In the logistics and transport industry, billing errors are more common than many realize. A study by AFS Logistics after checking nearly 250,000 of the less-than-truckload (LTL) invoices found that approximately 4.5% of them contain errors, with 42.8% of these due to inaccurate accessorial charges.

Mistakes in various types of financial documents often stem from manual data entry, missing tax and counterparties details, or unclear billing formats. Such errors not only delay payments but can also result in penalties and loss of trust. That’s why every logistics or trucking business needs a clear and professional way to bill for their services.

Creating your own billing documents from scratch can be time-consuming. That’s why having ready-made templates like a transport bill format in Excel, transport bill format in Word, or even a transport bill format PDF makes sense.

This article provides easy-to-use, GST-compliant simple transport bills for free download. You’ll learn about the essential parts every transport bill must have. You’ll also discover best practices to make your billing accurate, professional, and efficient.

- What is a Transport Bill?

- Essential Components of a Transport Bill Format

- Transport Bill Book Format: What You Need to Know

- Free Transport Bill Format Downloads

- How to Create a Transport Bill in Excel or Word

- Best Practices for Transport Billing

- Frequently Asked Questions on Transport Bills

- List of Resources

What is a Transport Bill?

Transport companies can’t work without clear paperwork. One of the most important documents is a transport bill — it proves that a delivery service was provided and shows how much it cost.

Definition and use in logistics and freight services

A transport bill is a document used to charge for transportation services. It’s common in trucking, courier, and logistics companies. This bill shows who is sending the goods, who is receiving them, what is being transported, and how much the service costs.

A clear and correct transport bill helps both the service provider and the client. It keeps records tidy, shows tax details like GST, and confirms delivery details. It’s often shared with customers, accounts teams, or tax authorities.

This bill is also useful for freight brokers and truck owners. Many use a simple transport bill format to get payments faster or to maintain clean records. Field teams may keep a printed transport bill book with serial numbers to issue bills by hand.

Difference between transport bills and general invoices

A general invoice can be used for any goods or services. It may not include transport-specific fields like vehicle number, distance (in km), or delivery location.

A transport bill includes extra fields that matter in logistics. These could be driver name, loading point, destination, freight amount, and more. This makes it easier to manage route-based charges, fuel adjustments, and weight-based pricing.

✔️ To sum up: general invoices work for regular sales. Transport bills work for logistics businesses — they are built for movement-based transactions.

Simplify Inventory, Production, Purchases, and Sales with Kladana ERP

Kladana is an easy-to-use cloud ERP for small and medium businesses. Manage stock, track production, process sales and purchases, and keep your finances in order — all in one place.

- Inventory Management

Track stock in real time, manage warehouses, and control batch and serial numbers.

- Production Management

Plan production orders, calculate unit costs, and manage raw materials and finished goods.

- Sales and Purchases

Handle sales orders, purchase orders, and supplier management in one system.

- Multi-channel Selling

Sync sales and inventory with Shopify and other platforms to avoid stock mismatches.

- Accounting Integration

Connect with popular accounting solutions to automate financial records.

- CRM and Counterparty Management

Manage customer and supplier data with built-in CRM features.

- Flexible Pricing and Scalability

Start with an affordable plan and add features as your business grows.

- Reports and Analytics

Get clear reports on stock, sales, purchases, and production performance.

- Cloud-Based Access

Work from anywhere with a secure, online ERP solution.

Now you can automate daily tasks and avoid manual errors. Kladana grows with your business and offers flexible, affordable plans.

