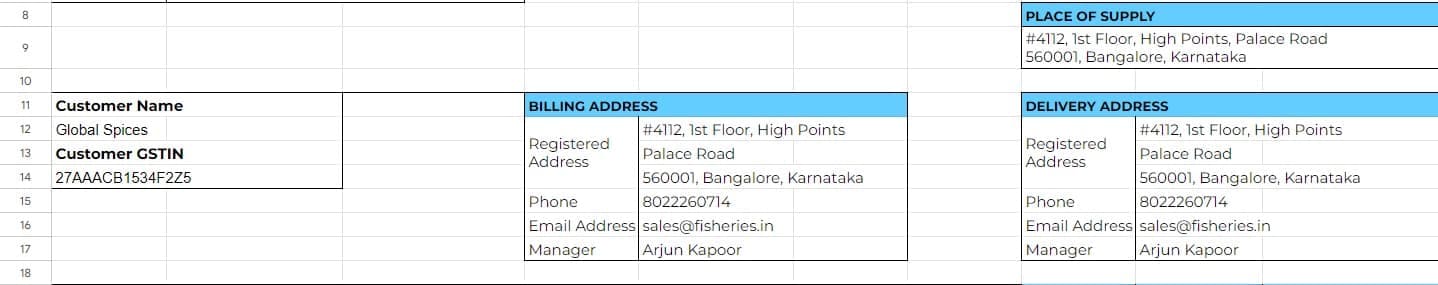

Step 3: Fill in Buyer Details and Place of Supply

- Add the buyer’s legal name, billing address, and GSTIN if registered

- Mention the place of supply (used to determine IGST Vs CGST/SGST)

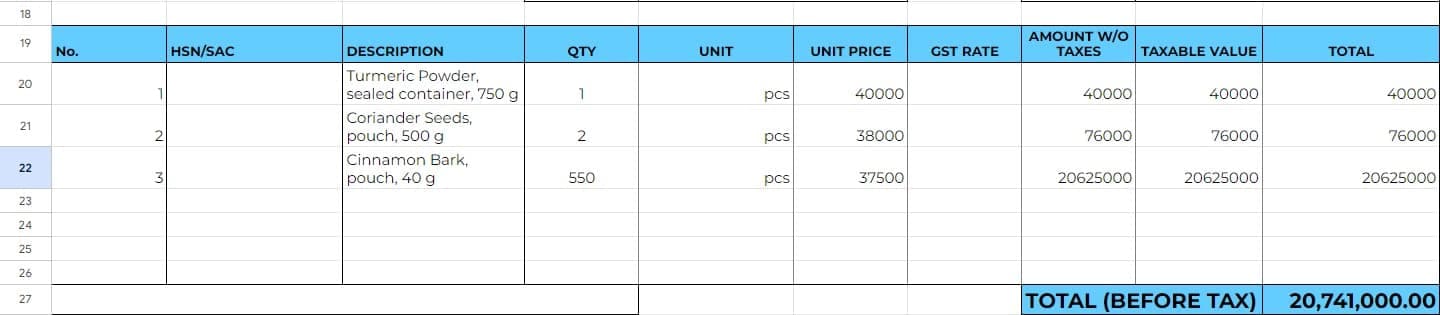

Step 4: List the Items or Services Sold

- Description of goods/services

- Quantity and unit

- Unit price

- HSN/SAC code

- Applicable GST rate

- The template will auto-calculate tax amounts and totals

💡 Formula for calculation: Tax Amount = (Quantity x Unit Price − Discount) × GST rate

