Running a business means constantly buying goods and services to keep operations moving. But purchasing is only half of the equation. Every request, order, delivery, invoice, and payment adds up to what finance and procurement teams call the procure-to-pay (P2P) process.

For small and mid-sized businesses, this cycle can shape cash flow, compliance, and supplier relationships. A delayed purchase order or mismatched invoice can easily lead to bottlenecks, hidden costs, or strained vendor trust.

This guide explains what the P2P process is, how the cycle works step by step, and why automation is becoming essential. Whether you are managing $5,000 in monthly purchases or $500,000, understanding P2P is the first step toward running procurement efficiently and paying suppliers on time. Let’s get to the details.

- Understanding the Procure-to-Pay (P2P) Process

- Key Steps in the P2P Process

- Common Challenges in Manual P2P

- Benefits of Automating the P2P Cycle

- P2P and Accounts Payable

- P2P Process Best Practices for SMEs

- P2P Process vs O2C Process

- Conclusion: Why SMEs Should Automate P2P

- FAQs on Procure-to-Pay Process (P2P)

Understanding the Procure-to-Pay (P2P) Process

Before diving into the individual steps, let’s start by defining what the procure-to-pay process actually means and why it holds such importance for businesses.

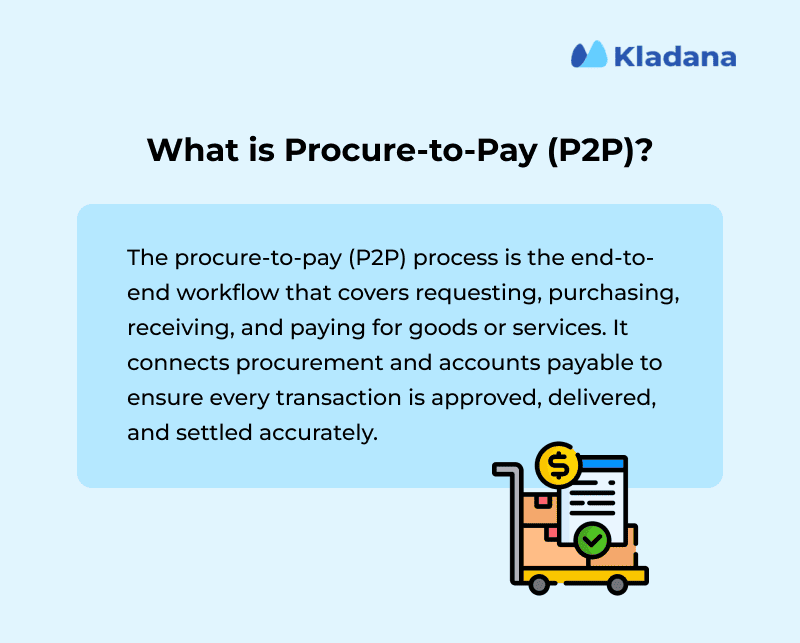

What is Procure-to-Pay (P2P)?

The procure-to-pay (P2P) process is the workflow businesses use to request, purchase, receive, and pay for goods or services. It begins with a purchase requisition and ends with supplier payment.

P2P combines procurement and accounts payable into a single cycle, ensuring that every order is authorized, fulfilled, and accurately paid. For SMEs, a well-structured P2P cycle prevents overpayments, reduces errors, and builds trust with suppliers.

Why It Matters for Businesses

Efficient P2P directly impacts cash flow and cost control. These are the reasons why most businesses have adopted P2P:

1. Controls costs: Manual invoice processing can cost $15 to $40 per invoice, while automation brings it below $5.

2. Saves money at scale: A company handling 2,000 invoices per year can save more than $50,000 by automating.

3. Improves compliance: Ensures adherence to tax rules such as India’s GST, TDS, or EU VAT, reducing audit risks.

4. Strengthens supplier relationships: Timely and accurate payments build trust and secure long-term vendor partnerships.