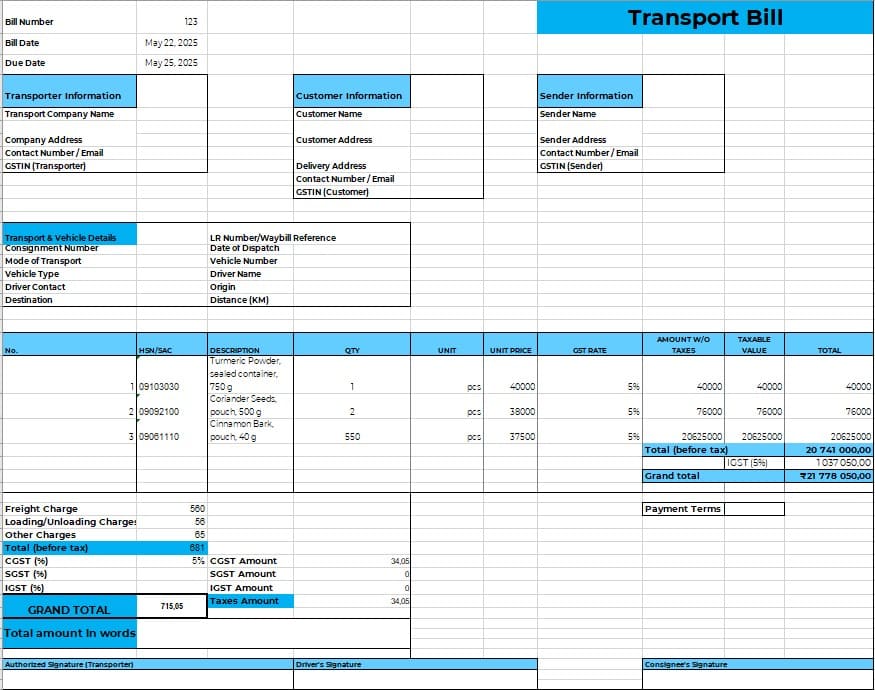

Essential Components of a Transport Bill Format

A professional transport bill format must include all the key details needed for billing, compliance, and delivery tracking. Whether you use a printed transport bill book format or a digital file like a transport bill format in Excel, these components stay the same.

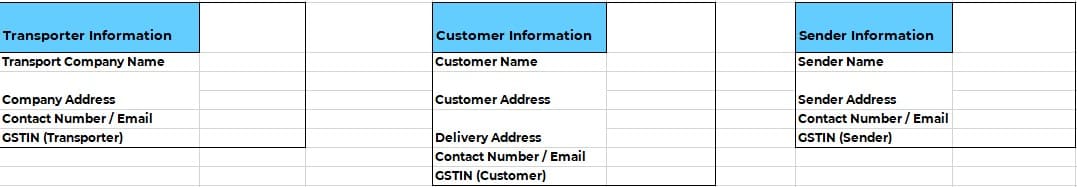

Transporter name and GST details

The transporter’s name, address, and contact number should be clearly written. If the company is registered under GST, include the GSTIN. This helps the buyer and seller claim input tax credit and stay compliant with Indian tax laws.

Consignor/consignee information

Mention who is sending the goods (consignor) and who is receiving them (consignee). Include full names, addresses, and phone numbers. This makes it easier to confirm delivery and helps avoid errors in shipping.

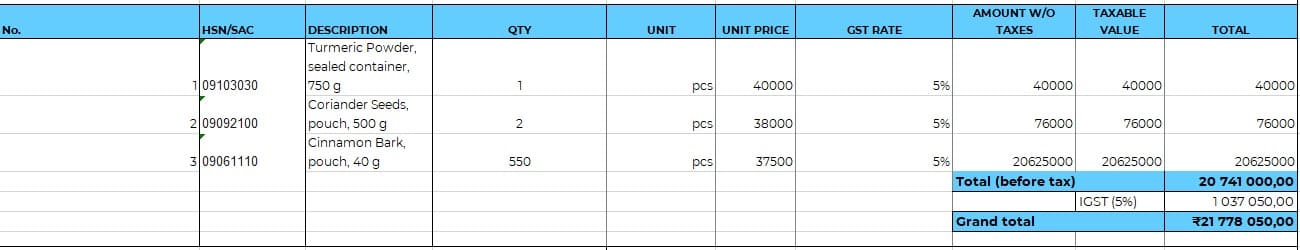

Goods description and quantity

List the items being transported. Include product names, item codes (if any), number of packages, total weight, and packaging type (e.g., boxes, pallets). This avoids confusion during unloading or inspection.

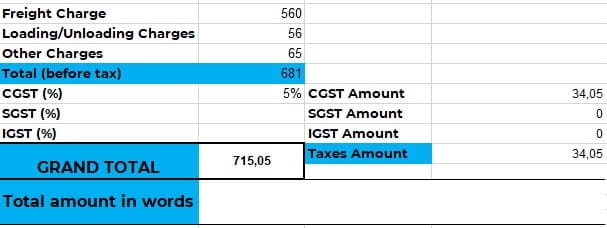

Freight charges, taxes, and total payable amount

Break down the cost: freight charges, loading/unloading fees, and any applicable taxes like GST. Mention the total amount payable. A simple transport bill format should make these charges easy to understand for all parties.