Step 5: Add Discounts, Totals, and Signature

- Enter any item-level or invoice-level discounts

- Confirm the taxable value and the total payable amount

- Add your signature or digital signature

- Review before printing or emailing

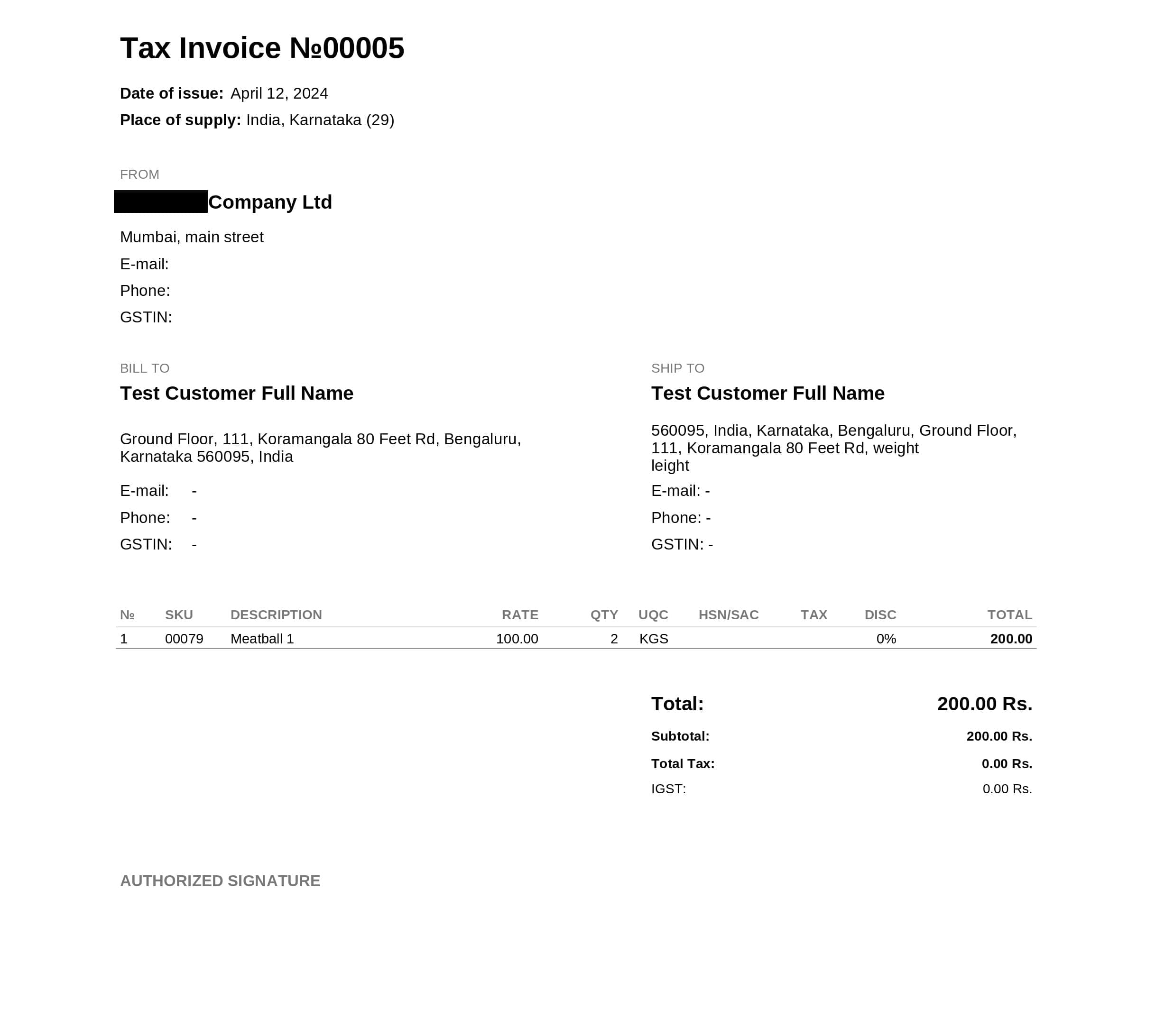

Free GST Invoice Template Downloads

Ready to skip the guesswork and get straight to invoicing? Below are fully editable GST invoice templates in multiple formats. Each is designed to help you stay compliant, save time, and work from any device.

1. GST Invoice Format in Excel

- Comes with built-in formulas to auto calculate CGST, SGST, IGST, and total

- Simply enter quantity, rate, and GST % and the rest is automated

- Customizable for item-level or invoice-level discounts

- Best for retailers, traders, and anyone doing bulk invoicing

✅ Works on desktop Excel or Excel Mobile App

2. GST Invoice Template in Word

- Easy to insert logos, change fonts, or format sections

- You can manually enter tax amounts

- Lightweight and printable

- Best for freelancers, consultants, and service providers

☑️ Compatible with MS Word mobile or Google Docs

3. GST Invoice Format in Google Sheets

- 100% cloud-based and mobile-friendly

- Built-in formulas, just like Excel

- Easy sharing with clients or team members

- Best for remote teams, startups, and mobile-first businesses

☑️ Use on Android, iPhone, or browser, no setup needed

Recommended Read: Looking for more invoice formats? Check these out:

Why Kladana Is Better Than a Static GST Format

Templates are a great starting point, but they still require manual effort. Every time you raise an invoice, you must enter customer details, recheck formulas, and ensure that nothing is overlooked.

