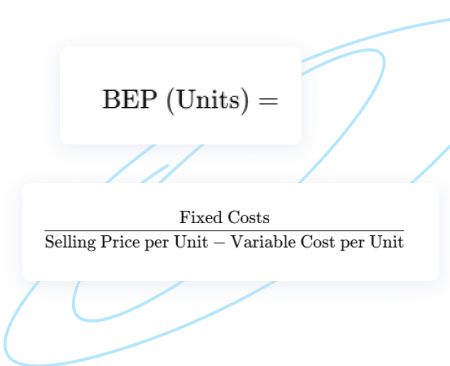

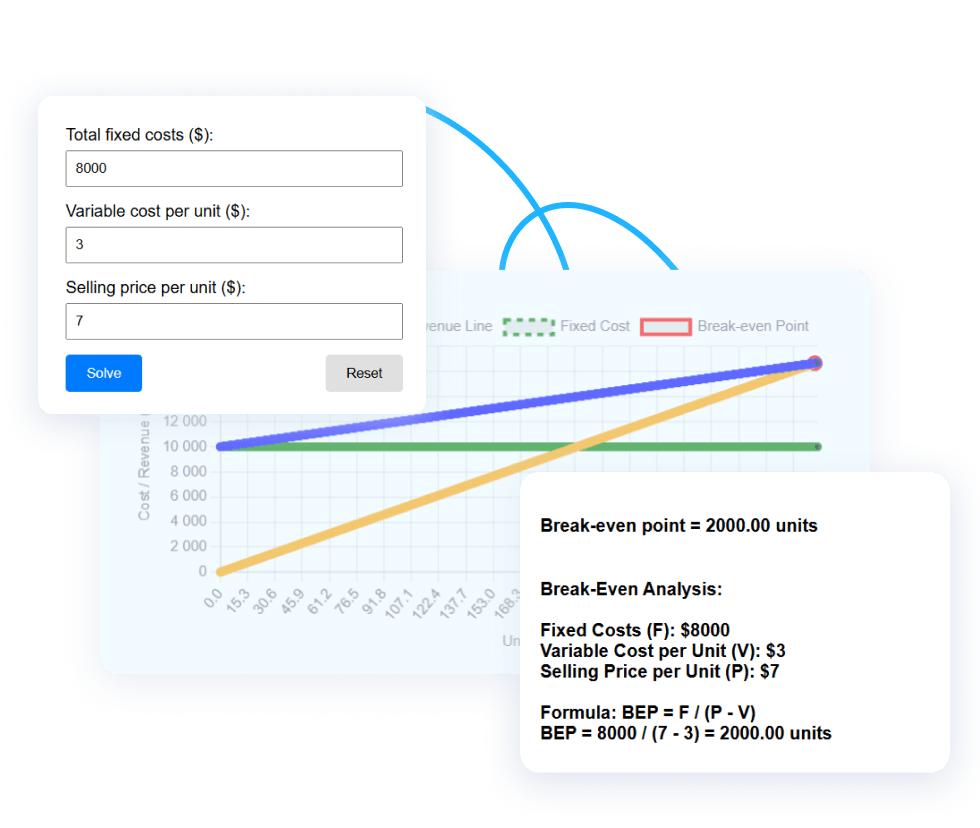

1. Enter your total fixed costs (in dollars).

Break Even Point Calculator

How to Use the Calculator

2. Enter the variable cost per unit.

3. Enter the selling price per unit.

4. Click "Solve" to see your break‑even point.

5. Use "Reset" to clear the fields and start again.

How You Can Benefit from the Calculator

🥗 Small Food Manufacturing

Task: Figure out how many batches to sell to cover rent, equipment, and staff.

Example: Fixed costs = $8,000 (rent, salaries), variable cost = $3 per jar, selling price = $7.

BEP: 8,000 ÷ (7 − 3) = 2,000 jars.

How it helps: Plan production volumes to ensure costs are covered before scaling up.