5. Enhances efficiency: Streamlined approvals and fewer errors shorten the procurement cycle and improve cash flow visibility.

📑 Automate Your P2P Cycle with Ease

Kladana simplifies purchase orders, invoice matching, and vendor payments — so you can spend less time on paperwork and more on growing your business.

- Auto-generate POs from approved requisitions and track every approval

- Run 3-way matching for POs, GRNs, and invoices to cut out errors

- Manage vendor payments with built-in GST compliance and scheduling

- Monitor spend patterns and vendor performance with real-time dashboards

➡️ Explore our Purchase Management Module

Difference Between P2P and O2C (Order-to-Cash)

P2P and O2C represent two sides of the same transaction. P2P covers the buyer’s perspective: starting with a requisition and ending with supplier payment. O2C is the seller’s perspective: beginning with a customer order and ending when payment is collected.

For example, when a retailer issues a purchase order (P2P), that same document triggers the supplier’s O2C process. Both cycles need to align so that goods, invoices, and payments flow smoothly between buyer and seller.

Key Steps in the P2P Process

The procure-to-pay process may look straightforward on paper, but every step plays a critical role in keeping operations smooth. For SMEs, missing just one control can mean delayed shipments, duplicate invoices, or strained cash flow. Here’s how the P2P cycle in procurement typically unfolds.

1. Purchase Requisition

The cycle begins when a team identifies a need. A purchase requisition is raised to formally request goods or services, often including specifications, quantity, and expected timelines.

In smaller businesses, this could be as simple as the store manager requesting printer cartridges, while in manufacturing, it might involve detailed input like material grades and part dimensions.

Approvals are essential at this stage to ensure the request is necessary and budgeted. Without them, companies risk maverick spending.

2. Purchase Order

Once approved, procurement converts the requisition into a purchase order (PO). This document becomes the contract with the supplier, setting clear terms on pricing, delivery, and conditions.

A PO protects both buyer and seller, providing a record in case of disputes. For example, if an SME orders $20,000 worth of raw materials, the PO ensures the supplier cannot later inflate prices or alter terms. Automated systems like Kladana can generate POs directly from requisitions, saving time and reducing the chance of manual entry errors.