That’s where Kladana ERP takes over.

It automates the entire GST invoicing process, syncing your inventory, orders, and customers, so that you don’t have to repeat tasks or worry about errors.

🔄 Manual GST Template vs Kladana ERP Automation

| Feature | GST Invoice Template (Excel/Word) | Kladana ERP GST Invoicing |

Auto-fetch buyer/seller details |

❌ Manual entry |

✅ Pulled from contact records |

GST tax calculations |

⚠️ Formulas (editable) |

✅ Auto calculated and locked |

❌ None |

✅ Auto-sync with stock levels |

|

Duplicate prevention |

❌ Need manual checks |

✅ Auto-generated serial numbers |

Report generation |

❌ Separate step |

✅ Instant reports and GSTR ready |

Mobile Invoicing |

⚠️ Limited |

✅ Fully mobile ERP dashboard |

Audit Trial |

❌ Not traceable |

✅ Fully trackable + User logs |

⚡ Create Smarter GST Invoices, Not Just Formats

Skip the Excel hassle — Generate GST Invoices Instantly in Kladana

How to Create Your GST Invoice Template

If you’re the kind of person who likes building things your way, you don’t have to rely on downloads. You can create your own GST invoice template in Excel or Word.

Step 1. Make a Copy of the Template

Open Google Sheets, head to the File menu → Make a copy → Rename the spreadsheet the way you need.

Step 2: Set Up the Top Section

Start with the basics: your business name, logo, and contact details. Then add these must-haves:

- Invoice Title: Call it Tax Invoice

- Unique invoice number

- Date

- Your GSTIN

📌 You can even reserve a corner for your brand’s stamp or digital sign

Step 3: Add the Buyer’s Details and Place of Supply

Now move to the buyer’s section to include:

- Buyer’s name and address

- Their GSTIN (If applicable)

- Place of supply

📌 If you’re selling across states, this line matters for your GST return.

Step 4: Build the Item Table

In the item table, add all the sales details line by line:

- Item or service description

- HSN/SAC code

- Quantity rate

- Taxable value

- GST % (5%, 12%, 18%)

- CGST, SGST, IGST (Split based on supply)

- Line total

🧮 If you’re in Excel, add these formulas:

- To calculate taxable value = Quantity × Rate

- To calculate 9% CGST or SGST = Taxable Value × 0.09

- To calculate Invoice total = Sum (All line totals)

Step 5: Add GST Break Up and Grand Total

Once you’ve listed the items, calculate the tax:

- Split GST into CGST, SGST, or IGST

- Display tax amounts clearly

- Show the total invoice value

☑️ This section ensures the invoice meets the GST structure and avoids mismatches

