If you run a small business, freelance, or handle accounts, creating professional invoices is part of your daily routine. Instead of paying for expensive software, you can rely on the tax invoice format in Excel to prepare legally compliant bills that work for GST, VAT, or simple billing needs. Excel provides complete flexibility to design invoices as you want, while keeping them free and easy to use.

In this guide, you’ll not only get free downloadable Excel tax invoice templates but also learn how to customize them for your own business. Whether you need a GST invoice format in Excel, a VAT Invoice template in Excel, or a simple Excel billing template, you’ll find ready-to-use formats and clear steps to create one yourself. By the end, you’ll know how to save these as reusable templates and convert them into professional invoices your clients can trust.

- What Is a Tax Invoice?

- Why Use Excel for Tax Invoices?

- Key Elements of a Tax Invoice

- Tax Invoice Format in Excel

- Free Excel Tax Invoice Templates

- How to Create a Tax Invoice in Excel (Step-by-Step)

- Customizing Your Excel Tax Invoice

- Advantages & Limitations of Using Excel for Tax Invoices

- Excel vs Accounting Software for Tax Invoices

- Smarter Alternative — Automated Invoicing Tools

- Native Integration: Kladana Invoicing Features

- To Sum Up

- Frequently Asked Questions on Tax Invoice in Excel

- List of Resources

What Is a Tax Invoice?