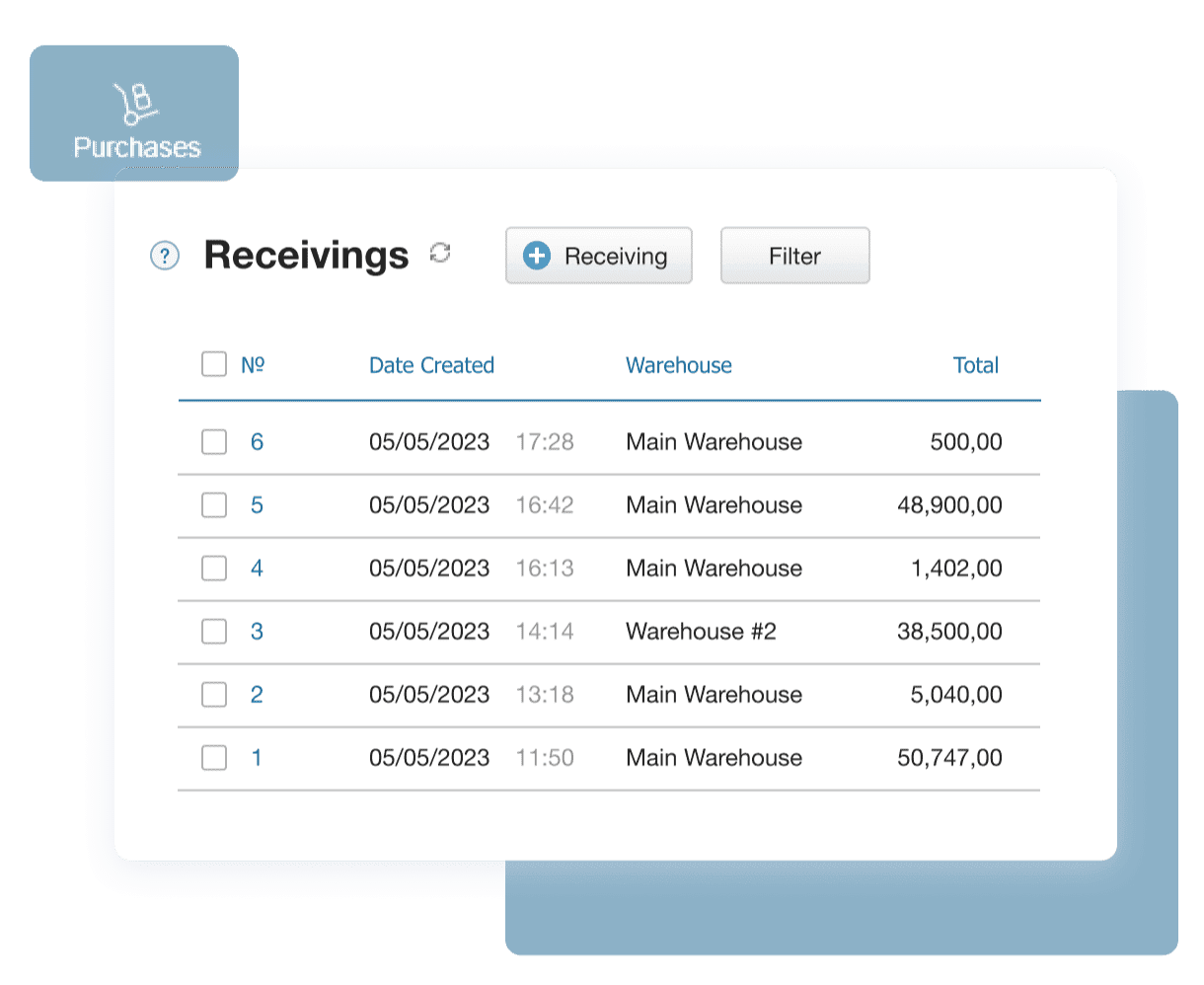

3. Goods Receipt

When goods arrive, the receiving team checks them against the PO. This step is critical to avoid paying for items not delivered or accepting poor-quality stock.

Imagine a company ordering 1,000 packaging boxes but receiving only 950, or worse, half of them being damaged in transit. Logging these exceptions into a Goods Receipt Note (GRN) prevents overpayment and flags suppliers with recurring quality issues. In retail or e-commerce, even small lapses here can disrupt fulfillment schedules.

4. Invoice Verification

Suppliers send invoices referencing the PO. Accounts payable then verifies the invoice using a three-way match: comparing the invoice, the PO, and the GRN. Some industries, such as pharmaceuticals or aerospace, add a fourth check with inspection reports.

This step prevents overbilling, duplicate payments, or fraudulent claims. Research shows manual invoice errors affect more than 3 percent of transactions, but automation can reduce this significantly. For SMEs, even a single duplicate payment of $5,000 can disrupt working capital, making this step non-negotiable.

5. Payment Processing

Once verification is complete, payments are scheduled as per agreed terms. This might mean a 30-day credit cycle, milestone-based payments, or immediate settlement for smaller vendors.

Electronic transfers are now the norm, with ACH and virtual cards offering speed and security over traditional checks. For Indian SMEs, this stage also requires GST compliance and TDS deductions. In the EU, businesses must follow VAT rules, while in the US, companies need to account for state-specific sales and use tax requirements.

Timely payments strengthen supplier relationships, while delayed ones can lead to penalties or loss of credit terms.

📘 Recommended Read: Payment processing is just one part of a larger puzzle. To see how automation can improve the entire cycle from requisitions to approvals, read our guide on business process automation. It breaks down how technology reduces delays, prevents errors, and keeps everything moving without constant manual follow-ups.