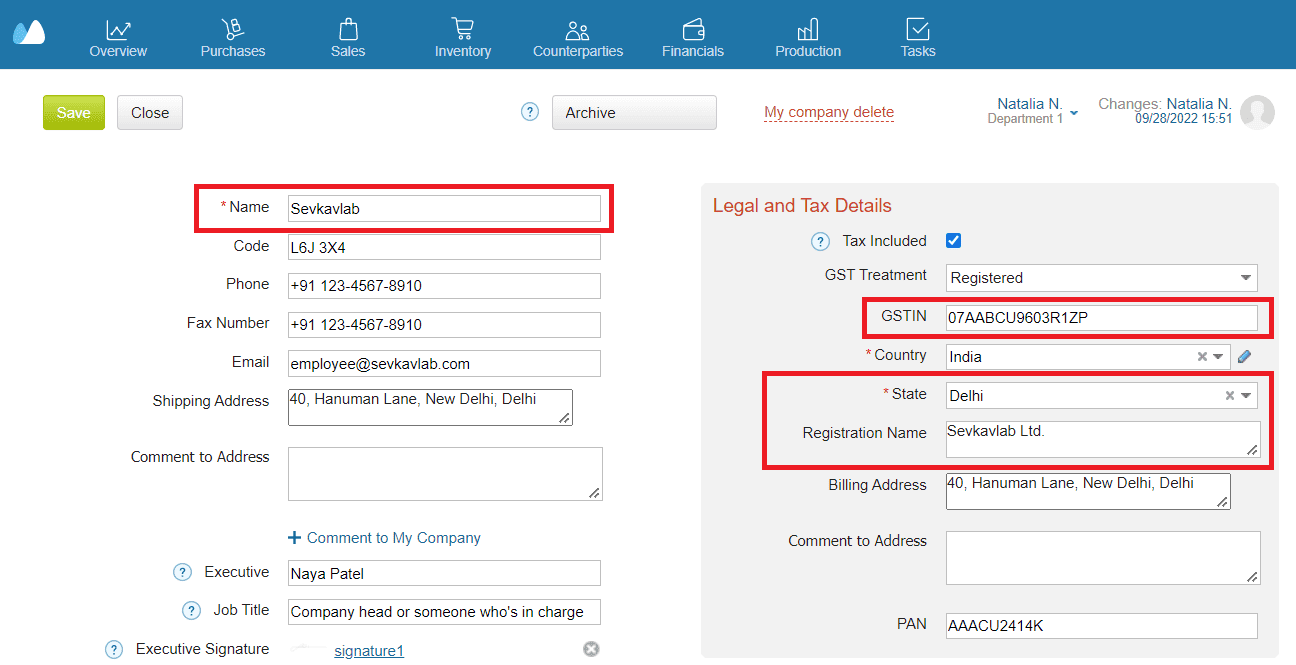

Step 6: Fill Out Your Business Details

Scroll back to the top-left section to complete your seller information:

- Legal business name

- Full address

- Phone number and email

- Registered GSTIN

📌 These fields are legally required and must match your GST registration certificate

Step 7: Wrap It Up Like a Pro

In the bottom section, add:

- Total invoice value

- A note for terms, due date, or bank details

- Your signature or digital certificate

- Optional: QR code or IRN if you’re e-invoicing

Step 8: Polish and Lock It

Give your invoice a clean, protected layout:

- Use bold fonts, border lines, and shading for clarity

- Lock your formulas so they don’t get overwritten

- In Google Sheets, protect cells and use dropdowns for tax rates

📌 Tip: Save it as a master copy and edit It easily on your phone using mobile excel or Google sheets.

Recommended Read: Get more free templates to manage your sales — no credit card needed:

🧩 DIY Tutorial: How To Label, Format, and Automate Your GST Template

Once you’ve followed the step-by-step guide above. Here’s how to enhance your template for efficiency, clarity, and error prevention

🔤 Label All Fields Clearly

Use bold text and top alignment for all header fields:

- Tax Invoice (merged and centered in A1:G1)

- Seller Details (A3-A6)

- Buyer Details (E3-E6)

- Invoice Metadata (A8-C9)

- Item Table Headers in Row 11: Item, HSN, Qty, Rate, etc

- Tax Summary: Bold + Shaded (Row 25+)

☑️ Tip: Use a light gray background to distinguish total rows and tax fields

🧮 Apply Useful Formulas

In Excel or Google Sheets, use these formulas inside the item table:

| Field | Formula Example |

Taxable Value |

= C12*D12 |

CGST (9%) |

= E12*0.09 |

SGST (9%) |

= E12*0.09 |

IGST (18%) |

= E12*0.18 |

Line Total |

= E12+G12+H12 |

Invoice Total |

= Sum (J12:J24) |

☑️ Tip: Extend these formulas down 10-20 rows to handle multiple items

🎛️ Add Dropdowns for GST Rates

To avoid typing errors:

| In Google Sheets | In Excel |

Select the GST% column |

Select Cells |

Go to data ➞ data validation |

Data ➞ data validation |

Criteria ➞ List of items: 5%, 12%, 18%, 28% |

Enter: 5%, 12%, 18%, 28% |

Show dropdown & reject invalid entries |

🧱 Format with Borders and Shading

- Apply thin borders around all item cells

- Use bold+shaded cells for totals and headers

- Align: left text fields (item description, buyer name)

- Align right text: amounts and rates

- Freeze row 1 to keep headers visible

🔏 Protect Formula Cells

| In Google Sheets | In Excel |

Right calculated cells |

Select formula cells ➞ Format cells ➞ Protection ➞ Lock |

Right click ➞ Protect range ➞ Set Permissions |

Then go to Review ➞ Protect Sheet to activate |

☑️ Tip: Leave input fields (like quantity, rate) unlocked for easy use

Summary

GST invoicing isn’t just a tax formality. It’s a daily part of doing business in India. From getting the format right to applying the correct tax rates and codes, a well-structured invoice helps you avoid compliance issues and keeps your operations running smoothly.