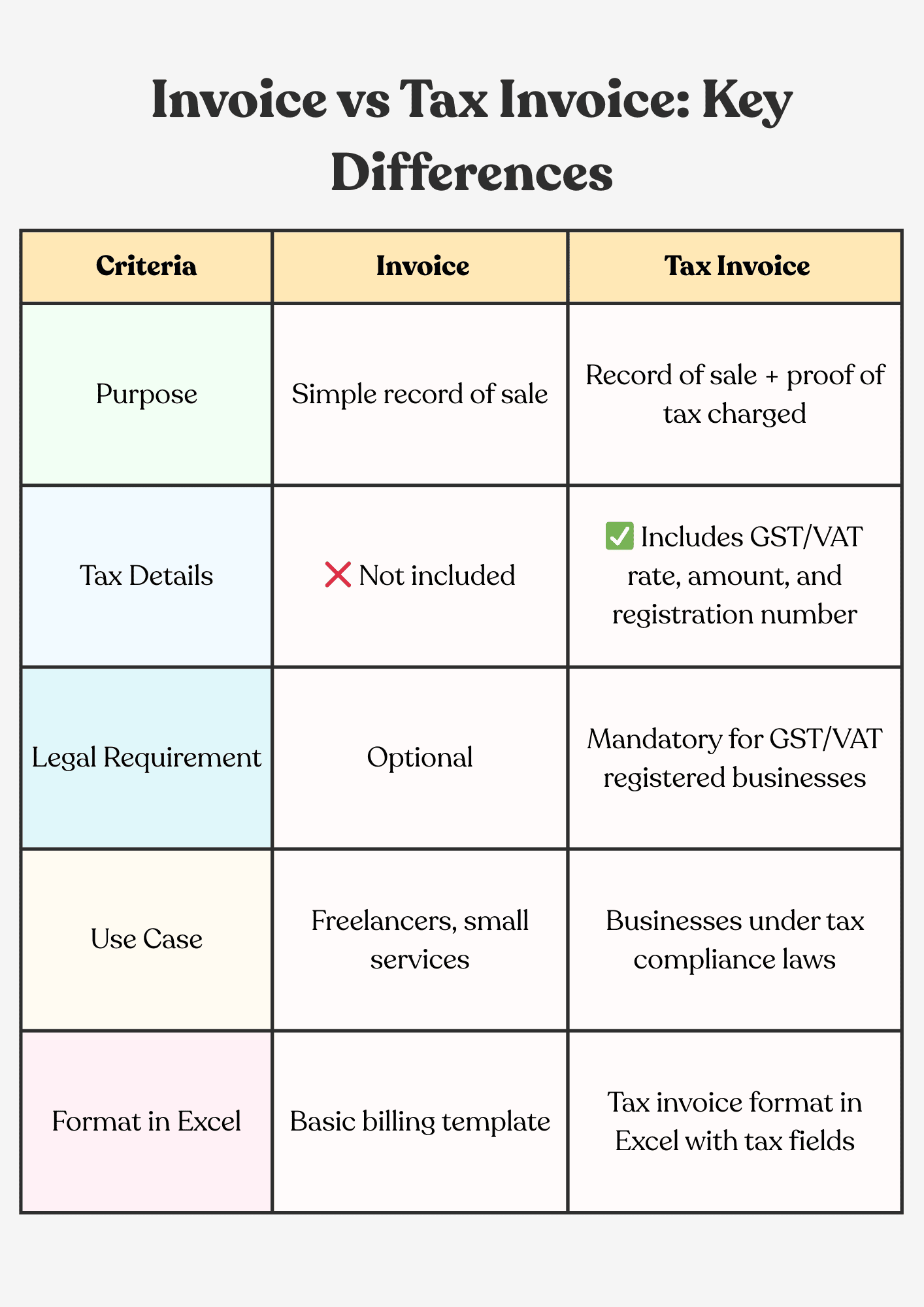

A tax invoice is an official document that records the details of a sale, including the tax charged. You use it to show your customers what they’re paying for, and it helps tax authorities verify your business transactions.

The key difference between a regular invoice and a tax invoice is the inclusion of tax details. A simple invoice typically lists only the product or service and its corresponding price. A tax invoice, on the other hand, must display applicable taxes, such as GST in India or VAT in different countries.

For your business, issuing a proper tax invoice isn’t just good practice; it’s a compliance requirement. If you’re registered under GST in India, you must generate a GST-compliant invoice that includes fields like GSTIN, HSN/SAC codes, and the correct tax split (CGST, SGST, or IGST). Similarly, if you’re in a VAT region, your invoice must show the VAT registration number and rate.

Why Use Excel for Tax Invoices?

If you don’t want to invest in expensive accounting software right away, using the tax invoice format in Excel is the smartest choice. Excel is not only free and accessible, but also flexible enough to meet the invoicing needs of most small businesses.

Here’s why it works so well for you.

Free and Accessible Tool

Excel is available on almost every computer, and you can even use it in Google Sheets as an alternative. This makes it cost-effective for startups and small businesses.

Customizable Fields and Layouts

You can design your invoice exactly how you want. Add columns for GST or VAT, insert your logo, or use formulas to auto-calculate taxes.

Easy for Small Businesses not Using ERP

If you’re not ready for an ERP or invoicing software, Excel can serve as a professional yet straightforward billing solution. You can save your life, convert it to PDF, and send it directly to clients.

📖 Recommended Read: GST Invoice Template: Download Free Formats in Excel, Word & Google Sheets

Key Elements of a Tax Invoice

When you create a tax invoice format in Excel, you need to make sure it includes every mandatory detail. Missing fields can make your invoice non-compliant and create problems during GST or VAT audits.

Here are the key elements you must add:

🏢 Seller details: Business name, address, and tax registration number (GSTN/VAT)

🧑💼 Buyer details: Customer’s name, address, and GSTIN/VAT if applicable

🔢 Invoice number & date: A unique serial number and the issue date of the invoice

📦 Item description: Product or service details, HSN/SAC codes (if required)