Common Challenges in Manual P2P

Even when the steps of a procure-to-pay cycle look straightforward, running them manually often creates more problems than solutions. Paper forms, scattered spreadsheets, and disconnected teams can easily slow the process down. Below are the most common challenges businesses face.

Long Procurement Cycles

Approvals stuck in email chains or paper files can stretch a simple purchase into weeks. For SMEs, delays in sourcing raw materials or spare parts can halt production altogether.

On average, invoice approval in manual setups averages 8–10 days, while automated workflows cut this to less than 3. A small manufacturer waiting on bearings worth $2,000 could lose far more in downtime than the cost of the order itself.

Duplicate or Missing Invoices

Paper-based systems often lead to lost invoices or the same invoice being processed twice. For a company handling 1,000 invoices annually, even a 2% duplicate rate means 20 payments made in error.

That is money tied up unnecessarily and often difficult to recover. Missing invoices are just as damaging, causing strained supplier relationships and late fees.

Misalignment Between Procurement and Warehouse

When procurement teams order goods without syncing with warehouse staff, mismatches occur. A warehouse may not have space for deliveries, or incoming stock may not match actual requirements.

For example, ordering 500 units of packaging material when only 200 are needed clogs storage and locks up cash that could be used elsewhere. Lack of coordination often results from disconnected systems and manual reporting.

High Risk of Errors and Fraud

Manual entry of data into POs, GRNs, and invoices increases the risk of typos, overbilling, or even deliberate fraud. SMEs are particularly vulnerable since they often lack dedicated compliance teams. Simple controls like three-way matching are harder to enforce when processes are paper-based.

Lack of Real-Time Visibility

With spreadsheets and siloed tools, procurement leaders often have no clear picture of what is ordered, what is received, and what is pending payment. This lack of visibility affects cash flow forecasting and supplier negotiations.

A business may unknowingly over-order materials already in transit or delay payments because invoices cannot be tracked. Automated dashboards solve this, but manual P2P leaves decision-makers operating in the dark.

Benefits of Automating the P2P Cycle

Shifting from spreadsheets and paper files to automated procure-to-pay systems changes the entire procurement experience. Automation cuts out repetitive tasks, speeds up approvals, and gives finance leaders accurate, real-time data to work with. Here are the key advantages.

Faster Approvals and Reduced Cycle Times

Manual approvals can stretch a requisition into a week-long process. With automation, requests are routed digitally to the right approvers in sequence, with reminders for pending actions. A business processing 500 requisitions per month can cut cycle time from 7 days to less than 2, ensuring materials arrive when needed.

Automatic Three-Way Matching (PO, GRN, Invoice)

Three-way matching is one of the most critical controls in procurement. Automated systems instantly compare purchase orders, goods receipt notes, and invoices to ensure they align.

This prevents overbilling, short shipments, and fake invoices from slipping through.

For example, if a supplier invoices $10,500 while the PO was $10,000, the discrepancy is flagged before payment is processed. In sectors like pharmaceuticals and manufacturing, this level of control is vital for compliance.

🧮 Check Profitability Alongside Your P2P Cycle

Not sure if your current purchasing prices and volumes really cover the costs? Try Kladana’s Break-Even Point Calculator:

- Enter fixed and variable costs plus your selling price

- Instantly see the break-even point in units and revenue

- Model different scenarios (discounts, price changes, supplier terms)

- Use the insights to support purchasing decisions and margin control

Fewer Errors and Duplicate Payments

Data entry errors and duplicate invoices are common in manual workflows. Studies show nearly 3% of invoices have errors, which can cost businesses thousands in overpayments.

Automation detects duplicates instantly and eliminates most manual input. For an SME handling $1 million in annual purchases, even avoiding a 2% error rate means protecting $20,000 in working capital.

Better Compliance and Audit Trails

Regulatory compliance is non-negotiable. In India, GST invoices and TDS deductions must be tracked carefully, while EU companies need VAT compliance and US firms must meet SOX standards.