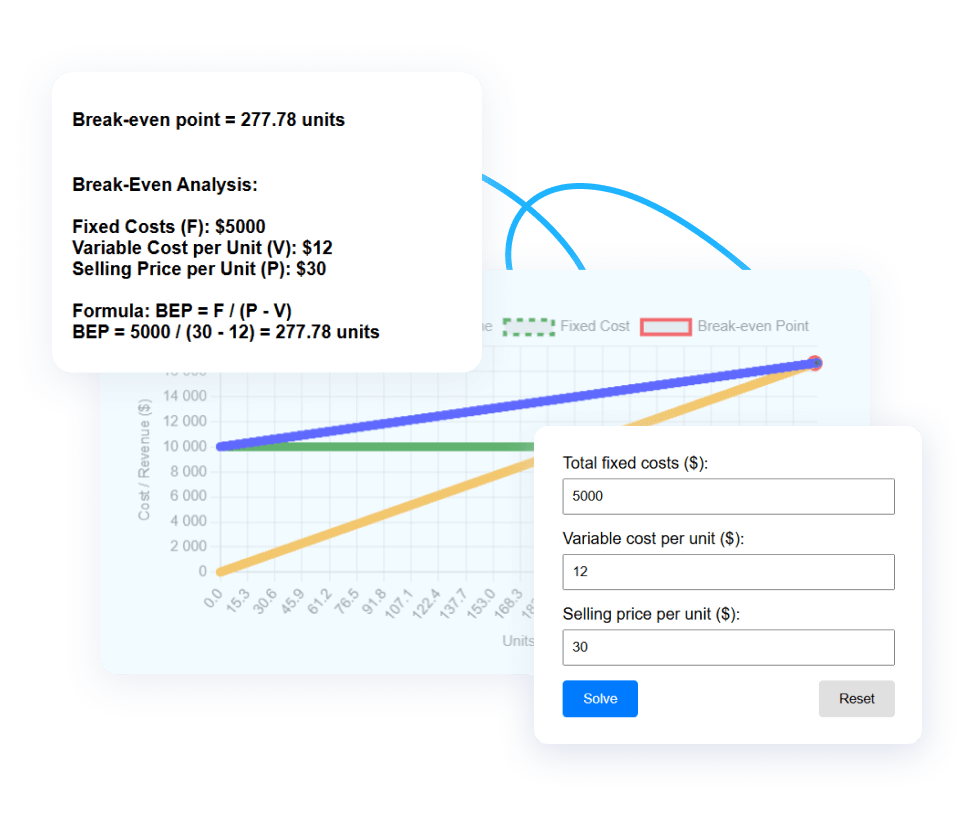

👕 Clothing Online Store

Task: See how many orders you need each month to pay for ads, storage, and returns.

Example: Fixed costs = $5,000 (ads, platform fees), variable cost = $12 per item (production, shipping), selling price = $30

BEP: 5,000 ÷ (30 − 12) = 278 orders.

How it helps: Set realistic monthly sales targets and adjust pricing or ad spend.

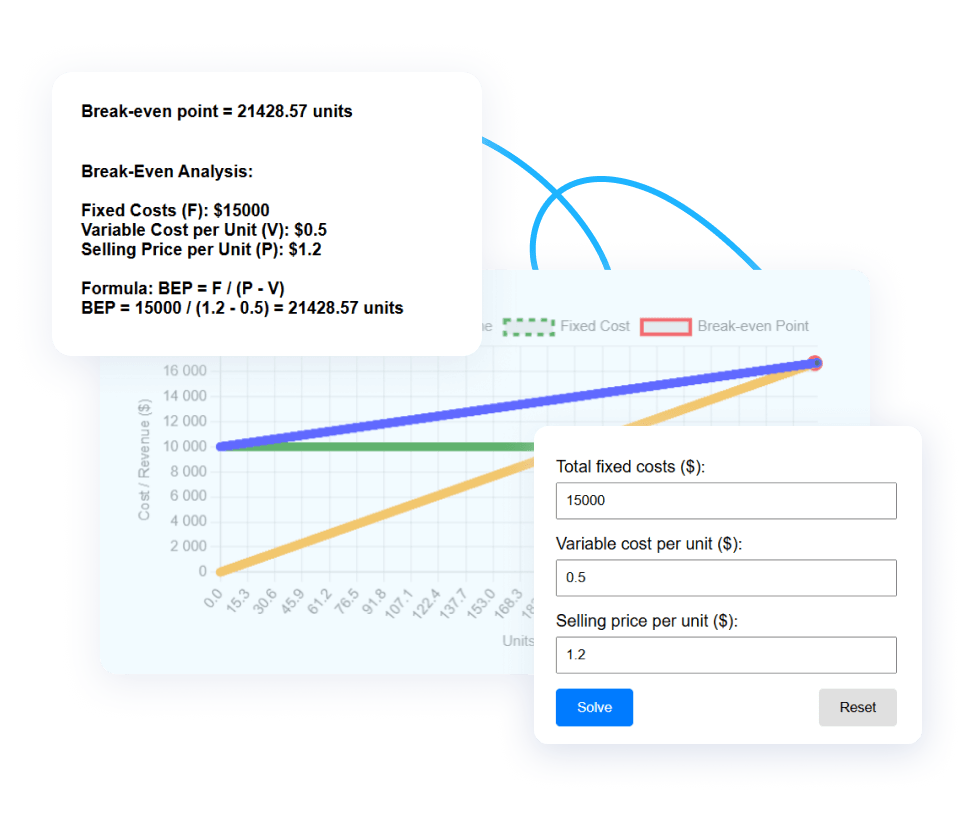

📦 Wholesale Packaging

Task: Know the order volume required to offset bulk purchase and warehouse costs.