💲 Quantity & price: Unit, rate, and total value before tax

💰 Tax rate & tax amount: CGST, SGST, IGST (For GST) or VAT% and calculated tax

📊 Total & grand total: Subtotal + tax = final payable amount

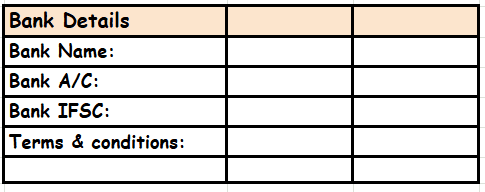

📅 Payment terms: Due date, payment mode, and bank details if needed

✍️ Signature or digital seal: Optional, but adds authenticity

🚀 Download templates or create error-free invoices with Kladana

Send polished, professional invoices without complex setup

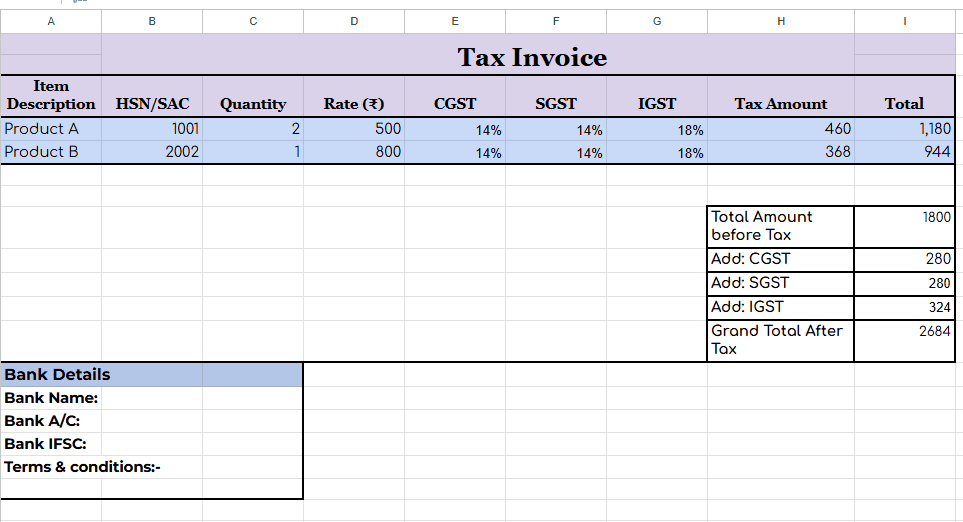

Tax Invoice Format in Excel

When setting up a tax invoice format in Excel, it is helpful to follow a clear structure. This way, you don’t miss any mandatory fields, and your invoices look professional every time.

Free Excel Tax Invoice Templates

Here are three ready-to-use formats you can download and customize. Each one is built for a specific business scenario.

1. GST Invoice Format in Excel

- Seller and Buyer GSTIN — Shown at the top so that both parties are legally identified

- HSN/SAC codes — Helps classify goods or services as per GST rules

- Tax Split (CGST/SGST/IGST) — Automatically separates state and interstate taxes

- Breakdown before total — Keeps the invoice transparent for audits and ITC claims

👉 Update 2025: GST e-invoicing is now mandatory if your turnover exceeds ₹5 crore. Businesses below this limit can continue using Excel invoices.

2. VAT Invoice Template in Excel

- VAT registration numbers — Both seller and buyer numbers included for compliance

- Net, VAT%, Gross Total — Each row shows how VAT is calculated step by step

- Region-specific format — Works for UK, UAE, EU, and other VAT-based regions

- Clear for customers — makes it easy for clients to see the exact tax charged

📌 VAT compliance note: Invoicing rules, including VAT IDs, Tax rates, and cross-border compliance, are mandatory. EY’s Worldwide VAT, GST & Sales Tax Guide (2025) confirms these requirements in 150+ jurisdictions worldwide. You can also check the full PDF or an overview.

3. Simple Billing Template in Excel

- No tax columns — perfect if your business isn’t GST or VAT registered

- Basic fields only — Invoice number, date, seller/buyer details, items, and totals

- Quick setup — Easy to fill in and send without extra compliance steps

- Professional Look — Even without tax, your invoice still looks neat and client-ready

How to Create a Tax Invoice in Excel (Step-by-Step)

Instead of downloading from different websites, you can set up your own Invoice format in Excel in just a few steps.

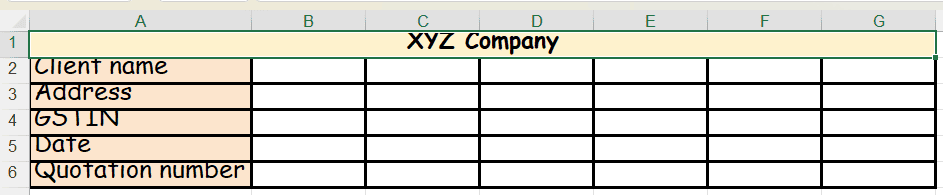

1. Open a New Excel Sheet

Start with a blank workbook and set the orientation to portrait for a standard invoice layout.

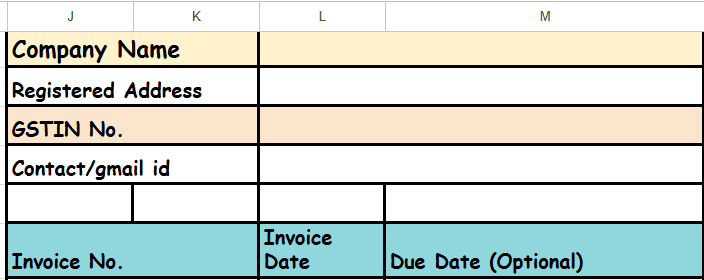

2. Add Business Details at the Top

Enter your company name, address, and GSTIN/VAT number. You can also insert your logo for branding.