Automated P2P solutions record every action, like who raised a requisition, who approved, when goods were received, and how payments were processed. This creates a complete audit trail, reducing compliance risks and simplifying external audits.

Real-Time Inventory and Cash Flow Visibility

Perhaps the biggest advantage is visibility. Automated dashboards show what has been ordered, what is pending delivery, and what payments are scheduled. Finance teams can forecast cash flow accurately, while procurement can plan based on actual stock levels.

For example, a retail SME can see that packaging supplies worth $15,000 are in transit and delay reordering, freeing up cash for seasonal purchases. Suppliers also benefit, as they get clearer payment timelines.

📘 Recommended Read: Real-time dashboards give you spend visibility, but it’s your cash flow from operating activities that tells you whether your business can actually fund those purchases. Learn how to calculate and interpret OCF, and why it matters more than net profit when it comes to short-term financial health and decision-making.

P2P and Accounts Payable

Accounts payable (AP) is not just the last step of the procure-to-pay cycle, it is the checkpoint where procurement decisions directly affect cash flow and compliance. For SMEs, connecting P2P with AP is what turns purchasing activity into financial accuracy.

Role of Finance in P2P

Finance teams ensure that every payment leaving the business is justified, documented, and compliant. Their role includes verifying invoices, applying tax rules, and scheduling payments according to terms.

For example, in India, finance teams must validate GST invoices and apply TDS deductions, while US firms handle 1099 reporting and SOX checks. Without AP oversight, businesses risk duplicate payments, late fees, or tax penalties.

How AP Automation Integrates With Procurement

Modern AP systems integrate seamlessly with procurement platforms, turning approvals, invoices, and payments into a single digital flow.

When POs and GRNs are already logged in the system, AP automation can instantly perform three-way matching, flag discrepancies, and route invoices for approval.

Payments can then be scheduled electronically, reducing cycle time from weeks to days. This frees staff from manual entry so they can focus on vendor negotiations or forecasting.

Impact on Working Capital Management

A tightly run P2P-AP cycle gives businesses better control over cash outflows. Real-time visibility into pending invoices and scheduled payments helps finance leaders optimize working capital.

For example, an SME may choose to pay a supplier early to secure a 2 percent discount on a $50,000 invoice, saving $1,000 instantly. On the other hand, visibility into future liabilities ensures the company avoids liquidity crunches.

With automation, finance teams can also analyze vendor payment patterns and align them with cash inflows from customer receivables.

P2P Best Practices for SMEs

Small and mid-sized businesses often lack the resources to recover from procurement mistakes. Following a few structured procure-to-pay process best practices ensures that every purchase is well-documented, approved on time, and fully traceable.

Standardize Documentation

Standard templates for requisitions, POs, GRNs, and invoices reduce confusion and make it easier to audit records. Using a consistent PO format ensures suppliers always include item codes, tax details, and delivery timelines. This eliminates back-and-forth emails and prevents disputes later.

Use Digital Approval Workflows

Email approvals are slow and prone to being missed. A digital workflow routes requests to the right stakeholders automatically, with built-in reminders and escalation if delays occur. SMEs processing 200 requisitions monthly can save days of waiting simply by replacing email trails with automated routing.

Integrate Procurement With Inventory/ERP

When procurement runs in isolation, businesses risk overstocking or stockouts. Integrating procurement with inventory and ERP ensures real-time stock visibility and cost tracking. For instance, if an apparel SME sees fabric stock falling below the threshold in its ERP, the system can auto-trigger a requisition, keeping production uninterrupted.

Train Staff on Compliance and Automation

Technology only delivers results when staff know how to use it. Regular training helps employees understand compliance requirements (GST, VAT, TDS) and use automation effectively.

For example, accounts teams trained on three-way matching software can spot mismatched invoices instantly rather than relying on manual checks. Ongoing sessions also prepare teams for regulatory updates and new system features.