Start by standardizing your process with clear, editable templates. As your invoicing load grows, move beyond spreadsheets. Automating with tools like Kladana ERP can reduce manual processes, minimize errors, save time, and make your entire billing workflow faster and audit-ready.

Frequently Asked Questions on GST Invoice Templates in Excel and Word

What is a GST Invoice, and why is it important?

A GST invoice is a tax document that a registered seller issues when supplying goods or services under the Goods and Services Tax system in India. It includes critical details such as GSTIN, HSN/SAC code, tax breakdown, and place of supply. A proper GST is necessary for the buyer to claim ITC and for the seller to stay compliant with GST laws.

Who is required to issue a GST Invoice?

Any person or business registered under GST must issue a GST invoice when making a taxable supply of goods or services. This applies to manufacturers, traders, service providers, freelancers, e-commerce sellers, and exporters. Even under reverse charge or ISD mechanisms, GST invoicing is mandatory.

Can I issue a GST invoice to an unregistered customer?

Yes. If your buyer is unregistered, you must still issue a GST invoice. The only exception is for B2C supplies under ₹200 per invoice, where you may issue a consolidated invoice at the end of the day. In all other cases, even unregistered buyers must be given a proper invoice.

What’s the difference between a regular invoice and a GST Invoice?

A regular invoice may display item and price details but lacks GST-specific fields, such as GSTIN, HSN/SAC, and tax split. A GST invoice, on the other hand, is structured by Rule 46 of the CGST and is legally required for claiming input tax credit. If you want to stay compliant and help your buyers claim GST, use the correct GST format.

Is there a minimum invoice amount for issuing a GST Invoice?

There is no minimum value threshold for issuing a GST invoice. If you are registered under GST and supply taxable goods or services, you must issue an invoice, regardless of the amount. For very small transactions, a consolidated amount is allowed.

How should I invoice exports under GST?

For exports, you must issue a GST invoice mentioning “Supply meant for export under bond or Letter of Undertaking. You also need to include the destination country and shipping address. Export invoices must follow the same mandatory rules under Rule 46, but are treated as having a zero supply rate under Section 16 of the IGST Act.

Can I use Excel or Google Sheets to create GST invoices?

Yes. You can use editable templates in Excel or Google Sheets to generate GST-compliant invoices, provided they include all mandatory fields, such as GSTIN, Invoice number, HSN/SAC codes, and accurate tax calculations.

Are discounts allowed in GST invoices?

Yes. Both pre-tax and post-tax discounts are allowed under GST. These must be shown clearly on the invoice. GST should be calculated on the net taxable value after discounts, and the discount terms should ideally be part of the contract or mentioned on the invoice.

What if I issue a wrong or incomplete GST invoice?

Issuing an incorrect invoice can result in penalties and complications for your buyer when claiming input tax credit. If the mistake is minor, you can issue a revised invoice. For changes in value or quantity, use a credit note or debit note. All corrections should be appropriately recorded and reflected in your GSTR-1 returns.

How can I automate GST Invoicing instead of using templates?

Manual templates are fine for one-off use, but automation saves time and reduces errors. Software like Kladana ERP allows you to auto-generate GST-compliant invoices, apply the correct tax rules, fetch party and item details, and even track them in real-time. It’s ideal for growing businesses that want to scale without losing control over compliance.

List of Resources

- GST Act: Rule 46 of the CGST Rules, Section 16 of the Act

- GST Rules: Indian Tax Law

Read‑alikes

Sales Report Templates: Tips, Examples, and 4 Free Downloads in Excel, Word, PDF, and Google Sheets

Bill Book Format PDF: Free Downloadable Templates for Mobile and Tax Invoices

How To Create a Quotation Format In Excel, That’s GST Ready, Error-Free, and Built for Scale

Quotation Format In Word: Free Templates for Freelancers, SMEs & MSMEs, Step-By-Step Guide

Sales Report Templates: Tips, Examples, and 4 Free Downloads in Excel, Word, PDF, and Google Sheets