3. Insert Buyer Details

Create fields for customer name, address, and GSTIN/VAT if applicable.

4. Create Invoice Header Fields

Add columns for Invoice Number and Date. These should stay at the top right of your sheet.

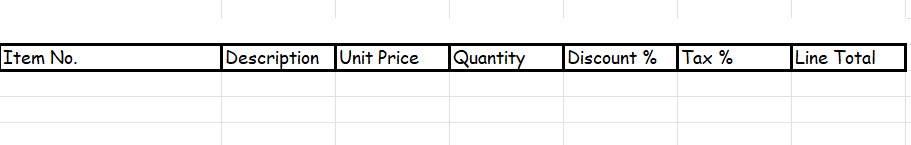

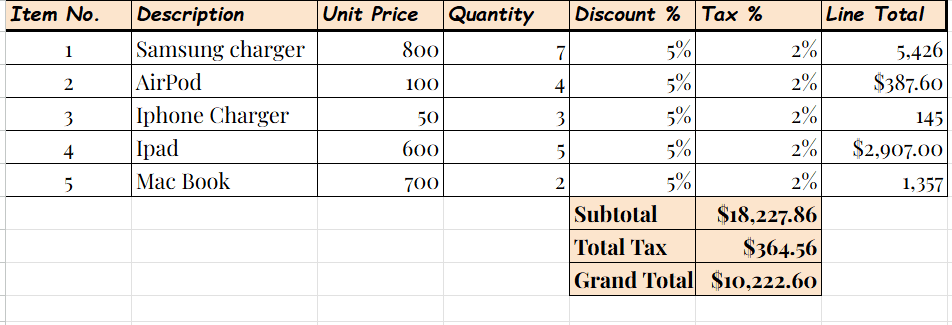

5. Build the Item Table

Set columns for item description, HSN/SAC, Quantity, Rate, Tax %, Tax amount, and total.

6. Add Formulas for Automation

Use Excel formulas to auto-calculate totals:

- = Quantity x Rate for line totals

- = Line Total x Tax % for tax amounts

- = Sum (Total column) for subtotal and grand total

7. Insert Payment Details

Add your bank details, due date, or payment terms to the bottom

8. Format for Professionalism (Formatting Tips)

- Merge cells for invoice header and titles

- Apply borders around the item table

- Bold the totals row

- Adjust column widths for readability

- Set a print area and page layout for clean PDF export

9. Save as a Reusable Template

Go to Save As ➡️ Excel template (.Xltx). This way, you can open it every time you need a new invoice without overwriting old ones.

10. Export as PDF

When ready, save or export the file as a PDF to share securely with clients.

📖 Recommended Read: Invoice Templates for Excel: Free Downloads, Formats & When to Use Them

Customizing Your Excel Tax Invoice

Once you have built the basic tax invoice format in Excel, you can make it more professional and efficient with a few customizations.

Add Company Branding

Once you have built the basic tax invoice format in Excel, you can make it more professional and efficient with a few customizations.

Automate Invoice Numbering

Use Excel formulas or macros to auto-generate the following invoice number instead of typing it manually each time.

Insert Advanced Formulas

Beyond totals, you can add formulas for discounts, shipping charges, or rounding-off values. This reduces manual errors.

Convert Excel Invoice to PDF

Use “save as” or “Export” so you can send a secure, uneditable version to your clients.

Create Multiple Templates

Save versions for GST, VAT, and no-tax billing so you can quickly open the right one depending on the client.

Advantages & Limitations of Using Excel for Tax Invoices

| Advantages | Limitations |

| ✅ Free — No need to invest in additional software; Excel is already available on most devices | ❌ Error-prone — Manual typing and formulas can lead to calculation mistakes |

| ✅ Customizable — You can adjust the format, add branding, and create layouts for GST, VAT, or simple billing | ❌ Lacks automation — No recurring invoices, reminders, or reporting tools |

| ✅ Easy to use — Basic knowledge of Excel is enough to set up and manage invoices | ❌ No multi-user sync — Hard to collaborate since multiple people can’t edit the same file smoothly |

Excel vs Accounting Software for Tax Invoices

While a tax invoice format in Excel works well when you’re starting, you might outgrow it as your business scales. Here’s how Excel compares with accounting or invoicing software.