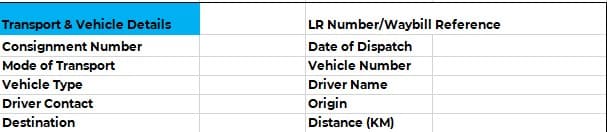

LR (Lorry Receipt) number or waybill reference

Every transport bill should include a unique reference number — like an LR number or waybill ID. This helps with tracking, customer queries, and proof of service.

✅ Transport Bill Checklist: What to Include

- Transporter Details

- Company Name

- Address

- GSTIN (if applicable)

- Contact Number

- Consignor (Sender) Details

- Name

- Address

- Contact Number

- GSTIN (if applicable)

- Consignee (Receiver) Details

- Name

- Address

- Contact Number

- GSTIN (if applicable)

- Bill Information

- Bill Number

- Date of Issue

- LR (Lorry Receipt) Number or Waybill Reference

- Transport Details

- Vehicle Number

- Driver Name

- Driver Contact

- Origin & Destination Points

- Distance (in KM)

- Goods Description

- Item Names

- Quantity & Units

- Weight (if applicable)

- Packaging Type

- Charges Breakdown

- Freight Charges

- Loading/Unloading Fees

- Taxes (GST: IGST/CGST/SGST)

- Other Charges (if any)

- Total Payable Amount

- Grand Total in Figures

- Amount in Words

- Signature Fields

- Authorized Signatory (Transporter)

- Driver’s Signature

- Consignee Acknowledgment (optional)

- Additional (Optional)

- QR Code for Tracking

- Terms & Conditions

- Payment Terms

Transport Bill Book Format: What You Need to Know

Many transport businesses still rely on paper-based billing systems. A transport bill book format is one of the most widely used options, especially in field operations where internet access is limited.

How traditional transport bill books work

A transport bill book format is a printed book with pre-numbered pages. Each page is a transport bill with space to fill in details like consignor name, goods, route, and charges. These books often have carbon copies — one page goes to the customer, and the other stays with the transporter.

Truck drivers and field staff often carry these books on the road. They fill out bills during loading or delivery. This method doesn’t need a computer or internet, so it’s still common in areas with low digital access.

When to use physical vs digital bill books

A physical transport bill book format is useful for small operators, remote routes, and cash-based transactions. It works best when billing needs to happen on the spot. But it has some limits — hard to edit, not easy to store, and prone to damage.

A digital format like a transport bill in Excel or a transport bill in Word is better for companies that manage many trips or need to send bills quickly by email. A transport bill format in PDF helps keep records clean and unchangeable.

✔️ TIP: you can use both. Write the bill by hand during delivery, then enter the same details into a digital file later. This way, you stay ready for audits and can track payments easily.

Download free Excel templates for:

- Inventory management

- Purchase orders

- GST billing

- E-Way bills

- Daily stock reports

- Bills of Materials

- Regular invoices

- Business operations reports

Customize them to suit your business requirements.

Free Transport Bill Format Downloads

Attention! This transport bill template was created according to GTS standards for 2025. Use the document with caution. It does not guarantee compliance with the current tax laws of your country.

Some fields in the document are filled in for example purposes only. You can delete them and enter your own data.

Many transport companies need ready-to-use billing formats that save time and reduce errors. Below are free templates in different formats. Pick the one that suits how you work — in the office or on the road.

Transport Bill Format in Excel

The transport bill format in Excel is perfect for companies that want to automate calculations. There are ready-to-use formulas for freight, tax, and totals, in this spreadsheet. It’s also easy to edit and duplicate for each new job.

💡 For your convenience, you can change the document orientation from portrait to landscape. To do this, go to the Print menu and select Landscape/Portrait Orientation.

Transport Bill Format in Word

The transport bill format in Word is great for those who need a clean, printable bill. You can enter details quickly, adjust text, and print or share the file without any extra setup.

Transport Bill Format in PDF

Use a transport bill format PDF when you want a fixed layout that no one can change. This version is best for sending final copies to clients or keeping a professional archive.

Simple Transport Bill Format for Quick Printing

Sometimes you just need a one-page simple transport bill format you can print fast. These are ideal for urgent jobs or when you’re billing on-site with a pen. They work well even without internet or software.

How to Create a Transport Bill in Excel or Word

You don’t need special billing software to make a professional-looking transport bill. With Excel or Word, you can build clear and accurate documents in just a few steps.

Step-by-step: setting up tables, tax fields, and total calculations

In Excel:

- Open a new sheet and create a header with your company name, GSTIN, and contact details.