Example: Fixed costs = $15,000 (warehouse, staff), variable cost = $0.50 per unit (materials), selling price = $1.20.

BEP: 15,000 ÷ (1.20 − 0.50) = 21,429 units.

How it helps: Plan minimum order quantities (MOQs) for B2B clients and pricing tiers.

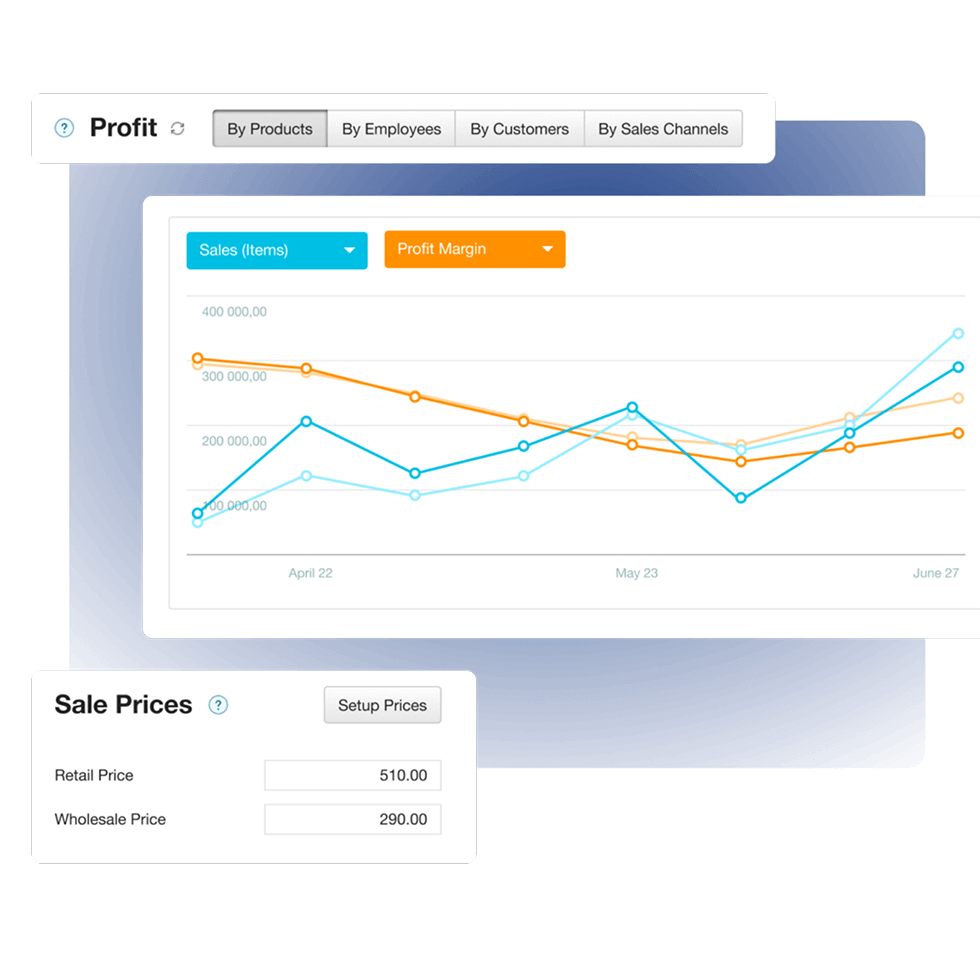

Get Full Financial Visibility

Tired of guessing where your money goes? With Kladana, you see every dollar — from cash flow to profit and loss — while managing stock, sales, and invoices in one place.

- Track cash flow in real time: know what’s coming in and going out

- View profit and loss reports instantly — no spreadsheets needed

- Monitor receivables and payables to avoid late payments

- Keep your team aligned with accurate, up‑to‑date numbers

Start with our forever free plan or take a 14‑day full‑access trial.

Frequently Asked Questions about Break Even Point Calculator

Break‑even point is the sales volume where revenue equals cost, resulting in no profit or loss.

It helps you see when profit begins and supports better pricing and cost decisions.

Yes. As long as you can estimate fixed and variable costs per service unit.

- Fixed costs: Rent, salaries, insurance, equipment.

- Variable costs: Materials, packaging, shipping, commissions.

The calculator will show that you can’t break even. You’ll need to raise prices, cut costs, or both.

It provides an estimate based on the data you enter. For detailed financial planning, consult with an accountant.

- Reduce fixed costs (e.g., renegotiate rent).

- Lower variable costs (e.g., bulk discounts).

- Increase selling price if the market allows.

This calculator is designed for a single product. For multiple products, calculate BEP separately for each or use a weighted average.

Learn how to arrange business routines for manufacturing, wholesale, retail & e‑commerce