| Criteria | Excel Tax Invoice | Accounting Software |

| Cost | Free (already included in most systems) | Paid subscription (monthly or yearly) |

| Customization | You can control layout, formulas, and branding | Limited to built-in templates |

| Automation | Manual entry, manual updates | Auto-calculations, auto-reporting, recurring invoices |

| Compliance | Manual updates when GST/VAT rules change | Built-in compliance updates (GST/VAT ready) |

| Multi-user access | Difficulty in sharing files can cause version issues | Cloud-based wit team collaboration |

| Best suited for | Freelancers, consultants, small businesses | Growing businesses, SMEs, enterprises |

📖 Recommended Read: How To Create a Quotation Format In Excel, That’s GST Ready, Error-Free, and Built for Scale

Smarter Alternative — Automated Invoicing Tools

While using the tax invoice format in Excel is suitable for beginners, it has its limits. If you’re sending many invoices every month, cloud-based invoicing tools save you time and reduce errors.

| Criteria | Excel Tax Invoice | Cloud Invoicing Tools |

| Setup | Manual — you design and maintain your template | Ready-made templates, updated automatically |

| Automation | Limited — you type and calculate everything yourself | Auto-calculations, recurring invoices, and payment reminders |

| Compliance | You must update the GST/VAT rules manually | Rules and formats updated as per the latest tax laws |

| Accessibility | File-based, offline, hard to share with the team | Cloud-based, accessible from anywhere, real-time sync |

| Scalability | Best for low Invoice volumes | Handles hundreds or thousands of invoices seamlessly |