P2P Process vs O2C Process

Although procure-to-pay (P2P) and order-to-cash (O2C) are distinct cycles, they represent two sides of the same transaction. The buyer’s P2P process triggers the supplier’s O2C process, which means close alignment is critical for smooth operations.

Key Differences between P2P and O2C

| Feature | P2P (Procure-to-Pay) | O2C (Order-to-Cash) |

| Focus | Centered on acquiring goods or services needed to run the business. The buyer manages requisitions, approvals, and payments. | Centered on selling goods or services to customers. The seller manages orders, fulfillment, and collections. |

| Department | Typically driven by procurement and finance teams who ensure spending is authorized and compliant. | Typically managed by sales and finance teams who ensure revenue is booked and payments are collected. |

| Cycle Start | Begins when an employee raises a purchase requisition for goods or services. | Begins when a customer places an order for products or services. |

| Cycle End | Concludes when the supplier is paid and the transaction is reconciled in accounts payable. | Concludes when customer payment is received and posted in accounts receivable. |

In practice, these processes are tightly linked. A purchase order raised in the buyer’s P2P cycle becomes the sales order that triggers the supplier’s O2C cycle. Likewise, the supplier’s invoice in O2C feeds directly into the buyer’s P2P process for verification and payment.

Conclusion: Why SMEs Should Automate P2P

Manual P2P systems slow down growth. They leave gaps in visibility, increase the risk of errors, and make your business reactive instead of ready. Automating procure-to-pay brings structure to spending, clarity to cash flow, and confidence to supplier relationships.

As more businesses shift to cloud-first procurement, automation is becoming the new baseline, not a luxury. Tools that connect finance, procurement, and inventory in real time help you avoid surprises, improve compliance, and make better decisions with less effort. Whether you’re chasing early payment discounts or managing tight margins, a digital P2P setup gives you the control to do more with less.

Now is the time to stop plugging gaps and start building a process that scales with you.

Take Control of Every Purchase, Payment, and Approval

Kladana brings procurement, payments, and inventory together in one platform. Cut delays, track vendor spends, and make smarter buying decisions — without juggling multiple systems.

FAQs on Procure-to-Pay Process (P2P)

Here are quick answers to the most common questions about the procure-to-pay (P2P) process.

What does P2P stand for in procurement?

P2P stands for procure-to-pay. It is the end-to-end process of requesting, ordering, receiving, and paying for goods or services.

What are the main steps in the P2P cycle?

The cycle includes purchase requisition, purchase order, goods receipt, invoice verification, and payment processing. Each step ensures accuracy and accountability.

What is the difference between P2P and O2C?

P2P covers the buyer’s journey from requisition to supplier payment. O2C covers the seller’s journey from receiving a customer order to collecting payment.

Why is 3-way matching important in P2P?

It compares the purchase order, goods receipt, and supplier invoice to prevent overbilling, duplicate payments, or fraudulent invoices.

How does automation improve procure-to-pay?

Automation speeds up approvals, ensures accurate matching, reduces manual errors, and provides real-time visibility into spend and cash flow.

What role does accounts payable play in P2P?

Accounts payable in P2P process validates invoices, ensures compliance with tax rules, and processes supplier payments according to agreed terms.

What are common P2P process challenges?

Common issues include long procurement cycles, missing or duplicate invoices, lack of visibility, and misalignment between procurement and warehouse teams.

How does P2P differ from Source-to-Pay?

P2P focuses on transactions after a supplier is chosen, while Source-to-Pay includes supplier identification, negotiation, and contracting before procurement begins.

Can small businesses implement P2P automation?

Yes. Cloud-based tools make automation affordable, helping SMEs streamline approvals, match invoices automatically, and stay compliant without large IT investments.

What KPIs measure P2P efficiency?

Key metrics include average cycle time, invoice processing cost, rate of duplicate payments, supplier on-time payment percentage, and compliance with approval policies.