- Add the same details for both customer and sender.

- Add fields for the bill number, date, LR number, and vehicle details.

- Insert a table with columns like: Description of Goods, Quantity, Rate, and Amount.

- Below the table, add rows for freight charges, loading/unloading charges, and GST.

- Use formulas like =SUM () to auto-calculate totals.

- Add a row for “Total Amount Payable/Grand Total” in bold.

In Word:

- Open a blank document and add your company header at the top.

- Use tables to structure the layout — one for shipment details, one for charges.

- Add all transport fields manually, such as origin, destination, and GSTIN.

- Leave space for the signatures and stamps.

✔️ TIP: You can turn both into a reusable transport bill format in Excel or transport bill format in Word by saving them as templates.

Formatting tips for clean transport documents

- Align all numbers to the right for easy reading.

- Use bold text for key fields like total amount and tax.

- Avoid fancy fonts — stick to clear ones like Arial or Calibri.

- Keep spacing consistent between sections.

- If printing, leave enough margin for binding or punching.

Even a simple transport bill format can look professional with clean formatting. Once finalized, you can export the file to share with clients securely.

Best Practices for Transport Billing

A good transport bill format helps you avoid disputes, delays, and penalties. These tips will improve the clarity and reliability of your billing documents, whether you’re using a printed transport bill book format or a digital file.

Clear itemization of freight charges

List each charge separately — not just the total. Show freight cost, loading charges, tolls, and any additional services. This makes your bills easier to understand and approve. It also helps the client compare rates across vendors. Even a simple transport bill should include a full breakdown.

Proper GST handling for interstate transport

For transport services within India, apply the correct GST rate based on location. Use IGST for interstate transport and CGST/SGST for services within the same state. Always mention your GSTIN and the customer’s GSTIN on the bill. Whether you use a transport bill format in Excel or a printed version, don’t skip tax details — they’re key to compliance.

Recording vehicle details and driver signature fields

Include truck number, driver’s name, and license plate on the bill. This is important for tracking and proof of delivery. Add a space for the driver’s signature as confirmation that the goods were handed over correctly.

Adding QR codes for quick freight status checks (optional)

You can add a QR code that links to a live freight status or receipt copy. This is useful for large transport companies with digital systems. It’s optional but shows professionalism. It also saves time for clients who need quick access to shipment details.

Frequently Asked Questions on Transport Bills

Many businesses have common doubts about using a transport bill template. Here are clear answers to help you create correct and professional bills.

What is the difference between a transport bill and a regular invoice?

A transport bill covers only freight and delivery services. A regular invoice is used for selling goods or other services.

Are transport bills mandatory for trucking companies in India?

Yes. For GST compliance and record-keeping, transport bills are required by transport businesses.

How do I add GST details to my transport bill format?

Add GSTIN numbers, SAC code, tax rate, and calculated GST amount in clear fields on the bill.

Can I use a transport bill format in Excel for official billing?

Yes. Excel is widely accepted if it shows all needed information like GST and freight charges.

What should I include under freight charges on a transport bill?

List freight cost, loading/unloading fees, tolls, and taxes separately for transparency.

Do I need different formats for different freight services?

One flexible format works for most cases. Special services may need minor adjustments.

Where can I get free transport bill format templates?

You can download Excel, Word, and PDF versions from our website, free of charge.

How to make my transport bill mobile-friendly?

Use a transport bill format PDF or simple Excel sheet designed for mobile screens.

Is a digital signature required?

It’s not compulsory but adds professionalism and speeds up approval.

What if my transport bill has errors?

Mistakes can delay payments and cause tax problems. Always double-check your bills.

List of Resources

AFS Logistics — Stat’s Incredible: Common LTL Invoicing Errors

✅ Useful Official Links for Transport Billing and Compliance in India

- Goods and Services Tax (GST) Portal

For official GST rules, tax rates, and invoicing requirements related to transportation services.

- E-Way Bill System

Mandatory electronic waybill system for goods movement, linked to transport billing and compliance.

- Ministry of Road Transport & Highways (MoRTH)

Information on vehicle registration, permits, and transport regulations for logistics businesses.

👉 Visit MoRTH — Government of India

- Institute of Chartered Accountants of India (ICAI)

Guidelines on invoicing, accounting standards, and compliance for SMEs and transport businesses.

👉 Visit ICAI — Accounting Standards

- Digital India Programme

Government initiative promoting digital billing, paperless documentation, and QR code usage in business processes.