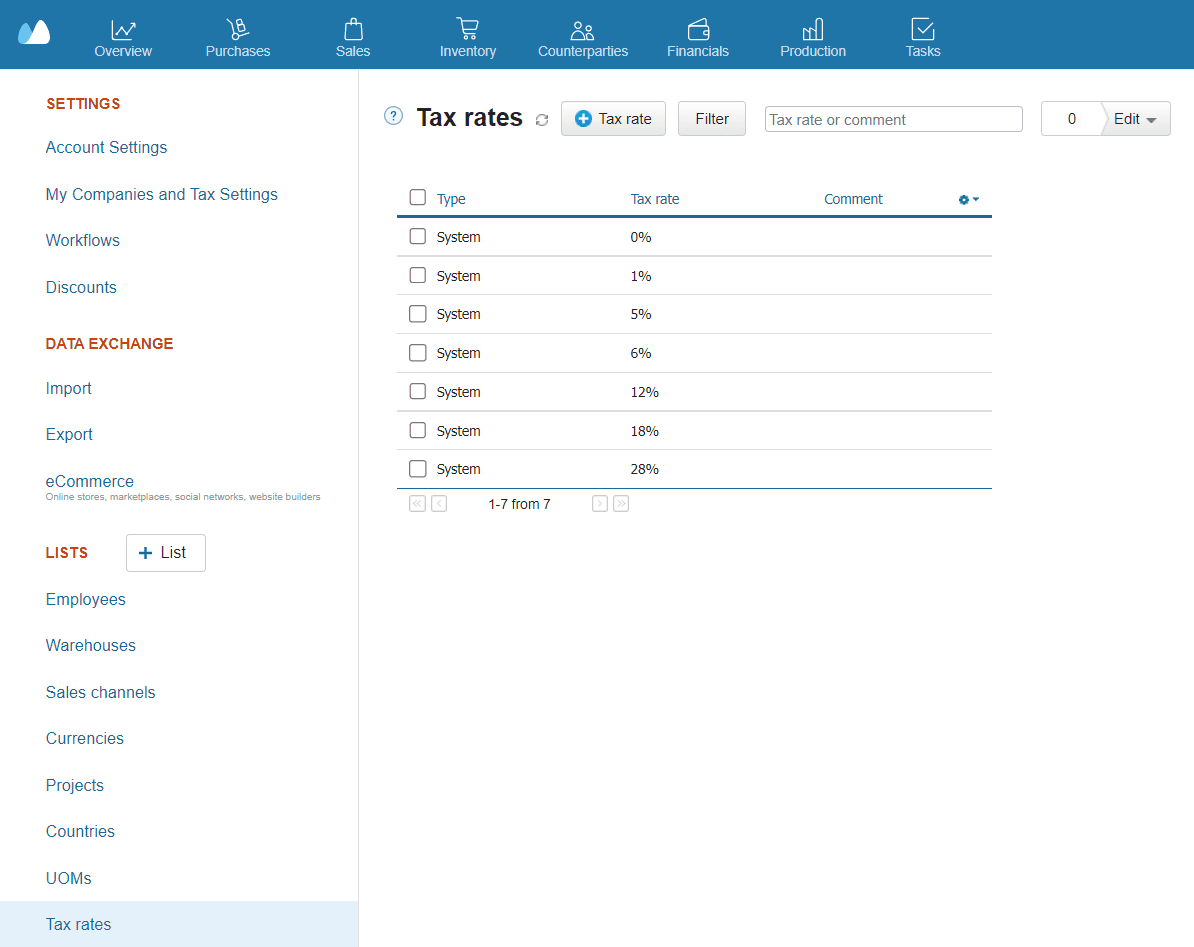

Native Integration: Kladana Invoicing Features

- Automatically applies GST calculations in Sales/Tax Invoices when your company and item settings (GSTIN, HSN/SAC) are configured correctly.

- Allows exporting invoice and sales data for offline use or sharing

- Ensures tax rules (rates, HSN/SAC) are applied based on your settings, reducing the chances of miscalculations. You view invoices and status via dashboards, making the tracking easier.

🚀 Stop fixing Excel formulas — switch to automated GST invoicing

Say goodbye to manual edits and mismatched tax columns

To Sum Up

Using a tax invoice format in Excel gives you a free, customizable, and professional way to stay compliant with GST or VAT rules while keeping invoicing simple. You can download ready-made templates, build your own with formulas, or customize layouts to match your business needs.

However, Excel has its limits. It can be error-prone, lacks automation, and isn’t a deal when your invoice volume grows. With GST-compliant invoicing, real-time tax rules, and integrated dashboards, you avoid manual mistakes and scale your invoicing process with ease.

Frequently Asked Questions on Tax Invoice in Excel

What is the correct format for a GST invoice in Excel?

A GST invoice in Excel must include the seller and buyer details, invoice number and date, HSN/SAC codes, GSTIN, item description, quantity, rate, tax %, and amount, as well as the total value.

Can I download a free tax invoice template in Excel?

Yes. You can download free tax invoice templates in Excel for GST, VAT, or simple billing formats. These are customizable and can be reused as needed.

What details must be included in an Indian GST invoice?

An Indian GST invoice must display the GSTIN of the seller and buyer, HSN/SAC codes, place of supply, tax split (CGST/SGST or IGST), Invoice number, date, and the total invoice value.

How do I auto-calculate GST in Excel invoices?

Use Excel formulas like = Amount x GST % for tax calculations and = Subtotal+Tax for totals. You can also create reusable templates with built-in GST formulas.

Is an Excel Invoice legally valid under GST?

Yes. Excel Invoices are valid as long as they include all mandatory GST fields. You can print them or export them as a PDF to issue to customers.

How do I create a VAT Invoice in Excel?

Set up columns for item description, net amount, VAT %, VAT amount, and gross total. Add the seller’s and buyer’s VAT registration numbers at the top.

Can I customize Excel Invoices for multiple tax rates?

Yes. You can separate columns for different tax rates and use formulas to calculate each tax amount separately.

What is the difference between a bill of supply and a tax invoice?

A tax invoice includes tax details, whereas a bill of supply is issued when no tax is charged for exempt goods/services, or for composition scheme taxpayers.

How long must I keep GST invoice records in India?

As per the GST law, you must keep invoice records for at least 6 years from the date of filing annual returns.

Can I use Excel Invoice templates internationally?

Yes. Excel supports customization for multi-currency, VAT, or sales tax formats, allowing you to adapt the template for different countries.

List of Resources

- GST Update: E-invoicing update 2025

- EY: VAT Guide

- EY: Worldwide report on VAT and Guide 2025

Read‑alikes

Sales Report Templates: Tips, Examples, and 4 Free Downloads in Excel, Word, PDF, and Google Sheets

Bill Book Format PDF: Free Downloadable Templates for Mobile and Tax Invoices

How To Create a Quotation Format In Excel, That’s GST Ready, Error-Free, and Built for Scale

Quotation Format In Word: Free Templates for Freelancers, SMEs & MSMEs, Step-By-Step Guide

Sales Report Templates: Tips, Examples, and 4 Free Downloads in Excel, Word, PDF, and Google Sheets